Concentrated Milk Fat Market Size, Share, Trends, Industry Analysis Report: By Product (Organic and Conventional), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5323

- Base Year: 2024

- Historical Data: 2020-2023

Concentrated milk fat Market Overview

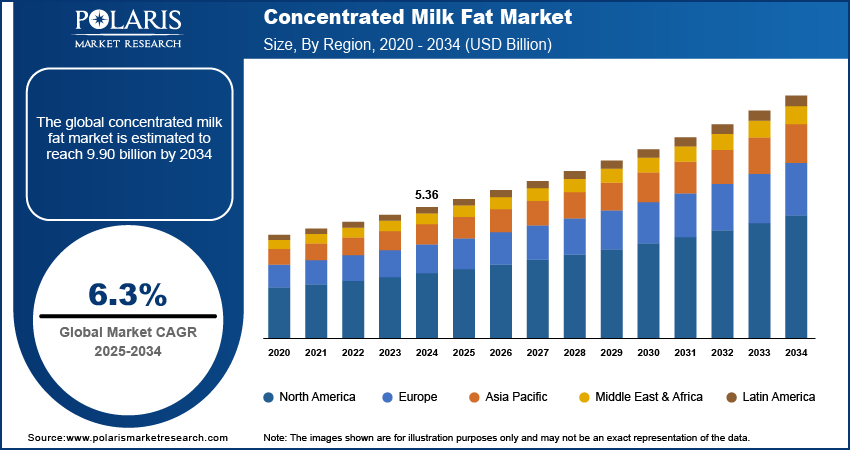

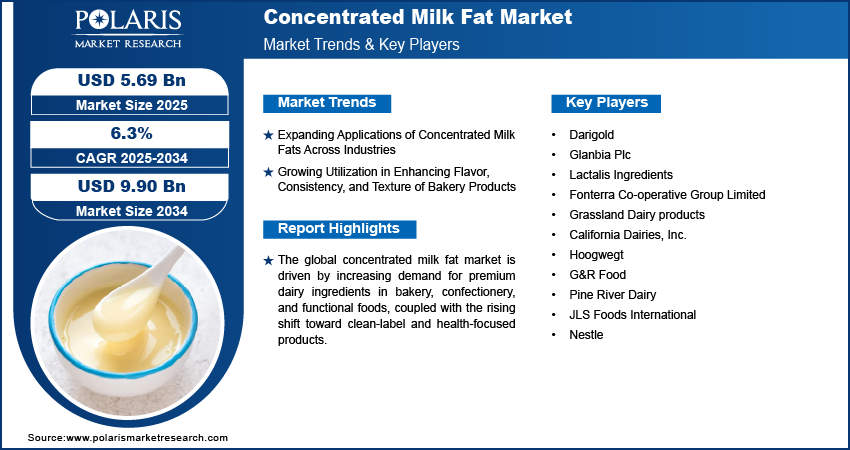

The concentrated milk fat market size was valued at USD 5.36 billion in 2024. It is projected to grow from USD 5.69 billion in 2025 to USD 9.90 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period.

Concentrated milk fat is a dairy product derived from cream or milk, containing a high percentage of butterfat by removing water and non-fat solids. It is widely used to enhance flavor, texture, and richness in food products such as baked goods, confectionery, and dairy items.

The growing demand for premium and indulgent food items, along with the expansion of the bakery and confectionery sectors, is fueling market growth. The increasing use of concentrated milk fat in convenience foods and ready-to-eat products aligns with changing consumer lifestyles.

For instance, in September 2023, report by the California Dairy Research Foundation noted the use of Milk Protein Concentrates (MPC) and Reduced Calcium Milk Protein Concentrates (RCMPC) as natural emulsifiers in clean-label ice cream. These dairy emulsifiers enhance texture, protein content, and storage stability while replacing synthetic options. Additionally, emerging markets are also contributing to growth due to rising disposable incomes and evolving dietary preferences. Innovations in production methods and the rising adoption of clean-label ingredients are further boosting the market.

To Understand More About this Research: Request a Free Sample Report

Concentrated Milk Fat Market Dynamics

Expanding Applications of Concentrated Milk Fats Across Industries

The expanding applications of concentrated milk fats across various industries, such as bakery products, confectionery, dairy, and processed foods, are driving the concentrated milk fat market growth. These fat’s are valued for their ability to improve flavor, texture, and stability in products, meeting the rising consumer demand for indulgent and high-quality food items. The market continues to benefit from this versatile ingredient as industries increasingly use concentrated milk fats in a variety of products, including ice creams, spreads, and ready-to-eat meals. Additionally, the shift toward clean-label products, which prioritize natural ingredients, is further fueling the adoption of concentrated milk fats. For instance, in August 2024, Fonterra extended its focus on providing clean-label solutions, with an emphasis on concentrated milk fats for improving texture, flavor, and functionality in a range of food products, including ice creams and bakery goods.

Growing Utilization in Enhancing Flavor, Consistency, and Texture of Bakery Products

The growing utilization of concentrated milk fats in bakery products is driven by their ability to enhance flavor, consistency, and texture. These fats improve the richness and creaminess of baked goods, ensuring a premium mouthfeel that meets consumer expectations for indulgent products. For instance, in August 2022, the a2 Milk Company (a2MC) expanded its product portfolio in Australia by introducing a lactose-free version of a2 Milk, addressing the needs of consumers with milk intolerance. Such innovations reflect the broader trend of meeting diverse dietary requirements while maintaining the quality and appeal of products.

Concentrated milk fats also play a vital role in maintaining the structural integrity of pastries, cakes, and cookies by improving air incorporation and stabilization, as these fats help trap air within the dough or batter, making the final product lighter and fluffier. Providing stability refers to their role in preventing the product from collapsing or becoming too dense during baking and storage. This adaptability makes them essential for modern bakery formulations, especially as clean-label and high-quality ingredients gain prominence in the food industry.

Concentrated Milk Fat Market Segment Analysis

Concentrated Milk Fat Market Assessment by Product Outlook

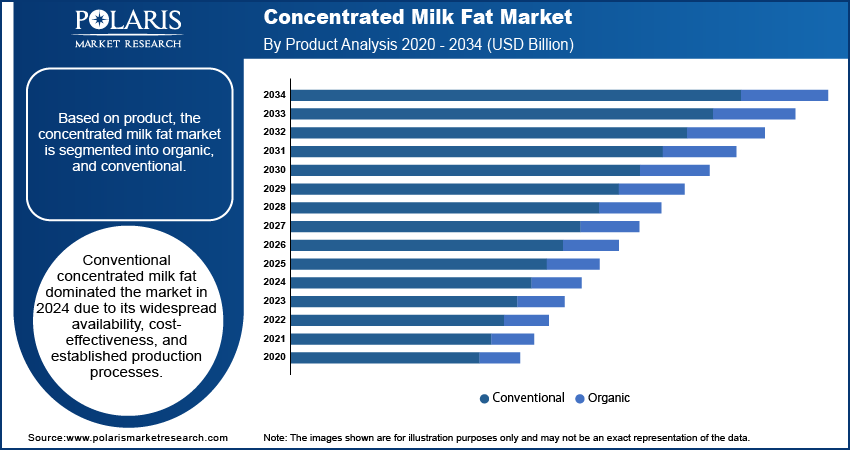

The global concentrated milk fat market segmentation, based on product, includes organic and conventional. The conventional segment in the concentrated milk fat market dominated the market in 2024 due to its widespread availability, cost-effectiveness, and established production processes. The lower cost of conventional milk fats compared to organic alternatives makes them a preferred choice for large-scale manufacturers, especially in food products such as dairy, bakery, and confectionery. Additionally, conventional concentrated milk fats offer consistency in quality and performance, which is crucial for mass production. This dominance is also supported by the greater familiarity and accessibility of conventional dairy supply chains, which continue to cater to the high demand across various industries such as bakery & confectionery and dairy products, among others.

Concentrated Milk Fat Market Evaluation by Application Outlook

The global concentrated milk fat market segmentation, based on application, includes bakery & confectionery, dairy products, nutraceuticals, and others. The nutraceuticals segment in the concentrated milk fat market is expected to register a significant CAGR due to the increasing demand for functional foods and supplements that offer health benefits beyond basic nutrition. Concentrated milk fats are recognized for their rich nutrient profile, including essential fatty acids, proteins, and vitamins, making them an ideal ingredient for strengthening nutraceutical products. The growing consumer awareness of the link between diet and health, alongside rising interest in natural, bioactive ingredients, is driving the demand for such products in the nutraceuticals sector. Additionally, the shift towards preventive healthcare and wellness is encouraging the incorporation of concentrated milk fats in various health-focused applications such as functional dairy products and dietary supplements.

Concentrated Milk Fat Market Regional Insights

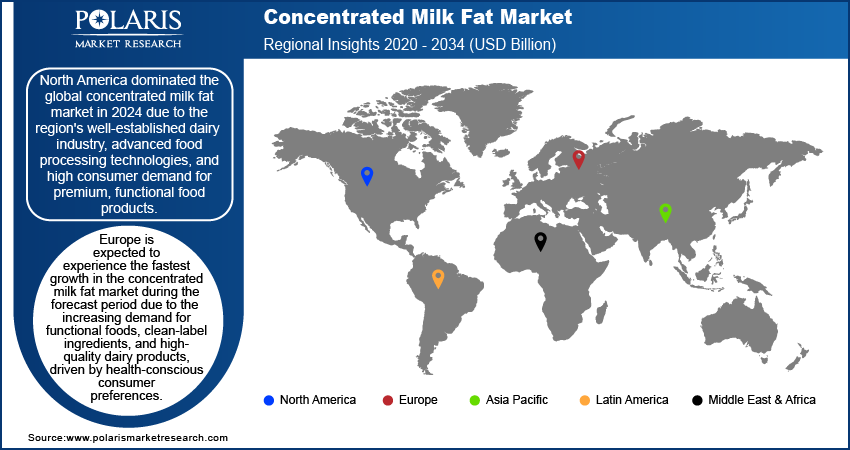

By region, the study provides concentrated milk fat market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 due to the region's well-established dairy industry, advanced food processing technologies, and high consumer demand for premium and functional food products. Strong healthcare awareness and a growing shift towards health-conscious, clean-label products have also increased the use of concentrated milk fats in nutraceuticals and functional foods. Moreover, high disposable incomes and robust distribution networks further support the market's growth in the region. The presence of major players in the food and dairy sectors, coupled with significant R&D investments, has led North America to emerge as a leader in the concentrated milk fat market. For instance, in November 2022, California Dairies, Inc. (CDI), recognized as the dairy farmer owned cooperative in California, announced its strategic decision to acquire DairyAmerica, with the transaction set to take effect on January 1, 2023, to expand its operational footprint and improving its position within the dairy supply chain.

Europe is expected to experience the fastest growth in the concentrated milk fat market during the forecast period due to the increasing demand for functional foods, clean-label ingredients, and high-quality dairy products driven by health-conscious consumer preferences. Additionally, there is a growing trend toward preventive healthcare, with consumers seeking products that contribute to overall wellness. Innovations in dairy processing technologies, along with rising investments in research and development by key market players, are also contributing to the region’s market growth. Moreover, Europe’s established dairy industry, along with stringent regulatory standards for food quality, ensures consumer safety and environmental sustainability. For instance, according to a March 2024 report by the European Parliament, Regulation (EU) 2023/915 establishes maximum limits for contaminants such as nitrates, heavy metals, and dioxins in both animal and plant-based foods, reinforcing Europe’s commitment to maintain high food safety and quality standards across the sector. The regulations also set maximum residue levels, ensuring that foodstuffs with unacceptable contaminant levels are not sold in the EU to protect public health, creating a favorable environment for expanding concentrated milk fats in various food applications.

Concentrated Milk Fat Market – Key Players and Competitive Analysis Report

The competitive landscape of the concentrated milk fat industry features a mix of global leaders and regional players competing for market share through innovation, strategic collaborations, and geographic expansion. Major companies such as Nestle, Darigold, and others utilize their robust R&D capabilities and extensive distribution networks to develop advanced concentrated milk fat solutions catering to diverse applications in bakery, confectionery, dairy, and nutraceuticals. Leading players focus on product innovation, prioritizing clean-label and high-quality ingredients to meet evolving consumer preferences for premium and health-focused products. Simultaneously, smaller regional firms are emerging with tailored offerings to address local market needs and preferences. Competitive strategies include mergers and acquisitions, partnerships with food manufacturers, and the introduction of organic and functional product lines to strengthen market presence in key regions. A few key major players are Darigold; Glanbia Plc; Lactalis Ingredients; Fonterra Co-operative Group Limited; Grassland Dairy Products; California Dairies, Inc.; Hoogwegt; G&R Food; Pine River Dairy; JLS Foods International; and Nestle.

Nestle SA (Nestle), headquartered in Vevey, Waadt, Switzerland, is a manufacturer and supplier of food products and beverages. The company's product portfolio comprises baby foods, bottled water, cereals, chocolates and confectionery, coffee, culinary products, chilled and frozen foods, dairy products, nutritional products, ice cream, and pet products. Nestle also offers nutritional products, sausages, and direct-to-consumer meal delivery services. Its major brands include Aero, Alpo, Milkybar, Nestle Ice Cream, Cerelac, Nescafe, Nespresso, Nestea, Milo, Maggi, Buitoni, Cailler, Movenpick, Freshly, Purina, Boost, Gerber, and Kit Kat. The company has a business presence in Asia, Oceania and sub-Saharan Africa, the Americas, Europe, the Middle East, and North Africa.

Glanbia plc is a global nutrition company headquartered in Kilkenny, Ireland, with operations spanning worldwide. The company is in the manufacturing and sale of sports nutrition and lifestyle nutrition products, offering a range of products such as powders, snacking foods, ready-to-eat bars, and ready-to-drink beverages. These products are distributed through various channels, including specialty retail, gyms, online platforms, drug, food, mass, and club channels. Beyond nutrition products, Glanbia is involved in the production and sale of cheese, non-dairy, and dairy nutritional and functional ingredients, along with mineral and vitamin premixes. The company is diverse in its business activities, participating in financing, research and development, property and land dealings, receivables management, property leasing, business services, weight management, and bioactive solutions. Glanbia plc manages a portfolio of well-known brands such as Optimum Nutrition, Isopure, BSN, SlimFast, Nutramino, Amazing Grass, think! Body & Fit, and LevlUp.

Key Companies in Concentrated Milk Fat Market

- Darigold

- Glanbia Plc

- Lactalis Ingredients

- Fonterra Co-operative Group Limited

- Grassland Dairy products

- California Dairies, Inc.

- Hoogwegt

- G&R Food

- Pine River Dairy

- JLS Foods International

- Nestle

Concentrated Milk Fat Market Development

July 2024: Fonterra partnered with Nourish Ingredients to develop dairy products utilizing fats created through precision fermentation. This collaboration aims to address limitations in animal-based ingredient supply chains and enhance the efficiency of food production. The initiative supports the growing demand for high-quality, flavorful, and texturally appealing dairy alternatives globally.

Concentrated milk fat Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Organic

- Conventional

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Bakery & Confectionery

- Dairy Products

- Nutraceuticals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Concentrated milk fat Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.36 billion |

|

Market Size Value in 2025 |

USD 5.69 billion |

|

Revenue Forecast by 2034 |

USD 9.90 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global concentrated milk fat market size was valued at USD 5.36 billion in 2024 and is projected to grow to USD 9.90 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the global concentrated milk fat market in 2024 due to the region's well-established dairy industry, advanced food processing technologies, and high consumer demand for premium, functional food products

A few key players in the market are Darigold; Glanbia Plc; Lactalis Ingredients; Fonterra Co-operative Group Limited; Grassland Dairy Products; California Dairies, Inc.; Hoogwegt; G&R Food; Pine River Dairy; JLS Foods International; Nestle.

Conventional concentrated milk fat dominated the market in 2024 due to its widespread availability, cost-effectiveness, and established production processes.

The nutraceuticals segment in the global concentrated milk fat market is expected to grow at the fastest CAGR.