Compact Construction Equipment Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Construction, Mining, and Utility Works), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5503

- Base Year: 2024

- Historical Data: 2020-2023

Compact Construction Equipment Market Overview

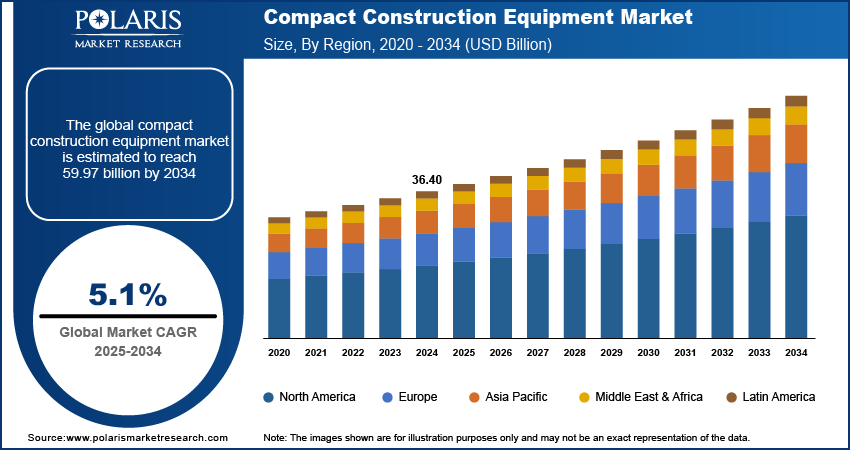

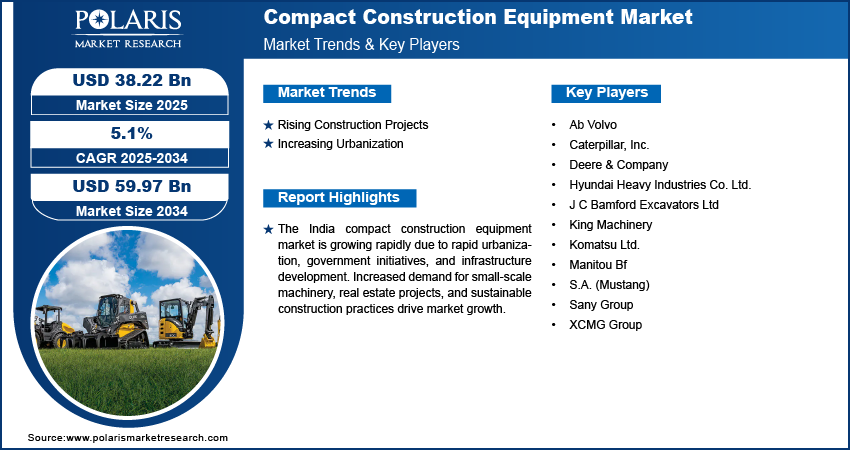

The global compact construction equipment market size was valued at USD 36.40 billion in 2024. The market is projected to grow from USD 38.22 billion in 2025 to USD 59.97 billion by 2034, exhibiting a CAGR of 5.1% during 2025–2034. Compact construction equipment refers to smaller, versatile machinery designed for tasks in tight spaces or smaller job sites, such as mini excavators, skid steer loaders, and compact track loaders. These machines offer high maneuverability and efficiency and are ideal for landscaping, residential construction, and urban projects where larger equipment cannot operate effectively.

Labor shortages in the construction industry have created a demand for machinery that increase productivity without requiring a large workforce. Compact construction equipment fills this gap by performing tasks traditionally done by multiple workers. These machines can handle a wide range of duties, such as digging, lifting, and grading, which reduces the need for manual labor and accelerates project timelines. Contractors facing challenges in finding skilled labor find compact equipment to be an attractive solution, enabling them to meet deadlines and reduce labor costs, thereby driving the compact construction equipment market demand.

To Understand More About this Research: Request a Free Sample Report

Technological advancements have significantly improved the performance and capabilities of compact construction equipment. Modern compact machines now feature innovations such as GPS tracking, telematics, and automation, which improve productivity and reduce downtime. These technologies enable contractors to monitor equipment performance, track fuel usage, and schedule maintenance efficiently, ensuring that the machines operate at peak efficiency. The introduction of electric or hybrid options helps reduce environmental impact while maintaining high performance. These technological improvements make equipment more efficient and cost-effective, attracting more buyers and thereby boosting the compact construction equipment market growth.

Compact Construction Equipment Market Dynamics

Rising Construction Projects

The number of residential and commercial construction is growing, due to which the demand for compact construction equipment is rising. According to the US Census Bureau, privately owned housing units authorized by building permits in February 2025 were 1,456,000. Compact construction equipment plays a vital role in meeting these needs by efficiently performing tasks such as digging, grading, and material handling. Smaller machines are necessary for working in restricted spaces, such as in the construction of apartment buildings, shopping centers, and warehouses. Their ability to work in smaller, confined spaces makes them an essential tool for contractors involved in residential and commercial construction. This surge in construction activity is driving the compact construction equipment market development.

Increasing Urbanization

Rapid urbanization has led to growing demand for infrastructure in cities, due to which the demand for compact construction equipment is rising. According to the World Bank Group, in 2023, 57% of the total population live in urban areas, showcasing the growth in the urban population. The increasing population in urban areas creates a rising need for new buildings, roads, and public spaces. Their ability to efficiently work in small areas makes them highly valuable for infrastructure development projects in cities and urban centers, thereby fueling the compact construction equipment market growth.

Compact Construction Equipment Market Segment Analysis

Compact Construction Equipment Market Assessment by Type Outlook

The compact construction equipment market segmentation, based on type, includes mini excavators, compact wheel loaders, compact track loaders, and skid steer loaders. The skid steer loaders segment is expected to witness significant growth during the forecast period. Skid steer loaders are highly versatile machines used in a variety of construction tasks, such as digging, grading, lifting, and material handling. The compact size of these machines allows them to work in tight spaces, making them ideal for urban construction projects, landscaping, and road maintenance. The increasing demand for efficient, multipurpose equipment and the rising need for machines that perform multiple tasks on small job sites contribute to the segmental growth.

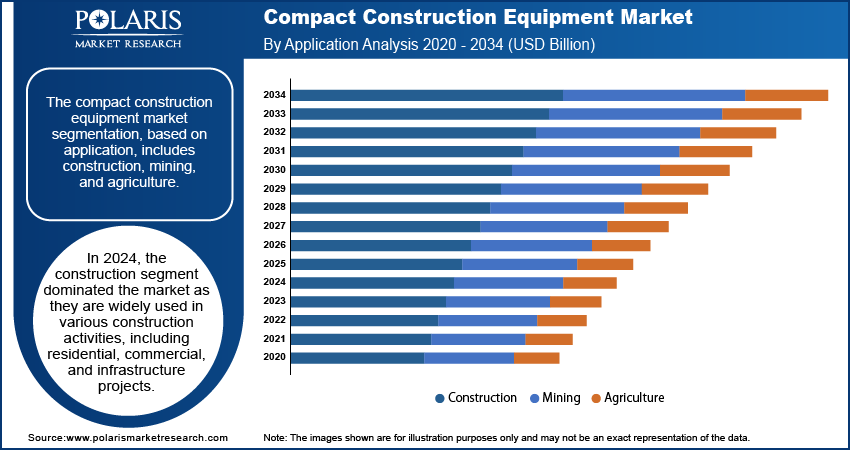

Compact Construction Equipment Market Evaluation by Application Outlook

The compact construction equipment market segmentation, based on application, includes construction, mining, and utility works. The construction segment dominated the compact construction equipment market revenue in 2024. Compact construction equipment is widely used in various construction activities, including residential, commercial, and infrastructure projects. These machines are essential for tasks such as digging, lifting, grading, and material handling, especially in areas with limited space. The versatility, maneuverability, and efficiency of compact construction equipment make them ideal for urban construction sites and small to medium-sized projects. The growing demand for infrastructure development and urbanization is boosting the segmental growth.

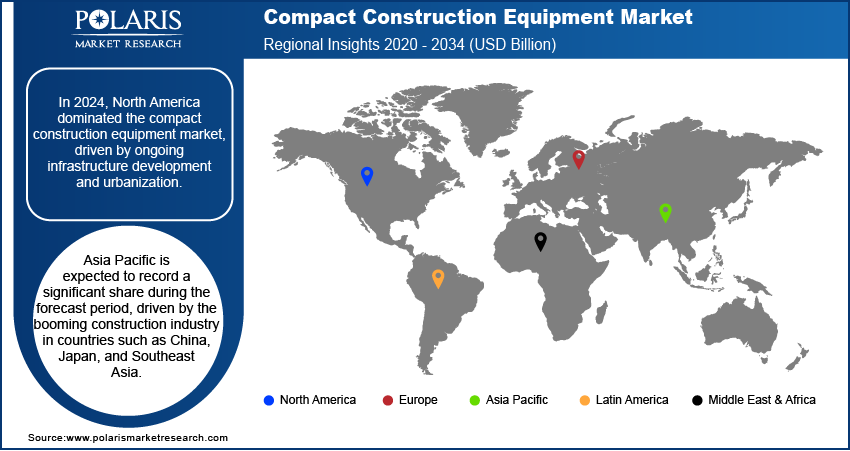

Compact Construction Equipment Market Regional Analysis

By region, the study provides the compact construction equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the compact construction equipment market share, driven by ongoing infrastructure development and urbanization. The demand for smaller, versatile machines is high due to the increasing need for construction projects in congested urban areas where space is limited. Additionally, advancements in technology, such as telematics and electric-powered machines, have attracted more contractors to adopt compact equipment. The region’s strong focus on sustainability and environmental regulations is also influencing the market, with companies seeking eco-friendly equipment, thereby driving the compact construction equipment market expansion in North America.

According to the compact construction equipment market statistics, Asia Pacific is expected to record a significant share during the forecast period, driven by the booming construction industry in countries such as China, Japan, and Southeast Asia. Rapid urbanization and increased demand for residential and commercial infrastructure are major factors fueling market growth. Additionally, growing investments in public infrastructure, such as roads and airports, further support the demand for compact construction equipment. The shift toward sustainable construction practices and the rise of government incentives for adopting eco-friendly machinery is driving the adoption of compact construction equipment in Asia Pacific.

The compact construction equipment market in India is experiencing substantial growth due to the country’s rapid urbanization and infrastructure development initiatives. Government programs such as “Smart Cities” and “Make in India” are fueling investments in construction projects, creating a demand for efficient, compact construction equipment. Additionally, the growing real estate sector and demand for residential and commercial buildings boost the need for versatile equipment that handles a range of tasks, thereby creating compact construction equipment market opportunities in India.

Compact Construction Equipment Market – Key Players & Competitive Analysis Report

The compact construction equipment market ecosystem is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Major global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the compact construction equipment market trends by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major players in the market includes Ab Volvo; Caterpillar, Inc.; Deere & Company; Hyundai Heavy Industries Co. Ltd.; J C Bamford Excavators Ltd; King Machinery; Komatsu Ltd.; Manitou Bf; Sany Group; and XCMG Group

Sany Heavy Industry Co., Ltd., established in 1989 and based in Changsha, Hunan, is a manufacturer of heavy equipment. The company began as a welding materials provider before transitioning into the construction machinery sector. It is notable for being the first Chinese company in its industry to be listed in the FT Global 500 and Forbes Global 2000 rankings. Sany offers a wide range of products across various segments. Its concrete machinery division includes concrete pumps and batching plants, while the earthmoving machinery segment features hydraulic excavators, backhoe loaders, and wheeled loaders. Sany also produces road machinery such as pavers and rollers, along with port machinery that includes reach stackers and cranes. Additionally, the company has a presence in mining machinery, particularly with roadheaders and coal cutters, and has expanded into energy equipment, focusing on oilfield solutions and renewable energy technologies. Sany operates on a global scale, with manufacturing facilities located in China, the USA, Germany, India, Brazil, and other regions. The company's sales and service network extend to over 180 countries. Sany provides mini excavators that offer versatility and power for various construction tasks. Designed for efficiency in tight spaces, these compact machines deliver performance and reliability.

Deere & Company, known as John Deere, is an American corporation that specializes in manufacturing agricultural, construction, and forestry machinery. Founded in 1837 by blacksmith John Deere in Grand Detour, Illinois, the company initially focused on producing steel plows designed for challenging prairie soil. Over time, it expanded its operations and product offerings significantly, officially incorporated in 1868. Today, John Deere is recognized for its extensive range of equipment used in various sectors. The company operates through three main segments: Agriculture and Turf, Construction and Forestry, and Commercial and Consumer Equipment. The Agriculture and Turf segment produces tractors, combines, sprayers, and turf equipment aimed at enhancing productivity for both agricultural and residential applications. The Construction and Forestry segment includes machinery such as excavators and backhoe loaders used for infrastructure projects and timber harvesting. The Commercial and Consumer Equipment segment focuses on lawn tractors and utility vehicles tailored for residential users. The company operates globally, with a strong presence in North America, Europe, Asia, South America, and Australia. Its headquarters are located in Moline, Illinois, supplemented by manufacturing facilities distributed worldwide to meet regional demands. Key international markets include Brazil, Germany, India, and China. John Deere offers compact track and skid loaders that offer power and versatility for various jobs. With numerous attachments and user-friendly controls, these machines enhance productivity and adaptability.

List of Key Companies in Compact Construction Equipment Market

- Ab Volvo

- Caterpillar, Inc.

- Deere & Company

- Hyundai Heavy Industries Co. Ltd.

- J C Bamford Excavators Ltd

- King Machinery

- Komatsu Ltd.

- Manitou Bf

- Sany Group

- XCMG Group

Compact Construction Equipment Industry Development

In January 2025, CASE India launched seven new products, including two advanced vibratory compactors, at the Bharat Construction Equipment Expo 2025, showcasing innovation, sustainability, and commitment to safety and productivity.

In October 2023, At the Equipment Expo 2023, CASE Construction Equipment unveiled a new lineup of mini track loaders and small articulated loaders, offering enhanced power, flexibility, and productivity for small contractors.

Compact Construction Equipment Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Mini Excavators

- Compact Wheel Loaders

- Compact Track Loaders

- Skid Steer Loaders

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Construction

- Mining

- Utility Works

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Compact Construction Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 36.40 billion |

|

Market Size Value in 2025 |

USD 38.22 billion |

|

Revenue Forecast by 2034 |

USD 59.97 billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 36.40 billion in 2024 and is projected to grow to USD 59.97 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Ab Volvo; Caterpillar, Inc.; Deere & Company; Hyundai Heavy Industries Co. Ltd.; J C Bamford Excavators Ltd; King Machinery; Komatsu Ltd.; Manitou Bf; Sany Group; and XCMG Group.

The construction segment dominated the market in 2024 as they are widely used in various construction activities, including residential, commercial, and infrastructure projects.

The skid steer loaders segment is expected to witness significant growth during the forecast period as they are highly versatile machines used in a variety of construction tasks, such as digging, grading, lifting, and material handling.