Commodity Plastics Market Size, Share, Trends, Industry Analysis Report: By Product [Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polystyrene (PS), and Others], End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1168

- Base Year: 2024

- Historical Data: 2020-2023

Commodity Plastics Market Overview

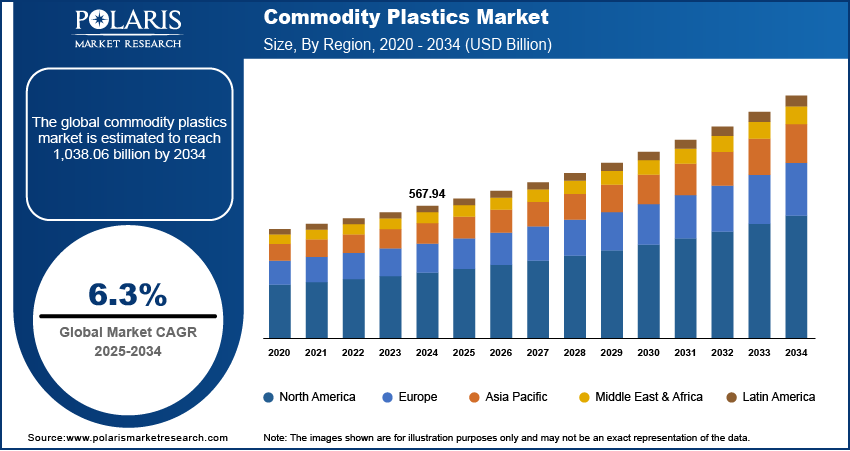

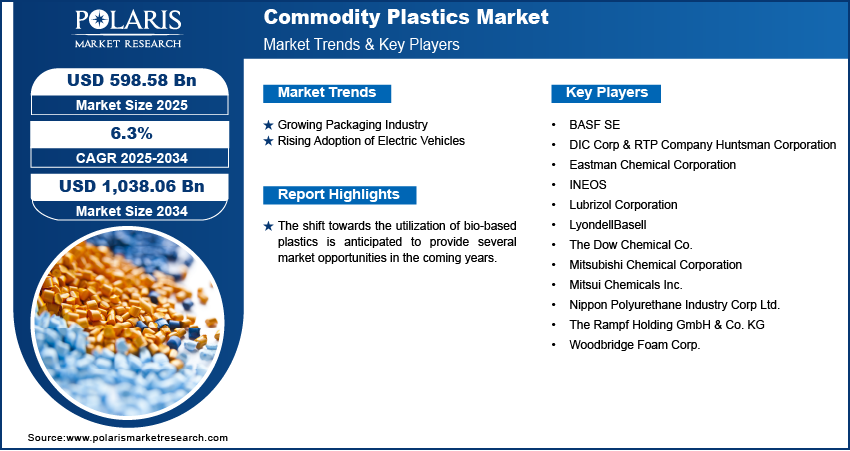

The global commodity plastics market size was valued at USD 567.94 billion in 2024. The market is projected to grow from USD 598.58 billion in 2025 to USD 1,038.06 billion by 2034. It is projected to exhibit a CAGR of 6.3% from 2025 to 2034.

Commodity plastics are inexpensive plastics with broad applicability across various industries. These plastics are used in a wide range of applications, including garbage containers, magnetic tapes, photography, and clothing.

The commodity plastics market growth is primarily fueled by the increased usage of these plastics in flexible packaging, automobile parts, and other consumable products. The desirable properties of commodity plastics, including high durability and enhanced moisture resistance, also contribute to their growing demand. The constantly rising need for long-lasting light materials in the construction industry further drives the expansion of the market.

The rising prices of metals have prompted manufacturers across various industries to seek alternative materials such as plastics, a trend expected to drive the commodity plastics market development in the coming years. The shift towards the utilization of bio-based plastics due to fluctuating crude oil prices and rising awareness about the environmental pollution caused by fossil fuels is also expected to create several market opportunities during the projection period.

To Understand More About this Research: Request a Free Sample Report

Commodity Plastics Market Dynamics

Growing Packaging Industry

The packaging industry has witnessed significant growth in recent times, driven by shifting consumer lifestyles and consumption patterns, technological advances in packaging, and the rise of e-commerce. Commodity plastics are widely used in many different types of packaging such as food packaging, non-packaging, and medical flexible packaging, as they are cost-effective, lightweight, and durable. These plastics can also be molded into different shapes and are easy to decorate and print on, making them important print marketing material. Thus, with the growing packaging industry, the commodity plastics market demand is rising.

Rising Adoption of Electric Vehicles

Several governments worldwide have introduced stringent regulations on vehicle emissions and fuel efficiency. These regulations have led to increased production of electric vehicles (EVs), which are a cleaner and more environmentally friendly transportation option. They have also compelled original equipment manufacturers (OEMs) to adopt lightweight materials such as plastics in EV manufacturing. The use of plastics reduces vehicle battery consumption, as less weight takes less energy during acceleration. Thus, the growing adoption of EVs is boosting the commodity plastics market revenue.

Commodity Plastics Market Segment Insights

Commodity Plastics Market Assessment by Product

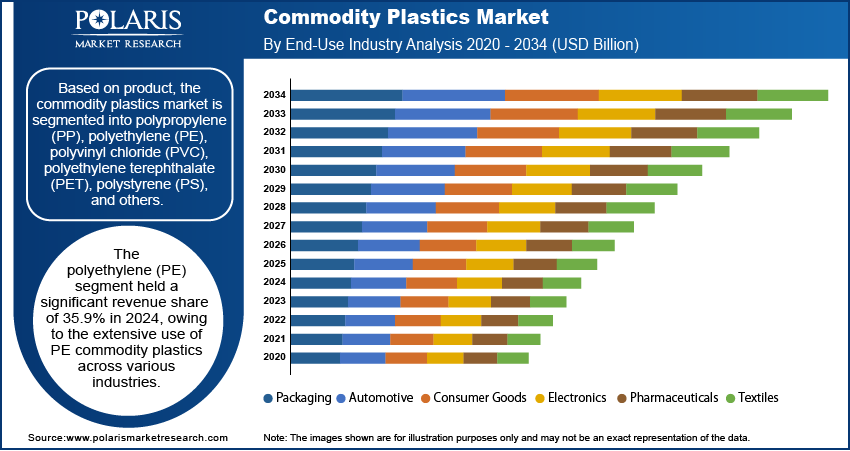

The commodity plastics market, based on product, is segmented into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), and others. The polyethylene (PE) segment held a significant revenue share of 35.9% in 2024. The versatility, durability, low density, and excellent chemical resistance of PE commodity plastics have resulted in their extensive use across various industries. PE is widely used in the manufacturing of bags, containers, and films for the packaging industry. In addition, there is a high demand for PE in the construction sector for piping and plumbing applications owing to their durability and longevity.

Commodity Plastics Market Evaluation by End-Use Industry

The commodity plastics market segmentation, based on the end-use industry, includes automotive, consumer goods, electronics, packaging, pharmaceuticals, and textiles. The packaging segment dominated the market with a revenue share of 41.8% in 2024, owing to the crucial role packaging plays in protecting products from spoiling and damage in every sector. The increased demand for flexible packaging has also boosted the adoption of commodity plastics in the packaging industry. Further, rising emphasis on sustainability and increased demand for bio-based polymers propels the robust growth of the segment.

Commodity Plastics Market Regional Analysis

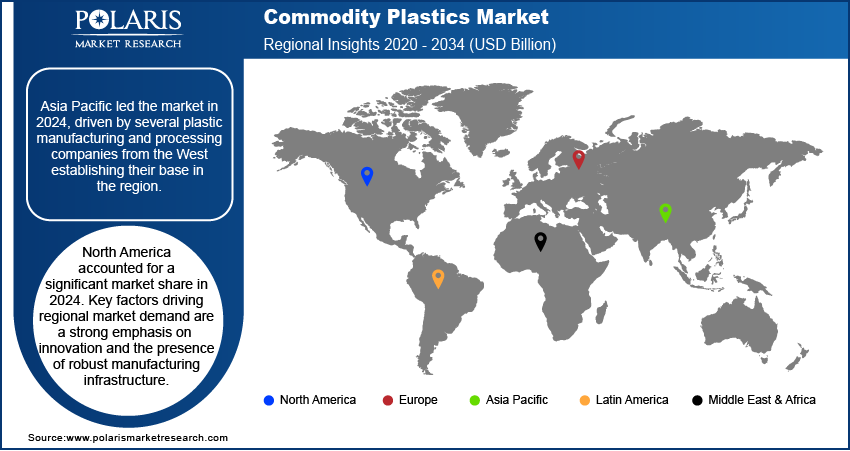

By region, the market report offers commodity plastics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific led the market with a revenue share of 50.9% in 2024. The significant investments by governments of many emerging nations to strengthen their skilled workforce have prompted many plastic manufacturing and processing companies from the West to establish their base in the region. The rapid growth of the e-commerce industry also contributes to the robust regional market demand.

The commodity plastics market in North America accounted for a significant market share in 2024. Key factors driving market demand in the region are a strong emphasis on innovation, robust manufacturing infrastructure, and the high use of commodity plastics such as PE, PVC, and PP. In addition, major auto companies in North America have integrated polymer technology into automotive manufacturing to improve vehicle performance and fuel efficiency, positively impacting market growth in the region.

Commodity Plastics Market – Key Players and Competitive Insights

The commodity plastics industry is fragmented, with several small and medium-sized companies. The leading market players are making significant investments in R&D to extend their product lines. They are also undertaking several strategic initiatives, such as mergers and acquisitions and partnerships, to improve their global reach. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the market for commodity plastics has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. The commodity plastics market research report offers a market assessment of all the key players, including BASF SE, Mitsui Chemicals Inc., Eastman Chemical Corporation, INEOS, Mitsubishi Chemical Corporation, DIC Corp & RTP Company Huntsman Corporation, LyondellBasell, The Dow Chemical Co., Nippon Polyurethane Industry Corp Ltd., Woodbridge Foam Corp., Lubrizol Corporation, and The Rampf Holding GmbH & Co. KG.

List of Key Players in Commodity Plastics Market

- BASF SE

- DIC Corp & RTP Company Huntsman Corporation

- Eastman Chemical Corporation

- INEOS

- Lubrizol Corporation

- LyondellBasell

- The Dow Chemical Co.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Nippon Polyurethane Industry Corp Ltd.

- The Rampf Holding GmbH & Co. KG

- Woodbridge Foam Corp.

Commodity Plastics Market Developments

February 2023: Ecolab partnered with TotalEnergies to launch a new recycled plastic packaging solution. According to the companies, the packaging material is specifically designed for highly concentrated cleaning products. It will help the packaging industry keep up with the circular commitments of the European Union (EU).

September 2022: Rebound announced the launch of Rebound Plastic Exchange (RPX), a global B2B platform for recycled plastics. The company stated the RPX platform will provide unique opportunities for businesses, governments, and civil society to fill demand gaps and enable global circularity.

Commodity Plastics Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Others

By End-Use Industry Outlook (Revenue – USD Billion, 2020–2034)

- Automotive

- Consumer Goods

- Electronics

- Packaging

- Pharmaceuticals

- Textiles

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Commodity Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 567.94 billion |

|

Market Size Value in 2025 |

USD 598.58 billion |

|

Revenue Forecast by 2034 |

USD 1,038.06 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market was valued at USD 567.94 billion in 2024 and is projected to grow to USD 1,038.06 billion by 2034.

• The market is projected to register a CAGR of 6.3% from 2025 to 2034.

• Asia Pacific accounted for the largest region-wise market size in 2024.

• A few of the key players in the market are BASF SE; Mitsui Chemicals Inc.; Eastman Chemical Corporation; INEOS; Mitsubishi Chemical Corporation; DIC Corp & RTP Company Huntsman Corporation; LyondellBasell; The Dow Chemical Co.; Nippon Polyurethane Industry Corp Ltd.; Woodbridge Foam Corp.; Lubrizol Corporation; and The Rampf Holding GmbH & Co. KG.

• The polyethylene (PE) segment accounted for the largest market share in 2024.

• The packaging segment dominated the market for commodity plastics in 2024.