Commercial Kitchen Appliances Market Size, Share, Trends, Industry Analysis Report: By Product (Dishwasher, Refrigerator, Oven, and Cooking Appliances), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1036

- Base Year: 2024

- Historical Data: 2020-2023

Commercial Kitchen Appliances Market Overview

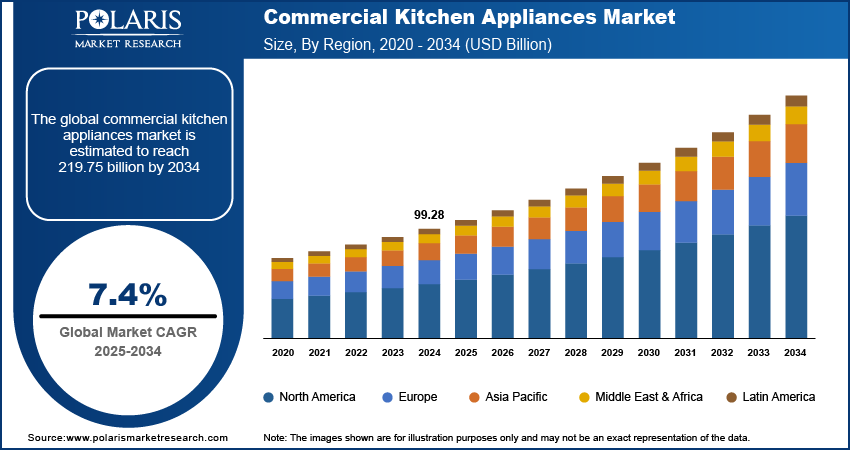

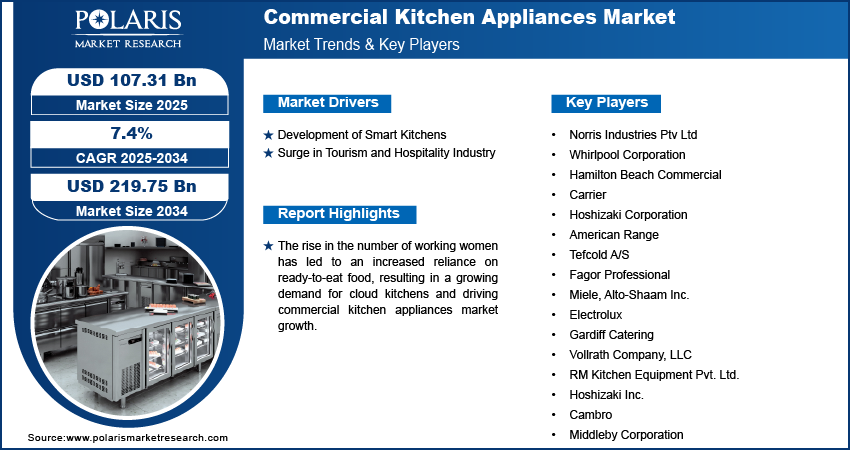

The commercial kitchen appliances market size was valued at USD 99.28 billion in 2024. The market is projected to grow from USD 107.31 billion in 2025 to USD 219.75 billion by 2034, exhibiting a CAGR of 7.4% from 2025 to 2034.

Commercial kitchen appliances are specifically engineered for high-volume cooking in commercial settings such as hotels, catering services, and cafes. Rapid urbanization is driving a shift in individuals' lifestyles and eating habits, resulting in increased consumption of packaged food, instant meals, and fast food. This change in consumer habits is creating a heightened demand for food production, thereby necessitating the efficient use of commercial kitchen appliances.

The rise in the number of working women has led to an increased reliance on ready-to-eat food, resulting in a growing demand for cloud kitchens and driving commercial kitchen appliances market growth.

To Understand More About this Research: Request a Free Sample Report

The education industry is further driving market growth due to the rise in training programs and schools. Training schools invest in commercial cooking appliances to facilitate the training of every student. In addition, various restaurants provide training to their staff, which increases the utilization of automated appliances.

Commercial Kitchen Appliances Market Trends and Drivers Analysis

Development of Smart Kitchens

Technological advancements are fostering innovations across various sectors, including cookware and kitchen appliances. The integration of advanced technology has led to the development of smart kitchens, which is significantly boosting the market revenue. Smart kitchens are designed to save energy, improve efficiency, and effectively utilize the space of the kitchen. Moreover, smart kitchen appliances reduce the efforts due to automated techniques inbuild in appliances. For instance, smart refrigerators and chillers are widely used in smart kitchens to monitor the temperature of food items and make adjustments accordingly. Also, smart ovens are designed to adjust the temperature required for cooking the food, which enhances the efficiency of the restaurants.

Smart kitchen appliances come with several enhanced features, such as Wi-Fi connectivity, mobile applications, and improved software. These features allow continuous monitoring of the food products and items from distances. For instance, Middleby Corp. introduced Varimixer ERGO automated mixer inbuild with a touch screen that offers easy visibility at a distance and helps reduce labor dependency. Besides, automated recipes and cooking apps provide accurate measurements and are widely used in education tools to train chefs. Furthermore, the use of enhanced filtering systems in restaurants and food processing industries maintains the flow of fresh air and reduces odor in kitchen areas. The improved sustainability and enhanced safety features offered by commercial kitchen appliances drives market growth.

Surge in Tourism and Hospitality Industry

The surge in the income level of individuals is significantly boosting the tourism industry and driving market growth. The demand for luxuries and comfortable services at hotels and restaurants has increased the need for advanced cooking appliances. Many restaurants and cafes are significantly investing in futuristic, high-volume, and automated cooking equipment to enhance efficiency and reduce serving time. In addition, updated and innovative cookwares are utilized by large restaurants and hospitality industries to improve infrastructure and enhance the tourist experience. Furthermore, the rise in the number of tourists has led to a surge in the demand for laborers. However, cooking appliances such as dishwashers and glass washers are also being adopted to reduce labor dependency.

The surge in the tourism industry after the COVID-19 pandemic is a key factor driving the commercial kitchen appliances market. For instance, as per the World Travel & Tourism Council, travel & tourism contributed to 9.1% of global GDP. Thus, an increasing number of tourists across various borders is leading to a rise in the number of restaurants and food services, thereby driving market expansion.

Commercial Kitchen Appliances Market Segment Analysis

Commercial Kitchen Appliances Market Breakdown by Product Insights

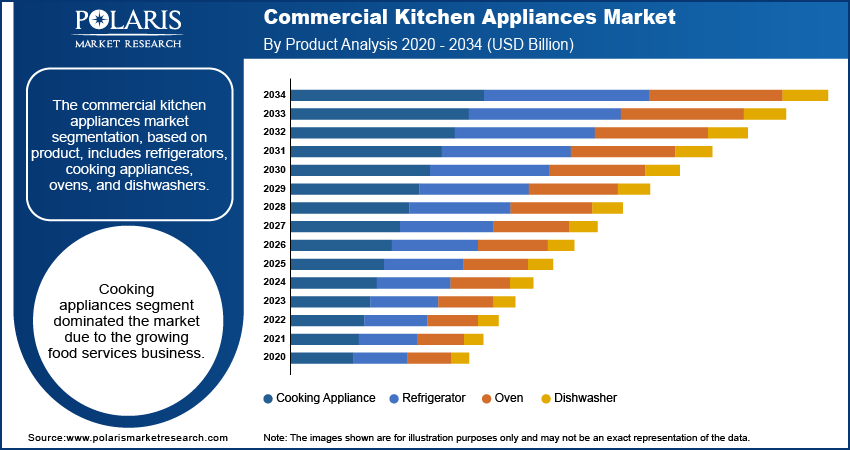

The commercial kitchen appliances market segmentation, based on product, includes refrigerators, cooking appliances, ovens, and dishwashers. Cooking appliances segment dominated the market due to the growing food services business. Individual preferences for diverse food habits and exploration of diversified cultural food habits in propelling a surge in multicuisine restaurants across regions. Restaurants and eateries are widely utilizing different types of cooking appliances, including inductions, gas, and electric stoves. Furthermore, the integration of technology in cooking appliances is leading to the development of innovative and automated cookware, further driving market growth.

Commercial Kitchen Appliances Market Breakdown by End-Use Insights

Based on end-use, the commercial kitchen appliances market segmentation includes quick-service restaurants, full-service restaurants, resorts & hotels, institutional canteens, hospitals, rail, cruise & airway catering, and others. The quick-service restaurants segment dominated the market in 2024 due to increasing home delivery services. Cafes are also adopting drive-through services, which help reduce overhead expenditures and enhance fast serving to customers. Further, the adoption of technology across various sectors has led to the development of online food ordering services and online payments, which is another key factor boosting market growth.

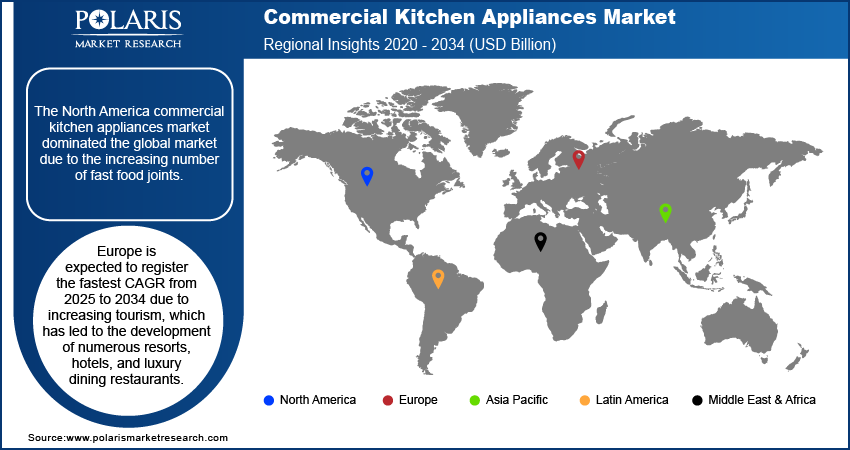

Commercial Kitchen Appliances Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America commercial kitchen appliances market dominated the global market due to the increasing number of fast food joints. In addition, the presence of major companies, such as American Range and Alto -Shaam Inc., offering their services further strengthens the market landscape in North America. The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The US holds the largest share in the commercial kitchen appliances market due to the growing number of fast food ventures that cater to the food preferences of the US population. Additionally, the increased application of kitchen cookware is driving higher demand for manufacturers across different regions. As a result, the rise in manufacturers of cookware kitchen appliances is driving market growth in the US. For instance, as per the National Center for Health Statistics, 36.6% of American adults consume fast food daily. Consequently, this substantial growth in several fast food ventures is boosting the commercial kitchen appliances market revenue.

Europe is expected to register the fastest CAGR from 2025 to 2034 due to increasing tourism, which has led to the development of numerous resorts, hotels, and luxury dining restaurants. Restaurants require timely upgradation with innovative cooking appliances to enhance customer dining experiences. Besides, the need for automated cooking appliances to reduce workload and provide faster services is significantly boosting market growth. In addition, France is contributing significantly to the market in the region due to a surge in e-commerce industries.

Commercial Kitchen Appliances Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product lines, which will help the commercial kitchen appliances market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the commercial kitchen appliances market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the commercial kitchen appliances market to benefit clients and increase the market sector. In recent years, the market has offered some technological innovations. Major players in the commercial kitchen appliances market include Norris Industries Ptv Ltd; Whirlpool Corporation; Hamilton Beach Commercial; Carrier; Hoshizaki Corporation; American Range; Tefcold A/S; Fagor Professional; Miele; Alto-Shaam Inc.; Electrolux; Gardiff Catering; Vollrath Company, LLC; RM Kitchen Equipment Pvt. Ltd.; Hoshizaki Inc.; and Cambro.

Vollrath Co., LLC, headquartered in Wisconsin (US), is a commercial cooking and serving equipment manufacturer. The company's product offering ranges from small cookware to serving systems and components. In addition, small cookware such as aluminum stock pots, double boilers, and domed covers are manufactured by the company. The products and services are utilized across various sectors, including catering, healthcare, restaurants, education, and others. The Vollrath company offers its services in the Midwest, New York, China, Spain, and Mexico.

American Range, headquartered in California, is a commercial cooking equipment manufacturer. The products manufactured by the company include convection ovens, broilers, fryers, cheese melters & salamanders, and others. The company's products are widely utilized across restaurants and commercial kitchens worldwide. In addition, it manufactures cooking equipment for residential applications. The residential product range, which includes equipment like range tops, ovens, cooktops, and more, is manufactured in Las Vegas, Nevada.

List of Key Companies in the Commercial Kitchen Appliances Market

- Norris Industries Ptv Ltd

- Whirlpool Corporation

- Hamilton Beach Commercial

- Carrier

- Hoshizaki Corporation

- American Range

- Tefcold A/S

- Fagor Professional

- Miele

- Alto-Shaam Inc.

- Electrolux

- Gardiff Catering

- Vollrath Company, LLC

- RM Kitchen Equipment Pvt. Ltd.

- Hoshizaki Inc.

- Cambro

- Middleby Corporation

Commercial Kitchen Appliances Market Developments

May 2024: The Vollrath Company introduced a new chicken rotisserie designed to deliver superior cooking performance and efficiency. The innovations in chicken rotisserie include separate cook & hold heating modes, removable carousels and doors for easy cleaning.

June 2024: Alto-Shaam Inc. partnered with Master Marketing Foodservice to promote commercial kitchen equipment across North and South Carolina.

December 2023: Alto-Shaam Inc. partnered with the LMS association to represent their commercial kitchen equipment in Texas and Oklahoma.

Commercial Kitchen Appliances Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Dishwasher

- Refrigerator

- Oven

- Cooking Appliance

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Quick Service Restaurants

- Full Service Restaurants

- Resorts & Hotels

- Institutional Canteens

- Hospitals

- Rail, Cruise & Air Ways

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Commercial Kitchen Appliances Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 99.28 billion |

|

Market Size Value in 2025 |

USD 107.31 billion |

|

Revenue Forecast in 2034 |

USD 219.75 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The commercial kitchen appliances market size was valued at USD 99.28 billion in 2024 and is expected to grow by 219.75 billion in 2034

The market is projected to grow at a CAGR of 7.4% from 2025 to 2034.

North America had the largest share of the market.

The key players in the market are Norris Industries Ptv Ltd; Whirlpool Corporation; Hamilton Beach Commercial; Carrier; Hoshizaki Corporation; American Range; Tefcold A/S; Fagor Professional; Miele; Alto-Shaam Inc.; Electrolux; Gardiff Catering; Vollrath Company, LLC; RM Kitchen Equipment Pvt. Ltd.; Hoshizaki Inc.; and Cambro.

The cooking appliances category dominated the market in 2024.

The quick service restaurants had the largest share of the market in 2024.