Commercial Aircraft Aftermarket Parts Market Size, Share, Trends, Industry Analysis Report: By Parts (MRO Parts and Rotable Replacement Parts), Aircraft Type, Component Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1604

- Base Year: 2024

- Historical Data: 2020-2023

Commercial Aircraft Aftermarket Parts Market Overview

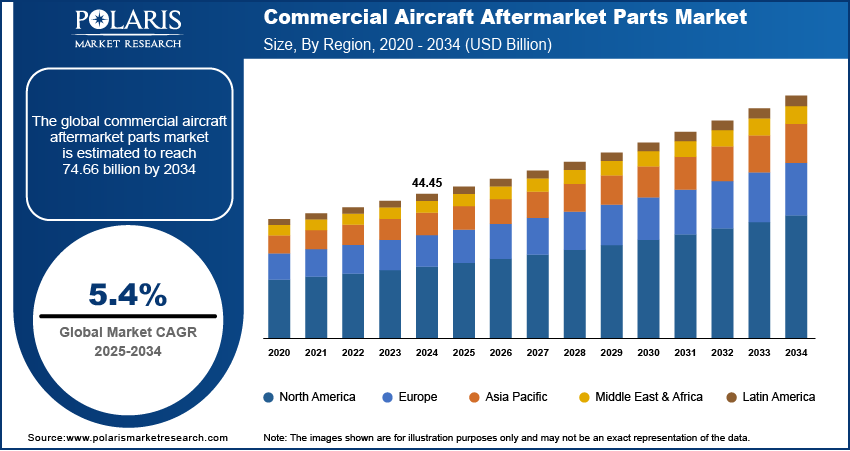

The commercial aircraft aftermarket parts market size was valued at USD 44.45 billion in 2024. The market is projected to grow from USD 46.70 billion in 2025 to USD 74.66 billion by 2034, exhibiting a CAGR of 5.4% during the forecast period.

The commercial aircraft aftermarket parts market focuses on the supply of replacement parts, components, and maintenance services for aircraft after they have been sold. These parts include everything from engines, airframes, and avionics to smaller components such as landing gear and control systems. The aftermarket also encompasses repair services, modifications, and upgrades. This market plays a crucial role in ensuring the continued safety, efficiency, and performance of aircraft throughout their operational lifespan.

The commercial aircraft aftermarket parts market demand has been growing significantly due to an increase in global air travel. Airlines are growing their fleets as more passengers travel by air, resulting in a higher demand for maintenance and replacement parts. The rise in air travel also correlates directly with an increase in aircraft usage, which accelerates the wear and tear on critical components, creating a need for more frequent replacements and repairs. Airlines and maintenance organizations are investing in aftermarket parts and solutions to extend the lifespan of their aircraft and ensure optimal operational performance and compliance with safety regulations, driving the commercial aircraft aftermarket parts market growth.

To Understand More About this Research: Request a Free Sample Report

Increased frequency of flights and extended hours that aircraft are flown are key factors fueling the commercial aircraft aftermarket parts market development. More frequent flights result in greater wear on aircraft, leading to more maintenance needs. Aircraft operating for longer hours also require more frequent checks and replacements of components. This trend is especially noticeable with low-cost carriers, which often have high utilization rates for their fleets. The growth in flight frequency and aircraft hours means that airlines must rely heavily on aftermarket parts to keep their operations running smoothly and meet safety standards.

Commercial Aircraft Aftermarket Parts Market Dynamics

Rising Preference for Outsourcing Maintenance, Repair, and Overhaul (MRO) Services

Outsourcing maintenance, repair, and overhaul (MRO) services from specialized providers offers numerous benefits as airlines aim to enhance operational efficiency, lower costs, and ensure fleet reliability. These include access to advanced technologies, expertise, and economies of scale that in-house maintenance teams may need. With the increasing complexity of aircraft systems and engines, airlines are increasingly turning to third-party digital MRO providers that offer comprehensive solutions, including engine maintenance, parts replacements, and even specialized services to help optimize fuel efficiency and reduce emissions. In February 2024, ST Engineering and PT Lion Group signed a five-year agreement for comprehensive MRO services for CFM56-7B engines, supporting the maintenance needs of Lion Air Group's expanding fleet. This collaboration underscores the growing dependence on external MRO expertise in the aviation industry. Therefore, the growing preference for outsourcing MRO services among airlines is significantly driving the commercial aircraft aftermarket parts market growth.

Technological Advancements in Aftermarket Parts for Efficiency and Reliability

Technological advancements are significantly enhancing the efficiency and reliability of aftermarket parts in the commercial aircraft industry. Innovations in materials science, such as the development of advanced alloys and composites, have led to more durable and lightweight components, improving overall aircraft performance and reducing maintenance costs. Furthermore, the integration of digital technologies such as the Internet of Things (IoT) and predictive analytics allows for real-time monitoring of aircraft systems, enabling predictive maintenance. This helps airlines identify potential issues before they become critical, thus minimizing downtime and improving operational efficiency. Automation and 3D printing also contribute to quicker production of parts, reducing lead times and costs. These technological advances are driving the growing demand for aftermarket parts as aircraft operators demand higher performance, safety, and reduced operational expenses. The ability to enhance component lifespan, reduce maintenance cycles, and ensure reliable performance is crucial to maintaining competitiveness in the commercial aircraft aftermarket parts market expansion.

Commercial Aircraft Aftermarket Parts Market Segment Analysis

Commercial Aircraft Aftermarket Parts Market Assessment by Parts Outlook

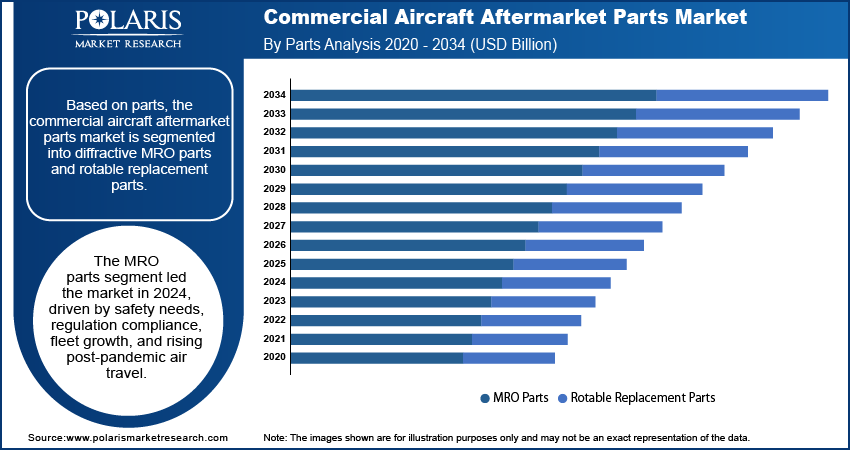

The global commercial aircraft aftermarket parts market segmentation, based on parts, includes MRO parts and rotable replacement parts. The MRO parts segment accounted for a larger commercial aircraft aftermarket parts market share in 2024 due to the essential role these components play in ensuring aircraft safety and operational efficiency. Airlines prioritize maintaining compliance with strict aviation regulations, which necessitates frequent replacements and servicing of critical parts, such as engines, avionics, and landing gear. The increasing global fleet size and the extended service life of aircraft further drive demand for MRO parts. Additionally, the surge in air travel post-pandemic has intensified the need for regular maintenance to minimize downtime. As a result, MRO parts have emerged as a vital segment, catering to the growing demand for reliability and performance in aviation operations.

Commercial Aircraft Aftermarket Parts Market Evaluation by Aircraft Type Outlook

The global commercial aircraft aftermarket parts market segmentation, based on aircraft type, includes narrow-body, wide-body, and regional jet. The narrow-body segment is expected to witness the highest growth during the forecast period due to its widespread adoption for short- and medium-haul routes. Airlines favor narrow-body aircraft for their fuel efficiency, cost-effectiveness, and ability to serve high-demand regional and domestic routes. The growing popularity of low-cost carriers (LCCs), which predominantly operate narrow-body fleets, further amplifies demand for aftermarket parts. Additionally, the post-pandemic recovery in air travel has increased flight frequencies, driving the need for regular maintenance and replacement parts for these aircraft. The segment is poised for significant growth with advancements in narrow-body models and expanding global fleets, supported by rising demand for efficient and economical air travel solutions.

Commercial Aircraft Aftermarket Parts Market Regional Analysis

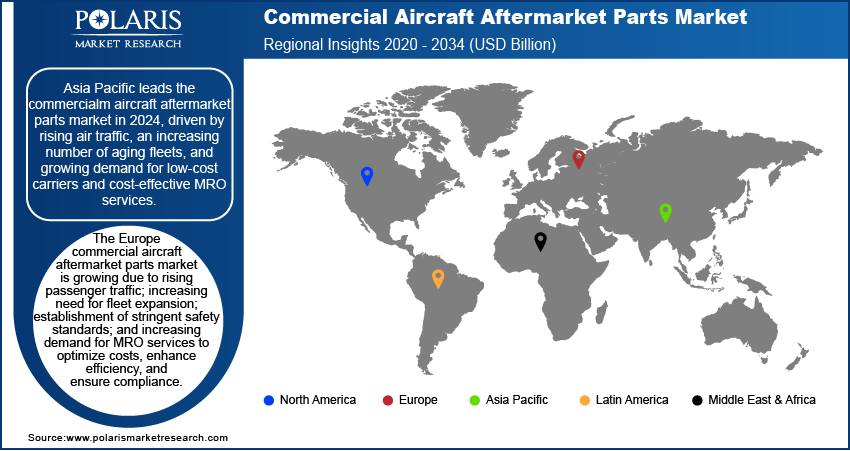

By region, the study provides commercial aircraft aftermarket parts market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the commercial aircraft aftermarket parts market share in 2024 due to rapid growth in air passenger traffic, a rise in the number of low-cost carriers, and a high concentration of aging aircraft fleets. The region’s booming aviation sector, coupled with increasing economic prosperity, has significantly increased demand for aircraft aftermarket services and parts. Airlines are growing their fleets as air travel becomes more accessible, driving the need for maintenance, repair, and overhaul services in the region.

The commercial aircraft aftermarket parts market expansion in Asia Pacific is driven by a surge in air traffic, which has resulted in higher aircraft utilization. Additionally, as airlines focus on maintaining operational efficiency, they are increasingly relying on aftermarket parts to ensure smooth operations and reduce downtime. The need for cost-effective solutions fuels this demand as airlines seek to maximize aircraft longevity while minimizing maintenance costs.

The expansion of MRO facilities across Asia Pacific plays a critical role in supporting the demand for commercial aircraft aftermarket parts. The establishment of MRO facilities enhances the ability to provide timely and efficient aircraft repairs, attracting more airlines to outsource their maintenance needs. This infrastructure growth ensures the continuous availability of quality aftermarket parts, further fueling the commercial aircraft aftermarket parts market growth in the region.

The Europe commercial aircraft aftermarket parts market is significantly growing due to the region's established aviation industry, extensive air traffic networks, and the establishment of stringent safety and maintenance standards. The demand for reliable maintenance, repair, and operations (MRO) distribution is increasing due to consistently rising air passenger volumes. Airlines are focusing on cost optimization and extending aircraft lifespan, leading to a greater demand for aftermarket parts.

The growing commercial aviation fleet across Europe directly drives the demand for aftermarket parts. The frequency of maintenance activities rises as airlines expand their fleets to accommodate higher passenger traffic. This creates a robust market for replacement parts, including engines, avionics, and interiors, to ensure operational efficiency, safety compliance, and cost-effectiveness, further fueling the Europe commercial aircraft aftermarket parts market expansion.

Commercial Aircraft Aftermarket Parts Market – Key Players and Competitive Analysis

The competitive landscape of the commercial aircraft aftermarket parts market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Aventure International Aviation Services, Honeywell International Inc., and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced commercial aircraft aftermarket parts solutions tailored for various applications. These major companies focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions. At the same time, smaller regional firms are entering the market with specialized commercial aircraft aftermarket parts solutions targeting local market demands, often focusing on customized and cost-effective applications. The competitive strategies in the market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence and cater to the growing demand for advanced grid solutions. A few key major market players are Aventure International Aviation Services, Honeywell International Inc., Collins Aerospace (RTX Corporation), Parker-Hannifin Corporation, General Electric Company, Moog Inc., GKN Aerospace (Melrose Industries), A J Walter Aviation Limited, Bombardier Inc., and The Boeing Company.

Honeywell International Inc. is a US-based multinational company specializing in aerospace, building technologies, performance materials, safety solutions, and Industry 4.0 innovations. For instance, Honeywell Forge focuses on energy efficiency, sustainability, and digital transformation across industries. In October 2023, VSE Corporation signed a license agreement with Honeywell to manufacture, repair, and sell over 300 Honeywell fuel control systems for four key engine platforms.

Collins Aerospace, a part of RTX, is a global leader in aerospace and defense, offering advanced solutions in autonomous operations, connected ecosystems, electrified aircraft, sustainability, and digital innovation, serving commercial, defense, and space industries. In February 2024, Collins Aerospace signed a three-year agreement with HNA Aviation Group airlines to provide nacelle MRO services for A320 and A320neo aircraft at its Tianjin, China facility.

List of Key Companies in Commercial Aircraft Aftermarket Parts Market

- A J Walter Aviation Limited

- Aventure International Aviation Services

- Bombardier Inc.

- Collins Aerospace (RTX Corporation)

- General Electric Company

- GKN Aerospace (Melrose Industries)

- Honeywell International Inc.

- Moog Inc.

- Parker-Hannifin Corporation

- The Boeing Company

Commercial Aircraft Aftermarket Parts Industry Development

In April 2024, Satair and Collins Aerospace renewed a four-year global distribution agreement for Collins' electric, environmental control, and engine system parts, covering Airbus, Boeing, Bombardier, and Embraer commercial and military platforms.

In March 2024, GE Aerospace will invest $650 million in 2024 to enhance manufacturing facilities, supply chain, and quality, creating over 1,000 jobs in the US and supporting commercial and defense customers.

Commercial Aircraft Aftermarket Parts Market Segmentation

By Parts Outlook (Revenue, USD Billion, 2020–2034)

- MRO Parts

- Rotable Replacement Parts

By Aircraft Type Outlook (Revenue, USD Billion, 2020–2034)

- Narrow-Body

- Wide-Body

- Regional Jet

By Component Type Outlook (Revenue, USD Billion, 2020–2034)

- Airframe

- Engine

- Interior

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Commercial Aircraft Aftermarket Parts Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 44.45 billion |

|

Market Size Value in 2025 |

USD 46.70 billion |

|

Revenue Forecast by 2034 |

USD 74.66 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 44.45 billion in 2024 and is projected to grow to USD 74.66 billion by 2034.

• The global market is projected to register a CAGR of 5.4% during the forecast period.

• Asia Pacific dominated the market revenue share in 2024.

• A few key players in the market are Aventure International Aviation Services, Honeywell International Inc., Collins Aerospace (RTX Corporation), Parker-Hannifin Corporation, General Electric Company, Moog Inc., GKN Aerospace (Melrose Industries), A J Walter Aviation Limited, Bombardier Inc., and The Boeing Company.

• The MRO parts segment dominated the market in 2024.

• The narrow-body segment is anticipated to grow during the forecast period.