Colorants Market Size, Share, Trends, Industry Analysis Report: By Color (Natural Color and Synthetic Color), Form (Pigments, Dyes, Color Concentrate, and Master Batches), Composition, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM1616

- Base Year: 2024

- Historical Data: 2020-2023

Colorants Market Overview

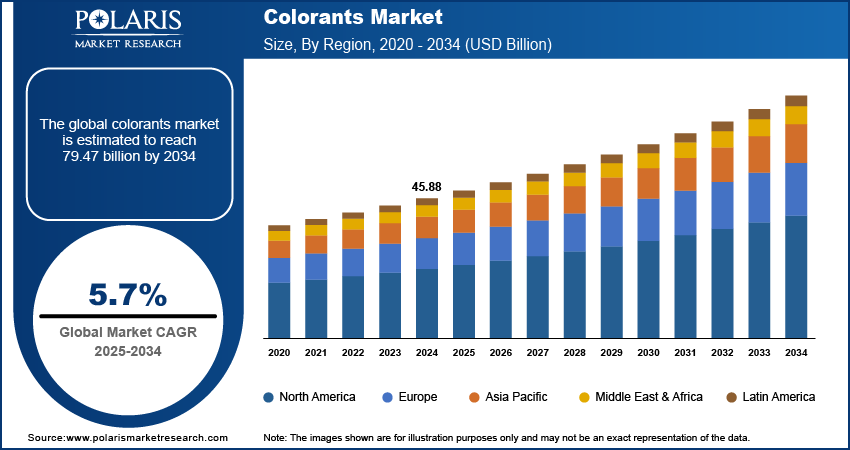

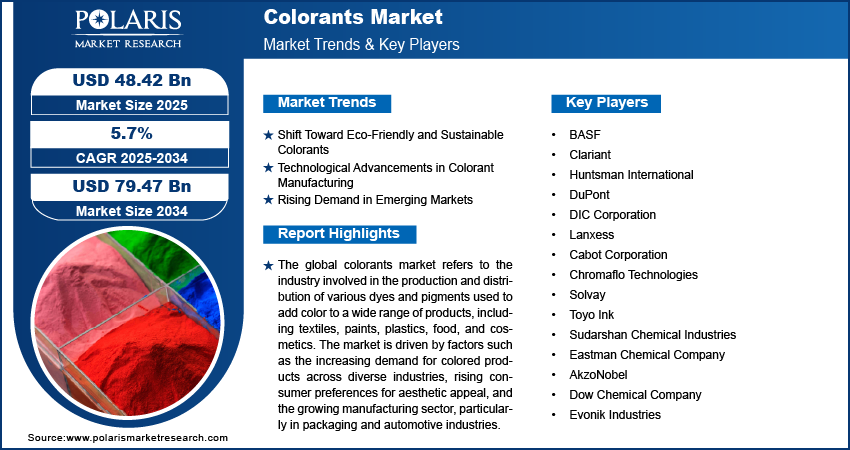

The global colorants market size was valued at USD 45.88 billion in 2024. The market is projected to grow from USD 48.42 billion in 2025 to USD 79.47 billion by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

The global colorants market refers to the industry involved in the production and distribution of various dyes and pigments used to add color to a wide range of products, including textiles, paints, plastics, food, and cosmetics. The market is driven by various factors such as the increasing demand for colored products across diverse industries, rising consumer preferences for aesthetic appeal, and the growing manufacturing sector, particularly in packaging and automotive industries. Colorants market trends are the rising shift toward eco-friendly and sustainable colorants, increasing regulatory pressures for safer chemicals, and growing technological advancements in colorant formulations. Increasing awareness regarding the environmental impact of synthetic colorants is encouraging the use of natural and bio-based alternatives.

To Understand More About this Research: Request a Free Sample Report

Colorants Market Dynamics

Shift Toward Eco-Friendly and Sustainable Colorants

The global colorants market is experiencing a significant shift toward more sustainable and eco-friendly solutions. As environmental concerns grow, regulatory pressures are pushing industries to adopt safer and greener alternatives to synthetic colorants. Natural colorants, derived from plants, minerals, and other organic sources, are gaining traction due to their reduced environmental impact compared to traditional synthetic dyes. The adoption of these sustainable colorants is particularly notable in sectors such as food & beverages, cosmetics, and textiles, where consumer demand for organic and natural products is increasing.

Technological Advancements in Colorant Manufacturing

Technological advancements in colorant production are transforming the industry by enhancing the performance and applications of colorants. Innovations such as nano-pigments and advanced colorant formulations are expanding the range of potential uses for colorants, particularly in specialized applications such as automotive coatings and high-performance plastics. Additionally, automation and digitalization in colorant production processes are improving efficiency, reducing waste, and enabling better customization. Companies are increasingly investing in research and development to create colorants with improved stability, durability, and environmental compatibility. The growth of digital printing technologies in industries such as textiles and packaging has also contributed to the need for more versatile and high-quality colorants.

Rising Demand in Emerging Markets

Emerging markets, particularly in Asia Pacific and Latin America, are becoming increasingly important for the global colorants market. Rapid industrialization, increasing urbanization, and rising disposable incomes are driving demand for colorants in various applications such as paints and coatings, packaging, and textiles. As consumers in these regions adopt modern lifestyles, there is an increasing preference for vibrant, aesthetically appealing products. For example, rising demand for textiles, personal care products, and food colorants are expected to boost the Indian colorants market growth during the forecast period.

Colorants Market – Segment Insights

Colorants Market Assessment – Color-Based Insights

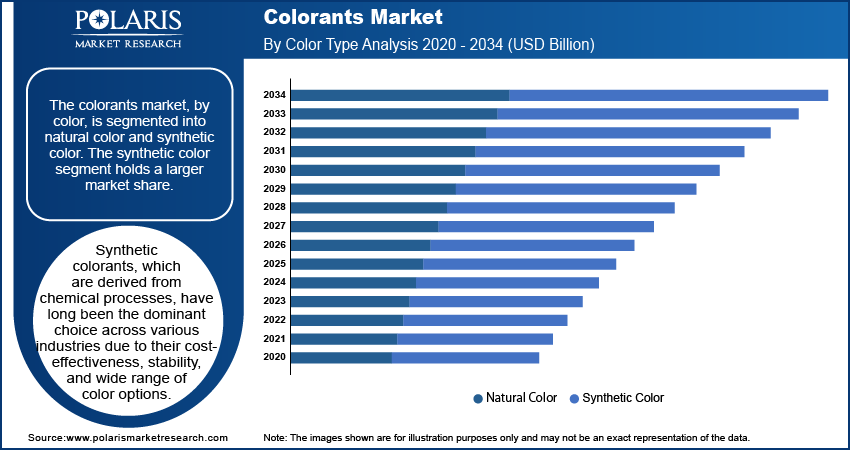

The colorants market, by color, is segmented into natural color and synthetic color. The synthetic color segment holds a larger market share. Synthetic colorants, which are derived from chemical processes, have long been the dominant choice across various industries due to their cost-effectiveness, stability, and wide range of color options. These colors are widely used in the automotive, textile, plastics, and coatings industries, where consistent color quality is essential. Despite concerns regarding their environmental and health impact, synthetic colors are used significantly, particularly in applications where durability and performance are paramount. The segment is expected to maintain its dominance in the coming years, driven by continuous innovations in production methods and an increasing demand for highly specialized colorants in sectors such as high-performance coatings and packaging.

The natural color segment is registering rapid growth, fueled by rising consumer awareness about sustainability and the health implications of synthetic chemicals. Natural colorants, sourced from plants, minerals, and other organic materials, are gaining popularity in industries such as food, beverages, cosmetics, and personal care, where there is a marked shift toward organic and clean-label products. This growth is particularly noticeable in the food & beverage industry, where consumers are increasingly seeking natural and nontoxic ingredients. As a result, natural colorants are becoming a preferred choice in regions where regulatory frameworks are tightening, and consumer demand for eco-friendly alternatives is intensifying.

Colorants Market Outlook– Form-Based Insights

The colorants market, based on form, is segmented into pigments, dyes, color concentrate, and master batches. The pigments segment holds the largest market share. Pigments are insoluble particles used to impart color to materials such as plastics, paints, and coatings. The segments dominate the market due to their versatility, durability, and strong color strength. The demand for pigments is particularly robust in the automotive, coatings, and plastics industries, where long-lasting and stable colorants are essential. The segment benefits from continuous innovations in pigment formulations, which improve performance and expand applications across various sectors. The pigments segment is expected to remain dominant in the market, fueled by rising industrial demand and increasing investments in advanced pigment technologies.

The color concentrate and master batch segments are witnessing rapid growth. These products are used for easy processing and customization of colorants in applications such as plastics and packaging. The increasing adoption of color concentrates and master batches is being driven by their ability to deliver more precise, consistent color formulations, while offering cost efficiencies and reducing processing times. This is particularly relevant in industries that require high production volumes with minimal quality variation, such as the packaging and consumer goods sectors. As industries prioritize operational efficiency and customization, the color concentrate and master batch segments are poised for substantial growth in the coming years, particularly in emerging markets where manufacturing processes are evolving.

Colorants Market Evaluation – Composition-Based Insights

The colorants market, by composition, is bifurcated into organic and inorganic. The inorganic segment holds a larger market share. Inorganic colorants, which are typically made from metal oxides or salts, are widely used across a range of applications due to their superior stability, heat resistance, and opacity. These characteristics make them particularly valuable in industries such as coatings, ceramics, construction, and automotive, where durability and long-lasting performance are critical. Inorganic colorants, including titanium dioxide and chromium oxide, are essential for applications that require strong, stable colors that withstand extreme conditions, thus ensuring their continued dominance in the market.

The organic segment is registering a higher growth rate, driven by increasing demand in the food, cosmetics, and textile industries. Organic colorants, derived from carbon-based compounds, offer vibrant and bright colors, making them highly desirable in applications where aesthetic appeal is a priority. The growth of the organic segment is further accelerated by the shift toward natural and sustainable products, as consumers increasingly prefer eco-friendly alternatives. This shift is particularly evident in the food & beverages and personal care sectors, where there is a rising preference for natural, plant-based, and bio-sourced colorants due to health and environmental concerns. The organic segment is expected to continue its rapid expansion, particularly in regions with stringent environmental regulations and growing consumer demand for sustainable products.

Colorants Market Outlook – Industry-Based Insights

The colorants market, by industry, is segmented into packaging, paper & printing, textiles, building & construction, automotive, consumer goods, and others. The packaging industry holds the largest market share due to the extensive use of colorants in packaging materials such as plastic, glass, and paper. Packaging requires colorants for aesthetic purposes and functional attributes, such as branding, differentiation, and protection against UV degradation. The demand for colorants in packaging is driven by the growing need for visually appealing and sustainable packaging solutions. As packaging is closely tied to consumer products, the market for colorants in this sector is vast and continues to expand, particularly with the rising focus on eco-friendly and recyclable materials. The packaging sector remains crucial in driving the demand for a wide variety of colorants, especially in consumer goods packaging, where differentiation and appeal are key.

The textiles industry is registering the highest growth in the colorants market, driven by the increasing demand for fashion and textile products worldwide. Colorants in textiles are used to achieve vibrant colors, patterns, and finishes. With the growing consumer interest in sustainable and eco-friendly fabrics, there has been a significant shift toward natural and biodegradable colorants. The rise of e-commerce and global textile trade, along with innovations in dyeing technologies, is further fueling the demand for colorants in this sector. The growing trend toward personalized fashion and the use of colorants in high-performance textiles, such as activewear, is contributing to the rapid growth of the textiles segment.

Colorants Market Regional Insights

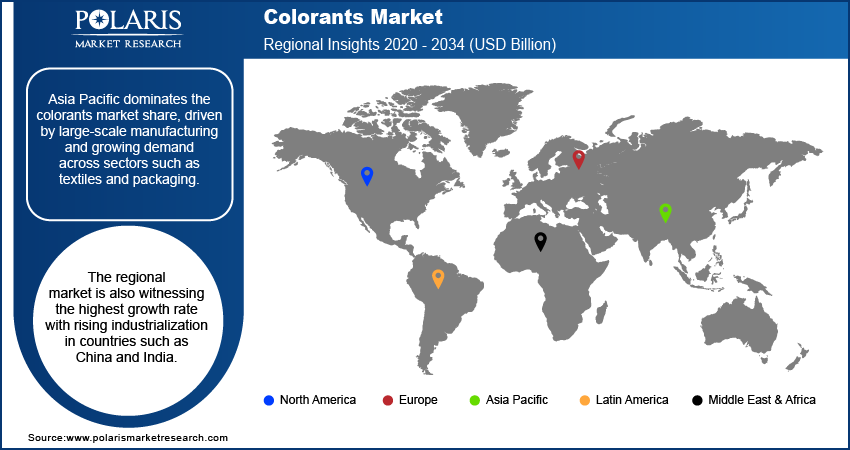

By region, the study provides colorants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest market share. This dominance is attributed to the region’s rapid industrialization; large-scale manufacturing capabilities; and significant demand across key sectors such as textiles, packaging, automotive, and consumer goods. Countries such as China and India are major contributors to this growth, driven by their expanding economies, increasing population, and rising disposable incomes. Additionally, in Asia Pacific, robust manufacturing infrastructure and the growing adoption of colorants in various industries, particularly in textiles and packaging, have solidified the region’s leading position in the global colorants market.

Europe holds a significant share of the global colorants market, driven by the region’s strong industrial base, stringent regulations, and increasing consumer demand for sustainable and eco-friendly products. Key industries such as automotive, packaging, and textiles play a crucial role in the demand for colorants, with the automotive sector prioritizing high-quality, durable colorants for coatings and finishes. The growing trend toward environmental sustainability and stricter regulations around chemical usage in consumer products are encouraging a shift toward natural and bio-based colorants. Additionally, the demand for high-performance colorants in specialized applications, including coatings and printing, continues to support the colorants market expansion in Europe.

Asia Pacific is the largest and fastest-growing region in the global colorants market. The regional market growth is largely driven by the rapid industrialization and expanding manufacturing sectors in countries such as China, India, and Japan. The region is a hub for textiles and packaging, both of which rely heavily on colorants for aesthetic and functional purposes. Furthermore, rising consumer demand for packaged goods, textiles, and personal care products, coupled with increasing disposable income, fuels the requirement for vibrant and innovative colorant solutions. The region’s large-scale production capabilities, low labor costs, and high focus on sustainable colorant solutions are a few key factors contributing to Asia-Pacific's dominant position in the market.

Colorants Market – Key Players and Competitive Insights

Key players in the global colorants market are BASF, Clariant, Huntsman International, DuPont, and DIC Corporation, all of which actively produce and distribute colorants across various industries. Other important participants include Lanxess, Cabot Corporation, Chromaflo Technologies, Solvay, Toyo Ink, and Sudarshan Chemical Industries. These companies are involved in manufacturing a wide range of colorants, including pigments, dyes, and masterbatches, catering to diverse industries such as automotive, packaging, textiles, and consumer goods. A few more notable players are Eastman Chemical Company, AkzoNobel, and the Dow Chemical Company, which continue to innovate in product development and sustainability initiatives. These companies leverage their strong manufacturing capabilities and global supply chains to remain competitive in the market.

The competitive landscape of the colorants market is shaped by companies focusing on innovation, product diversification, and sustainability. Many players are investing in R&D to develop colorants that meet the growing demand for eco-friendly and bio-based solutions, responding to both consumer preferences and increasingly stringent regulations. There is also a significant focus on offering customized color solutions, particularly in industries such as packaging and automotive, where specific color performance is crucial. Furthermore, as industries seek better operational efficiencies, the demand for color concentrates and masterbatches is on the rise, prompting players to expand their portfolios in this direction. Additionally, some of the key players have adopted strategic collaborations and partnerships to enhance their product offerings and strengthen their market presence.

In terms of regional dynamics, players are expanding their operations in emerging markets, particularly in Asia Pacific, where manufacturing growth and rising consumer demand are significant drivers. Companies such as Clariant and BASF have established a strong foothold in the region, capitalizing on the demand for colorants in textiles, packaging, and consumer goods. To maintain their competitive advantage, many companies are also focusing on enhancing their sustainability credentials by aligning their product offerings with eco-friendly standards. The competitive pressure in the market also stems from the rise of regional players that are increasingly able to offer cost-effective and specialized solutions, intensifying the challenge for global firms. The key players are continuing to adapt to changing market conditions through strategic investments and by expanding their product lines to stay relevant in this evolving market.

BASF is a global company that produces a wide range of products, including colorants for various industries such as automotive, coatings, and textiles. They focus on developing solutions that meet the diverse needs of different sectors, with an emphasis on improving product quality and sustainability. BASF has made significant efforts in recent years to promote eco-friendly and sustainable practices in its production processes.

Clariant is another significant player in the colorants market, providing a range of colorants for applications in plastics, paints, and coatings, as well as personal care products. The company has made efforts to integrate sustainability into its business model, focusing on innovations that reduce the environmental impact of colorant production.

Key Companies in Colorants Market

- BASF

- Clariant

- Huntsman International

- DuPont

- DIC Corporation

- Lanxess

- Cabot Corporation

- Chromaflo Technologies

- Solvay

- Toyo Ink

- Sudarshan Chemical Industries

- Eastman Chemical Company

- AkzoNobel

- Dow Chemical Company

- Evonik Industries

Colorants Industry Developments

- In March 2024, BASF announced the launch of a new series of bio-based colorants for the textile industry, aimed at reducing the environmental impact of synthetic dyes. The company's ongoing research and development are central to its strategy of providing high-performance colorants while meeting environmental and regulatory requirements.

- In February 2024, Clariant launched a new range of colorants made from renewable raw materials, designed to help meet the growing demand for sustainable and eco-friendly products in the packaging industry. The company's commitment to sustainability, along with its focus on custom solutions for customers, positions it as an important player in the global colorants market.

Colorants Market Segmentation

By Color Outlook

- Natural Color

- Synthetic Color

By Form Outlook

- Pigments

- Dyes

- Color Concentrate

- Master Batches

By Composition Outlook

- Organic

- Inorganic

By Industry Outlook

- Packaging

- Paper & Printing

- Textiles

- Building & Construction

- Automotive

- Consumer Goods

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Colorants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 45.88 billion |

|

Market Size Value in 2025 |

USD 48.42 billion |

|

Revenue Forecast in 2034 |

USD 79.47 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global colorants market size was valued at USD 45.88 billion in 2024 and is projected to grow to USD 79.47 billion by 2034.

The global market is projected to register a CAGR of 5.7% during 2025–2034.

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the global colorants market are BASF, Clariant, Huntsman International, DuPont, and DIC Corporation, all of which actively produce and distribute colorants across various industries. Other important participants include Lanxess, Cabot Corporation, Chromaflo Technologies, Solvay, Toyo Ink, and Sudarshan Chemical Industries

The synthetic color segment accounted for a larger share of the global market in 2024.

The pigments segment accounted for the largest share of the global market in 2024.

Colorants are substances used to impart color to various materials, including textiles, plastics, paints, coatings, food, and cosmetics. They are typically classified into two main types—pigments, which are insoluble and provide color by scattering light, and dyes, which are soluble and color materials by binding to their surface. Colorants are used in numerous industries to enhance the visual appeal of products, improve functionality, and sometimes provide protective properties, such as UV resistance.

A few key trends in the colorants market are described below: Rising Demand for Sustainable and Eco-Friendly Colorants: Increasing consumer preference for natural, bio-based, and nontoxic colorants due to environmental and health concerns. Increasing Focus on Bio-Based Colorants: Growing development and use of bio-based colorants, particularly in the food, beverage, and cosmetics industries, driven by sustainability initiatives. Customization and Personalization: Increasing demand for customized color solutions, especially in the packaging, automotive, and consumer goods sectors. Technological Innovations: Continued research and development in colorant technology, including high-performance pigments and dyes for specialized applications.

A new company entering the colorants market must focus on developing sustainable and eco-friendly colorants, as consumer demand for natural and bio-based products continues to rise. Investing in advanced technologies for customization and precision, such as digital color matching, could help differentiate the company in industries such as packaging and automotive. Additionally, offering innovative solutions for emerging markets, particularly in Asia Pacific, where industrialization is booming, would be a key growth area. Focusing on regulatory compliance and providing safer, nontoxic alternatives could also appeal to industries facing stricter environmental standards.

Companies manufacturing, distributing, or purchasing colorants and related products, and other consulting firms must buy the report.