Colombia Tire Recycling Market Size, Share, Trends, Industry Analysis Report: By Tire Types [Off-The-Road (OTR) Tires Recycling, On The Road Tires Recycling, and Aircraft Tire Recycling], Recycling Methods, and Applications – Market Forecast 2025–2034

- Published Date:Mar-2025

- Pages: 54

- Format: PDF

- Report ID: PM5395

- Base Year: 2024

- Historical Data: 2020-2023

Colombia Tire Recycling Market Overview

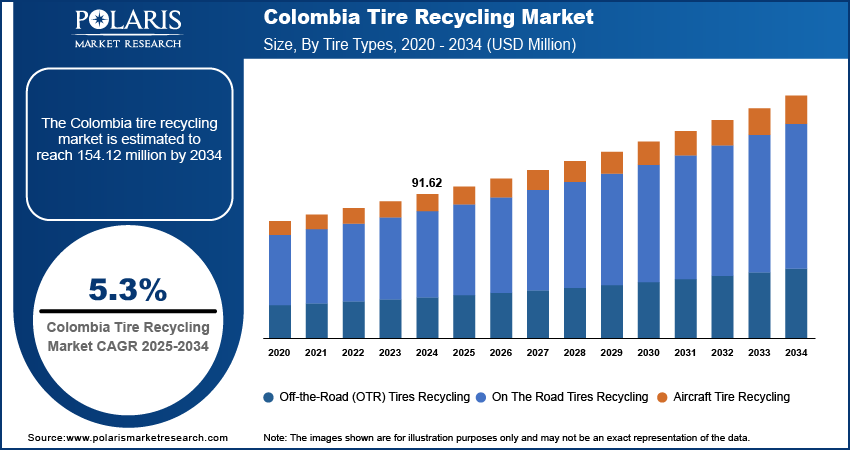

The Colombia tire recycling market size was valued at USD 91.62 million in 2024. The market is projected to grow from USD 96.43 million in 2025 to USD 154.12 million by 2034, exhibiting a CAGR of 5.3% from 2025 to 2034.

Tire recycling refers to the process of converting end-of-life tires into reusable materials and byproducts through various mechanical, chemical, and thermal methods. This practice addresses the challenge of managing the increasing number of waste tires, ensuring environmental sustainability while creating economic value.

The rising vehicle ownership in Colombia and the resulting surge in end-of-life tires are significantly contributing to the Colombia tire recycling market demand. The need to mitigate the environmental risks associated with discarded tires, such as soil and water pollution, has amplified the importance of effective recycling solutions, making the market a critical aspect of sustainable waste management.

To Understand More About this Research: Request a Free Sample Report

Colombia's commitment to sustainability and introduction of environmental policies plays a pivotal role in driving the market growth. Government initiatives, including extended producer responsibility (EPR) programs, are encouraging manufacturers to adopt sustainable practices in tire collection and recycling. The promotion of circular economy has further reinforced these efforts, creating a pathway for integrating recycled materials into industrial infrastructure. Public awareness campaigns and policy frameworks aimed at reducing waste and promoting recycling practices are further supporting the Colombia tire recycling market development, offering opportunities for businesses involved in waste management and recycling.

Technological advancements are reshaping the Colombia tire recycling market by introducing innovative and sustainable recycling methods. Practices such as catalytic pyrolysis and crumb rubber production are gaining momentum, producing valuable byproducts that are used in industries such as construction, manufacturing, and energy generation. Rubberized asphalt, derived from recycled tires, is being increasingly utilized for road construction and maintenance, reducing the environmental footprint of infrastructure projects. These advancements are driving the efficiency of recycling processes and are also opening up new market opportunities.

Colombia Tire Recycling Market Dynamics

Expansion of Automotive Industry

Colombia's automotive industry has witnessed substantial growth in recent years, driven by its efficient business ecosystem and rising vehicle demand from domestic and international markets. According to ProColombia, in association with Comercio, Industria y Turismo, vehicle sales in Colombia reached 250,497 units in 2021, an increase of 33% as compared to 2020. The increased sales positioned Colombia as the fourth-largest vehicle manufacturer in Latin America. This growth emphasizes the country’s enhanced manufacturing capacity, contributing to the production of vehicles and a parallel increase in the generation of end-of-use tires.

The country’s low motorization rate of 87 vehicles per 1,000 inhabitants in 2022 emphasizes the immense potential for Colombia tire recycling market expansion. In contrast, Argentina, with a rate of 227 vehicles per 1,000 inhabitants, highlights Colombia's untapped opportunities for vehicle assembly and sales growth. This steady rise in vehicle ownership translates into a growing supply of tires requiring sustainable recycling solutions.

Government policies promoting electric mobility and sustainable transportation have further accelerated this trend. The transition toward hybrid and electric vehicles supports environmental goals and amplifies the demand for tire recycling, creating significant opportunities for the recycling market to flourish.

Growing Focus on Sustainable Economic Activities

The growing emphasis on sustainable economic activities has prompted government industries, and consumers to prioritize environmental responsibility. This shift has led to the development of innovative solutions for managing waste, particularly in the form of discarded tires. Tire recycling helps mitigate the environmental hazards associated with landfills and illegal dumping and also supports the circular economy.

Governments worldwide are introducing stringent regulations and providing incentives to encourage sustainable practices. For instance, Colombia introduced the Green Taxonomy framework in April 2022. It classifies economic activities that support sustainability and guides investors and businesses to focus on environmentally responsible projects. Additionally, Colombia’s commitment to reducing greenhouse gas emissions by 2030 and achieving carbon neutrality by 2050 underscores the importance of managing waste, including tires, to help meet climate objectives.

Industries such as construction and energy are increasingly incorporating end-of-life tires into their processes. Recycled tires are used to produce rubberized asphalt, which is more durable and noise-absorbent. Tire-derived fuel, used in energy generation, reduces reliance on traditional fuels. This efficient application of tire waste supports industries in reducing their use of raw materials and fuels, contributing to their sustainability goals.

Colombia Tire Recycling Market Assessment by Tire Types Outlook

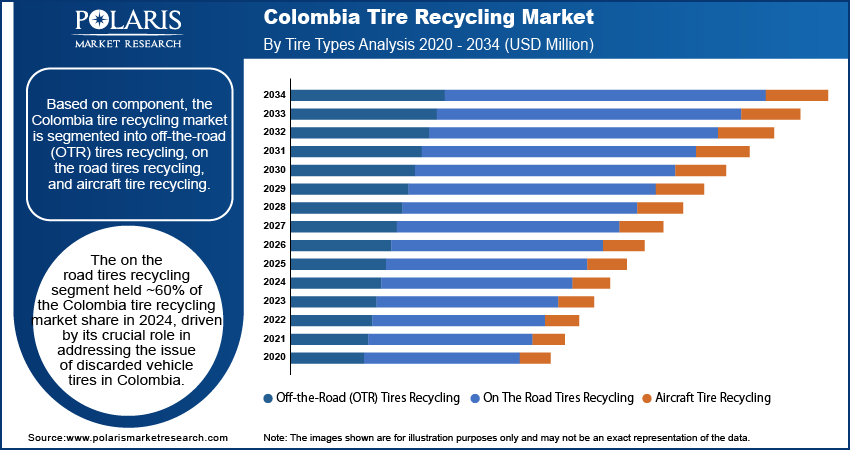

The Colombia tire recycling market segmentation, based on tire types, includes off-the-road (OTR) tires recycling, on the road tires recycling, and aircraft tire recycling. The on the road tires recycling segment held ~60% of the Colombia tire recycling market share in 2024. On-the-road tire recycling plays a crucial role in addressing the issue of discarded vehicle tires in Colombia. This process involves collecting and converting non-functional tires into reusable materials such as rubber, steel, and fiber, which are utilized in sectors such as construction and manufacturing. This initiative reduces the environmental risks posed by abandoned tires and also enhances resource efficiency by minimizing reliance on raw material extraction.

The growing demand for on-the-road tire recycling in Colombia is attributed to impactful government programs such as “Llantatón.” This campaign actively involves citizens and businesses in recycling efforts, significantly reducing waste. In February 2022, the program demonstrated its effectiveness by collecting 570 tires, reflecting a strong commitment to sustainability at both individual and community levels. Colombia’s efforts resonate with global sustainability goals, emphasizing environmental responsibility. Expanding these programs and investing in advanced recycling technologies further support the transition to a circular economy.

Colombia Tire Recycling Market Evaluation by Recycling Methods Outlook

The Colombia tire recycling market segmentation, based on recycling methods, includes shredding & grinding, pyrolysis, retreading, and others. The pyrolysis segment is expected to register the highest CAGR of 5.5% during the forecast period due to its ability to convert waste tires into valuable byproducts efficiently. This process decomposes tires at high temperatures without oxygen, producing pyrolysis oil, carbon black, and steel wire, which are used in various industrial applications. Additionally, it presents an eco-friendly alternative to conventional tire disposal methods, addressing environmental concerns while promoting resource recovery.

The rising demand for pyrolysis in Colombia is attributed to a stronger emphasis on sustainability and stricter waste management regulations. Both government initiatives and private sector investments are recognizing the potential of pyrolysis to reduce landfill waste while generating economically valuable outputs. This growing support is fueling the expansion of pyrolysis technologies in the country. For instance, in March 2020, the installation of four 12T/D waste tire pyrolysis plants by DOING highlighted Colombia’s increasing adoption of advanced pyrolysis methods. This development underscores the country's commitment to incorporating solutions in tire recycling.

Colombia Tire Recycling Market – Key Players and Competitive Insights

The competitive landscape of the Colombia tire recycling market is characterized by a mix of Colombian leaders and regional players competing for market share through innovation, strategic partnerships, and regional expansion. Key players such as Drummond Company, Inc, Liberty Tire Recycling, and others in the market leverage their robust research and development (R&D) capabilities along with extensive distribution networks to offer advanced tire recycling solutions tailored for various applications. They also focus on continuous product innovation to improve efficiency, reliability, and scalability to meet the evolving needs of industries that require advanced power management solutions.

Smaller regional firms are entering the market with specialized tire recycling solutions targeting local market demands, often focusing on customized and cost-effective applications. The competitive strategies in the Colombia tire recycling market include mergers and acquisitions, collaborations with technology firms, and expanding product portfolios to enhance market presence. A few key major players are Ruedaverde, Liberty Tire Recycling, Neoland SAS, Duramos, EcoTireGreen, Genan, Drummond Ltd., Lehigh Technologies (A Michelin Group Company), and Ecolomondo Corporation.

Rueda Verde, a tire management organization in Colombia, addresses environmental challenges through Extended Producer Responsibility. It ensures efficient tire collection, transportation, and recycling, recovering valuable resources while promoting sustainability, education, and investment in advanced recycling technologies.

Genan leads tire recycling with advanced technology, processing over 400,000 metric tons annually. It produces granulates, rubber powder, and steel, supporting industries such as construction and manufacturing while reducing CO₂ emissions and promoting sustainability in the circular economy.

List of Key Companies in Colombia Tire Recycling Market

- Drummond Company, Inc.

- Duramos S.A.S.

- Ecolomondo Corporation

- EcotireGreen

- Genan

- Lehigh Technologies (A Michelin Group Company)

- Liberty Tire Recycling

- Neoland SAS

- Rueda Verde

Colombia Tire Recycling Industry Developments

In January 2024, Liberty Tire Recycling announced the acquisition of Empire Tire and McGee Tire in Central Florida. The company stated the strategic development will enhance its footprint and recycling operations in the growing region to improve tire collection and sustainability efforts.

In June 2022, Drummonds collaborated with Duramos SAS to hire their services for the proper disposal of waste tires.

Colombia Tire Recycling Market Segmentation

By Tire Types Outlook (Revenue, USD Million, 2020–2034)

- Off-the-Road (OTR) Tires Recycling

- On the Road Tires Recycling

- Aircraft Tire Recycling

- Airplanes

- Helicopters

- Others

By Recycling Methods Outlook (Revenue, USD Million, 2020–2034)

- Shredding & Grinding

- Pyrolysis

- Retreading

- Others

By Applications Outlook (Revenue, USD Million, 2020–2034)

- Energy Generation

- Consumer Goods

- Manufacturing and Industrial Uses

- Civil Engineering and Infrastructure

Colombia Tire Recycling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 91.62 million |

|

Market Size Value in 2025 |

USD 96.43 million |

|

Revenue Forecast by 2034 |

USD 154.12 million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Colombia tire recycling market size was valued at USD 91.62 million in 2024 and is projected to grow to USD 154.12 million by 2034.

The market is projected to register a CAGR of 5.3% during the forecast period.

A few key players in the market are Ruedaverde, Liberty Tire Recycling, Neoland SAS, Duramos, EcoTireGreen, Genan, Drummond Ltd., Lehigh Technologies (A Michelin Group Company), and Ecolomondo Corporation.

The on the road tires recycling segment dominated the Colombia tire recycling market in 2024.

The pyrolysis segment of the Colombia tire recycling market is anticipated to grow during the forecast period.