Cold Plasma Market Size, Share, Trends, Industry Analysis Report: By Regime (Low Pressure and Atmospheric Pressure), Application, End Use, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 107

- Format: PDF

- Report ID: PM2308

- Base Year: 2024

- Historical Data: 2020-2023

Cold Plasma Market Overview

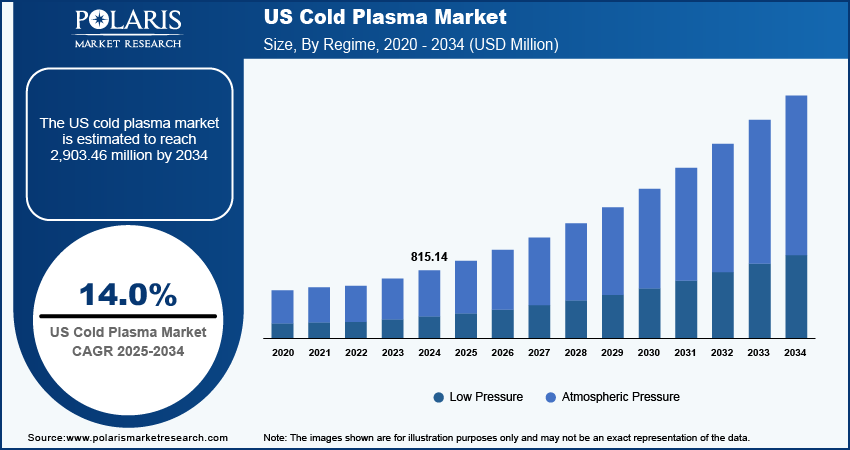

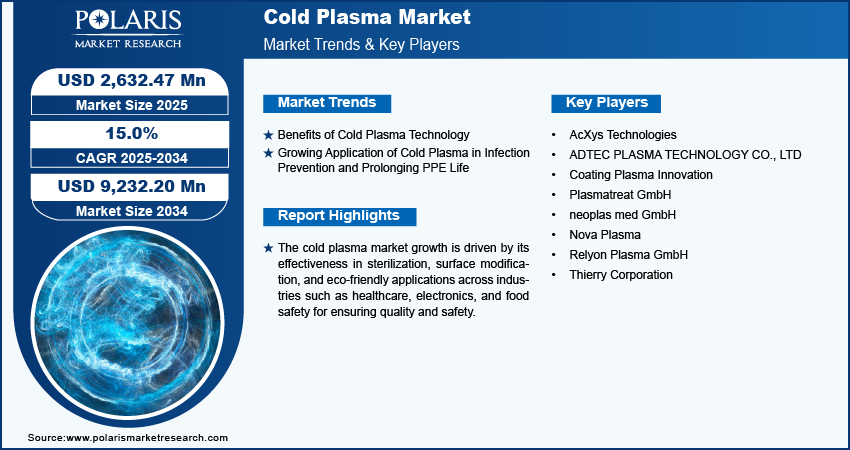

The global cold plasma market size was valued at USD 2,293.15 million in 2024. The market is projected to grow from USD 2,632.47 million in 2025 to USD 9,232.20 million by 2034, exhibiting a CAGR of 15.0% during the forecast period.

Cold plasma, also known as non-thermal plasma, is a partially ionized gas with low temperature. It is used in various applications such as sterilization, surface treatment, and medical therapies. The cold plasma market has been experiencing significant growth in recent years, driven by its applications, including surface modification, sterilization, and decontamination across numerous industries such as semiconductors and automotive. Moreover, in the healthcare sector, it is employed in wound healing, cancer treatment, and infection control, further enhancing the demand for cold plasma technologies. In addition, the growing preference for eco-friendly, non-chemical alternatives in industries such as automotive, electronics, and textiles is contributing to the market expansion.

A prominent trend in the cold plasma market is its rising integration into the healthcare sector. Moreover, the technology is increasingly being utilized in the sector for sterilizing medical devices, treating infections, and promoting faster wound healing. Also, with the growing advancements in cold plasma technology, innovative applications such as cancer treatment using cold atmospheric plasma are expected to accelerate market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Another key driving factor for the growth of the cold plasma market is its increasing application toward food safety through food and packaging decontamination. Cold plasma technology is effective in decontaminating food surfaces, extending shelf life, and ensuring microbial safety without altering food quality. Further, with the increasing demand for safer, longer-lasting food products, especially in the processed food industry, the adoption of cold plasma technology is rising.

Major players in the cold plasma market encompass multinational corporations and specialized providers with expertise in plasma technology applications, surface treatment, and sterilization processes. These companies compete based on service quality, technological advancements, geographic reach, and pricing strategies. Key market participants frequently collaborate with healthcare institutions, food processing companies, and industrial manufacturers to offer integrated solutions that effectively meet client requirements across various sectors.

Cold Plasma Market Trends

Benefits of Cold Plasma Technology

Cold plasma technology is increasingly used for various applications such as coating, finishing, and surface treatment. Cold plasma, a non-thermal ionized gas, provides numerous benefits that enhance its attractiveness across multiple sectors. A key advantage is its ability to modify surface properties without relying on high temperatures or harmful chemicals. Moreover, the feature is essential in applications such as surface treatment and coating, where it enhances adhesion, durability, and functionality for materials such as metals, plastics, and textiles.

In healthcare, cold plasma is gaining popularity for its effectiveness in sterilizing surfaces and promoting wound healing without harming surrounding tissues. Moreover, its ability to reduce microbial contamination and stimulate tissue repair makes it valuable in managing chronic wounds and controlling infections. Additionally, cold plasma technology supports environmental sustainability by providing eco-friendly solutions for air and water purification. Also, its non-thermal and chemical-free processes align with the increasing demand for greener technologies, such as renewable energy and smart grids, among others. As industries seek advanced, efficient, and environmentally conscious solutions, it will lead to broader adoption and innovation of cold plasma. Thus, the advantages of cold plasma technology would drive the cold plasma market growth during the forecast period.

Growing Application of Cold Plasma in Infection Prevention and Prolonging PPE Life

Cold plasma is gaining popularity due to its ability to reduce microbial contamination, which is essential in healthcare environments that require high hygiene standards. It effectively inactivates bacteria, viruses, and fungi without using chemicals, thus featuring it as an excellent option for sterilizing surfaces and medical equipment to improve infection control.

In terms of personal protective equipment (PPE), cold plasma technology helps maintain the antimicrobial properties of protective gear, enhancing its durability and effectiveness. By treating PPE with cold plasma, manufacturers can improve the quality and performance of materials used in masks, gloves, and gowns, ensuring continued safety for users. Therefore, this method meets the urgent need for effective infection prevention and sustainable PPE solutions, particularly in high-risk environments.

As the emphasis on healthcare safety intensifies and the need for effective infection control solutions rises in response to global health challenges, the application of cold plasma technology is on the rise. Therefore, this growth highlights the benefits of the technology, ultimately fuelling the market expansion as industries seek advanced methods to improve hygiene, safety, and sustainability. Therefore, the rising use of cold plasma technology in infection prevention and extending the PPE lifespan is expected to become a key future trend in the cold plasma market.

Cold Plasma Market Segment Insights

Cold Plasma Market Breakdown, by Regime Insights

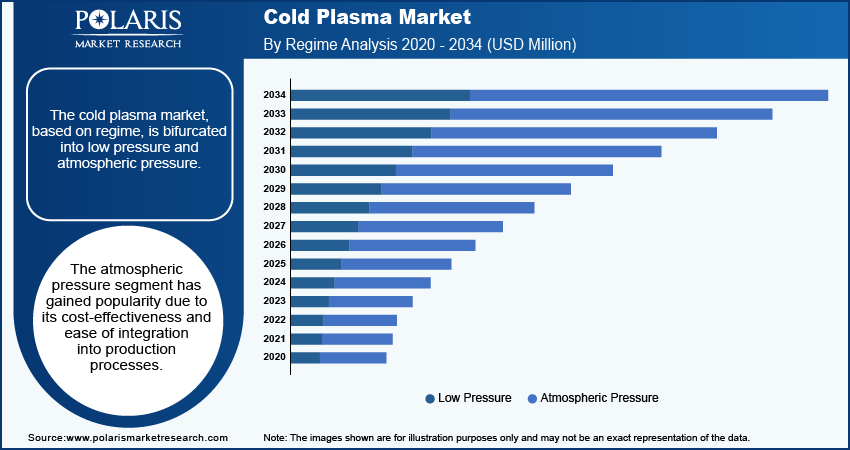

The cold plasma market, based on regime, is bifurcated into low pressure and atmospheric pressure. In 2024, the atmospheric pressure segment dominated the market, accounting for 68.5% of market revenue (USD 2,293.15 million) share. In the cold plasma market, the atmospheric pressure regime is gaining popularity due to its cost-effectiveness and ease of integration into production processes. By eliminating the need for vacuum chambers, it simplifies system design, making it more practical for industries for applications such as surface modification, sterilization; and air and water purification.

Many industries such as packaging, textiles, and agriculture are increasingly adopting atmospheric pressure cold plasma due to its ability to provide uniform treatments in continuous processes. The technology's scalability and ability to treat larger areas under ambient conditions boost operational efficiency and lower production costs, ultimately fueling its adoption across multiple industries. For instance, Plasmatreat GmbH is offering Openair-Plasma technology, associated with atmospheric pressure that performs the microfine cleaning effect on surfaces such as metal and glass.

Cold Plasma Market Breakdown, by End Use Insights

The cold plasma market segmentation, based on end use, includes automotive, electronics & semiconductors, food processing & packaging, medical, aerospace, polymers & plastics, and others. The medical segment is expected to register a CAGR of 17.0% during the forecast period owing to its rapid expansion in terms of technology's effectiveness toward wound care and infection control. Cold plasma is used to sterilize medical instruments and surfaces by eliminating pathogens without damaging sensitive equipment. Moreover, in wound care, it accelerates healing by reducing microbial load, promoting tissue repair, and stimulating regeneration, making it highly effective for treating chronic wounds and surgical incisions.

Cold plasma's ability to deliver targeted treatments at low temperatures, combined with its noninvasive nature and minimal side effects, has increased its adoption in medical applications. This growth is driving innovation and improving patient outcomes, positioning cold plasma as a valuable tool in healthcare for infection control and wound management.

Cold Plasma Market Breakdown, by Regional Insights

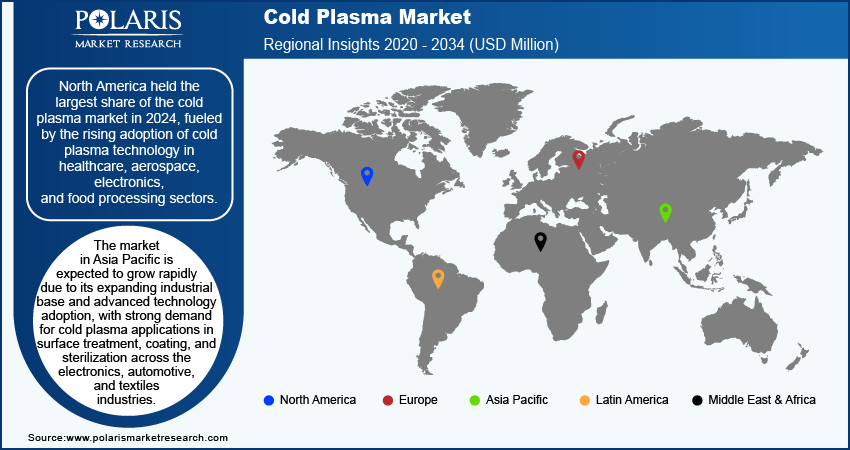

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America held the largest share of the cold plasma market in 2024, driven by the increasing adoption of cold plasma technology across various sectors, including healthcare, aerospace, electronics, and food processing. North America comprises the headquarters of leading research institutions and firms that are actively developing and commercializing cold plasma applications, contributing to the regional market expansion. Additionally, the region benefits from robust regulatory frameworks and a high level of investments in research and development that is fostering innovation and deployment of cold plasma solutions. The growing demand for advanced surface treatments, sterilization methods, and environmental applications further establishes North America as a key player in the global cold plasma market.

In the cold plasma market, Europe accounts for the second-largest market share due to its strong emphasis on research and development, advanced manufacturing capabilities, and strict regulatory standards. The region's focus on innovative solutions for industries such as automotive, healthcare, and textiles drives the adoption of cold plasma technology. European countries, such as Germany, the UK, and France, are developing eco-friendly and efficient technologies, and cold plasma aligns with these goals by offering non-thermal and chemical-free processing options. Additionally, Europe’s extensive network of research institutions and industry partnerships supports continuous advancements in cold plasma applications. Furthermore, the region's stringent regulations for product safety and environmental protection are fueling the demand for effective and sustainable cold plasma solutions, thereby positioning Europe as a significant player in the global market.

The Asia Pacific cold plasma market is experiencing rapid growth due to its expanding industrial base and increasing adoption of advanced technologies. The region's booming manufacturing sector, particularly in electronics, automotive, and textiles, drives demand for cold plasma applications in surface treatment, coating, and sterilization. Countries such as China, Japan, and South Korea are leading in research and development, contributing to technological advancements and commercialization of cold plasma solutions. Additionally, the growing focus on improving product quality and environmental sustainability fuels the adoption of cold plasma technology. The region's robust economic growth, coupled with investments in industrial modernization and environmental management, further accelerates the expansion of the cold plasma market in Asia Pacific.

Cold Plasma Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the cold plasma market in the coming years. Market participants are undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the cold plasma market players must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global cold plasma market to benefit clients. A few major players in the market are AcXys Technologies; ADTEC PLASMA TECHNOLOGY CO., LTD; Coating Plasma Innovation; Plasmatreat GmbH; neoplas med GmbH; Nova Plasma; Relyon Plasma GmbH; and Thierry Corporation.

Adtec Plasma Technology Co. Ltd. is headquartered in Fukuyama, Japan. The company’s key product portfolio includes a high frequency plasma generation equipment designed for semiconductor processes. The firm is a manufacturer and supplier of RF Plasma products to the semiconductor and display industries. In June 2023, Adtec Healthcare introduced cold plasma for wound treatment, demonstrating its antibacterial benefits and paving the way for further clinical applications.

Plasmatreat GmbH is a provider of atmospheric pressure plasma systems for surface pretreatment across industries such as automotive, electronics, transportation, packaging, consumer goods, and textile. The company has technology centers in locations such as Germany, USA, Canada, China, and Japan. In March 2024, Plasmatreat GmbH expanded its presence in Austria by founding Plasmatreat Austria GmbH to offer atmospheric pressure plasma systems across the region.

List of Key Companies in Cold Plasma Market

- AcXys Technologies

- ADTEC PLASMA TECHNOLOGY CO., LTD

- Coating Plasma Innovation

- Plasmatreat GmbH

- neoplas med GmbH

- Nova Plasma

- Relyon Plasma GmbH

- Thierry Corporation

Cold Plasma Industry Developments

August 2022: NGK SPARK PLUG announced a strategic investment in German cold plasma jet therapy company neoplas med, providing growth capital through its Venture Capital Fund, CVC.

January 2023: RELYON PLASMA GmbH announced that it is enhancing its piezobrush PZ3-i with a CAN-Bus Interface. This compact, safe, and efficient cold plasma unit integrates seamlessly into production lines, making it ideal for pre-treating bonding, printing, and laminating processes.

Cold Plasma Market Segmentation

By Regime Outlook

- Low Pressure

- Atmospheric Pressure

By Application Outlook

- Surface Treatment

- Sterilization & Disinfection

- Coating

- Finishing

- Adhesion

- Wound Healing

- Agriculture Seed Treatment

- Environmental and Water Purification

- Food Preservation

- Others

By End Use Outlook

- Automotive

- Electronics & Semiconductors

- Food Processing & Packaging

- Medical

- Aerospace

- Polymers & Plastics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cold Plasma Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,293.15 million |

|

Market Size Value in 2025 |

USD 2,632.47 million |

|

Revenue Forecast by 2034 |

USD 9,232.20 million |

|

CAGR |

15.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cold plasma market size was valued at USD 2,293.15 million in 2024 and is projected to grow to USD 9,232.20 million by 2034.

The global market is expected to register a CAGR of 15.0% during 2025–2034.

North America accounted for the largest share of the global cold plasma market in 2024, owing to the increasing adoption of cold plasma technology across various sectors, including healthcare, aerospace, electronics, and food processing.

AcXys Technologies; ADTEC PLASMA TECHNOLOGY CO., LTD; Coating Plasma Innovation; Plasmatreat GmbH; neoplas med GmbH; Nova Plasma; Relyon Plasma GmbH; and Thierry Corporation are among the key players in the market

The atmospheric pressure segment dominated the market in 2024

The wound healing segment held the largest share of the market in 2024.