Cold Chain Market Size, Share, Trends, Industry Analysis Report: By Type (Storage, Transportation, Packaging, and Monitoring Components), Temperature Range, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5339

- Base Year: 2024

- Historical Data: 2020-2023

Cold Chain Market Overview

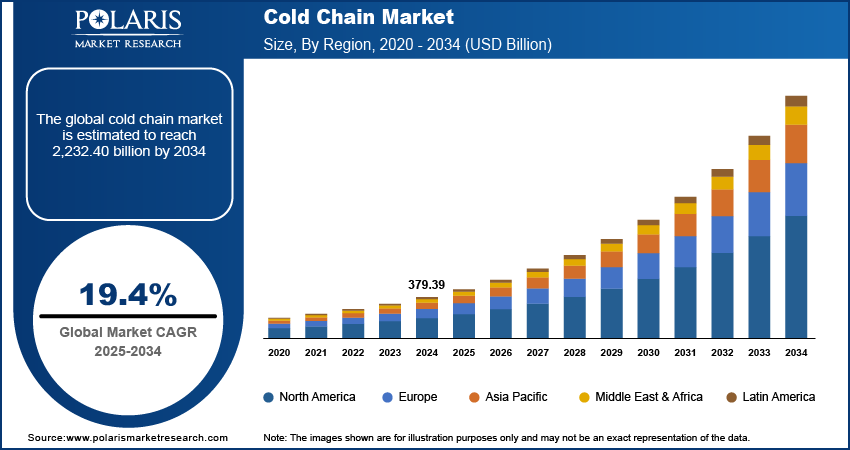

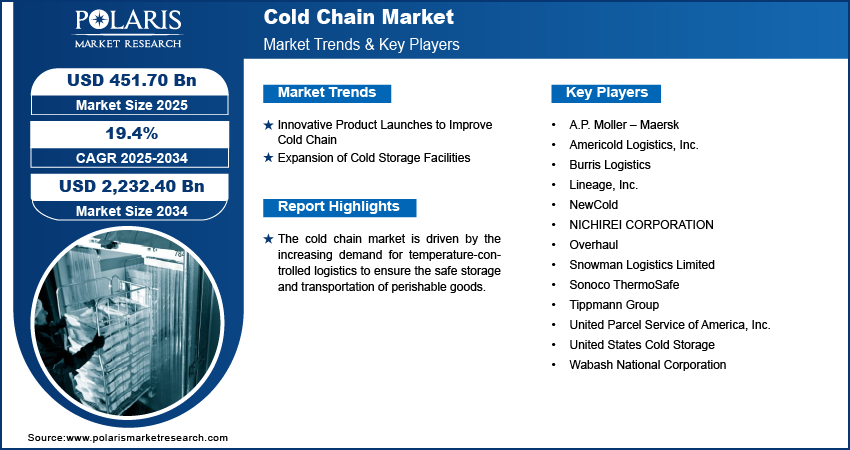

The global cold chain market size was valued at USD 379.39 billion in 2024. The market is projected to grow from USD 451.70 billion in 2025 to USD 2,232.40 billion by 2034, exhibiting a CAGR of 19.4% during 2025–2034.

The cold chain is a temperature-controlled supply chain that ensures the quality and safety of perishable products, such as food, pharmaceuticals, and vaccines, throughout the journey from production to consumption. The cold chain market growth is fueled by the increasing bilateral trade between countries across the globe. The countries are increasingly engaging in export-import activities for the exchange of goods, including food and pharmaceutical products. According to IBEF, in the fiscal year 2023, the bilateral trade between India and the US reached USD 128.78 billion, surpassing the value of USD 119.48 billion in FY22. Indian exports to the US accounted for USD 78.54 billion of the total trade in FY23, while American exports to India amounted to USD 50.24 billion. This expansion of bilateral trade between countries necessitates the efficient and reliable transportation of perishable goods across borders. The cross-border movement requires effective cold chain infrastructure to maintain the appropriate temperature conditions throughout the supply chain, ensuring product quality and safety. Consequently, the surge in global trade activities stimulates investments in advanced cold storage facilities and refrigerated transport, thereby driving the cold chain market expansion.

To Understand More About this Research: Request a Free Sample Report

Rising investment activities by investment firms are propelling the cold chain market by injecting capital into the development and expansion of infrastructure and technology. Investment firms are recognizing the growing demand for efficient cold chain solutions driven by increasing global trade and regulatory requirements. Thus, these firms are funding cold chain companies to support the enhancement of cold storage facilities. For instance, in March 2024, Fundalogical Ventures (FLV) invested in Indicold, a technology-driven cold supply chain company, during its Pre-Series A funding round. The investment is allocated in technological advancements, geographical expansion, and team enlargement. This influx of capital enables cold chain companies to scale operations and improve service capabilities, which drives the cold chain market development.

Cold Chain Market Trends

Innovative Product Launches to Improve Cold Chain

Companies are introducing advanced solutions that address the evolving needs of temperature-controlled packaging. The companies are introducing new technologies, such as energy-efficient refrigeration units, that enhance the precision and reliability of cold chain operations. For instance, in August 2024, ArcticRx, by ChefsFridge Co., introduced its innovative ArcticRx pod designed for ultra-low temperature (ULT) transportation. ArcticRx has engineered a ULT delivery pod that can maintain stable temperatures for over 21 days on a single charge of dry ice by collaborating with Rolls-Royce thermal engineers. Such product advancements are enhancing the efficiency and effectiveness of cold chain systems by integrating solutions that optimize temperature management and ensure compliance with stringent regulations. Thus, the rising innovative product launches are expected to drive the cold chain market growth in the coming years.

Expansion of Cold Storage Facilities

The companies are expanding the cold storage facilities by increasing the capacity and efficiency of temperature-controlled logistics to maintain the longevity of perishable goods, such as fresh produce, dairy foods, and pharmaceuticals. For instance, in November 2023, Lineage Logistics expanded its cold storage facility in Calgary, Canada, increasing total capacity to over 200,000 square feet and over 24,000 pallet positions. The expansion of Lineage’s Foothills facility is specifically tailored to cater to customers engaged in exporting meat and other products to Asia and other international markets. Such developments of new cold storage facilities, equipped with advanced refrigeration systems and optimized for energy efficiency, allow for reduced spoilage. Thus, the expansion of cold storage infrastructure would propel the cold chain market demand as it facilitates smoother supply chain operations.

Cold Chain Market Segment Insights

Cold Chain Market Evaluation by Type Outlook

The global cold chain market segmentation, based on type, includes storage, transportation, packaging, and monitoring components. The monitoring components segment is projected to register a significant CAGR in the global market due to its important role in ensuring the integrity and efficiency of temperature-controlled logistics. Also, the companies are introducing advanced monitoring technologies, including IoT sensors and real-time temperature tracking systems, which are essential for maintaining the precise temperature conditions required for perishable goods and pharmaceuticals. In April 2024, CSafe, a provider of temperature-controlled shipping solutions for the biopharmaceutical industry, launched three new technologies—Multi-Use Dewars, Connect Control Tower, and Silverpod MAX RE. These technologies integrate real-time data tracking to provide comprehensive visibility throughout the entire shipping process. Such launches in monitoring technologies enhance transparency, traceability, and reliability, thereby driving the substantial growth of the monitoring component segment in the cold chain market.

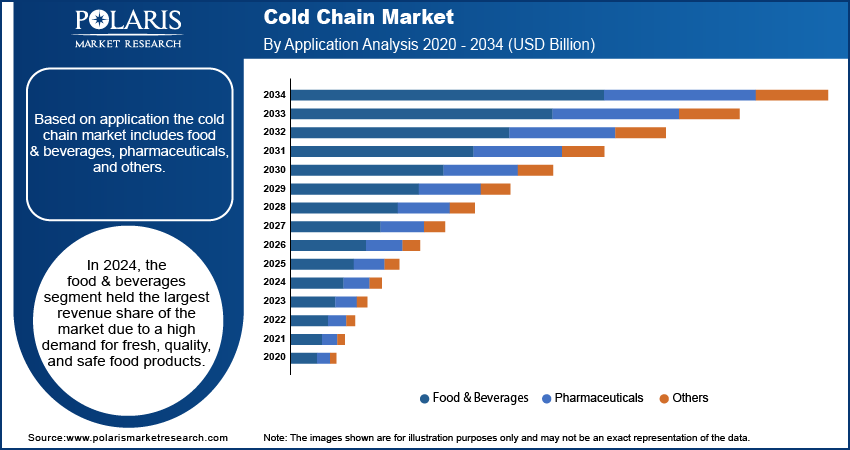

Cold Chain Market Assessment by Application Outlook

The global cold chain market segmentation, based on application, includes food & beverages, pharmaceuticals, and others. In 2024, the food & beverages segment held the largest revenue share of the market due to a high demand for fresh, quality, and safe food products. The global consumption of perishable food items, including fruits, vegetables, dairy products, and meat, continues to rise as consumer preferences shift toward fresh and minimally processed foods. An efficient cold chain is essential for preserving the quality and extending the shelf life of these products throughout the journey from production to consumption. Thus, the food and beverages companies are increasingly adopting the cold chain storage and transport infrastructure.

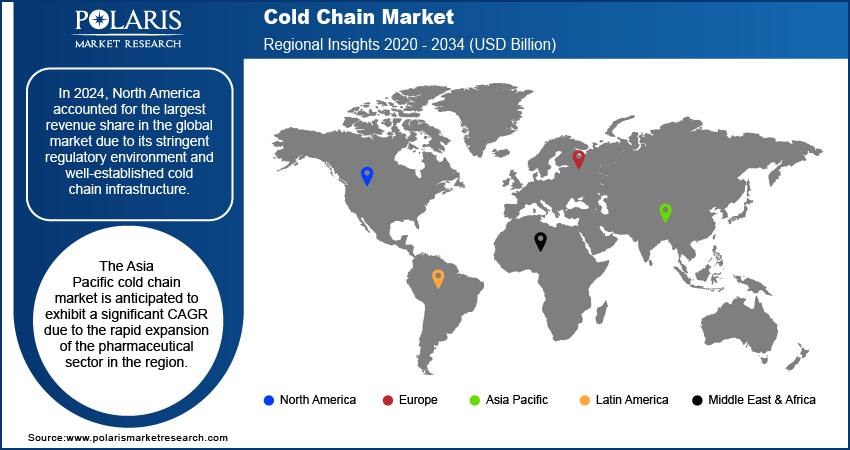

Cold Chain Market Regional Insights

By region, the study provides the cold chain market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the global market due to its stringent regulatory environment and well-established cold chain infrastructure. The comprehensive regulations imposed by the Food and Drug Administration (FDA) and the International Council for Harmonisation of Technical Requirements of Pharmaceuticals for Human Use (ICH) ensure high standards for food safety and pharmaceutical storage, driving significant investments in advanced storage and transportation technologies. Such regulations focus on precise temperature controls, monitoring, and detailed record-keeping, which fostered the development of refined cold chain systems. Therefore, strict regulatory requirements resulted in increased adoption of cold chain facilities in the region.

The Asia Pacific cold chain market is anticipated to exhibit a significant CAGR due to the rapid expansion of the pharmaceutical sector in the region. The pharmaceutical industry in Asia Pacific is experiencing robust growth driven by increasing healthcare demands, rising investments in drug development, and a burgeoning population requiring medical treatments. According to the Ministry of Industry and Information Technology (MIIT), during the 14th Five-Year Plan period (i.e., 2021–2025), China's pharmaceutical industry has experienced an annual average growth rate of 9.3% in its primary business revenues. This growth necessitates the development of advanced cold storage facilities, specialized transportation solutions, and monitoring technologies. Thus, the expansion of the pharmaceutical sector drives investments in cold chain infrastructure and logistics, resulting in the robust growth of the Asia Pacific market.

The cold chain market in India is expected to have significant growth due to the growing e-commerce sector in the country. The e-commerce industry in India is developing because of the rise of online shopping platforms, especially for groceries and perishable goods. For instance, according to IBEF, the Indian e-commerce industry is forecasted to reach USD 300 billion by 2030. Moreover, the online grocery market in India is expected to grow from USD 3.95 billion in FY21 to USD 26.93 billion by 2027, at a CAGR of 33%. This surge in e-commerce activity is prompting investments in cold storage facilities and refrigerated transport. Thus, the need for robust cold chain infrastructure in the e-commerce sector is fueling the market growth in India.

Cold Chain Market – Key Players and Competitive Insights

The cold chain market is represented by global and regional players competing for market share through technological advancements, strategic partnerships, and extensive service networks. Leading companies are providing comprehensive cold chain solutions that include storage facilities and refined transportation systems. These industry leaders leverage global reach and resources to offer integrated and scalable cold chain services.

Regional players focus on niche markets, providing tailored solutions to meet local demand and regulatory requirements. The competitive environment is intensified by ongoing innovations in refrigeration technology, data analytics, and sustainable practices as companies strive to enhance efficiency, reduce costs, and improve service reliability to capture and retain customers in a growing market. A few major players in the cold chain market are A.P. Moller – Maersk; Americold Logistics, Inc.; Burris Logistics; Lineage, Inc.; NewCold; NICHIREI CORPORATION; Overhaul; Snowman Logistics Limited; Sonoco ThermoSafe; Tippmann Group; United Parcel Service of America, Inc.; United States Cold Storage; and Wabash National Corporation.

A.P. Moller-Maersk specializes in ocean transport and logistics, with a primary focus on container shipping activities, including terminal handling, demurrage and detention, container storage, documentation and container services, and transshipment hubs. The company provides comprehensive, integrated transportation, fulfillment, and management solutions, encompassing landside and air transportation, cold chain logistics, distribution, warehousing, supply chain management, depot services, and custom brokerage services. Additionally, A.P. Moller-Maersk is actively involved in gateway terminal activities and offers advanced digital solutions for booking, tracking shipments, managing, and related operations. In January 2024, A.P. Moller–Master's commenced the construction of its new cold store facility in Gujarat, India. This facility is being custom-built to meet the specific requirements of HyFun Foods and will provide advanced temperature-controlled storage solutions for perishable frozen processed food items.

Lineage Logistics specializes in temperature-controlled warehousing and logistic solutions. Lineage offers comprehensive solutions to food and beverage companies with a network of over 450 facilities across 20 countries. The company's global warehousing services provide a diversified suite of cold storage solutions, including dedicated fresh facilities, fully automated warehouses, and port operations that connect clients to customers worldwide. Also, Lineage offers global integrated solutions, providing transportation services that streamline businesses and move products from the point of origin to the last mile. In December 2020, Lineage Logistics Holdings, LLC entered into the Polish cold storage market by acquiring Pago Sp. z o.o., a provider of distribution, warehousing, and transport logistics services in Poland.

List of Key Companies in Cold Chain Market

- A.P. Moller – Maersk

- Americold Logistics, Inc.

- Burris Logistics

- Lineage, Inc.

- NewCold

- NICHIREI CORPORATION

- Overhaul

- Snowman Logistics Limited

- Sonoco ThermoSafe

- Tippmann Group

- United Parcel Service of America, Inc.

- United States Cold Storage

- Wabash National Corporation

Cold Chain Industry Developments

In June 2024: Overhaul launched a Cold Chain Quality Solution, a software that offers unmatched risk and quality control for perishable cargo requiring specific time and temperature conditions, guaranteeing ideal environments across the supply chain for pharmaceuticals, healthcare products, and high-value food and beverage items.

In June 2024: Shenzhen Mindray Bio-Medical Electronics Co., Ltd. presented its minimally invasive surgical solutions, including a full line of disposable and reusable surgical equipment, at the European Association for Endoscopic Surgery International Congress.

In October 2023: Lineage Logistics completed the acquisition of the cold storage and e-commerce fulfillment assets of Burris Logistics, a third-party logistics provider. As part of this agreement, Lineage acquired eight facilities in six states, which collectively span ∼1.3 million square feet.

In November 2023: The U.S. FDA approved Applied Medical Resources Corporation's Inzii Ripstop Redeployable Retrieval System. This innovative device is designed to assist in the removal of tissue, organs, and stones during laparoscopic and general surgical procedures.

In October 2022: Snowman Logistics Limited introduced Fifth-Party Logistics (5PL) services in India, marking the company as an innovator in the introduction of this advanced service in the cold chain logistics and supply chain management sector within the country.

Cold Chain Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Storage

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast Freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Transportation

- By Mode

- Road

- Sea

- Rail

- Air

- By Offering

- Refrigerated Vehicles

- Refrigerated Containers

- Packaging

- Crates

- Insulated Containers & Boxes

- Large (32 to 66 Liters)

- Medium (21 to 29 Liters)

- Small (10 to 17 Liters)

- X-small (3 to 8 Liters)

- Petite (0.9 to 2.7 Liters)

- Cold Chain Bags/Vaccine Bags

- Ice Packs

- Others

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-Premise

- Cloud-Based

By Temperature Range Outlook (Revenue, USD Billion; 2020–2034)

- Chilled (0°C to 15°C)

- Frozen (–18°C to –25°C)

- Deep-Frozen (Below –25°C)

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cold Chain Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 379.39 billion |

|

Market Size Value in 2025 |

USD 451.70 billion |

|

Revenue Forecast by 2034 |

USD 2,232.40 billion |

|

CAGR |

19.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cold chain market size was valued at USD 379.39 billion in 2024 and is projected to grow to USD 2,232.40 billion by 2034.

The global market is projected to grow at a CAGR of 19.4% during 2025–2034.

North America had the largest share of the global market in 2024.

A.P. Moller – Maersk; Americold Logistics, Inc.; Burris Logistics; Lineage, Inc.; NewCold; NICHIREI CORPORATION; Overhaul; Snowman Logistics Limited; Sonoco ThermoSafe; Tippmann Group; United Parcel Service of America, Inc.; United States Cold Storage; and Wabash National Corporation are among the key players in the market

The monitoring components segment would record the highest CAGR in the global market during 2025–2034.

The food & beverages segment dominated the cold chain market share in 2024.