Coiled Tubing Market Size, Share, Trends, Industry Analysis Report: By Service, Operation, Application (Offshore and Onshore), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1510

- Base Year: 2024

- Historical Data: 2020-2023

Coiled Tubing Market Overview

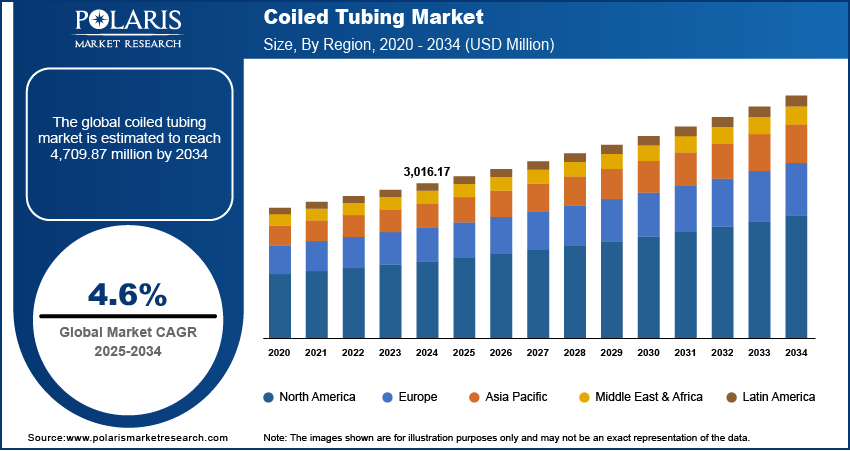

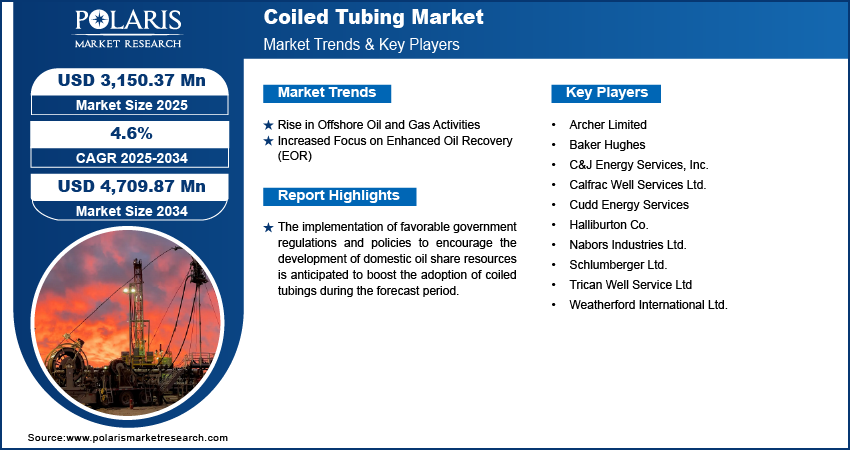

The global coiled tubing market size was valued at USD 3,016.17 million in 2024. The market is projected to grow from USD 3,150.37 million in 2025 to USD 4,709.87 million by 2034. It is projected to exhibit a CAGR of 4.6% from 2025 to 2034.

Coiled tubing is a flexible, long pipe used for well repair and workover activities in the oil & gas industry. It has no joints and can be inserted into the borehole to a depth of up to 15,000 feet. The diameter of the pipe ranges from 25 mm to 83 mm. Coil tubing provides several advantages over conventional wireline techniques, including improved formation fluid circulation, enhanced well performance, and reduced environmental impact.

To Understand More About this Research: Request a Free Sample Report

The substantial rise in global energy demand, shift toward horizontal well drilling techniques, and increased use of natural gas as a fuel primarily drive the coiled tubing market growth. Growing oil and gas exploration and development activities, along with increased emphasis on developing unconventional oil fields, further stimulate the demand for coiled tubing.

The implementation of favorable government regulations and policies to encourage the development of domestic oil share resources is anticipated to boost the adoption of coiled tubing in the coming years. Technological advancements in oil exploration techniques and growing investments in R&D are projected to provide lucrative coiled tubing market opportunities during the forecast period.

Coiled Tubing Market Dynamics

Rise in Offshore Oil and Gas Activities

In recent years, there has been a significant increase in offshore oil and gas production activities. Offshore wells often require specialized techniques, such as coiled tubing, for well intervention, production tubing, and well maintenance due to the complex and challenging nature of these environments. Further, coiled tubing is used to conduct stimulation treatments and acquire essential data through logging activities in wells. Thus, the rise in offshore oil and gas activities drives the demand for coiled tubing, impacting the coiled tubing market development favorably.

Increased Focus on Enhanced Oil Recovery (EOR)

With many mature oil fields experiencing a natural decline in production, there is a growing emphasis on enhanced oil recovery (EOR) techniques. EOR processes, including thermal recovery, gas injection, and chemical injection, increase the amount of oil that can be extracted from a reservoir. This makes EOR crucial for ensuring long-term energy security and sustainability. Coiled tubing is often used in various EOR processes, further driving the coiled tubing market demand.

Coiled Tubing Market Segmentation

Coiled Tubing Market Outlook – Based on Operation

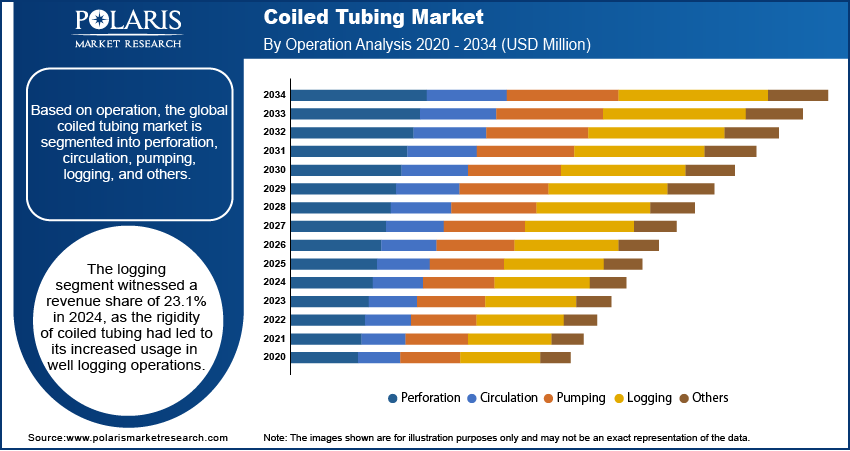

The coiled tubing market, based on operation, is segmented into perforation, circulation, pumping, logging, and others. The logging segment witnessed a revenue share of 23.1% in 2024. The rigidity of coiled tubing and its ability to be pushed well from the surface has led to its increased usage in well logging operations. In addition, the integration of an electric wireline conductor cable into coiled tubing creates new possibilities for well logging, further contributing to the growth of the segment.

Coiled Tubing Market Evaluation – Based on Application

The coiled tubing market, based on application, is bifurcated into offshore and onshore. The onshore segment accounted for a larger market share of 68% in 2024. This is primarily due to increasing production activities and rising demand for exploration using lightweight onshore units. Moreover, the cost-effectiveness and feasibility of onshore wells as compared to offshore wells propels the segment’s robust growth.

Coiled Tubing Market Regional Analysis

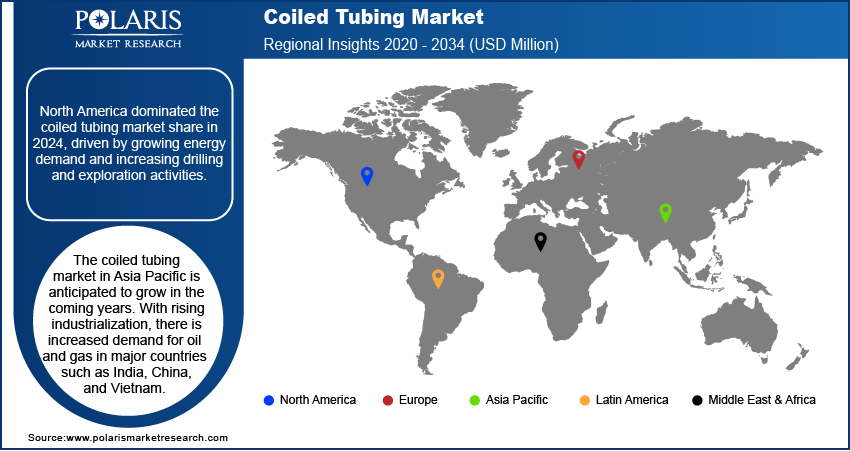

By region, the market report offers coiled tubing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market with a revenue share of 30.1% in 2024. The increase in drilling and exploration activities, growing energy demand, and rising prominence of the shale gas industry have led to increased demand for coiled tubing in North America. Technological advancements to improve well efficiency are further driving the adoption of coiled tubing in the region.

The Asia Pacific coiled tubing market is anticipated to register a CAGR of 3.7% from 2025 to 2034. With rising industrialization, there is increased demand for oil and gas in major economies such as India, China, and Vietnam. As such, these countries are vying for the development of new oil fields, thereby propelling the coiled tubing market demand in the region.

Coiled Tubing Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the coiled tubing market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

The development of new oil fields to increase production is one of the key business tactics used by manufacturers in the global market to benefit clients and improve their market share. In recent years, the market has witnessed several technological advancements. A few major players covered in the coiled tubing market research report are Halliburton Co.; Weatherford International Ltd.; Baker Hughes; Trican Well Service Ltd; Cudd Energy Services; Schlumberger Ltd.; Calfrac Well Services Ltd.; C&J Energy Services, Inc.; Nabors Industries Ltd.; and Archer Limited.

List of Key Players in Coiled Tubing Market

- Archer Limited

- Baker Hughes

- C&J Energy Services, Inc.

- Calfrac Well Services Ltd.

- Cudd Energy Services

- Halliburton Co.

- Nabors Industries Ltd.

- Schlumberger Ltd.

- Trican Well Service Ltd

- Weatherford International Ltd.

Coiled Tubing Industry Developments

May 2022: Halliburton announced the installation of a new coiled tubing system at its Louisiana Training Facility. According to Halliburton, the new system comes with a 750-ton capacity tension light frame and is designed for high pressure operations.

March 2022: Baker Hughes signed an agreement for the acquisition of Altus Intervention, a global provider of well intervention services. The company stated that the acquisition will enhance its life-of-well capabilities as operators increasingly seek to enhance the efficiency of mature fields.

Coiled Tubing Market Segmentation

By Service Outlook

- Well Intervention & Production

- Well Cleaning

- Well Completion

- Others

- Drilling

- Others

By Operation Outlook

- Perforation

- Circulation

- Pumping

- Logging

- Others

By Application Outlook

- Offshore

- Onshore

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coiled Tubing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,016.17 million |

|

Market Size Value in 2025 |

USD 3,150.37 million |

|

Revenue Forecast by 2034 |

USD 4,709.87 million |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 3,016.17 million in 2024 and is projected to grow to USD 4,709.87 million by 2034.

The market is projected to register a CAGR of 4.6% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Halliburton Co.; Weatherford International Ltd.; Baker Hughes; Trican Well Service Ltd; Cudd Energy Services; Schlumberger Ltd.; Calfrac Well Services Ltd.; C&J Energy Services, Inc.; Nabors Industries Ltd.; and Archer Limited.

The logging segment held a significant market share in 2024.

The onshore segment dominated the market in 2024.