Cocoa Derivatives Market Share, Size, Trends, Industry Analysis Report, By Type (Cocoa Powder, Cocoa Butter, Cocoa Mass/ Liquor, Others), By Application (Food & Beverage, Personal Care & Cosmetics, Others), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4244

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

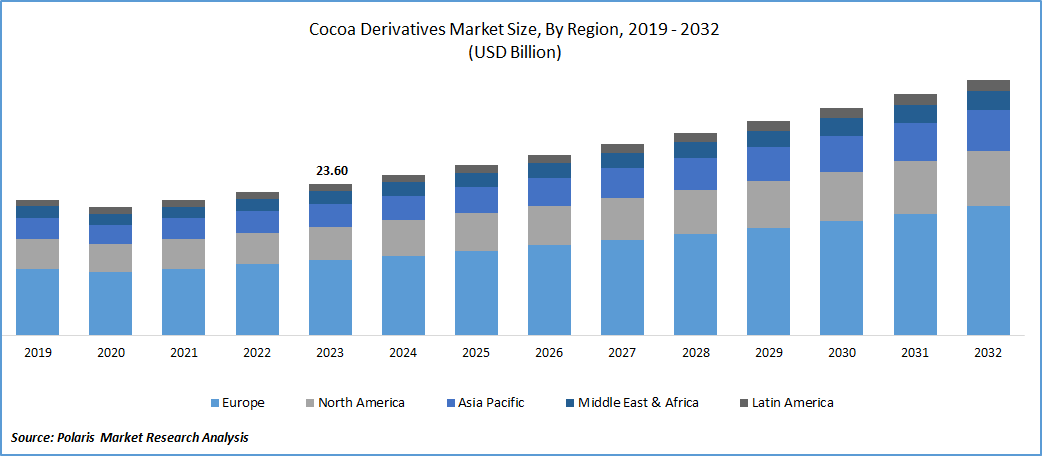

The global cocoa derivatives market size and share was valued at USD 23.60 billion in 2023 and is expected to grow at a CAGR of 6.0% during the forecast period.

This robust growth can be attributed to the rising demand for cocoa beans, which serve as essential ingredients in various industries. Cocoa beans find extensive applications in sectors such as functional food & beverage, confectionery, pharmaceuticals, & cosmetics, driven by their myriad health benefits. These advantages encompass the regulation of fatigue syndrome, remarkable antioxidant properties, and the ability to mitigate the impact of hypertension. In essence, the increasing utilization of cocoa derivatives across diverse industries is fueling the expansion of the market.

To Understand More About this Research: Request a Free Sample Report

The European Union has taken a proactive stance in implementing regulations aimed at ensuring that commodities, including cocoa, are sourced from land free of deforestation. This regulatory initiative aligns with broader environmental and sustainability goals, emphasizing the EU's commitment to combating deforestation and promoting responsible sourcing practices within the supply chain. For cocoa, a vital agricultural commodity with ties to tropical regions, the regulations seek to prevent the negative impacts associated with deforestation, such as loss of biodiversity and disruption to local ecosystems.

This regulatory framework has garnered support from leading chocolate manufacturers who recognize the importance of sustainable and environmentally friendly sourcing practices. By endorsing and complying with these regulations, chocolate manufacturers contribute to the preservation of ecosystems and the well-being of communities engaged in cocoa farming. The regulations reflect a collective effort to address environmental concerns associated with cocoa production, fostering a more responsible and ethical approach to the cocoa supply chain within the European Union.

The research report offers a quantitative and qualitative analysis of the Cocoa Derivatives Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Industry Dynamics

Growth Drivers

Growing Demand for Chocolate Products

The demand for cocoa derivatives is anticipated to witness a surge driven by the growing consumer awareness and preference for products with certifications and sustainable sourcing practices. As consumers increasingly seek ethically sourced and certified products, the market for cocoa derivatives is expected to expand. Major retailers play a crucial role in shaping consumer choices by emphasizing and expanding their offerings of certified cocoa derivatives.

Initiatives undertaken by prominent retailers, such as PLUS supermarket in the Netherlands, and COOP, and Waitrose in the UK & Switzerland, to offer certified chocolates contribute significantly to the overall growth and demand for cocoa derivatives. This trend reflects a broader shift toward sustainable and responsibly sourced cocoa products in response to consumer preferences for ethical and environmentally conscious consumption.

Report Segmentation

The market is primarily segmented based on type, application, distribution channel, and region.

|

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Cocoa powder segment accounted for the largest market share in 2023

Cocoa powder segment accounted for the largest share. It is driven by its widespread utilization in the bakery and confectionery industry. Its application extends to various products such as cakes, cookies, brownies, muffins, and pastries, where it serves to impart both the flavor and color associated with chocolate. The growing popularity of chocolate-infused baked goods and confectionery items is a key factor propelling the demand for cocoa powder. Additionally, the expanding middle-class populations in emerging economies have contributed to an increased appetite for chocolate and cocoa products. With rising disposable incomes in these regions, there is a heightened preference for indulgent and luxury food items, further augmenting the demand for cocoa powder.

Cocoa butter segment is expected to grow at the fastest rate. The segment’s growth is propelled by its extensive application in the cosmetics and personal care industry. Renowned for its superb natural moisturizing and emollient properties, cocoa butter has gained popularity in skincare products, including lotions, creams, lip balms, and body butter. The increasing preference for natural and organic skincare solutions has contributed to the surge in demand for cocoa butter, given its soothing and nourishing attributes.

Moreover, the demand for cocoa butter is being propelled by innovations in the cosmetics and food sectors. Manufacturers are actively engaged in discovering novel formulations and applications for cocoa butter, resulting in heightened demand across diverse product categories. For instance, in July 2021, Cargill Beauty introduced sustainably sourced cocoa butter with a unique crystal structure, facilitating rapid melting and providing nourishment to the skin.

By Application Analysis

Food & beverage segment accounted for the largest market share in 2023

Food & beverage segment accounted for the largest share. The increasing desire for premium and gourmet food and beverage products is contributing to the growing demand for cocoa derivatives such as Cocoa Mass/Liquor. These derivatives are frequently linked with high-quality and luxurious offerings, catering to consumers seeking distinctive and upscale chocolate experiences.

Personal care segment is expected to grow at the fastest rate. Consumers are increasingly recognizing the potential health advantages of cocoa derivatives when incorporated into skincare products. The connection of cocoa with antioxidant properties and potential skincare benefits appeals to consumers seeking natural and beneficial ingredients in their beauty routines. For instance, Sensient Cosmetic Technologies offers Natpure Xco Choco CC864, derived from cocoa husks and easily soluble in personal care, hair care, and skincare products.

Regional Insights

Europe dominated the global market in 2023

Europe dominated the global market. The market for cocoa processing is characterized by diversity, with a considerable demand for specialty cocoa and an increasing awareness of sustainability among consumers. Moreover, the growing trend of the single-origin chocolate is a significant driver for the cocoa derivatives. Private-label brands & retailers, including well-known names like Delicata and E-Leclerc, are actively contributing to this trend by offering a diverse range of cocoa products, meeting the preferences of consumers who seek unique and high-quality chocolate experiences tied to specific regions of origin.

The Asia Pacific will grow at a substantial pace. This growth is primarily attributed to the increasing demand for cocoa ingredients in confectionery items and baked goods within the region. As the middle class expands in the region, there is a growing consumer base with an inclination towards indulgent and premium food products, including chocolate and cocoa-based derivatives.

The rise in disposable income among the youth demographic further amplifies the demand for these products, as consumers seek novel and high-quality food experiences. Confectionery items and baked goods often incorporate cocoa derivatives to enhance flavor and quality, making them particularly appealing to consumers looking for diverse and indulgent treats.

Key Market Players & Competitive Insights

The global market exhibits a notable level of innovation, marked by the continuous development and introduction of new products and methodologies. This innovation-driven environment reflects the industry's commitment to meeting evolving consumer preferences, addressing sustainability concerns, and adapting to changing market dynamics.

In the realm of cocoa derivatives, which include various products derived from cocoa beans, innovation is witnessed across multiple facets. This can include advancements in processing techniques, formulation of novel cocoa-based products, and the introduction of sustainable and ethically sourced derivatives. Companies within the cocoa derivatives market are actively engaged in research and development efforts to enhance the quality, functionality, and appeal of their products.

Some of the major players operating in the global market include:

- Olam Group Ltd.

- Cargill Inc.

- Natra SA

- JB Foods Ltd

- Ecuakao Group Ltd

- United Cocoa Processor Inc.

- Indcre S.A.

- Barry Callebaut AG

- Moner Cocoa SA

- Altinmarka Gida ve Tic AS

Recent Developments

- In August 2022, Lil’ Goodness introduced a new Prebiotic Cocoa Powder. This product is composed of 100% fat-reduced, high-antioxidant real cocoa, and it features natural prebiotic fibers derived from sources such as papaya, soybeans, citrus fruits, & cocoa beans.

- In May 2021, Van Houten, a subsidiary of the Barry Callebaut Group, introduced a new powdered chocolate made from ruby chocolate. This powdered chocolate is specifically designed for use in coffee bars and by baristas.

Cocoa Derivatives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24.99 billion |

|

Revenue Forecast in 2032 |

USD 39.77 billion |

|

CAGR |

6.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

Gain profound insights into the 2024 cocoa derivatives market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Live Commerce Platforms Market Size, Share 2024 Research Report

Peptide and Oligonucleotide CDMO Market Size, Share 2024 Research Report

Energy Engineering Service Outsourcing (ESO) Market Size, Share 2024 Research Report

FAQ's

The Cocoa Derivatives Market report covering key segments are type, application, distribution channel, and region.

The global cocoa derivatives market size is expected to reach USD 39.77 Billion by 2032

The global cocoa derivatives market is expected to grow at a CAGR of 6.0% during the forecast period

Europe regions is leading the global market

Growing Demand for Chocolate Products are the key driving factors in Cocoa Derivatives Market