Coalescing Agents Market Size, Share, Trends, Industry Analysis Report: By Type (Hydrophilic and Hydrophobic), By Application, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5029

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

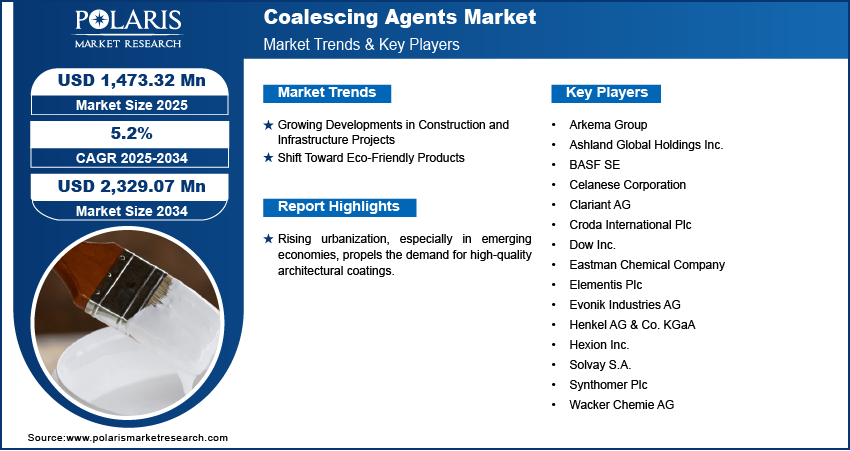

The global coalescing agents market size was valued at USD 1,321.35 million in 2023. The market is projected to grow from USD 1,388.74 million in 2024 to USD 2,081.69 million by 2032, exhibiting a CAGR of 5.2% during forest period.

The global coalescing agents market is experiencing significant growth, driven by their increasing demand in different industries, such as paints & coatings, and the rising introduction of eco-friendly formulations. Coalescing agents are essential additives used to optimize the film formation process in waterborne coatings, enhancing properties such as durability and appearance. These agents facilitate the fusion of polymer particles in the coating, resulting in a smooth, continuous film. This property is particularly vital in the construction industry, where high-quality architectural coatings are required to withstand harsh environmental conditions and enhance aesthetic appeal. In addition, the ongoing urbanization and infrastructure developments, particularly in emerging economies, boost the demand for high-performance coatings, which drives the market growth.

To Understand More About this Research:Request a Free Sample Report

Government bodies of various countries across the world are introducing stringent environmental regulations, pushing manufacturers to develop low-VOC (volatile organic compounds) products. This shift is driving innovation in the coalescing agents market, with a focus on sustainable and bio-based solutions that meet regulatory standards while delivering optimal performance.

Coalescing Agents Market Outlook

Growing Developments in Construction and Infrastructure Projects

Rising urbanization, especially in emerging economies, propels the demand for high-quality architectural coatings. These coatings require effective coalescing agents to ensure durability and an attractive finish. Rising development of large-scale infrastructure projects, growing construction of residential and commercial buildings, and increasing renovation activities fuel the requirement for advanced paints and coatings. This trend is expected to continue as governments and private sectors invest significantly in infrastructure development to support economic growth, further boosting the coalescing agents market growth.

Shift Toward Eco-Friendly Products

There is an increasing emphasis on reducing VOC (volatile organic compounds) emissions in paints and coatings owing to the introduction of strict environmental regulations across the world. This has led to a shift toward sustainable, low-VOC, and bio-based coalescing agents. Manufacturers are investing heavily in research and development to create innovative products that meet these regulatory requirements while maintaining high performance. Consumers are also becoming environmentally conscious, driving demand for green products that offer ecological benefits and superior quality.

Technological Advancements and Product Innovation

Companies are focusing on developing new formulations and improving existing ones to enhance performance characteristics such as weather resistance, durability, and ease of application. Innovations in nanotechnology and the development of hybrid coalescing agents that combine the benefits of different types of agents are opening new possibilities for the market. Additionally, there is a growing trend toward customizing products to meet customer requirements, which is driving competitive differentiation and expanding the application scope of coalescing agents across various industries.

Coalescing Agents Market Segment Insights

Coalescing Agents Market, Type-Based Insights

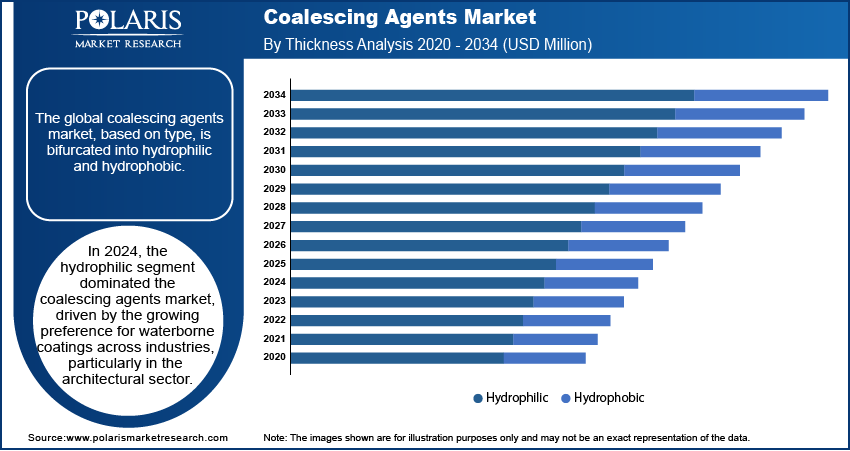

The global coalescing agents, based on type, are bifurcated into hydrophilic and hydrophobic. Hydrophilic coalescing agents are designed to work effectively in water-based formulations, promoting good dispersion and film formation. They are widely used in various applications due to their compatibility with environmentally friendly, low-VOC paints and coatings. Hydrophobic coalescing agents, on the other hand, are more suitable for solvent-based formulations, offering superior water resistance and durability. While hydrophobic coalescing agents have a strong presence in industrial applications where high-performance characteristics are required, the market is increasingly shifting toward hydrophilic agents due to environmental regulations and the rising demand for eco-friendly products.

In 2023, the hydrophilic segment dominated the coalescing agents market, driven by the growing preference for waterborne coatings across industries, particularly in the architectural sector. These agents' ability to comply with stringent environmental standards and their suitability for low-VOC formulations make them highly attractive. Also, the hydrophilic segment is expected to be the highest-growing segment during the forecast period. This growth is fueled by the increasing investments in green building projects and the global trend toward sustainable development. The push for reducing VOC emissions and the advancements in hydrophilic coalescing agent technology are key factors contributing to the demand for hydrophilic coalescing agents.

Coalescing Agents Market, Application-Based Insights

In terms of application, the global coalescing agents market is segmented into paints & coatings, adhesives & sealants, inks, personal care ingredients, and others. In 2023, the paints & coatings coalescing agents market segment dominated the market, driven by the extensive use of coalescing agents in architectural, automotive, and industrial coatings. The increasing construction activities and urbanization, particularly in emerging economies, fuel the demand for high-performance coatings, which, in turn, boosts the requirement for effective coalescing agents. Additionally, the shift toward waterborne and low-VOC coatings in response to stringent environmental regulations supports the dominance of this segment.

Among the various applications, the personal care ingredients coalescing agents market segment is expected to witness the highest growth rate during the forecast period. The growing demand for personal care products, such as lotions, creams, and sunscreens, that require effective film-forming agents, is driving this segment's expansion. The increasing consumer awareness regarding personal grooming and the rising disposable incomes in developing regions are contributing to the rapid market growth for this segment. Furthermore, advancements in formulation technologies and the introduction of innovative personal care products are expected to fuel the demand for coalescing agents in this application, making it the fastest-growing segment in the market.

Coalescing Agents Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Coalescing Agents Market, Regional Insights:

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North American coalescing agents market is experiencing significant growth, supported by rising demand from the construction, automotive, and industrial sectors. Coalescing agents, which are essential for improving the performance of paints, coatings, and adhesives, are seeing increased use due to the region's expanding infrastructure and industrial activities.

According to the U.S. Environmental Protection Agency (EPA), the construction industry’s growth, driven by infrastructure projects and residential developments, has amplified the need for advanced coatings that meet environmental regulations. The automotive sector’s shift towards sustainable and high-performance coatings is also fueling market expansion. Additionally, the EPA’s regulations on volatile organic compounds (VOCs) are encouraging the use of low-VOC coalescing agents. As of recent industry reports, the North American market is forecasted to grow at a steady pace, reflecting the region’s focus on innovation, sustainability, and regulatory compliance.

The market growth in Latin America is propelled by the construction and automotive sectors, despite economic fluctuations. The Middle East & Africa coalescing agents market witnesses increasing demand from construction and infrastructure projects, with a gradual shift toward eco-friendly solutions driven by growing awareness and regulatory measures.

Coalescing Agents Market, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Europe represents a mature market for coalescing agents, characterized by a high demand for sustainable and environmentally friendly products. The Europe coalescing agents market is experiencing notable growth, driven by the expanding construction, automotive, and industrial sectors. Coalescing agents are crucial additives used in paints, coatings, and adhesives to enhance film formation and improve the performance of these products. As the European construction industry sees increased activity, the demand for high-quality, durable coatings is rising. Additionally, the automotive sector’s emphasis on advanced, eco-friendly coatings further fuels market growth. Regulatory support for low-VOC (volatile organic compounds) products is also pushing the market towards innovative, environmentally friendly coalescing agents. According to recent industry reports, the European market is expected to witness substantial expansion, with significant investments in research and development leading to the introduction of new, efficient products. The increasing focus on sustainability and performance in various industrial applications continues to drive market dynamics and opportunities.

The paints & coatings industry in countries such as Germany, France, and the UK is a major contributor to the Europe coalescing agents market, with a focus on green building practices and energy-efficient solutions boosting the demand for advanced coalescing agents.

The Asia Pacific coalescing agents market is experiencing the fastest growth during the forecast period in countries such as China, India, and Southeast Asia. The burgeoning construction industry and increasing automotive production are significant drivers of the regional market. Additionally, the growing middle-class population and rising disposable incomes are leading to higher demand for quality consumer goods, including paints and personal care products, further supporting market growth. The region's regulatory environment is also gradually moving toward stricter VOC controls, which is expected to boost the adoption of eco-friendly coalescing agents in the coming years.

Coalescing Agents Market – Key Players and Competitive Insights:

The global coalescing agents market is highly competitive, with several key players striving to enhance their market presence through innovation, strategic partnerships, and mergers and acquisitions. Eastman Chemical Company, BASF SE, Dow Inc., Arkema Group, Evonik Industries AG, Croda International Plc, Solvay S.A., Elementis Plc, Ashland Global Holdings Inc., Synthomer Plc, Celanese Corporation, Clariant AG, Michelman Inc., Wacker Chemie AG, and Hexion Inc are among the prominent players in the market.

Competitive analysis reveals that these companies in the coalescing agents market are focusing on developing sustainable and low-VOC coalescing agents to comply with stringent environmental regulations and meet the growing demand for eco-friendly products. Eastman Chemical Company and BASF SE lead the market with extensive product portfolios and strong global distribution networks. Dow Inc. and Arkema Group are also significant players, known for their innovative solutions and technological advancements. Evonik Industries and Croda International are expanding their market share through strategic acquisitions and partnerships, enhancing their product offerings and market reach. The competitive landscape is characterized by continuous innovation, with players aiming to differentiate themselves through product quality, sustainability, and performance enhancements.

Eastman Chemical Company is a global player in the coalescing agents market, known for its extensive range of high-performance additives and specialty chemicals. The company focuses on innovation and sustainability, offering products that meet stringent environmental regulations and customer demands for low-VOC and eco-friendly solutions. Eastman's global reach and strong distribution network enable it to serve various industries effectively. A recent news highlight for Eastman is its strategic partnership with automotive and specialty materials companies to develop sustainable materials, showcasing its commitment to driving innovation and sustainability in the market.

BASF SE is another major player in the coalescing agents market, renowned for its comprehensive portfolio of chemical products and solutions. BASF's emphasis on research and development has positioned it at the forefront of innovation, particularly in creating advanced and sustainable coalescing agents. The company serves diverse industries, including paints & coatings, adhesives, and personal care. Recently, BASF announced the expansion of its production capacity for waterborne dispersion products in Europe, aimed at supporting the growing demand for environmentally friendly products and strengthening its market position.

Key Companies in Coalescing Agents Market:

- Eastman Chemical Company

- BASF SE

- Dow Inc.

- Arkema Group

- Evonik Industries AG

- Croda International Plc

- Solvay S.A.

- Elementis Plc

- Ashland Global Holdings Inc.

- Synthomer Plc

- Celanese Corporation

- Clariant AG

- Henkel AG & Co. KGaA

- Wacker Chemie AG

- Hexion Inc.

Coalescing Agents Industry Developments

- In June 2023, Henkel AG & Co. KGaA announced the establishment of a new manufacturing facility for its Adhesive Technologies business unit in the Yantai Chemical Industry Park in Shandong Province, China.

- In November 2023, IMCD N.V. announced that IMCD India had signed an agreement to acquire two business lines from CJ Shah and Company. These business lines focus on cellulose acetate butyrate, coalescing agents, polyolefin polymers, and other chemicals primarily used in paints, coatings, adhesives, and life science applications.

Coalescing Agents Market Segmentation:

Coalescing Agents Market, by Type

- Hydrophilic

- Hydrophobic

Coalescing Agents Market, by Application

- Paints & Coatings

- Adhesives & Sealants

- Inks

- Personal Care Ingredients

- Others

Coalescing Agents Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coalescing Agents Market Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,321.35 million |

|

Market size value in 2024 |

USD 1,388.74 million |

|

Revenue forecast in 2032 |

USD 2,081.69 million |

|

CAGR |

5.2% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019–2022 |

|

Forecast period |

2024–2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive landscape |

|

|

Report format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentations. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The coalescing agents market, by types, has been broadly segmented into hydrophilic and hydrophobic. Moreover, the study provides the reader with a detailed understanding of the different applications in which these agents are utilized.

Growth/Marketing Strategy: The companies are increasingly investing in research and development to create advanced, low-VOC, and bio-based coalescing agents that comply with stringent environmental regulations and meet the rising demand for eco-friendly products. Expanding product portfolios and improving performance characteristics, such as durability and weather resistance, are key focus areas.

FAQ's

The global coalescing agents market size was valued at USD 1,321.35 million in 2023 and is projected to grow to USD 2,081.69 million by 2032.

The global market is projected to witness a CAGR of 5.2% during 2023–2032.

North America accounted for the largest share of the global market in 2023

Eastman Chemical Company, BASF SE, Dow Inc., Arkema Group, and Evonik Industries AG are a few key players in the market

The hydrophilic segment dominated the market in 2023.

The paints & coatings segment held the largest share of the global market in 2023.

Coalescing agents are additives used in water-based paints, coatings, adhesives, and other products to enhance film formation. They work by temporarily softening the polymer particles in these formulations, allowing them to fuse together as the water evaporates.

A few key trends observed in this market are described below: Increasing Demand for Eco-Friendly Products: Rising environmental regulations and increasing consumer preference for low-VOC and bio-based coalescing agents. Growing Construction and Infrastructure Projects: Boosted demand for high-performance architectural coatings, particularly in emerging economies. Technological Advancements and Product Innovations: Continuous developments of advanced coalescing agents, including hybrid and nano-technology-based solutions. Shift Toward Waterborne Coatings: Greater adoption of waterborne formulations due to environmental benefits and regulatory compliance

For a new company entering the global coalescing agents market, prioritizing innovation by developing advanced, low-VOC, and bio-based coalescing agents will be crucial, as environmental regulations continue to tighten and demand for sustainable products rises. Investing in research and development to create high-performance, cost-effective solutions that cater to the needs of various industries, such as construction, automotive, and personal care, will help differentiate the company. Additionally, forming strategic partnerships and collaborations with established industry players can enhance market reach and credibility.

Companies producing coalescing agents and related additives, firms in the paints and coatings industry, adhesives and sealants manufacturers, personal care and cosmetic companies, developers and contractors, and other consulting firms.