CNG Tanks Market Size, Share, Trends, Industry Analysis Report: By Tank Type, Material Type (Metal, Carbon Fiber, and Glass Fiber), Vehicle Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5218

- Base Year: 2024

- Historical Data: 2020-2023

CNG Tanks Market Overview

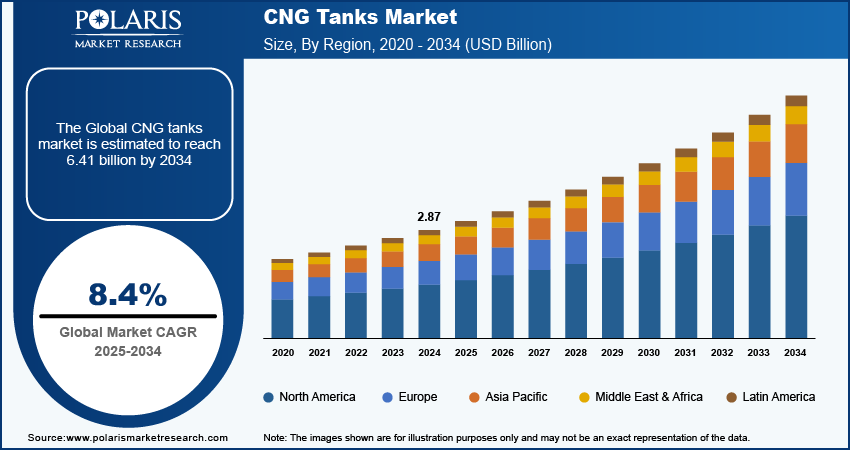

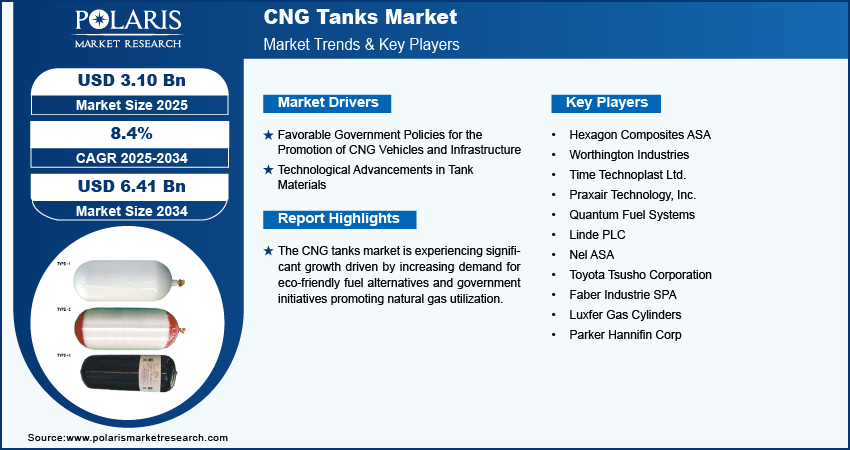

The CNG tanks market size was valued at USD 2.87 billion in 2024. The market is projected to grow from USD 3.10 billion in 2025 to USD 6.41 billion by 2034, exhibiting a CAGR of 8.4% during 2025–2034.

CNG (Compressed Natural Gas) tanks are advanced high-pressure storage systems engineered to securely contain and transport CNG, which serves as an alternative fuel for vehicles. These tanks are designed to withstand significant pressure fluctuations and are constructed from materials that ensure durability and safety. The application of CNG provides benefits for the vehicles such as reduced emissions compared to conventional gasoline and diesel fuels, contributing to cleaner air quality and lower greenhouse gas emission.

The CNG tank market is experiencing robust growth, primarily fueled by the increasing demand for sustainable and economically feasible fuel alternatives in the automotive sector. As concerns regarding air quality boost and emissions regulations become stricter, CNG is emerging as a feasible cleaner fuel option, contributing to an uptick in the adoption of CNG-powered vehicles.

The CNG tank market growth is supported by government incentives aimed at promoting natural gas utilization alongside technological advancements in tank materials, particularly lightweight composites that optimize fuel efficiency and extend range. For instance, according to a report shared by Maruti Suzuki in 2021, the company is advancing toward green mobility solutions with a technology-agnostic approach, focusing on CNG vehicles that support the Indian government's goal to reduce oil imports and boost the share of natural gas in the nation’s energy mix from 6.2% to 15% by 2030. Moreover, the expansion of CNG infrastructure across various regions is facilitating market expansion, with key industry players such as Maruti Suzuki, Tata Motors, Hyundai, and others increasingly investing in innovative tank designs to adapt to shifting consumer preferences and compliance requirements.

To Understand More About this Research: Request a Free Sample Report

CNG Tanks Market Driver Analysis

Favorable Government Policies for the Promotion of CNG Vehicles and Infrastructure

Favorable governmental policies are influencing the CNG tank market by facilitating the adoption of CNG vehicles and improving the infrastructure. Policies related to financial incentives such as Alternative Fuel Vehicle (AFV) Tax Credits, tax benefits, and subsidies effectively lower the overall costs associated with CNG vehicles and fuel, thereby increasing their appeal to consumers and commercial fleets.

The imposition of stringent emissions regulations aims to minimize air pollution, thereby positioning CNG as a viable and cleaner alternative to traditional gasoline and diesel fuels. The ongoing investments in the construction and expansion of CNG refueling stations further support market growth by improving fuel accessibility and convenience for end users. According to a report by the Ministry of Petroleum & Natural Gas, the government initiatives to increase the share of natural gas in the energy mix have resulted in ambitious plans to expand the CNG network to 17,751 stations by 2023. This alignment of regulatory frameworks with infrastructure development is crucial for accelerating the transition toward more sustainable transportation solutions.

Technological Advancements in Tank Materials

Advancements in CNG tank construction are increasingly focused on lightweight composite materials, particularly carbon fiber-reinforced polymers. These materials are designed to reduce the tank’s weight and improve its durability and safety. Additionally, lighter tanks improve fuel efficiency and lower vehicle costs while allowing for higher storage pressures, thus expanding driving range. Hexagon's Type 4 cylinders are designed in collaboration with global automotive manufacturers to meet stringent safety, quality, and installation standards. These advanced high-pressure CNG tanks, made from lightweight composite materials, can withstand greater pressures, thereby increasing fuel storage capacity and improving the performance of CNG-powered fleets. Properties such as superior corrosion and impact resistance make them a long-lasting alternative to steel. As the automotive industry adapts to stricter emission standards, the demand for advanced, lightweight, high-capacity CNG tanks grows across vehicle segments.

CNG Tanks Market Segment Analysis

CNG Tanks Market Breakdown by Tank Type Outlook

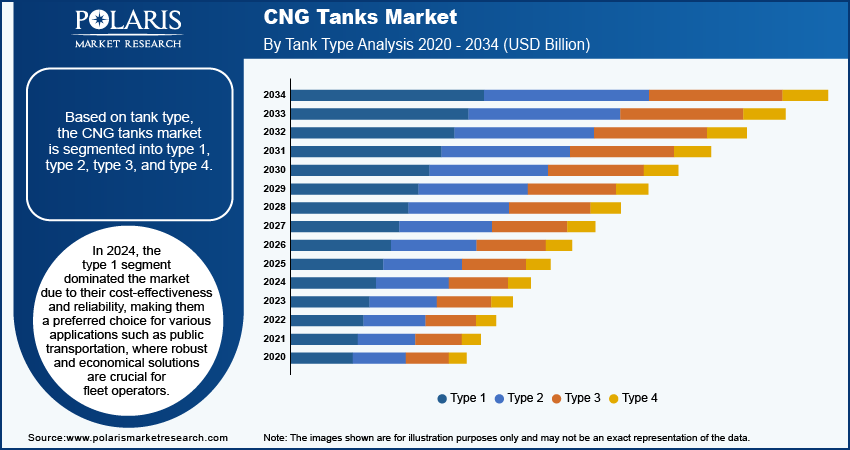

The global CNG tanks market segmentation, based on tank type, includes type 1, type 2, type 3, and type 4. In 2024, the type 1 segment dominated the market due to their cost-effectiveness and reliability, making them a preferred choice for various applications such as public transportation, where robust and economical solutions are crucial for fleet operators. Type 1 tanks are constructed from high-strength steel; these tanks have a proven track record across various applications, making them popular among fleet operators and manufacturers.

Type 1 tanks can withstand the high pressures required for compressed natural gas (CNG) storage, ensuring safety and durability with rising demand for CNG vehicles. Thus, the demonstrated performance and affordability of type 1 tanks have solidified their market position.

CNG Tanks Market Breakdown by Material Type Outlook

The global CNG tanks market segmentation, based on material type, includes metal, carbon fiber, and glass fiber. The carbon fiber segment is projected to grow at the fastest rate during the forecast period due to the lightweight properties and superior strength of carbon fiber compared to traditional materials. This makes them particularly advantageous for improving vehicle fuel efficiency and performance, as lighter tanks allow for greater payloads and improved handling. Additionally, advancements in carbon fiber manufacturing processes have led to reduced production costs, making these tanks more accessible to vehicle manufacturers. The increasing demand for fuel-efficient and environmentally friendly vehicles further drives the adoption of carbon fiber CNG tanks, positioning them as a leading choice in the evolving market.

CNG Tanks Market Breakdown by Regional Outlook

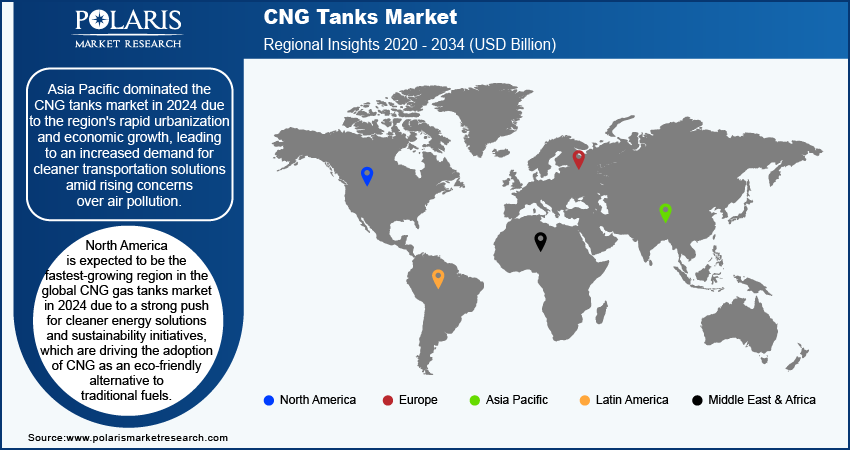

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the CNG tanks market in 2024 due to the region's rapid urbanization and economic growth, leading to an increased demand for cleaner transportation solutions amid rising concerns over air pollution. Governments of countries such as India and China have implemented initiatives to promote the adoption of natural gas vehicles, further driving the demand for CNG tanks. Additionally, the expansion of CNG infrastructure, including refueling stations, has made it more convenient for consumers to switch to CNG-powered vehicles. According to a report by the Ministry of Petroleum & Natural Gas 2024, the inauguration of 201 CNG stations marks a step toward India's gas-based economy and energy security. Established by 15 City Gas Distribution entities across 17 states, this initiative aims to increase natural gas's share in the energy basket to 15% by 2030. This expansion improves CNG infrastructure, promotes cleaner fuel accessibility, and supports the goal of Atmanirbhar Bharat. The region's focus on sustainable energy and reducing dependence on fossil fuels has also contributed to the growth of the CNG tanks market, making Asia Pacific a leading player in this sector.

North America is expected to be the fastest-growing region in the CNG gas tanks market during the forecast period due to a strong push for cleaner energy solutions and sustainability initiatives, which are driving the adoption of CNG as an eco-friendly alternative to traditional fuels. Additionally, advancements in CNG infrastructure, including the expansion of refueling stations and distribution networks, are making it easier for consumers and businesses to access CNG.

Government incentives and policies aimed at reducing carbon emissions are encouraging the transition to CNG-powered vehicles. The growing demand from the transportation sector, especially for heavy-duty trucks and fleet vehicles, is contributing to the CNG tanks market expansion. In May 2024, Hexagon Agility and Brudeli Green Mobility partnered to transform the Class 7 and 8 North American truck market. By integrating Hexagon's CNG/RNG systems with Brudeli's POWERHYBRID technology, fleets can maintain diesel-like performance while saving on fuel costs and meeting emissions regulations. Overall, these factors combined are positioning North America as a leader in the CNG tank market.

CNG Tanks Market – Key Players and Competitive Insights

The competitive landscape of the CNG tanks market is characterized by a mix of global leaders and regional players striving to capture market share through innovation, strategic partnerships, and regional growth. Major companies in the industry, such as Faber Industries, Hexagon Composites, and others, leverage robust research and development capabilities and extensive distribution networks to provide advanced CNG tank solutions that meet the needs of various sectors, including automotive, public transportation, and industrial applications. These leading firms focus on product innovation, enhancing tank materials and designs to improve safety, efficiency, and storage capacity. Smaller regional companies are emerging with specialized CNG tank solutions tailored to specific market requirements, offering unique designs and customized applications. Competitive strategies in this market encompass mergers and acquisitions, collaborations with technology providers, and the expansion of product lines to strengthen their market presence across key geographic regions. A few major market players are Hexagon Composites ASA; Worthington Industries; Time Technoplast Ltd.; Praxair Technology, Inc.; Quantum Fuel Systems; Linde PLC; Nel ASA; Toyota Tsusho Corporation; Faber Industrie SPA; Luxfer Gas Cylinders; and Parker Hannifin Corp.

Time Technoplast Limited specializes in the manufacturing of composite cylinders, particularly for Compressed Natural Gas (CNG) applications. Their innovative Type IV composite cylinders are designed for both onboard use in vehicles and CNG cascades, enhancing safety and efficiency compared to traditional steel cylinders. Time Technoplast has established a strong presence in over 50 countries, exporting its products globally, and it is actively engaging with Original Equipment Manufacturers (OEMs) to expand its market share in the automotive sector. The company is also focused on expanding its manufacturing capacity, with plans to increase production capabilities significantly in the coming years.

Parker Hannifin Corporation is a manufacturer of motion and control technologies specializing in solutions for compressed natural gas (CNG) applications. The company offers a comprehensive range of CNG products, including fittings, valves, hoses, and regulators designed for medium and heavy-duty vehicles. Their advanced CNG Vehicle Gas Regulator System ensures stable pressure control from 225 psi to 3,600 psi, enhancing fuel efficiency and performance in demanding environments. Parker's commitment to quality compliance with various industry standards such as CSA and UL ensures safety and reliability in fuel systems. Additionally, their XF70 CNG dispenser facilitates faster refueling processes, allowing fleets to minimize downtime.

Key Companies in the CNG Tanks Industry Outlook

- Hexagon Composites ASA

- Worthington Industries

- Time Technoplast Ltd.

- Praxair Technology, Inc.

- Quantum Fuel Systems

- Linde PLC

- Nel ASA

- Toyota Tsusho Corporation

- Faber Industrie SPA

- Luxfer Gas Cylinders

- Parker Hannifin Corp

CNG Tanks Industry Developments

In August 2024, Tata Motors enhanced the Tiago and Tigor models by integrating their innovative dual-cylinder CNG tank technology. This design incorporates two smaller cylinders strategically positioned under the luggage compartment, as opposed to utilizing a single, larger CNG cylinder that compromises boot space. Consequently, the Tigor iCNG acquires a total CNG tank capacity of 70 liters, optimizing space while maintaining efficiency in fuel storage.

In August 2024, Time Technoplast became the first and only company in India to obtain PESO approval for the production of Type-IV CNG cylinders, applicable for both cascade systems and on-board applications. Additionally, the company has broadened its composite cylinder offerings, now including Type-III cylinders specifically designed for breathing air and medical oxygen.

CNG Tanks Market Segmentation

By Tank Type Outlook (Revenue, USD Billion, 2020–2034)

- Type 1

- Type 2

- Type 3

- Type 4

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Metal

- Carbon Fiber

- Glass Fiber

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- LDV

- MDV

- HDV

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Fuel Tank

- Transportation Tank

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

CNG tanks Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.87 billion |

|

Market Size Value in 2025 |

USD 3.10 billion |

|

Revenue Forecast by 2034 |

USD 6.41 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global CNG tanks market size was valued at USD 2.87 billion in 2024 and is projected to grow to USD 6.41 billion by 2034.

The global market is projected to register a CAGR of 8.4% during the forecast period.

Asia Pacific dominated the CNG tanks market in 2024.

A few key players in the market are Hexagon Composites ASA; Worthington Industries; Time Technoplast Ltd.; Praxair Technology, Inc.; Quantum Fuel Systems; Linde PLC; Nel ASA; Toyota Tsusho Corporation; Faber Industrie SPA; Luxfer Gas Cylinders; and Parker Hannifin Corp.

The type 1 segment dominated the market in 2024

The carbon fiber segment is projected to grow at the fastest rate during the forecast period.