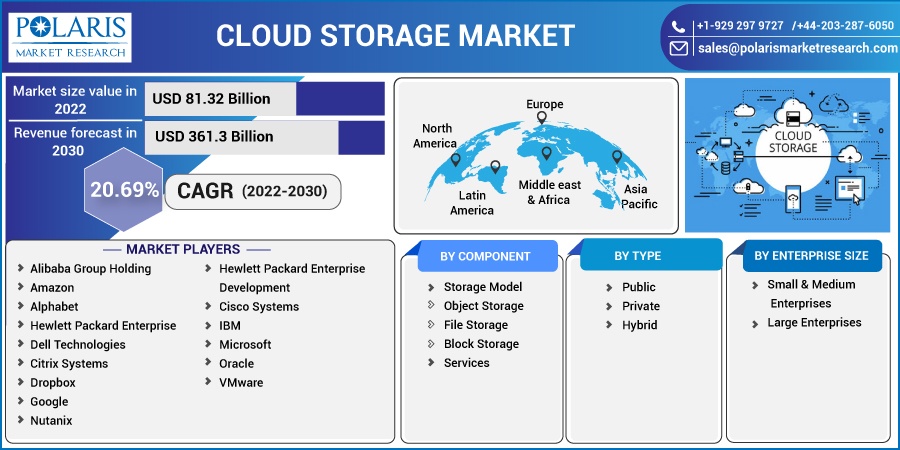

Cloud Storage Market Share, Size, Trends, Industry Analysis Report, By Component; By Type; By Enterprise Size (Small & Medium Enterprises, Large Enterprises); By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2814

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

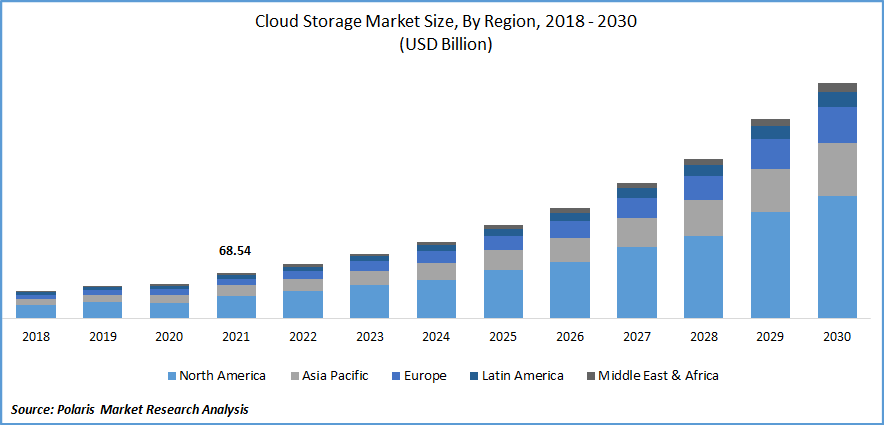

The global cloud storage market was valued at USD 68.54 billion in 2021 and is expected to grow at a CAGR of 20.49% during the forecast period.

An increase in the need for big data storage is likely to propel the global market for cloud-based storage forward throughout the forecast period. Businesses must retain a large amount of data for business purposes, and cloud storage offers a simple platform. These operational advantages are anticipated to fuel market growth and expansion in the near future.

Know more about this report: Request for sample pages

Digital data is maintained in a logical network of pools using cloud-based storage. With the help of this technology, users may easily access the data across any available network, and it can be easily maintained, backed up, and managed. A hosting business is in charge of and owns the actual stashing place. This industry is growing as a result of technology suppliers' increased efforts to help BFSI organizations migrate to the cloud.

The outbreak created uncertainty, but it also opened doors for brand-new commercial strategies based on cutting-edge technology. The financial services industry currently makes substantial use of a hybrid multi-cloud architecture, and as time passes, digital transformation will become more selective.

According to the 2022 study, the TCS BaNCS Cloud is a specialized industrial cloud supported by TCS' “business 4.0” and “cloud-first” initiatives. TCS BaNCS Cloud provides the powerful capabilities of TCS BaNCS business solutions spanning banking, capital markets, and insurance on a SaaS and on-cloud platform using cloud nativity features. TCS BaNCS Cloud has more than 220 users worldwide. This is expected to increase the use of cloud storage over the estimated time period.

COVID-19 is expected to have a major impact on market growth during the study. Employees may interact and maintain connections as firms move to remote working environments with the help of cloud-based technologies. For instance, Oracle Cloud was used to run the COVID-19 immunization campaign in the United States in December 2020. The partnership aims to support US public health agencies collecting and examining COVID-19 data. As a result, joint ventures and alliances support market expansion during the COVID-19 pandemic. As data volume grows, cloud infrastructure becomes more and more necessary. The market is anticipated to be driven in the coming years by an increase in investments made by significant market players to construct data centers all over the world in response to the COVID-19 pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing need for cloud-based networking and storage technologies. As a result, data has been gathered in enormous quantities as a result of remote sensing, the Internet of Things, and enhanced video quality due to 4K or 8K resolution cameras. Similarly, to this, it is predicted that when artificial intelligence becomes more widely used, there will be a greater need for storage as a means of enhancing data security. For instance, in June 2022, at RSA 2022, Cisco Systems introduced Everything-as-a-Service Cisco Plus for Unified Secure Access Service Edge.

Because the platform offers features for secure connectivity between programmers, users, and devices regardless of location, it is anticipated to ensure security in hybrid and multi-cloud setups. Without vendor lock-in, the platform will provide customizable threat detection, prevention, response, and cleanup. Furthermore, linked devices and autonomous systems like self-driving cars likely drive the need for cloud computing services, such as data storage for real-time assistance. These factors are expected to steer the market toward a higher growth trajectory.

Report Segmentation

The market is primarily segmented based on component, type, enterprise size, and region.

|

By Component |

By Type |

By Enterprise Size |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Block storage is the industry's largest market segment in 2021

Block storage is anticipated to account for a sizable portion of the market due to the rise in demand for dependable and high-performance storage throughout the course of the forecast period. Due to its expanded storage capacity, the file storage cloud is anticipated to develop at the fastest CAGR. Block storage systems host databases, provide random read/write operations, and store the system files for virtual machines. Files are stored in blocks and volumes, divided into equal-sized storage blocks.

For instance, in February 2021, Google Cloud and Nasuni Corporation, a company that offers file cloud data storage, partnered. The growing need for enterprise information storage had a significant impact on the relationship. Utilizing storage models helps organizations meet fundamental requirements, including data security, availability, and durability. These features are anticipated to promote the adoption of cloud-based data storage in businesses.

Private cloud segment will account for a higher share of the market.

Increased security and data protection services are expected to cause the private cloud to expand steadily throughout the forecast period. A private cloud server may be the best option when complete environmental control is required, and businesses have dynamic computing needs. Businesses are utilizing mobile workforces more and more as the workforce grows. Businesses are now forced to build a private cloud server due to the increase in the mobile workforce and the related changes in demand for fast access to computing resources and apps.

Due to a private cloud server's single-tenant environment and more secure and flexible hosted resources, including storage, processing power, and networking, businesses can benefit from all the advantages of a public cloud server. Over the next few years, it is projected that technology developments in storage accessibility, threat monitoring, and firewalls will significantly improve the market expansion potential.

Large enterprises is expected to hold the significant revenue share

The large enterprise segment will rule the market for the anticipated time frame. For large enterprises, data security and dependability are crucial goals. As a result, large businesses frequently seek out dependable and secure services. Private cloud server solutions are being used more frequently by small and medium-sized enterprises since they allow them access to round-the-clock support without requiring a professional IT specialist. According to the EY-NASSCOM cloud survey, for instance, 75% of organizations are using multi-cloud models for remote work monitoring, operations management, and governance in 2022, making the cloud the main driver of firm growth in an unpredictable business environment.

The demand in North America is expected to witness significant growth

The market for cloud storage in North America held the largest revenue share in 2021. Due to major cloud service providers, a surge in data centers, the quick uptake of cutting-edge technology, and smart home devices, the region's market is witnessing revenue growth. The need for cloud storage alternatives is continuously supported by the expanding use of electronic payments and video streaming services. Improved IT infrastructure and rising high-value investments in various R&D initiatives for cloud-based solutions also contribute to the market's growth. For instance, to increase its North American footprint in the Canadian market, Opti9, a hybrid cloud provider, will partner with HostedBizz in May 2022.

The combination of Opti9 and HostedBizz is anticipated to facilitate the development of expertise in the Canadian cloud computing market as well as the expansion of the partner ecosystem and service offerings.

Competitive Insight

Some of the major players operating in the global market include Alibaba Group Holding, Amazon, Alphabet, Hewlett Packard Enterprise, Dell Technologies, Citrix Systems, Dropbox, Google, Nutanix, Hewlett Packard Enterprise Development, Cisco Systems, IBM, Microsoft, Oracle, and VMware.

Recent Developments

- In June 2022, Backblaze released "cloud replication" to help organizations store and synchronize data across several sites. Backblaze previously introduced B2, an object storage service used by many businesses for purposes beyond simple backups. Backblaze's new cloud replication service, however, is anticipated to offer automatic backup of data that is currently saved in B2.

Cloud Storage Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 81.32 billion |

|

Revenue forecast in 2030 |

USD 361.3 billion |

|

CAGR |

20.49% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Type, By Enterprise Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Alibaba Group Holding, Amazon, Alphabet, Hewlett Packard Enterprise, Dell Technologies, Citrix Systems, Dropbox, Google, Nutanix, Hewlett Packard Enterprise Development, Cisco Systems, IBM, Microsoft, Oracle, and VMware. |