Cloud Services Brokerage Market Size, Share, Trends, Industry Analysis Report: By Service Type, Cloud Service Model (PaaS, IaaS, SaaS), Organization Size, Vertical, and Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 126

- Format: PDF

- Report ID: PM5324

- Base Year: 2024

- Historical Data: 2020-2023

Cloud Services Brokerage Market Overview

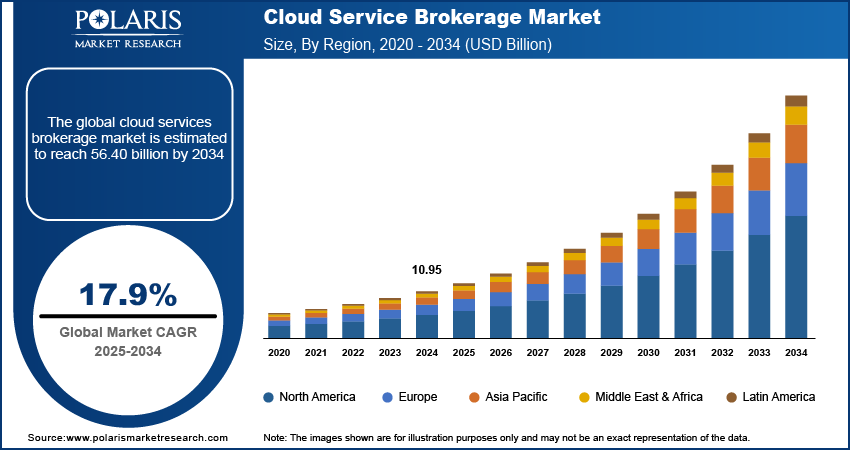

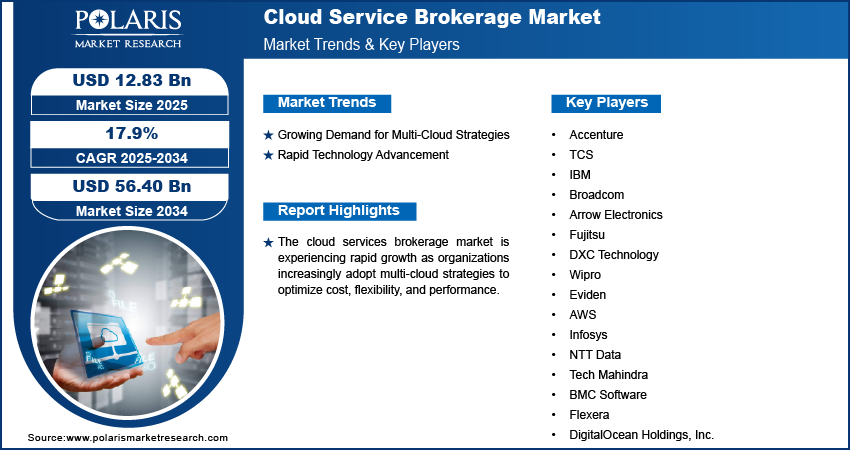

Global cloud services brokerage market size was valued at USD 10.95 billion in 2024. It is projected to grow from USD 12.83 billion in 2025 to USD 56.40 billion by 2034, exhibiting a CAGR of 17.9% during the forecast period. Cloud services brokerages (CSBs) are emerging as critical intermediaries, assisting organizations in integrating, managing, and optimizing their cloud services, especially as multi-cloud strategies become more prevalent. With businesses increasingly relying on multiple cloud providers to meet specific operational needs, CSBs simplify the complexities of managing diverse environments. The market is driven by the growing demand for automation, artificial intelligence, and advanced analytics, which enhance service delivery, resource allocation, and cost optimization. Additionally, the rise of hybrid cloud storage adoption and the need for cloud cost management solutions are fueling cloud services brokerage market growth.

Organizations are seeking flexibility, scalability, and efficiency in their cloud operations, and Cloud services brokerage are instrumental in ensuring seamless integration and interoperability across various cloud platforms. The need for robust security and compliance measures is another driver, as businesses face regulatory challenges and data protection concerns. As a result, the CSB market is expected to experience significant growth, driven by the increasing adoption of cloud technologies and the ongoing pursuit of operational agility.

To Understand More About this Research: Request a Free Sample Report

Cloud Services Brokerage Market Dynamics

Growing Demand for Multi-Cloud Strategies

The increasing adoption of multi-cloud strategies is driven by businesses seeking to leverage multiple cloud providers while avoiding vendor lock-in. This approach allows organizations to optimize performance and costs by selecting the best services from different providers tailored to their specific needs. However, managing multiple cloud environments presents significant challenges. CSBs play a vital role in simplifying the integration, management, and optimization of these diverse services. By offering tools and solutions, CSBs enable organizations to streamline operations, enhance data security, and ensure regulatory compliance across various platforms. This allows businesses to fully harness the benefits of multi-cloud strategies while mitigating associated risks.

For example, in March 2024, Microsoft and Oracle expanded their partnership to allow customers to run Oracle applications on Azure, providing a more seamless multi-cloud experience. This collaboration aims to simplify operations and improve data management for businesses utilizing both platforms, highlighting the growing importance of CSBs in multi-cloud ecosystems.

Rapid Technology Advancement

Rapid advancements in automation, artificial intelligence (AI), and analytics are boosting the cloud services brokerage market demand. These technologies are revolutionizing how businesses manage their cloud environments by streamlining complex processes and improving operational efficiency. Automation tools, for instance, enable businesses to handle tasks such as resource provisioning and scaling with minimal manual intervention, reducing the risk of human error and speeding up deployment times. Advanced AI tools further enhance cloud management by predicting potential issues and automating responses, ensuring more seamless operations. In 2023, Google Cloud introduced new AI-powered solutions for automating cloud operations, including infrastructure management and security monitoring. These innovations utilize advanced algorithms to enhance performance, reduce downtime, and improve security, allowing organizations to optimize their multi-cloud strategies better.

Cloud Services Brokerage Market Segment Analysis

Cloud Services Brokerage Market Assessment by Service Type Outlook

The global cloud services brokerage market segmentation, based on service type, includes aggregation, service intermediation, security management, performance & usage reporting, service arbitrage, service catalogue management, marketplace integration, and enablement services. The service intermediation segment dominated the global cloud services brokerage market in 2024 due to its critical role in simplifying the integration of multiple cloud services for businesses. Service intermediation helps bridge the gap between different cloud providers, enabling seamless communication, interoperability, and optimized service delivery. The need for effective service intermediation to streamline and manage these diverse cloud environments has grown as organizations increasingly adopt multi-cloud strategies. This segment also provides value by offering businesses centralized management, cost control, and enhanced flexibility in selecting and integrating cloud services to meet their specific needs.

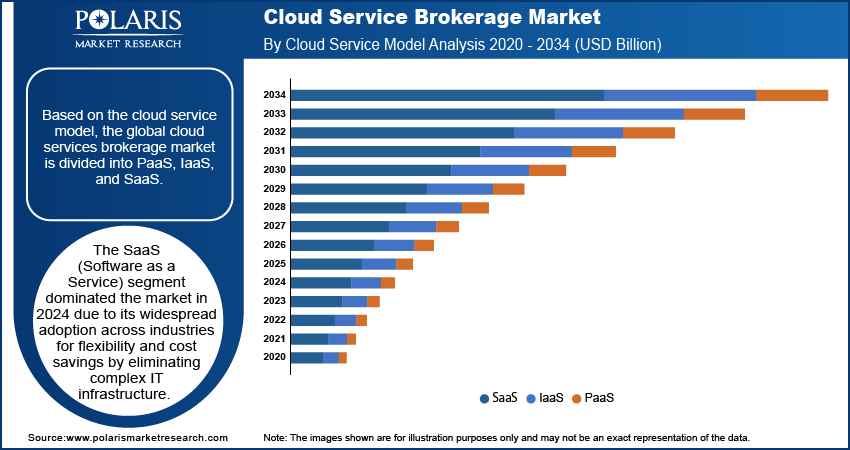

Cloud Services Brokerage Market Assessment by Cloud Service Outlook

The global cloud services brokerage market segmentation, based on cloud service, includes PaaS (Platform as a Service), IaaS (Infrastructure as a Service), and SaaS (Software as a Service). In 2024, the SaaS segment dominated the market due to its widespread adoption across various industries. SaaS solutions offer businesses flexibility and cost savings by eliminating the need for complex IT infrastructure. Applications such as customer relationship management (CRM), enterprise resource planning (ERP), and collaboration tools are among the most popular SaaS products, driving demand for cloud brokerage services to manage, secure, and optimize these platforms. The rise of subscription-based models has further accelerated the adoption of SaaS, making it crucial for businesses to leverage CSB to integrate various SaaS platforms and ensure smooth operations.

To enhance the dependability of multiple SaaS solutions used by businesses, they require CSB providers to ensure interoperability between different software platforms, enhance security measures, and manage costs efficiently. While IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) are also growing rapidly, SaaS is the dominant force due to its widespread application in everyday business processes. This dominance is expected to increase as more organizations embrace cloud-native applications and subscription models that heavily rely on SaaS solutions.

Cloud Services Brokerage Market Evaluation by Vertical Outlook

The global cloud services brokerage market segmentation, based on vertical, includes IT & telecom, BFSI, retail & consumer goods, energies & utilities, media & entertainment, healthcare & life sciences, government & public sector, manufacturing, and other verticals. The retail and consumer goods sector is expected to witness the highest growth in the global cloud services brokerage market during the forecast period due to the increasing need for digital transformation and improved customer experiences. Retailers are increasingly adopting cloud-based solutions to enhance their operations, streamline supply chains, and offer personalized services. Cloud services brokerage helps manage the integration of various cloud platforms, ensuring seamless interactions between e-commerce, inventory management, and customer relationship systems. Additionally, the rise of omnichannel strategies and the need for real-time data analytics in the retail sector further drive the demand for advanced cloud brokerage services to support scalability and agility.

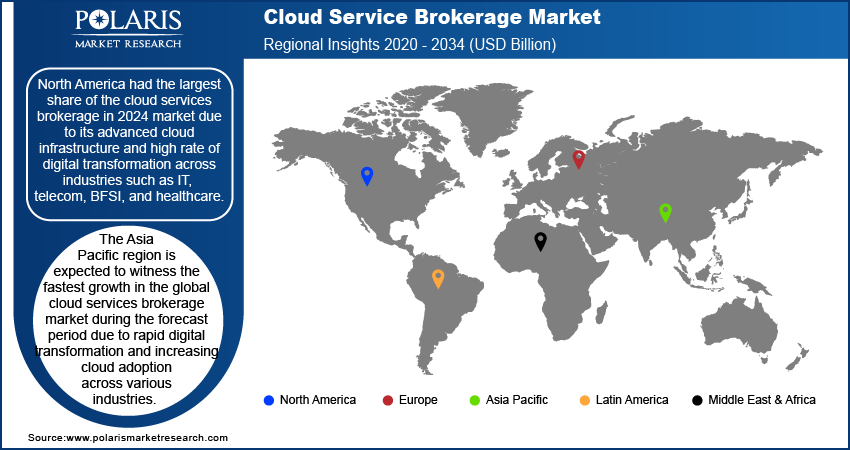

Cloud Services Brokerage Market Share by Region

By region, the study provides cloud services brokerage market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share in 2024 due to the region’s highly advanced cloud infrastructure, with leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud based in the US. The established infrastructure drives demand for brokerage services to manage complex multi-cloud environments. North America also has a high rate of digital transformation across industries, particularly in sectors including IT, telecom, BFSI, and healthcare, which require advanced cloud management solutions. The region's strong regulatory frameworks for data security and privacy, alongside significant investment in cloud technologies, further contribute to the growing demand for CSB services. Moreover, large enterprises in the region are early adopters of innovative cloud technologies, fueling the need for advanced brokerage solutions to optimize cloud performance and cost efficiency.

The Asia Pacific region is expected to witness the fastest growth in the global cloud services brokerage market during the forecast period due to rapid digital transformation and increasing cloud adoption across various industries. The region’s growing emphasis on technology driven innovation, particularly in sectors such as retail, manufacturing, and healthcare, is fueling demand for cloud solutions. Additionally, the rise of small and medium-sized enterprises (SMEs) in Asia Pacific is contributing to the need for cost-effective and scalable cloud services. The region's evolving regulatory frameworks and investments in cloud infrastructure further support market growth, making it a key area for cloud services brokerage development.

Cloud Services Brokerage Key Market Players & Competitive Analysis

The competitive landscape of the cloud services brokerage industry is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as IBM, NTT Data, and Infosys, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced cloud services. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of healthcare providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific healthcare needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with technology companies, and investments in emerging markets to expand reach and enhance market presence. Major players include, Accenture, TCS, IBM, Broadcom, Arrow Electronics, Fujitsu, DXC Technology, Wipro, Eviden, AWS, Infosys, NTT Data, Tech Mahindra, BMC Software, Flexera, and Jamcracker

Infosys Limited is an Indian multinational technology company established in 1981, with its headquarters in Bengaluru, Karnataka. It specializes in providing digital services and consulting to help organizations undergo digital transformation across various sectors, including finance, healthcare, and manufacturing. The company employs over 343,000 people and operates in more than 50 countries. Infosys offers a wide range of services and products to address the needs of its clients. Its consulting services cover areas such as digital experience, cloud solutions, data analytics, artificial intelligence (AI), engineering, and sustainability. In addition to consulting, Infosys provides business process outsourcing through its subsidiary, Infosys BPM, which encompasses functions like finance, procurement, customer service, and human resources. The company has developed several digital products aimed at enhancing operational efficiency. Key offerings include Finacle, a banking solution for financial institutions; Panaya, which facilitates application delivery; Infosys Equinox, a platform for digital commerce; and EdgeVerve Systems, focusing on enterprise software. In terms of geographical presence, Infosys generates a significant portion of its revenue from North America, which accounts for approximately 61%. Europe contributes around 25%, while other regions including India (3%), the Middle East, Australia, and Japan (11%).

International Business Machines Corporation (IBM), nicknamed Big Blue, is an American multinational technology company based in Armonk, New York, and present in over 175 countries has officially confirmed its acquisition of Polar Security in May 2024, which will be integrated into its Guardium unit. This integration will enable IBM customers to identify security risks and compliance violations more effectively. Backed by USD 8.5 million in funding from investors such as Gilot, IBI, and several individuals, Polar Security recently emerged from stealth mode. IBM has invested USD 60 million in this acquisition, underscoring its commitment to enhancing data protection in the cloud.

List of Key Companies in Cloud Services Brokerage Market

- Accenture

- TCS

- IBM

- Broadcom

- Arrow Electronics

- Fujitsu

- DXC Technology

- Wipro

- Eviden

- AWS

- Infosys

- NTT Data

- Tech Mahindra

- BMC Software

- Flexera

- DigitalOcean Holdings, Inc.

Cloud Service Brokerage Market Development

October 9, 2023: Cloud Technology Solutions (CTS) and Appsbroker announced a strategic merger to form Europe's largest Google Cloud-only digital consultancy. The merger brought together the expertise and resources of two top cloud technology firms to create a more robust company capable of taking on ambitious digital transformation projects.

January 2023: Dell acquired the cloud orchestration startup Cloudify for an estimated amount of up to $100 million. This acquisition was intended to strengthen Dell's cloud services business, particularly its offerings in DevOps. Cloudify, an Israeli startup, developed a platform for cloud orchestration and infrastructure automation. Cloudify's tools are utilized by cloud architects and DevOps engineers to manage containers, workloads, and more across hybrid environments.

March 2023: Cisco acquired Lightspin Technologies, an Israeli cloud security software company that specializes in cloud security posture management for cloud-native resources. This acquisition involves an investment ranging from $200 million to $250 million by Cisco, aiming to enhance its ability to help customers safeguard their data, applications, and infrastructure. This moves underscores Cisco's commitment to delivering robust cloud security solutions aligned with evolving organizational needs in a cloud-centric landscape.

Cloud Services Brokerage Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Aggregation

- Multi-cloud Management

- Data Integration

- Automation & Orchestration

- Service Intermediation

- Security Management

- Performance & Usage Reporting

- Service Arbitrage

- Service Catalogue Management

- Marketplace Integration

- Enablement Services

By Cloud Service Model Outlook (Revenue, USD Billion, 2020–2034)

- PaaS (Platform as a Service)

- IaaS (Infrastructure as a Service)

- SaaS (Software as a Service)

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Medium Enterprises

- Small Enterprises

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- IT and Telecom

- BFSI

- Retail & Consumer Goods

- Energies & Utilities

- Media & Entertainment

- Healthcare & Life Sciences

- Government & Public Sector

- Manufacturing

- Other Verticals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud Service Brokerage Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.95 billion |

|

Market Size Value in 2025 |

USD 12.83 billion |

|

Revenue Forecast in 2034 |

USD 56.40 billion |

|

CAGR |

17.9% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

By Service Type Cloud Service Model Organization Size Vertical |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cloud services brokerage market size was valued at USD 10.95 billion in 2024 and is projected to grow to USD 56.40 billion by 2034.

The global market is projected to grow at a CAGR of 17.9% during the forecast period.

In 2024, North America had the largest share of the cloud services brokerage market due to its advanced cloud infrastructure and high rate of digital transformation across industries such as IT, telecom, BFSI, and healthcare.

The key players in the market are Accenture; TCS; IBM; Broadcom; Arrow Electronics; Fujitsu; DXC Technology; Wipro; Eviden; AWS; Infosys; NTT Data; Tech Mahindra; BMC Software; Flexera; Jamcracker

The SaaS (Software as a Service) segment dominated the market in 2024.

The retail and consumer goods sector is expected to experience the highest growth in the global cloud services brokerage market.