Cloud Kitchen Market Share, Size, Trends, Industry Analysis Report, By Type (Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods); By Nature (Franchised, Standalone); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 113

- Format: PDF

- Report ID: PM2077

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

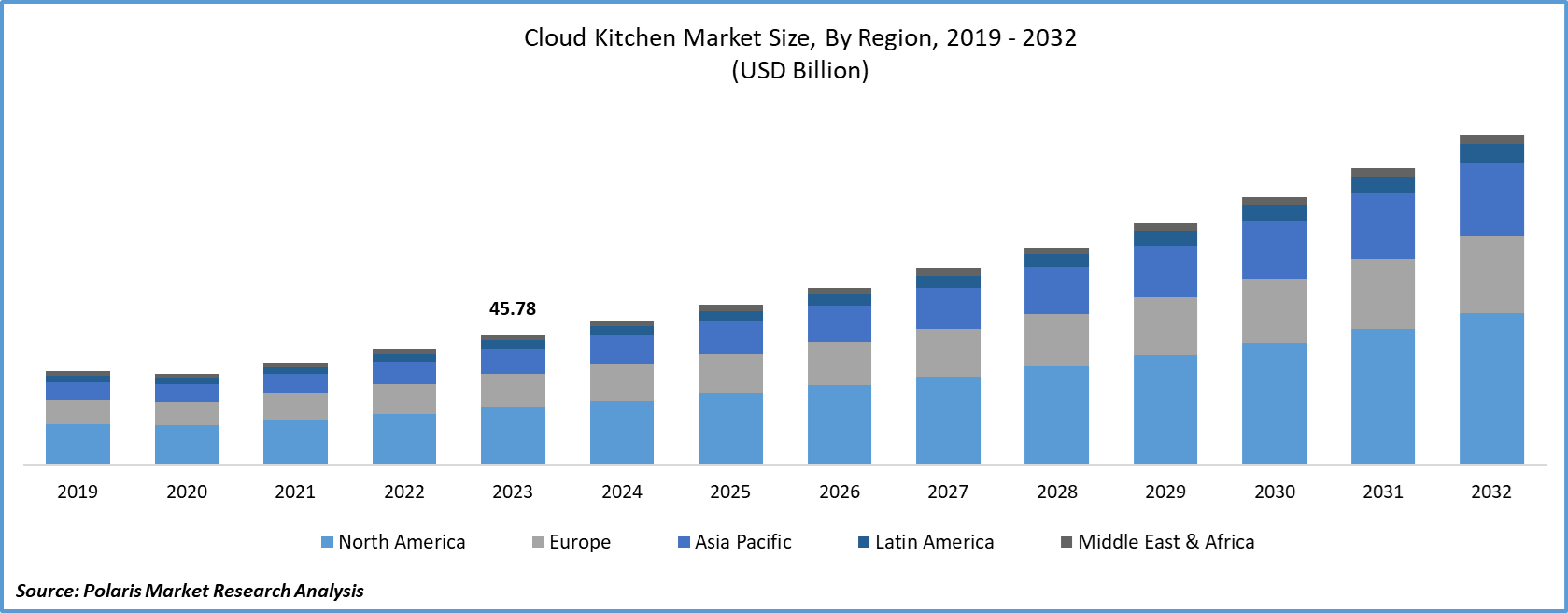

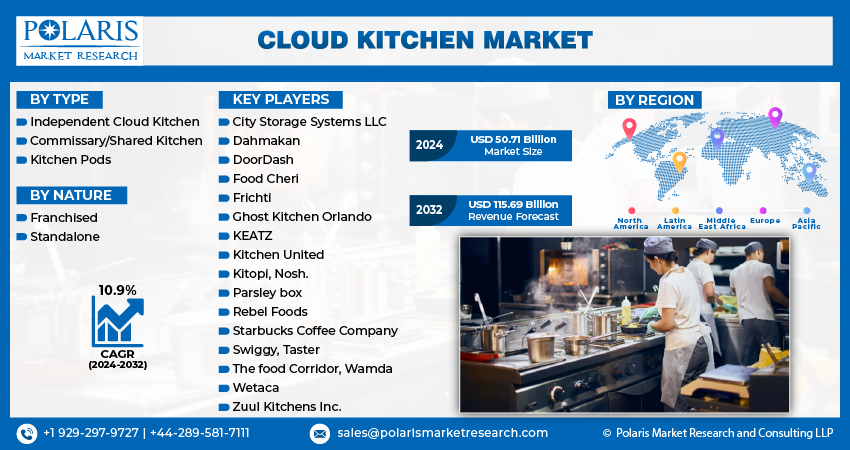

The global cloud kitchen market size was valued at USD 45.78 billion in 2023. The market is anticipated to grow from USD 50.71 billion in 2024 to USD 115.69 billion by 2032, exhibiting the CAGR of 10.9% during the forecast period.

Continually increasing customer preference for online food services over dining experiences and increasing incentives and government schemes regarding online food delivery are the few prominent factors expected to accelerate the cloud kitchen market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

In addition, several online food retailing companies nowadays offer discount coupons for strengthening online food services, which encourage sales volume and increase their customer base. Swiggy and Zomato are offering extensive discounts to expand their market shares on account of the rise in COVID-19 cases. They offer hefty discounts of up to 60% as well as increased spending on marketing and advertising across channels to attract new customers. This, in turn, is creating the immense potential for boosting the preference for cloud kitchens around the world.

The wake of the COVID-19 pandemic has enabled important changes in the online food delivery business. One such instance is the massive popularity of cloud kitchens on the back of the increased dependency of consumers on these establishments. Cloud kitchens work on a delivery-only model and usually receive orders and deliver them to the customers. This seamless way of cloud kitchens has become the go-to option for the consumers, and thus these kitchens are expected to continue to gain traction, promoting the cloud kitchen market growth globally.

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades supported by manifold factors, such as the enormous range of benefits, along with the increasing real-estate costs and competition, including dine-in restaurants, restaurateurs, and entrepreneurs.

Moreover, the advancements in technology are also assisting restaurateurs in managing more efficiently and expanding their profit margins. For instance, restaurateurs utilize sophisticated tools to obtain consumer insights to evaluate and update their menu depending on popularity and switch items with a greater margin item, which is expected to raise the global cloud kitchen market's growth outlook. Apart from that, the area of online to offline (O2O) commerce is increasing the usage of online food delivery platforms. Globally, the surge of online food delivery has revolutionized how many customers and food suppliers interact; therefore, food retailers are looking for innovative solutions to generate orders.

According to Gloria Food, nearly 48% (around 2 billion) of the total U.S. population ordered a meal via online platforms in 2016, up from 22% (637 million) from 2011. Further, in 2018, it is estimated that nearly 68% of the U.S. people ordered food items via online platforms. Thus, food outlet vendors are implementing cloud kitchens that allow businesses the opportunity to provide consumers directly without the pressure of supplementary costs, which aided the market growth globally.

Report Segmentation

The market is primarily segmented on the basis of type, nature, and region.

|

By Type |

By Nature |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type segment, the independent cloud cookhouse segment was the largest revenue contributor in the global market in 2020 and is anticipated to retain its dominance in the foreseen period. Independent cloud cookhouses mainly aim at consumers that select a single cuisine type and extensively rely on third-party channels for delivery.

Therefore, the rise in consumer preference for intercontinental cuisines, fast foods, and online food ordering is likely to drive the segment. Furthermore, the growing number of standalone brands that are typically serving consumers from a single location, in turn, is creating huge investments and market demand for independent cloud cook space globally.

Insight by Nature

The franchised segment is expected to witness large revenue in the global market, owing to the rapid development of such cloud cook space, opening up new opportunities for new players in the marketplace. Further, these cloud cook homes are gaining wide popularity due to the rise in international cuisines and tailored foods that promote operators to spend in such popular brands.

Furthermore, creating such restaurants involves fewer risks since the franchisor provides training and assistance, which generally includes everything from supplies and equipment to marketing and employee training. Hence, benefits like the reduced risk engaged in forming a cloud cookhouse and obtaining a significant profit share that accelerates the growth of the global market.

On the flip side, the standalone segment is expected to pave a high market share in terms of revenue over the forecast period, as it involves minimum investment ensuring entire and better control over cooking areas operations. Furthermore, increasing affluent consumers requiring quality food delivery services is promoting restaurateurs to determine for standalone cloud cook areas are projected to propel the segment growth during the foreseen period.

Geographic Overview

Geographically, Asia-Pacific accounted for the largest share in 2020 and is projected to observe considerable growth in the global market due to the increasing popularity and adoption of such cloud cookhouse with the rise in disposable income of income, along with the growing adoption of smartphone applications among millennials and leading food chain outlets to offer online food delivery services in the region. This, in turn, is continually expanding the market at a rapid pace considering the global scenario.

Additionally, countries such as China, Australia, Japan, and South Korea are further estimated to register the largest number of initiatives to opt for online food delivery services supporting the implementation of cloud cookhouses. Similarly, in countries such as India, most online food delivery companies use cloud cook houses as it significantly works exclusively on the delivery-only model, restaurateurs can easily maintain their businesses processing and serving consumers efficiently.

For instance, as per the European Journal of Clinical Nutrition, internet users in China increased from December 2017 to June 2019 from 772 million to 854 million. Within this period, online-to-offline (O2O) food delivery consumers increased steadily by almost 22.7%, from 343 million to 421 million, which will considerably promote the market demand for the cloud cook houses market in the region.

Competitive Insight

Some of the major players operating in the global market include City Storage Systems LLC, Dahmakan (Pop Meals), DoorDash, Food Cheri, Frichti, Ghost Kitchen Orlando, KEATZ, Kitchen United, Kitopi, Nosh. Parsley box, Rebel Foods, Starbucks Coffee Company, Swiggy, Taster, The food Corridor, Wamda, Wetaca, and Zuul Kitchens Inc.

Cloud Kitchen Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 50.71 billion |

|

Revenue forecast in 2032 |

USD 115.69 billion |

|

CAGR |

10.9% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By Nature, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

City Storage Systems LLC, Dahmakan (Pop Meals), DoorDash, Food Cheri, Frichti, Ghost Kitchen Orlando, KEATZ, Kitchen United, Kitopi, Nosh. Parsley box, Rebel Foods, Starbucks Coffee Company, Swiggy, Taster, The food Corridor, Wamda, Wetaca, and Zuul Kitchens Inc. |