Cloud Infrastructure Entitlement Management Market Size, Share, Trends, Industry Analysis Report: By Component (Solution and Services), Organization Size, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5572

- Base Year: 2024

- Historical Data: 2020-2023

Cloud Infrastructure Entitlement Management Market Overview

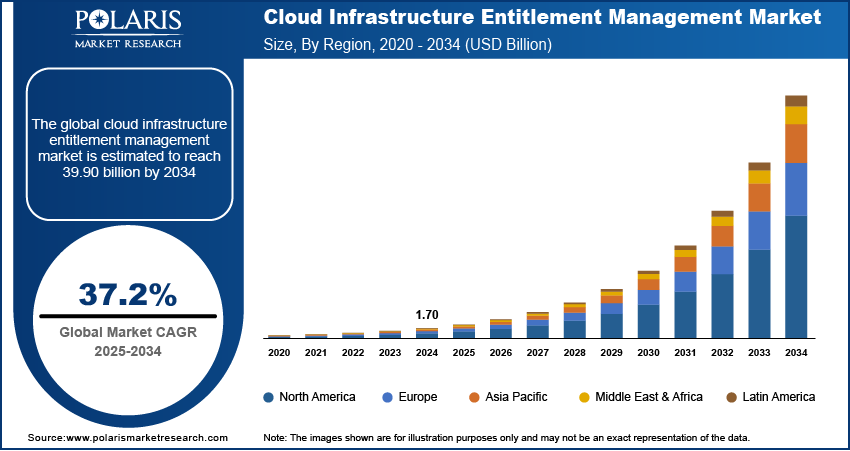

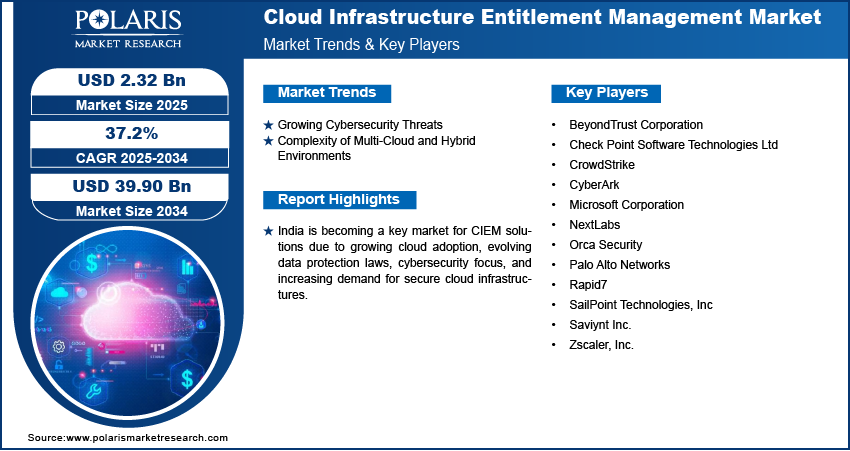

The global cloud infrastructure entitlement management market size was valued at USD 1.70 billion in 2024. The market is projected to grow from USD 2.32 billion in 2025 to USD 39.90 billion by 2034, exhibiting a CAGR of 37.2% from 2025 to 2034.

Cloud infrastructure entitlement management (CIEM) refers to the processes and tools used to control and manage user access and permissions within cloud environments. It ensures that the right individuals or systems have the appropriate levels of access to resources, helping to prevent security risks and compliance issues.

The rapid shift of companies to the cloud has made managing access to cloud resources a critical concern. Organizations now rely on multiple cloud services to store and process data, making it essential to control who can access these resources. Consequently, the demand for CIEM solutions is rising, as they provide centralized control over user permissions and ensure that only authorized individuals or systems can access sensitive data. Additionally, the growing need for secure cloud environments is driving the demand for CIEM tools, which in turn is contributing to the cloud infrastructure entitlement management market growth.

Stricter regulations and data privacy laws, such as GDPR, HIPAA, and SOX, have forced companies to improve their data security measures and improve their control over user access to cloud resources. Non-compliance with these regulations can result in hefty fines and reputational damage, making it essential for businesses to ensure proper access management. CIEM solutions enable organizations to comply with these regulations by providing detailed monitoring, auditing, and reporting features that track who accessed what data. This, in turn, drives the cloud infrastructure entitlement management market demand.

To Understand More About this Research: Request a Free Sample Report

Cloud Infrastructure Entitlement Management Market Dynamics

Growing Cybersecurity Threats

Growing concerns over data privacy risks are driving the demand for CIEM solutions. For instance, according to the Identity Theft Resource Center, 1,603 data thefts were recorded in the US alone in 2022. This rise in data theft has raised concerns over data privacy. As organizations increasingly store sensitive data in cloud environments, they face heightened pressure to ensure proper access control to ensure privacy and comply with stringent regulations. Improper management of user permissions can lead to data exposure, compromising customer trust and legal compliance. CIEM solutions enable businesses to enforce access policies, track entitlement changes, and prevent unauthorized access, thereby mitigating data privacy risks. Thus, rising cybersecurity threats are fueling the cloud infrastructure entitlement management market expansion.

Complexity of Multi-Cloud and Hybrid Environments

Many businesses are adopting multi-cloud and hybrid cloud strategies, leveraging services from different cloud providers to meet specific needs. While these strategies offer flexibility and efficiency, they also introduce complexities in managing user access. CIEM solutions help centralize access control across multiple platforms, making it easier to monitor permissions and reduce the complexity of managing access in different cloud environments. By simplifying the process of granting, revoking, and auditing user entitlements, these solutions help businesses maintain control and reduce vulnerabilities in their cloud infrastructure. Thus, the complexity of multi-cloud and hybrid cloud environments is driving the adoption of CIEM solutions and propelling the cloud infrastructure entitlement management market revenue.

Cloud Infrastructure Entitlement Management Market Segment Insights

Cloud Infrastructure Entitlement Management Market Assessment by Component Outlook

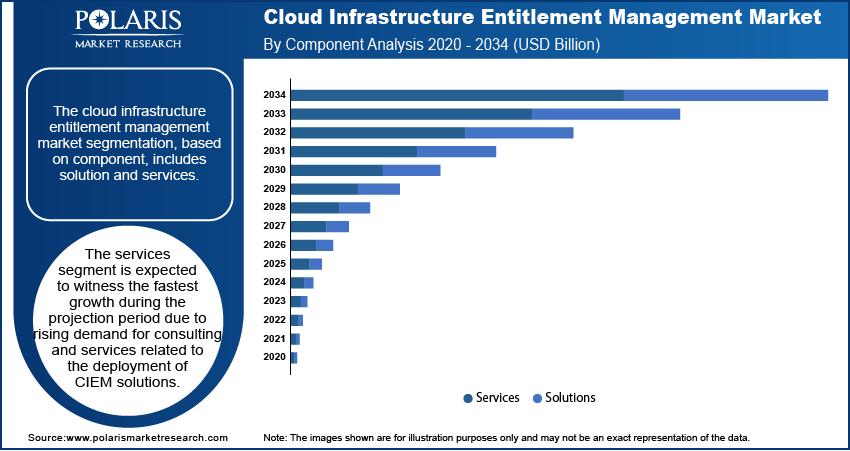

The cloud infrastructure entitlement management market assessment, based on component, includes solution and services. The services segment is expected to witness the fastest growth from 2025 to 2034. Businesses adopting CIEM solutions need more than just software; ongoing support, integration, and customization services are essential. Service providers offer crucial assistance in the implementation, management, and optimization of CIEM solutions, helping companies effectively manage cloud permissions. These services also ensure that access controls align with security policies, compliance requirements, and operational needs. The growing complexity of cloud environments, along with the increasing demand for expert support, is driving segmental growth in the global market.

Cloud Infrastructure Entitlement Management Market Evaluation by End Use Outlook

The cloud infrastructure entitlement management market evaluation, based on end use, includes BFSI, healthcare & life sciences, retail & e-commerce, government & defense, manufacturing, IT and ITeS, and others. The BFSI segment dominated the cloud infrastructure entitlement management market in 2024. The BFSI sector handles large amounts of sensitive data, making secure access control crucial to protect financial and personal information. CIEM solutions help safeguard sensitive data and maintain trust as data security becomes increasingly important in the BFSI sector. Stringent regulatory requirements, such as data privacy laws and industry standards, are further driving the demand for CIEM solutions among businesses in the BFSI sector.

Cloud Infrastructure Entitlement Management Market Regional Analysis

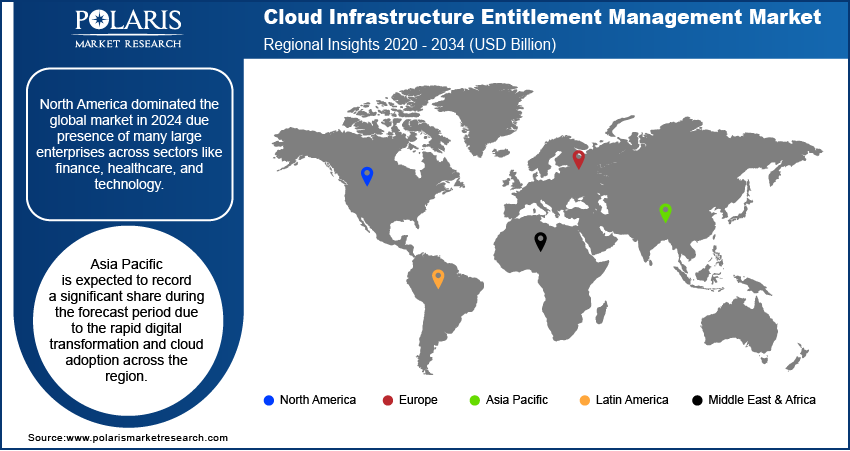

By region, the study provides the cloud infrastructure entitlement management market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024. The region is home to many large enterprises across sectors like finance, healthcare, and technology, all of which require robust cloud security solutions. This demand for security solutions is driven by stringent regulatory frameworks, such as GDPR and HIPAA. Additionally, the growing adoption of multi-cloud environments and digital transformation initiatives contributes to regional market dominance.

Asia Pacific is expected to record a significant share during the forecast period due to the rapid digital transformation and cloud adoption across the region. Countries like China, Japan, and South Korea are investing heavily in cloud technologies, driving the demand for secure access management solutions. Additionally, the increasing volume of data, combined with evolving regulatory requirements, has raised awareness about the importance of securing cloud environments. Furthermore, the rise of startups and the adoption of AI, IoT, and big data technologies in the Asia Pacific are accelerating the need for effective cloud infrastructure entitlement management solutions, thereby propelling market growth in the region.

The India cloud infrastructure entitlement management market is experiencing substantial growth driven by its rapidly expanding digital economy. The country’s growing adoption of cloud computing, especially among tech companies, financial institutions, and government agencies, has created a need for robust access management solutions. India’s evolving data protection regulations and the increasing focus on cybersecurity are also contributing to the growing adoption of cloud CIEM tools.

Cloud Infrastructure Entitlement Management Market – Key Players and Competitive Insights

The cloud infrastructure entitlement management market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the cloud infrastructure entitlement management market includes Microsoft Corporation; CyberArk; Palo Alto NetworksCheck Point Software Technologies Ltd; Zscaler, Inc.; BeyondTrust Corporation; Rapid7; CrowdStrike; SailPoint Technologies, Inc; Saviynt Inc.; Orca Security; and NextLabs.

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office and the Xbox gaming console. Microsoft has invested heavily in artificial intelligence (AI) and machine learning (ML) technologies in recent years. The company has been using AI to improve its products and services and developing new AI-based applications. For instance, Microsoft's Cortana virtual assistant uses ML to provide personalized recommendations and insights to users. Microsoft has also developed several AI-based products and services, including the Azure Machine Learning platform, which allows developers to build, deploy, and manage ML models at scale. The company also provides AI tools for healthcare, such as Microsoft Healthcare Bot, which helps patients get answers to their health-related questions. Furthermore, Microsoft is actively involved in AI research and development and has established partnerships with leading universities and research institutions worldwide. The company is committed to using AI to solve the world's most pressing problems, such as climate change, healthcare, and education. Microsoft’s CIEM solution, Microsoft Entra Permissions Management, grants visibility and control over permissions for any identity and resource across Microsoft Azure, AWS, and GCP. This helps in automating least privilege and unifying cloud access policies.

NextLabs, Inc., founded in 2004 and headquartered in San Mateo, California, specializes in data-centric security solutions within a zero-trust framework. The company is known for its dynamic authorization technology, which enables organizations to monitor and control access to sensitive data, ensuring compliance with various regulatory standards. Its product offerings include dynamic authorization, which enforces access policies in real-time based on user attributes, and data-centric security (DCS), which protects structured and unstructured data throughout its lifecycle, whether at rest, in transit, or in use. Additionally, NextLabs provides a policy management platform that facilitates the management of access rights across multiple applications without requiring extensive integration efforts. Another key feature is real-time data masking, which ensures sensitive data is accessible only to authorized users through dynamic segregation and obfuscation policies. NextLabs targets large enterprises that protect sensitive information while enabling secure collaboration among internal teams and external partners. The company primarily operates in the US but has established partnerships with global enterprises, including SAP, Siemens, Microsoft, AWS, Accenture, Deloitte, Infosys, and IBM.

List of Key Companies in Cloud Infrastructure Entitlement Management Market

- BeyondTrust Corporation

- Check Point Software Technologies Ltd

- CrowdStrike

- CyberArk

- Microsoft Corporation

- NextLabs

- Orca Security

- Palo Alto Networks

- Rapid7

- SailPoint Technologies, Inc

- Saviynt Inc.

- Zscaler, Inc.

Cloud Infrastructure Entitlement Management Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Services

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Healthcare & Life Sciences

- Retail & E-Commerce

- Government & Defense

- Manufacturing

- IT and ITeS

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud Infrastructure Entitlement Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.70 billion |

|

Market Size Value in 2025 |

USD 2.32 billion |

|

Revenue Forecast by 2034 |

USD 39.90 billion |

|

CAGR |

37.2% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The cloud infrastructure entitlement management market size was valued at USD 1.70 billion in 2024 and is projected to grow to USD 39.90 billion by 2034.

The global market is projected to register a CAGR of 37.2% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Microsoft Corporation; CyberArk; Palo Alto NetworksCheck Point Software Technologies Ltd; Zscaler, Inc.; BeyondTrust Corporation; Rapid7; CrowdStrike; SailPoint Technologies, Inc; Saviynt Inc.; Orca Security; and NextLabs.

The BFSI segment dominated the market in 2024 due presence of vast amounts of sensitive data, making secure access control crucial to protect financial and personal information.

The services segment is expected to witness the fastest growth during the forecast period due to rising demand for consulting and services related to the deployment of the CIEM solutions.