Cloud FinOps Market Size, Share, Trends, Industry Analysis Report: By Offering (Solution and Services), Service Model, Deployment Model, Organization Size, Application, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5278

- Base Year: 2024

- Historical Data: 2020-2023

Cloud FinOps Market Overview

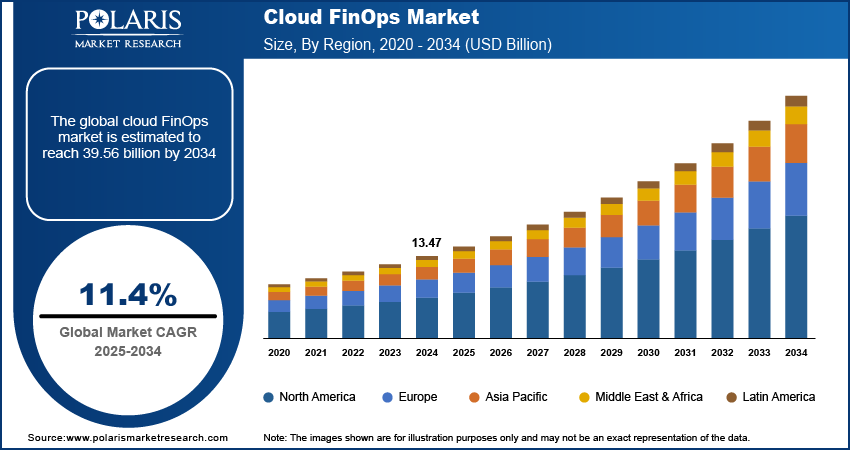

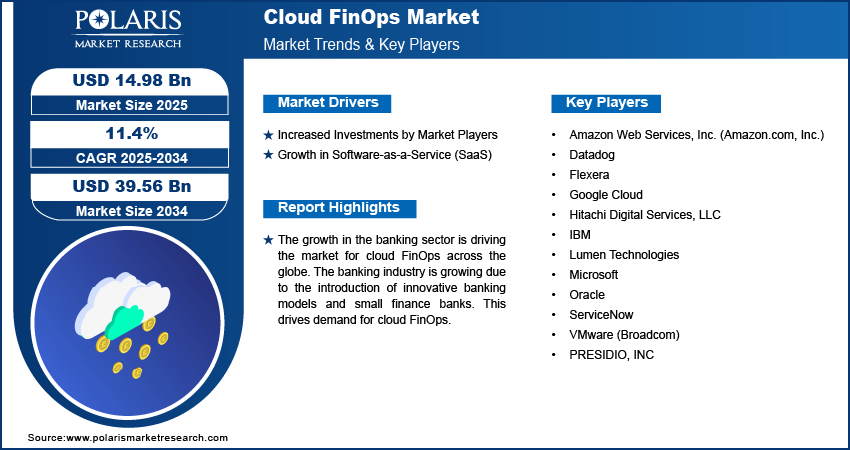

The cloud FinOps market size was valued at USD 13.47 billion in 2024. The market is projected to grow from USD 14.98 billion in 2025 to USD 39.56 billion by 2034, exhibiting a CAGR of 11.4% during the forecast period.

Cloud FinOps is a set of practices and principles designed to manage and optimize cloud spending. It combines financial management, operations, and technology to help organizations gain better visibility into their cloud costs and make informed decisions about resource usage. The growth of the cloud FinOps market is fuelled by the increasing adoption of cloud services to meet the need for efficient financial management. Organizations are migrating their operations toward the cloud to meet complex pricing structures and adopting cloud resources.

For instance, according to Eurostat, in 2023, 45.2% of enterprises in the European Union adopted cloud computing services, reflecting a 4.2 percentage point increase from 2021. This growth in adoption is creating a demand for several cloud-based services, including cloud FinOps. Cloud FinOps offers comprehensive tools and practices to manage and optimize cloud expenditures. Thus, organizations are managing their cloud budgets, minimizing overspending, and enhancing overall financial efficiency by leveraging cloud FinOps, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

The growth in the banking sector is driving the market for cloud FinOps across the globe. The banking industry is growing due to the introduction of innovative banking models and small finance banks. For instance, according to the IBEF, the Indian Fintech industry is projected to be at USD 150 billion by 2025. Such growth in the banking sector is significantly driving the global market for cloud FinOps due to the sector's increasing reliance on cloud technology for its operations and services. The complexity of cloud billing, combined with the stringent regulatory requirements and the need for precise cost control, makes cloud FinOps essential in the banking sector. Therefore, the demand for cloud FinOps solutions is growing as banks are shifting towards digital transformation, which drives cloud FinOps market expansion.

Cloud FinOps Market Driver Analysis

Increased Investments by Market Players

Market players are raising funds to invest in developing advanced tools and technologies that address the complexities of cloud financial management. For instance, in May 2024, Finout, an Israeli FinOps startup, completed its Series B funding round by raising USD 26.3 million. The funding round was led by Red Dot Capital Partners, with significant contributions from Pitango, Team8, and Jibe Ventures. Finout's FinOps platform is utilized by major industry firms such as the New York Times, Lyft, Choice Hotels, Tenable, Wiz, and Appsflyer to manage and optimize cloud spending efficiently. Such investments are leading to the creation of more solutions that offer enhanced features for cost optimization, real-time financial monitoring, and automated budgeting. Thus, the surge in investment is improving the capabilities of cloud FinOps solutions and fostering market growth.

Growth in Software-as-a-Service (SaaS)

The growth in the software-as-a-service (SaaS) market is supporting the growth of the cloud FinOps market as more organizations adopt SaaS solutions to streamline operations and enhance productivity. For instance, according to IBEF, India's SaaS market is experiencing an annual growth rate of 20%, driven by the rising acceptance of software-as-a-service solutions by Indian small and medium-sized businesses (SMBs) and enterprises spanning various sectors. This growth in the adoption of SaaS creates the need for effective financial management and optimization. Cloud FinOps provides the tools and practices necessary to manage costs and offers features such as detailed cost tracking, budgeting, and financial forecasting that meet the demand for efficient financial management. Thus, the growing demand for cost control and financial transparency in the domain of expanding SaaS is driving the growth of the Cloud FinOps market.

Cloud FinOps Market Segment Analysis

Cloud FinOps Market Assessment by Application

The global cloud FinOps market segmentation, based on application, includes budgeting & forecasting, cost allocation & chargeback, cost management & optimization, reporting & analytics, workload management & optimization, and others. The budgeting and forecasting segment in the market is projected to grow at a significant CAGR due to the increasing need for precise financial planning and control in cloud environments.

Companies are expanding their cloud usage to manage and predict cloud costs. Advanced budgeting and forecasting tools within cloud FinOps solutions enable businesses to create detailed financial plans, monitor spending patterns, and forecast future cloud expenditures with greater accuracy. These tools help organizations align their cloud investments. Consequently, the growing emphasis on cost efficiency in cloud operations is driving the demand for budgeting and forecasting capabilities, which is expected to fuel the segment's rapid growth in the cloud FinOps market.

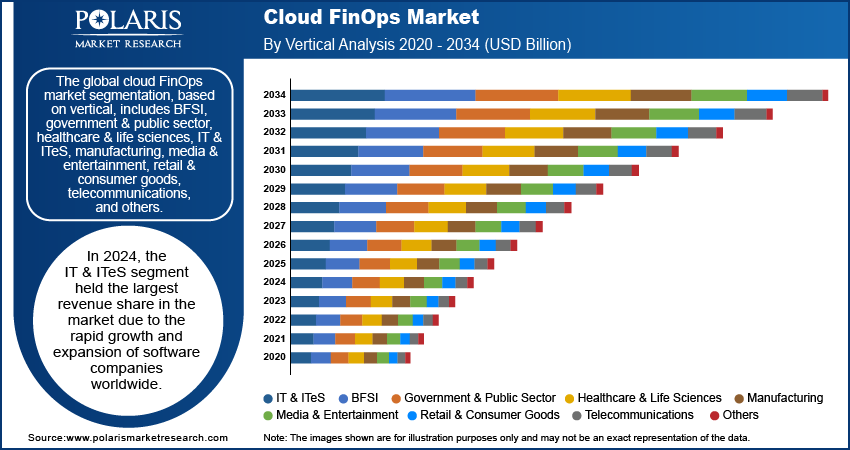

Cloud FinOps Market Evaluation by Vertical

The global cloud FinOps market segmentation, based on vertical, includes BFSI, government & public sector, healthcare & life sciences, IT & ITeS, manufacturing, media & entertainment, retail & consumer goods, telecommunications, and others. In 2024, the IT & ITeS segment held the largest revenue share in the market due to the rapid growth and expansion of software companies worldwide.

The IT & ITeS sector, encompassing software development, software consulting, and various technology services, is dependent on cloud infrastructure for its operations. For instance, according to CompTIA, in 2019, the US had over 557,000 software and IT services companies, such as suppliers of computer systems design firms, custom computer programming services, software publishers, and facilities management companies. Such companies are scaling up and increasing cloud usage, that created a demand for complex financial management solutions. Thus, cloud FinOps solutions are utilized by IT companies to meet the growing need for managing cloud spending and optimizing resource usage, which contributed to the dominance of the IT & ITeS vertical in the global cloud FinOps market.

Cloud FinOps Regional Insights

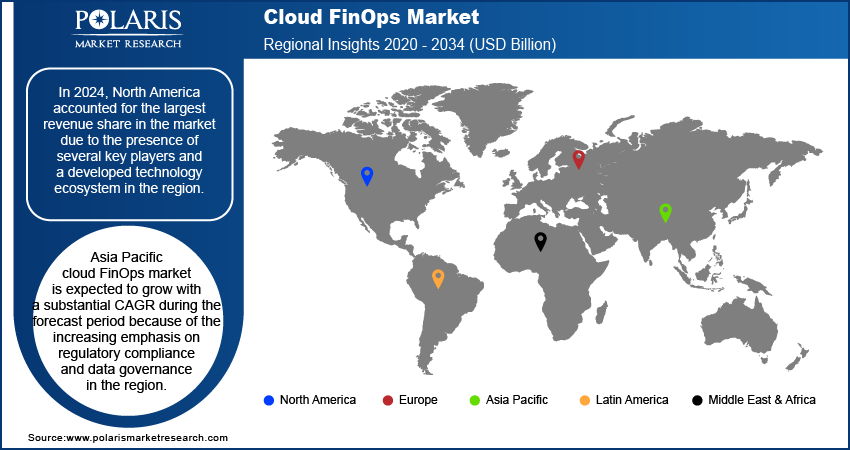

By region, the study provides the cloud FinOps market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the market due to the presence of several key players and a developed technology ecosystem in the region. North America possesses many cloud service providers, financial management software companies, and innovative tech firms, including Amazon Web Services, Inc.; Microsoft; IBM; Google; and Oracle, that drive advancements in Cloud FinOps solutions. This concentration of major technology firms in the region fostered a competitive environment that led to the dominance of North America in the global cloud FinOps market.

The US held a significant market share of the North American cloud FinOps market due to the increasing number of innovative offerings by the key players of the country. American companies are developing advanced cloud FinOps solutions driven by substantial investments in research and development. For instance, in July 2024, the three cloud service providers, including Microsoft, Google, and AWS, announced the launch and improvements to their FinOps offerings at the FinOps X event held in San Diego, United States. Such innovations in offerings include tools for cost optimization, real-time financial insights, and automated budgeting, which cater to the complex needs of diverse industries. Therefore, the expanded offerings by major industry players have contributed to the dominance of the US in the North America cloud FinOps market.

Asia Pacific cloud FinOps market is expected to grow with a substantial CAGR during the forecast period because of the increasing emphasis on regulatory compliance and data governance in the region. Businesses and governments in the Asia Pacific are implementing stricter regulations for data security and financial transparency, creating the need for cloud FinOps solutions. These solutions assist organizations in ensuring compliance by providing detailed financial reporting, cost tracking, and audit capabilities, thereby driving their adoption and contributing to the significant growth of the market in the region.

Cloud FinOps Key Market Players & Competitive Analysis Report

Several key players, such as major cloud service providers, financial management software companies, and specialized FinOps solution vendors, represent the cloud FinOps market. Multinational tech companies are offering integrated FinOps capabilities within their platforms to strengthen market presence. Additionally, dedicated cloud FinOps companies are offering advanced tools for cost optimization, budgeting, and financial reporting.

The market is highly competitive, with constant innovations and partnerships focused on improving financial management and cost efficiency in cloud environments. The market is growing due to increasing competition for ongoing progress and the development of specialized solutions that cater to the varied requirements of companies in different sectors. Major players in the cloud FinOps market include Amazon Web Services, Inc. (Amazon.com, Inc.); Datadog; Flexera; Google Cloud; Hitachi Digital Services, LLC; IBM; Lumen Technologies; Microsoft; Oracle; ServiceNow; VMware (Broadcom); and PRESIDIO, INC.

IBM (International Business Machines Corporation) offers integrated solutions and services globally. The company has divided its operation into several segments, including software, infrastructure, consulting, and financing segments. The software segment provides AI and hybrid cloud platforms for digital and AI transformations across applications, data, and environments. The infrastructure segment offers cloud-based and on-premises server and storage solutions, along with services for hybrid cloud infrastructure deployment. The consulting segment concentrates on skills integration for experience, technology, strategy, and operations by domain and industry. The financing segment provides commercial and client financing to facilitate the acquisition of software, hardware, and services. In May 2024, IBM announced the product integration between IBM Cloudability and IBM Turbonomic. The integration enabled more in-depth cost analysis and collaboration between engineering, business, and finance teams.

Amazon.com, Inc., is a multinational technology company with three primary segments, including International, North America, and Amazon Web Services (AWS). The company's primary business is the advertising, retail sale of consumer products, and subscription services through online and physical stores worldwide. The company offers a wide range of electronic devices, including Kindle, Fire TVs, Echo, Fire tablets, Blink, Ring, and Eero, and develops and produces media content. Amazon also provides a range of services, including storage, database, computing, machine learning, analytics, and other services, as well as advertising services through programs such as display, sponsored ads, and video advertising. In November 2023, AWS introduced a Cost Optimization Hub to assist businesses in reducing cloud expenses. This feature facilitated enterprises in identifying, filtering, aggregating, and quantifying potential savings through AWS cost optimization recommendations.

List of Key Companies in the Cloud FinOps Market

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Datadog

- Flexera

- Google Cloud

- Hitachi Digital Services, LLC

- IBM

- Lumen Technologies

- Microsoft

- Oracle

- ServiceNow

- VMware (Broadcom)

- PRESIDIO, INC

Cloud FinOps Industry Developments

November 2023: Presidio, a global digital services and solutions provider, introduced PRISM (Proactive Recapture into Savings Management) FinOps with AI to address the growing need for enhanced cloud expenditure oversight and governance.

March 2023: Flexera introduced Flexera One FinOps, a solution that enhances an enterprise’s FinOps and cloud central teams while promoting the convergence of ITAM and FinOps. Flexera One FinOps enables enterprises to enhance visualization and allocation of cloud usage and billing, effectively manage hybrid IT estates, and operate the cloud at scale.

July 2023: Apptio, a technology spend and value management company, introduced advanced FinOps capabilities to its Cloudability product line. These new capabilities are designed to simplify the management and optimization of multi-cloud environments, reducing complexity for users.

Cloud FinOps Market Segmentation

By Offering Outlook (Revenue - USD Billion, 2020 - 2034)

- Solution

- Native Solutions

- Third-party Solutions

- Services

- Professional Services

- Managed Services

By Service Model Outlook (Revenue - USD Billion, 2020 - 2034)

- laaS

- PaaS

- SaaS

By Deployment Model Outlook (Revenue - USD Billion, 2020 - 2034)

- Hybrid Cloud

- Private Cloud

- Public Cloud

By Organization Size Outlook (Revenue - USD Billion, 2020 - 2034)

- Large Enterprises

- SMEs

By Application Outlook (Revenue - USD Billion, 2020 - 2034)

- Budgeting & Forecasting

- Cost Allocation & Chargeback

- Cost Management & Optimization

- Reporting & Analytics

- Workload Management & Optimization

- Others

By Vertical Outlook (Revenue - USD Billion, 2020 - 2034)

- BFSI

- Government & Public Sector

- Healthcare & Life Sciences

- IT & ITeS

- Manufacturing

- Media & Entertainment

- Retail & Consumer Goods

- Telecommunications

- Others

By Regional Outlook (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud FinOps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.47 Billion |

|

Market Size Value in 2025 |

USD 14.98 Billion |

|

Revenue Forecast in 2034 |

USD 39.56 Billion |

|

CAGR |

11.4% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cloud FinOps market size was valued at USD 13.47 billion in 2024 and is projected to grow to USD 39.56 billion by 2034.

The global market is projected to register a CAGR of 11.4% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are Amazon Web Services, Inc. (Amazon.com, Inc.); Datadog; Flexera; Google Cloud; Hitachi Digital Services, LLC; IBM; Lumen Technologies; Microsoft; Oracle; ServiceNow; VMware (Broadcom); and PRESIDIO, INC.

The budgeting and forecasting segment in the market is projected to grow at a significant CAGR due to the rising demand for precise financial planning and control within cloud environments.

In 2024, the IT & ITeS sector dominated the market in terms of revenue, driven by the substantial global expansion and accelerated growth of software firms.