Clinical Trial Technology and Services Market Size, Share, Trends, Industry Analysis Report: By Technology Solutions (Solutions and Services), Phases, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5526

- Base Year: 2024

- Historical Data: 2020-2023

Clinical Trial Technology and Services Market Overview

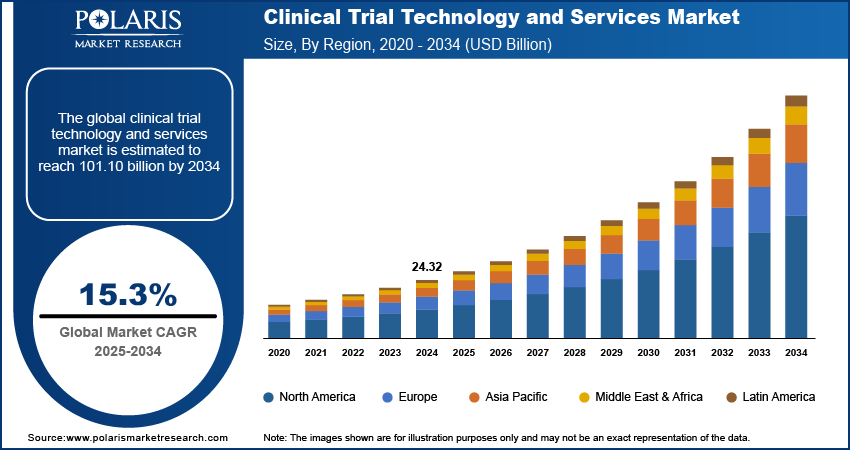

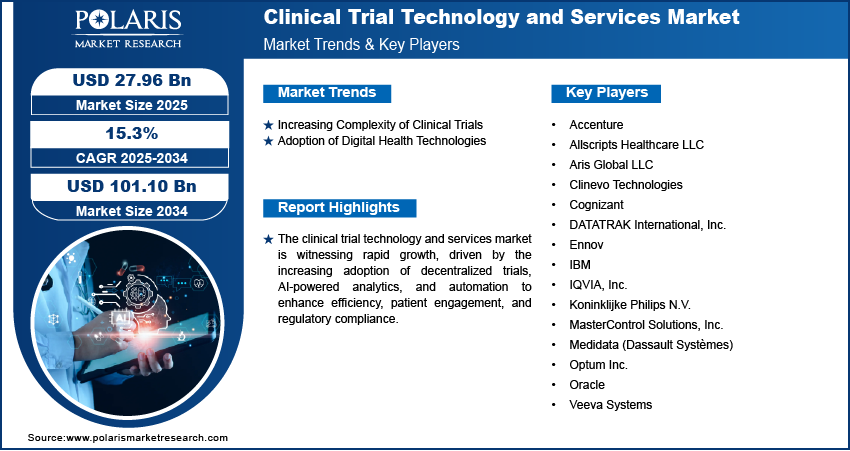

The global clinical trial technology and services market was valued at USD 24.32 billion in 2024. The market is expected to grow from USD 27.96 billion in 2025 to USD 101.10 billion by 2034, at a CAGR of 15.3% from 2025 to 2034.

Clinical trial technology and service refers to the specialized solutions and support systems designed to enhance the efficiency, accuracy, and compliance of clinical trials. The clinical trial technology and services market growth is driven by regulatory support and innovation. Regulatory agencies worldwide are actively promoting advancements in clinical research by streamlining approval processes, adopting digital solutions, and emphasizing data transparency. For instance, in November 2023, Casgevy, the first CRISPR-based therapy, was approved for treating sickle cell disease (SCD) and transfusion-dependent thalassemia (TDT). Clinical trials showed significant, durable results, but challenges remain in manufacturing, delivery, cost (USD 2 million per patient), and safety due to pre-treatment chemotherapy. This push for modernization is driving the adoption of innovative technologies, such as decentralized trials, electronic data capture (EDC) systems, and AI-driven analytics, which improve trial efficiency, reduce costs, and ensure compliance with evolving regulatory frameworks.

To Understand More About this Research: Request a Free Sample Report

Additionally, the growing focus on efficient patient recruitment is shaping the demand for advanced clinical trial technologies and services. Patient enrollment remains a critical challenge in clinical research, with delays in recruitment especially impacting trial timelines and costs. To address this, sponsors and contract research organizations (CROs) are leveraging AI-driven patient-matching platforms, real-world data analytics, and digital engagement tools to identify and retain suitable participants more effectively. For instance, in September 2024, ImageBloom, Inc. launched the patient recruitment marketplace, a first-of-its-kind platform offering ready-to-use marketing materials for clinical trial recruitment. The platform aims to streamline recruitment efforts, reduce timelines, and improve patient engagement through customizable study kits, flyers, videos, and digital media graphics. The integration of these technologies enhances recruitment efficiency, reduces drop-out rates, and improves overall trial outcomes, making them indispensable in the evolving clinical research landscape.

Clinical Trial Technology and Services Market Dynamics

Increasing Complexity of Clinical Trials

Evolving study designs, strict regulatory requirements, and the rise of precision medicine demand more sophisticated solutions. For instance, a May 2021 Tufts CSDD report revealed that oncology trials, driven by advanced designs, global scope, and targeted patient subpopulations, face longer durations, higher data volumes, and more protocol deviations, intensifying execution challenges despite faster regulatory reviews. Modern trials often involve adaptive designs, biomarker-driven patient stratification, and multi-site operations, necessitating advanced technologies for efficient data management, remote monitoring, and protocol adherence. Additionally, the integration of real-world evidence and increasing trial endpoints add to the complexity, requiring robust clinical trial management systems (CTMS), electronic trial master files (eTMF), and AI data management to streamline processes. The adoption of technology-driven solutions is essential to enhance operational efficiency, maintain compliance, and ensure data integrity throughout the study lifecycle as trials become more intricate. Thus, the increasing complexity of clinical trials is driving the clinical trial technology and services market revenue.

Adoption of Digital Health Technologies

The adoption of digital health technologies is another major driver boosting the clinical trial technology and services market share as the industry shifts toward more patient-centric and decentralized trial models. For instance, in November 2023, AstraZeneca launched Evinova, a digital health solutions provider backed by AstraZeneca, Parexel, and Fortrea. Evinova focuses on optimizing clinical trials, reducing drug development costs, and advancing digital remote patient monitoring and therapeutics to improve healthcare delivery and patient outcomes. Wearable devices, mobile health applications, and remote monitoring tools enable real-time data collection, improving patient engagement while reducing the need for frequent site visits. These technologies improve trial efficiency by providing continuous and accurate patient data, allowing researchers to monitor adherence, detect adverse events early, and optimize study protocols. Furthermore, telemedicine and electronic informed consent (eConsent) platforms facilitate seamless participant interactions, expanding trial accessibility and improving recruitment and retention rates. The growing reliance on digital health technologies is transforming clinical research, making trials more efficient, scalable, and adaptable to modern healthcare demands.

Clinical Trial Technology and Services Market Segment Insights

Clinical Trial Technology and Services Market Assessment by Technology Solutions Outlook

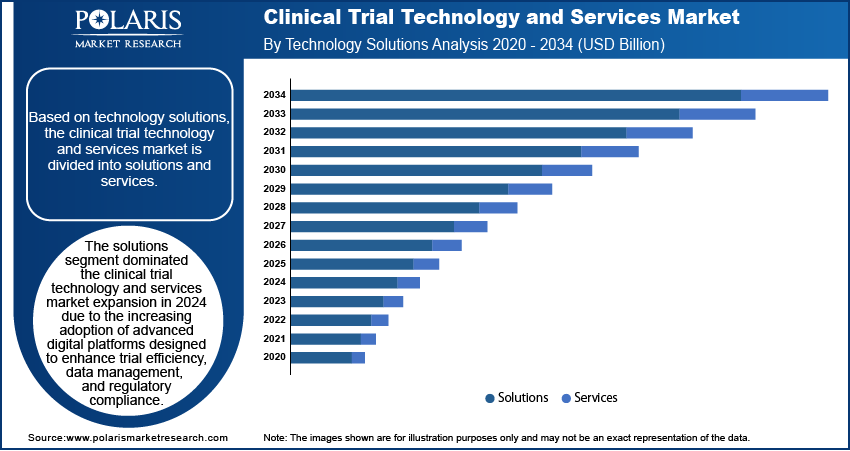

The global clinical trial technology and services market assessment, based on technology solutions, includes solutions and services. The solutions segment dominated the clinical trial technology and services market in 2024 due to the increasing adoption of advanced digital platforms designed to enhance trial efficiency, data management, and regulatory compliance. Pharmaceutical companies and contract research organizations (CROs) are prioritizing solutions such as electronic data capture (EDC), clinical trial management systems (CTMS), remote monitoring, and AI-powered analytics to streamline operations as clinical trials grow in complexity. These solutions allow seamless data integration, improve trial oversight, and enhance patient engagement, reducing trial timelines and costs. The growing demand for real-time insights, decentralized trial capabilities, and automation-driven efficiencies further strengthens the adoption of technology-driven solutions over traditional service-based approaches.

Clinical Trial Technology and Services Market Evaluation by Phases Outlook

The global clinical trial technology and services market evaluation, based on phases, includes phase I, phase II, phase III, and phase IV. The phase I segment is expected to witness the fastest clinical trial technology and services market growth during the forecast period, driven by the increasing number of early-stage clinical trials and the rising need for innovative technology solutions to optimize study design and execution. Phase I trials are critical for evaluating the safety, dosage, and pharmacokinetics of new drug candidates, requiring precise data collection, monitoring, and patient recruitment strategies. The adoption of AI-driven analytics, predictive modeling, and real-world data integration is enhancing trial efficiency and success rates in this phase. Additionally, the shift toward adaptive trial designs and decentralized methodologies is fueling the demand for advanced digital solutions, accelerating the adoption of clinical trial technologies in early-phase research.

Clinical Trial Technology and Services Market Regional Analysis

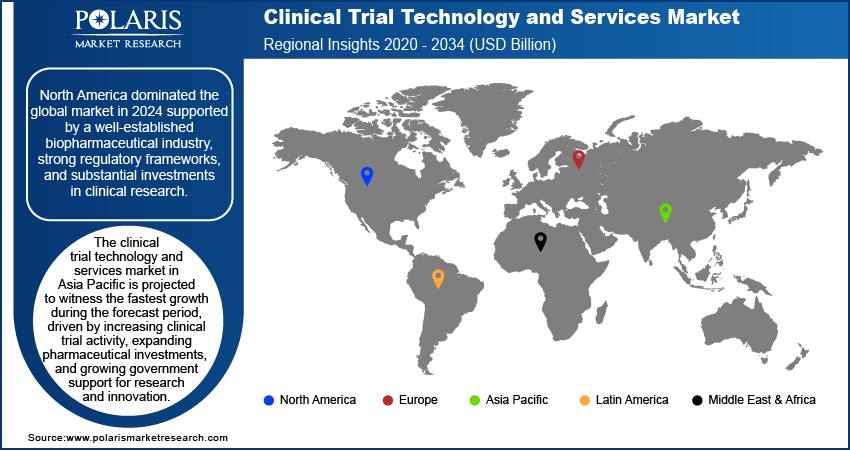

By region, the report provides the clinical trial technology and services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the clinical trial technology and services market revenue in 2024, supported by a well-established biopharmaceutical industry, strong regulatory frameworks, and substantial investments in clinical research. For instance, in October 2023, HCA Healthcare and GRAIL partnered to offer GRAIL’s Galleri multi-cancer early detection (MCED) test at select HCA practices. The test detects over 50 cancers via a blood draw, aiming to improve early detection and reduce cancer mortality rates. The region is home to leading pharmaceutical companies, CROs, and technology providers, enabling innovation and accelerating the adoption of advanced clinical trial solutions. Additionally, favorable regulatory policies, such as expedited approval pathways and digital trial adoption initiatives, encourage the implementation of cutting-edge technologies. The increasing focus on decentralized trials, precision medicine, and AI-driven analytics further strengthens North America’s leadership in the clinical trial technology and services market, positioning it as an essential hub for research and development activities.

The Asia Pacific clinical trial technology and services market is projected to witness the fastest growth during the forecast period, driven by increasing clinical trial activity, expanding pharmaceutical investments, and growing government support for research and innovation. The region’s large and diverse patient population provides a favorable environment for recruitment, while advancements in digital health infrastructure and regulatory harmonization enhance trial efficiency. Additionally, the rising adoption of decentralized trials, AI-driven analytics, and cloud-based platforms is transforming the clinical research landscape in the Asia Pacific. The demand for technology-driven solutions is expected to surge as biopharmaceutical companies and CROs expand their presence in emerging markets, driving the region’s rapid expansion opportunities.

Clinical Trial Technology and Services Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for clinical trial technology and services market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Clinical trial technology and services market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with clinical trial technology and services market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the clinical trial technology and services industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Veeva Systems; Koninklijke Philips N.V.; Cognizant; Allscripts Healthcare LLC; Optum Inc.; Aris Global LLC; Clinevo Technologies; MasterControl Solutions, Inc.; Ennov; Accenture; and IBM.

IQVIA, Inc. is a provider of clinical trial technology and services, offering a wide suite of solutions designed to optimize efficiency, enhance trial outcomes, and accelerate innovation in the life sciences industry. IQVIA's Orchestrated Clinical Trials platform seamlessly integrates best-of-breed, modular, and interoperable technologies to streamline clinical trials, leveraging advanced analytics and machine learning to improve protocol design, site selection, and patient recruitment. The company's Clinical Trial Analytics Services utilize real-world data and AI-driven solutions to reduce risk, improve timelines, and enhance trial outcomes, enabling faster access to critical therapies. IQVIA has also launched One Home for Sites, a technology platform that simplifies clinical research site operations by integrating multiple systems into a single dashboard, reducing technology overload and increasing site capacity. Additionally, IQVIA offers Interactive Response Technology (IRT), supporting direct-to-patient trials and providing data-driven insights for faster study start-ups. The company's clinical trial payments solution ensures timely and transparent site payments, reducing administrative burdens and enhancing site satisfaction. IQVIA supports patient-centric drug development and accelerates the journey from research to commercialization by connecting data, technology, analytics, and operational expertise.

Medidata, a Dassault Systèmes brand, is a provider of clinical trial technology and services, offering a unified platform that integrates data, AI-powered insights, and patient-centric solutions to accelerate clinical research. The Medidata Platform connects patients, sites, sponsors, and partners in a secure and scalable cloud environment, enabling centralized management of clinical and operational data, automation, and AI-driven workflows. This platform accelerates study timelines, reduces study builds by up to a month, and conducts studies five months faster when using multiple products. Medidata has recently launched Clinical Data Studio, which leverages AI to modernize the data experience in clinical trials. This technology simplifies the data lifecycle by integrating numerous data sources, allowing stakeholders to identify potential data issues and safety signals more effectively and reducing data review and reconciliation activities by up to 80%. Additionally, Medidata offers a wide Decentralized Clinical Trials (DCT) Program, which provides scalable solutions for virtualizing clinical trials, improving patient engagement, and ensuring data quality through remote monitoring. The company's AI solutions also support data-driven decision-making, improving site selection and forecasting enrollment timelines.

List of Key Companies in Clinical Trial Technology and Services Market

- Accenture

- Allscripts Healthcare LLC

- Aris Global LLC

- Clinevo Technologies

- Cognizant

- DATATRAK International, Inc.

- Ennov

- IBM

- IQVIA, Inc.

- Koninklijke Philips N.V.

- MasterControl Solutions, Inc.

- Medidata (Dassault Systèmes)

- Optum Inc.

- Oracle

- Veeva Systems

Clinical Trial Technology and Services Industry Developments

February 2025: Inovalon launched the Clinical Research Patient Finder, an AI-powered tool integrating with EHRs to streamline patient recruitment for clinical trials. It enables real-time patient identification and continuous data monitoring, improving trial efficiency and accelerating the development of life-saving therapies.

June 2024: IQVIA launched One Home for Sites, a unified platform simplifying clinical trial management for research sites. It offers single sign-on and a dashboard to streamline tasks, improving efficiency and enabling sites to manage more trials effectively.

Clinical Trial Technology and Services Market Segmentation

By Technology Solutions Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

By Phases Outlook (Revenue, USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Healthcare Companies

- Healthcare Providers

- Healthcare Payers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clinical Trial Technology and Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.32 billion |

|

Market Size Value in 2025 |

USD 27.96 billion |

|

Revenue Forecast in 2034 |

USD 101.10 billion |

|

CAGR |

15.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global clinical trial technology and services market size was valued at USD 24.32 billion in 2024 and is projected to grow to USD 101.10 billion by 2034.

The global market is projected to register a CAGR of 15.3% during the forecast period.

North America dominated the market in 2024.

Some of the key players in the market are IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Veeva Systems; Koninklijke Philips N.V.; Cognizant; Allscripts Healthcare LLC; Optum Inc.; Aris Global LLC; Clinevo Technologies; MasterControl Solutions, Inc.; Ennov; Accenture; and IBM.

The solutions segment dominated the clinical trial technology and services market expansion in 2024.

The phase I segment is expected to witness the fastest clinical trial technology and services market growth during the forecast period.