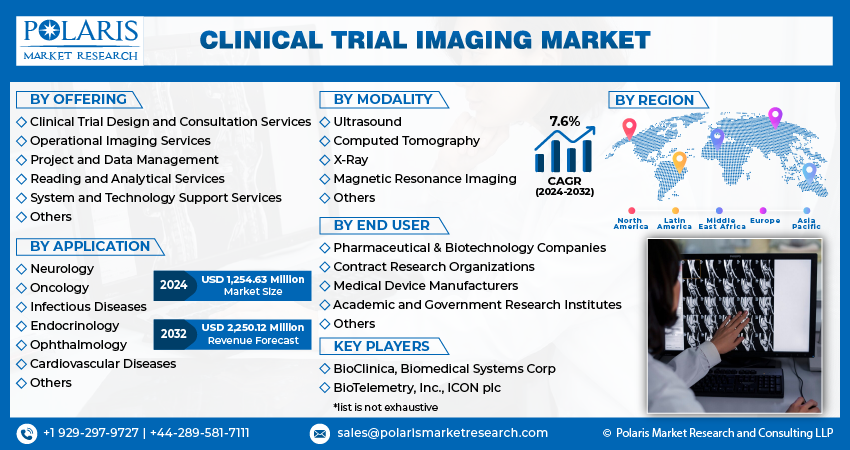

Clinical Trial Imaging Market Share, Size, Trends, Industry Analysis Report, By Offering; By Modality (Ultrasound, Computed Tomography, X-Ray, Magnetic Resonance Imaging, Others); By Application; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4696

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

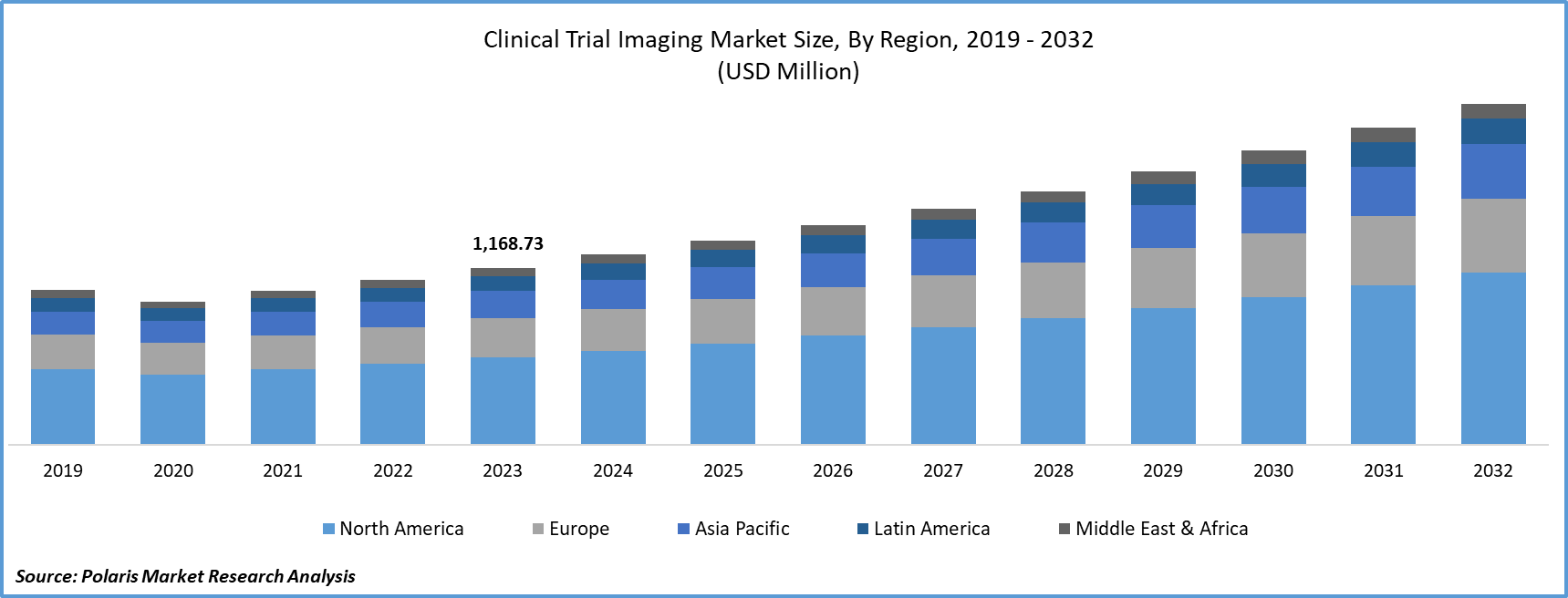

- Global clinical trial imaging market size was valued at USD 1,168.73 million in 2023.

- The market is anticipated to grow from USD 1,254.63 million in 2024 to USD 2,250.12 million by 2032, exhibiting the CAGR of 7.6% during the forecast period.

Market Introduction

The clinical trial imaging market size is propelled by a heightened emphasis on drug development efficiency worldwide. Pharmaceutical and biotech companies are encouraged to expedite the drug development process without compromising safety and efficacy. Clinical trial imaging, utilizing modalities like MRI, CT, PET, and ultrasound, aids in visualizing and quantifying physiological changes, enhancing drug effects assessment and treatment response evaluation. Integration of imaging endpoints in trial protocols enables accurate efficacy assessment and early adverse event detection, minimizing late-stage trial failures and costs. Regulatory recognition of imaging data's significance further drives its adoption, streamlining trial processes, cutting costs, and expediting drug approvals for more efficient drug development pipelines.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research:Request a Free Sample Report

- For instance, in March 2023, Clario introduced an innovative cloud-based Image Viewer tool tailored for sponsors and CROs to review clinical trial images. This new tool enables sponsors and CROs to conveniently access high-quality images promptly via an intuitive web-based imaging viewer, nearly in real-time.

The clinical trial imaging market share experiences substantial growth due to increasing demand for biomarker assessment. Biomarkers play a vital role in understanding disease mechanisms and predicting treatment responses. Imaging modalities offer non-invasive ways to visualize and quantify biomarkers in vivo, aiding in disease monitoring and treatment evaluation. Advancements in molecular imaging and AI-driven analysis streamline biomarker assessment, enhancing accuracy and efficiency. This surge in demand reflects the growing emphasis on precision medicine and personalized therapies, driving innovation in clinical trial design and therapeutic development.

Industry Growth Drivers

Increasing clinical trial activities are projected to spur the product demand

The increase in global clinical trial activities propels the clinical trial imaging market growth. As pharmaceutical and biotech firms develop new treatments, imaging services become crucial for assessing safety and efficacy. Various modalities like MRI, CT, PET, and ultrasound offer insights into disease progression and treatment response. Regulatory agencies mandate robust imaging data for drug approval, leading to the integration of imaging endpoints in trial protocols. Furthermore, precision medicine's rise drives demand for imaging biomarkers to identify patient subgroups benefiting from specific therapies. This emphasis on evidence-based medicine, coupled with imaging technology advancements, fuels the market expansion.

Advancement in imaging technologies is expected to drive clinical trial imaging market growth

Advancements in imaging technologies are reshaping clinical trials, fueling growth in the market. These innovations encompass MRI, CT, PET, and ultrasound, offering high-resolution images for precise disease assessment. AI and machine learning algorithms enhance image analysis, expediting drug development and reducing trial costs. Additionally, decentralized trials and remote imaging technologies are gaining traction, facilitating seamless data sharing and collaboration. These advancements drive efficiency and precision in clinical trial design and execution, enhancing drug development strategies in the pharmaceutical and biotechnology industries.

Industry Challenges

High cost of imaging services is likely to impede the market growth

The clinical trial imaging market share encounters limitations due to the high costs associated with imaging services. While imaging plays a pivotal role in clinical trials by offering insights into disease progression and treatment efficacy, the expenses involved in acquiring, maintaining, and analyzing imaging data can be prohibitive. Initial investments in advanced imaging equipment and personnel, along with regulatory compliance requirements, impose significant financial burdens on clinical trial sponsors and contract research organizations. Additionally, the need for specialized expertise and infrastructure further adds to the overall expenditure.

Report Segmentation

The market analysis is primarily segmented based on offering, modality, application, end user, and region.

|

By Offering |

By Modality |

By Application |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

Operational imaging services segment held considerable revenue share in 2023

The operational imaging services segment held considerable revenue share in 2023 due to their essential role throughout the trial process. Offering comprehensive solutions from image acquisition to endpoint analysis, these services ensure compliance with regulatory standards and protocol requirements. With specialized expertise, advanced technology, and flexible scalability, they cater to diverse trial needs effectively. While requiring significant initial investments, operational imaging services streamline trial operations and offer cost-effective solutions for sponsors and CROs.

By Modality Analysis

Computed tomography segment held significant revenue share in 2023

The computed tomography segment held significant revenue share in 2023 due to its diagnostic versatility and wide application spectrum across therapeutic areas like oncology, cardiology, and neurology. CT imaging provides detailed anatomical information, accurate disease assessment, and quantitative analysis capabilities, making it valuable for evaluating treatment efficacy and patient outcomes in clinical trials. Additionally, its rapid imaging acquisition enables efficient data collection and timely assessment of study endpoints, beneficial in oncology trials where CT is extensively used for tumor staging and treatment response monitoring.

By Application Analysis

Oncology segment held significant revenue share in 2023

The oncology segment held a significant revenue share in 2023. The high incidence of oncology trials globally drives demand for imaging services. Additionally, the complexity of oncology trials, necessitating frequent imaging assessments, requires specialized imaging services and expertise. Furthermore, the utilization of advanced imaging techniques such as MRI and PET-CT in oncology trials enhances growth. The growing pipeline of oncology drugs in development fuels the demand for imaging services within the oncology segment.

By End User Analysis

The demand from pharmaceutical & biotechnology companies is expected to increase during the forecast period

The demand from pharmaceutical & biotechnology companies is expected to increase during the forecast period owing to ongoing drug development initiatives requiring imaging for efficacy and safety assessments, the rise of precision medicine necessitating imaging biomarkers for patient stratification, and the development of innovative therapeutics requiring advanced imaging techniques for treatment evaluation. Additionally, regulatory requirements mandate robust imaging data for drug approvals, while the cost-effectiveness and non-invasiveness of clinical trial imaging make it an appealing option for streamlining drug development processes.

Regional Insights

North America region accounted for a significant market share in 2023

In 2023, the North American region accounted for a significant market share. The region has an advanced healthcare infrastructure and hosts a large volume of clinical trials across various therapeutic areas. Moreover, it is home to leading pharmaceutical companies and contract research organizations, driving demand for imaging services. Stringent regulatory standards and compliance requirements emphasize the importance of imaging endpoints, further boosting utilization. Continuous technological advancements in medical imaging and collaboration between academia and industry contribute to the region's attractiveness. Additionally, significant investments in research and development initiatives by both government agencies and private organizations further propel the growth of the market in North America.

Asia-Pacific is expected to experience significant growth during the forecast period due to rapid expansion of healthcare infrastructure, increasing outsourcing of clinical trials to the region, and a burgeoning pharmaceutical and biotechnology sector. Additionally, the shift towards precision medicine and government initiatives promoting healthcare innovation is driving the demand for advanced imaging technologies. Emerging economies such as China, India, and South Korea are witnessing a surge in clinical trial activities, further fueling market growth.

Key Market Players & Competitive Insights

The clinical trial imaging market players encompasses various participants, and the forthcoming entry of new competitors is set to escalate competition. Established frontrunners consistently innovate their technologies to uphold a competitive edge, focusing on efficiency, dependability, and safety. These enterprises prioritize strategic initiatives like forging partnerships, enhancing product ranges, and engaging in collaborative ventures. Their goal is to surpass rivals in the sector, solidifying a notable market share.

Some of the major players operating in the global market include:

- BioClinica

- Biomedical Systems Corp

- BioTelemetry, Inc.

- Cardiovascular Imaging Technologies

- ICON plc

- Intrinsic Imaging

- IXICO plc

- Median Technologies

- Medpace

- Merge Healthcare

- Navitas Clinical Research, Inc

- ProScan Imaging

- Radiant Sage LLC

- Resonance Health

- WorldCare Clinical

Recent Developments

- In November 2022, VIDA Diagnostics introduced its enhanced VIDA Intelligence Portal 2.0, an artificial intelligence (AI)-driven platform designed to enhance operational efficiencies in clinical trial imaging. This update aims to expedite the integration of clinical trial sites into the platform.

- In November 2023, ConcertAI revealed a long-term strategic partnership with Memorial Sloan Kettering Cancer Center (MSK), centered on expediting the creation and implementation of Clinical AI algorithms and integrated imaging workflows for enhancing clinical trials and augmenting oncology clinical decision-making.

- In June 2023, WCG disclosed a collaboration with Mint Medical to utilize its mint Lesion radiology platform for oncology trials. This collaboration aims to integrate WCG's range of clinical trial management solutions with mint Lesion's validated, readily accessible platform, structured reporting, and customized workflows for site-specific operations, resulting in an enhanced solution for oncology trials.

Report Coverage

The clinical trial imaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offerings, modalities, applications, end users, and their futuristic growth opportunities.

Clinical Trial Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,254.63 million |

|

Revenue forecast in 2032 |

USD 2,250.12 million |

|

CAGR |

7.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Clinical Trial Imaging Market are BioClinica, BioTelemetry, Inc., Cardiovascular Imaging Technologies, ICON plc, Merge Healthcare

Global clinical trial imaging market exhibiting the CAGR of 7.6% during the forecast period.

The Clinical Trial Imaging Market report covering key segments are offering, modality, application, end user, and region.

key driving factors in Clinical Trial Imaging Market are Increasing clinical trial activities

Clinical Trial Imaging Market Size Worth $2,250.12 Million By 2032