Clinical Operations and Development Market Size, Share, Trends, Industry Analysis Report: By Phase (Phase I, Phase II, Phase III, and Phase IV), Service Type, Indication, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 155

- Format: PDF

- Report ID: PM5388

- Base Year: 2024

- Historical Data: 2020-2023

Clinical Operations and Development Market Overview

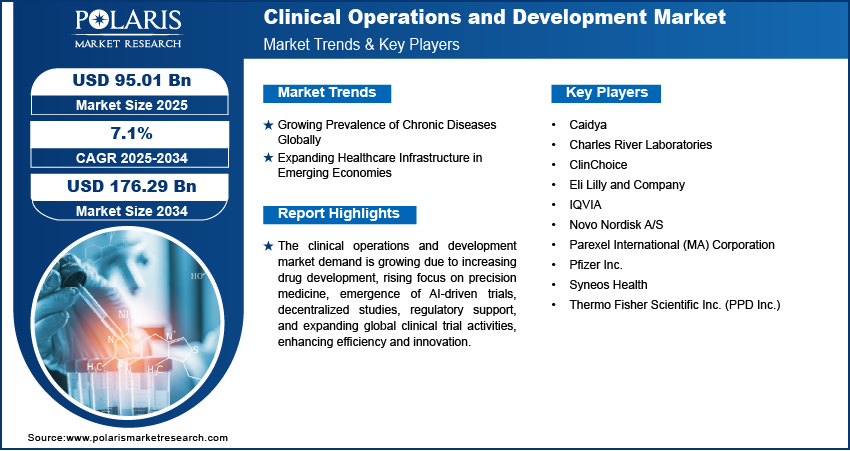

The global clinical operations and development market size was valued at USD 89.07 billion in 2024. The market is projected to grow from USD 95.01 billion in 2025 to USD 176.29 billion by 2034, exhibiting a CAGR of 7.1% during 2025–2034.

Clinical operations and development encompass the planning, execution, and management of clinical trials from Phase I to Phase IV, ensuring the safe and efficient evaluation of new drugs. This process involves multiple stakeholders, including researchers, healthcare professionals, regulatory agencies, and patients, to facilitate the smooth progression of clinical studies. Key elements such as protocol development, site selection, data management, compliance, and risk mitigation play a crucial role in optimizing trial outcomes. The integration of advanced technologies and data-driven approaches further enhances efficiency, contributing to the clinical operations and development market expansion.

To Understand More About this Research: Request a Free Sample Report

The rising demand for innovative drug development processes is fueling the demand for more efficient clinical operations. Pharmaceutical companies and research organizations are investing in advanced methodologies to streamline clinical trial designs, accelerate regulatory approvals, and enhance patient recruitment strategies. The adoption of decentralized trials, artificial intelligence, and real-world evidence is transforming traditional trial models and creating new clinical operations and development market opportunities. The demand for specialized clinical services continues to grow as the pharmaceutical industry prioritizes rapid drug development, shaping a dynamic market landscape.

The increasing prevalence of infectious diseases worldwide is significantly driving the clinical operations and development market demand. According to the World Health Organization, hepatitis is one of the leading global causes of mortality, resulting in 1.3 million deaths each year. The rapid spread of diseases such as HIV and hepatitis has intensified the urgency for novel treatments and vaccines. Pharmaceutical companies and research institutions are strengthening clinical operations by implementing advanced data management systems and global recruitment strategies. The rising incidence of infectious diseases directly correlates with the growing demand for clinical operations, reinforcing the market’s upward trajectory.

Clinical Operations and Development Market Dynamics

Growing Prevalence of Chronic Diseases Globally

The rising prevalence of chronic diseases worldwide is significantly driving clinical operations and development market growth. According to the World Health Organization, at least 43 million deaths were reported due to non-communicable diseases (NCDs) or chronic diseases in 2021, equivalent to 75% of non-pandemic-related deaths globally. The increasing burden of conditions such as cardiovascular diseases, diabetes, and cancer necessitates continuous advancements in drug development, clinical trials, and regulatory processes.

An escalating number of patients requires innovative treatments, accelerating clinical operations, and developing market demand. Pharmaceutical and biotech companies are investing heavily in research, optimizing trial designs, and adopting digital solutions to enhance efficiency. The demand for decentralized clinical trials and real-world data analytics is also shaping the clinical operations and development market landscape.

Expanding healthcare needs and regulatory complexities emphasize the importance of streamlined clinical operations. The focus on patient-centric trials and precision medicine underscores the necessity for robust infrastructure, ensuring sustainable clinical operations and development market growth worldwide.

Expanding Healthcare Infrastructure in Emerging Economies

Countries such as India and Thailand are heavily investing in hospitals, diagnostic labs, and clinics, aiming to enhance healthcare access. This infrastructure expansion leads to increased demand for clinical operations and development services, including patient recruitment, trial monitoring, and data management, which are essential for conducting clinical trials and research. For instance, India’s government increased healthcare spending by 37% from 2020–21 to 2021–22, reflecting a boost in infrastructure investment, which directly impacts clinical operations and development market demand.

Governments in these countries are focusing on improving diagnostics, particularly for rare diseases, which fuels the need for clinical trials and research. These initiatives create larger pools of potential participants and increase the scope for developing new treatments. Additionally, medical tourism, with India ranking 10th in the Medical Tourism Index for 2020–2021, further encourages healthcare infrastructure investments. Therefore, the expanding healthcare infrastructure in emerging economies is significantly driving the clinical operations and development market development.

Clinical Operations and Development Market Segment Analysis

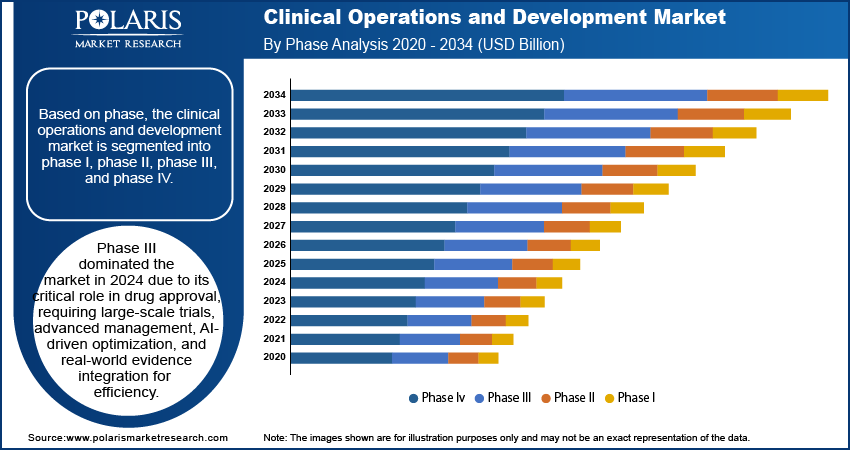

Clinical Operations and Development Market Assessment by Phase Outlook

The global clinical operations and development market segmentation, based on phase, includes phase I, phase II, phase III, and phase IV. The phase III segment accounted for around 50% of the clinical operations and development market share in 2024 due to its critical role in drug approval. This phase involves large-scale trials with thousands of participants across multiple sites, requiring extensive coordination among sponsors, contract research organizations (CROs), regulatory agencies, and clinical investigators. The complexity and scale of these trials greatly enhance the clinical operations and development market growth, requiring advanced trial management, effective patient recruitment strategies, and adherence to strict regulatory requirements.

The requirement to demonstrate a drug’s efficacy, safety, and long-term benefits compared to existing treatments drives clinical operations and development market demand. Services in phase III focus on protocol design, site selection, real-time data monitoring, and risk-based approaches to ensure smooth trial execution. The introduction of AI-driven optimization, adaptive trial designs, and real-world evidence integration is transforming phase III operations. For instance, in November 2024, Formation Bio, OpenAI, and Sanofi launched Muse, an AI-powered tool, to enhance phase III trial efficiency.

Clinical Operations and Development Market Evaluation by Service Type Outlook

The global clinical operations and development market segmentation, based on service type, includes laboratory services & bioanalytical testing, data management & biostatistics services, site management & monitoring services, medical writing & publishing services, patient recruitment & retention services, and others. The laboratory services & bioanalytical testing segment is expected to register the highest CAGR of 5.3% during the forecast period due to the increasing demand for precise analytical techniques in drug development. Pharmaceutical companies and research organizations rely on these services to ensure the safety, efficacy, and quality of drug formulations, driving clinical operations and development market demand.

The rising adoption of biomarker analysis, immunogenicity assessments, and bioequivalence studies is fueling clinical operations and development market growth. Advanced technologies such as chromatography, mass spectrometry, and molecular biology methods enhance drug characterization and regulatory compliance. The shift toward personalized medicine and targeted therapies further increases the demand for specialized laboratory services, which is expected to emerge as clinical operations and development market trends during the forecast period.

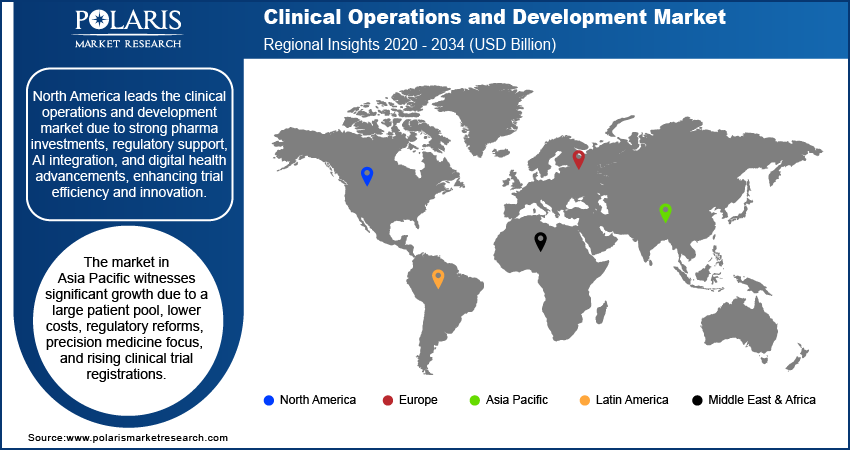

Clinical Operations and Development Market Regional Analysis

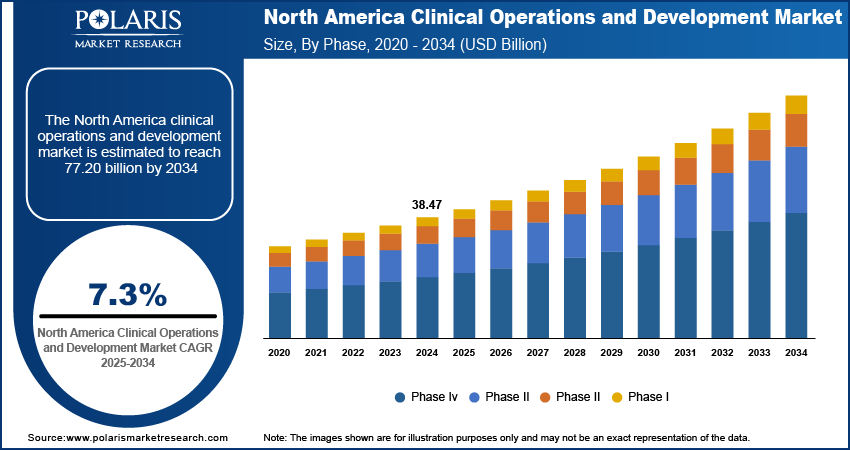

By region, the study provides clinical operations and development market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market due to the strong presence of pharmaceutical and biotechnology companies actively investing in drug development. The growing demand for innovative therapies and complex clinical trials has driven the need for efficient trial execution, boosting clinical operations and development market expansion in the region. The adoption of real-world evidence (RWE), remote monitoring, and digital health technologies has enhanced trial efficiency, reducing costs and improving study outcomes.

Regulatory agencies such as the FDA and Health Canada have introduced flexible guidelines for decentralized and adaptive trials, encouraging companies to expand clinical operations. The rapid integration of AI, big data analytics, and precision medicine has strengthened clinical trial capabilities. In January 2023, Elligo Health Research launched Data Connect, an AI-driven platform accelerating clinical trials, reinforcing North America’s leadership in the clinical operations and development market.

The Asia Pacific clinical operations and development market is experiencing substantial growth due to its large population, which provides a vast patient pool for clinical trials. The lower cost of medical studies, along with streamlined regulatory processes, has attracted pharmaceutical companies and contract research organizations (CROs) to conduct trials in the region. The presence of key clinical institutions, such as the National Center for Global Health and Medicine in Japan and Renji Hospital in China, further strengthens clinical research capabilities. China recorded 4,300 drug clinical trial registrations in 2023, a 26.1% increase from the previous year, highlighting the region’s accelerating clinical research activities.

Government initiatives and regulatory reforms in countries such as India and South Korea are simplifying clinical trial approvals, propelling foreign investments and driving clinical operations and development market demand. The rising focus on precision medicine and personalized therapies is increasing demand for specialized trials, boosting regional market growth.

Clinical Operations and Development Market – Key Players and Competitive Analysis Report

The competitive landscape of the clinical operations and development market is marked by the presence of global leaders and regional players striving for market dominance through innovation, strategic collaborations, and regional expansion. Companies such as ClinChoice, Thermo Fisher Scientific Inc. (PPD Inc.), IQVIA, Charles River Laboratories, Syneos Health, Eli Lilly and Company, Pfizer Inc., Novo Nordisk A/S, Parexel International (MA) Corporation, and Caidya leverage their strong research and development (R&D) capabilities and extensive distribution networks to offer advanced solutions tailored for various applications.

Major players focus on continuous product innovation, enhancing efficiency, reliability, and scalability to address the growing industry demands. Regional firms are entering the market with specialized and cost-effective solutions, catering to local requirements. Strategies such as mergers and acquisitions, collaborations with technology firms, and portfolio expansion play a crucial role in strengthening market presence. The increasing demand for clinical operations services is driving intense competition and boosting rapid advancements in the industry.

ClinChoice, a global CRO, offers end-to-end clinical development, regulatory, and post-marketing services across pharmaceuticals, biotechnology, and medical devices. Operating in 30+ countries, it leverages technology to accelerate innovation and streamline workflows. In March 2023, ClinChoice announced the acquisition of CROMSOURCE S.r.l., an ISO-certified full-service CRO with its corporate headquarters in Verona, Italy, and its US headquarters in Cary, NC. The acquisition strengthened ClinChoice's global network and deepened its full-service capabilities.

IQVIA, a global player in analytics, technology, and clinical research, operates in 100+ countries, leveraging big data and AI to accelerate medical innovation, enhance patient outcomes, and support life sciences companies worldwide. In June 2024, IQVIA announced the launch of One Home for Sites, a new technology platform that solves challenges and reduces overload at research sites.

List of Key Companies in Clinical Operations and Development Market

- Caidya

- Charles River Laboratories

- ClinChoice

- Eli Lilly and Company

- IQVIA

- Novo Nordisk A/S

- Parexel International (MA) Corporation

- Pfizer Inc.

- Syneos Health

- Thermo Fisher Scientific Inc. (PPD Inc.)

Clinical Operations and Development Industry Development

In December 2024, Charles River Laboratories International, Inc. announced the launch of the Charles River Incubator Program (CIP) to support biotechnology companies in the discovery, development, and phase-appropriate manufacturing of advanced therapies.

In October 2024, Eli Lilly and Company announced a $4.5 billion investment to create the Lilly Medicine Foundry, a new center for advanced manufacturing and drug development. This unique facility will give Lilly the ability to research new ways of producing medicines while also scaling up the manufacturing of medicines for clinical trials.

In September 2024, Parexel, one of the world’s largest CROs providing the full range of phase I to IV clinical development services, announced the strengthening of its Real World Research (RWR) offering, bringing together the company’s Scientific Data Organization (SDO) and Real World Evidence (RWE) capabilities to meet growing customer needs better.

Clinical Operations and Development Market Segmentation

By Phase Outlook (Revenue, USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Laboratory Services & Bioanalytical Testing

- Data Management & Biostatistics Services

- Site Management & Monitoring Services

- Medical Writing & Publishing Services

- Patient Recruitment & Retention Services

- Others

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Central Nervous System (CNS) Disorders

- Cardiovascular Disease (CVD)

- Metabolic/Endocrine Diseases

- Respiratory Diseases

- Infectious Diseases

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clinical Operations and Development Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 89.07 billion |

|

Market Size Value in 2025 |

USD 95.01 billion |

|

Revenue Forecast by 2034 |

USD 176.29 billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global clinical operations and development market size was valued at USD 89.07 billion in 2024 and is projected to grow to USD 176.29 billion by 2034.

• The global market is projected to register a CAGR of 7.1% during the forecast period.

North America dominated the global market in 2024.

• A few key players in the market are ClinChoice, Thermo Fisher Scientific Inc. (PPD Inc.), IQVIA, Charles River Laboratories, Syneos Health, Eli Lilly and Company, Pfizer Inc., Novo Nordisk A/S, Parexel International (MA) Corporation, and Caidya.

• The phase III segment led the market share in 2024.

• The laboratory services & bioanalytical testing segment is anticipated to register the highest growth rate during the forecast period.