Clear Aligners Market Size, Share, Trends, Industry Analysis Report

: By Age (Adults and Teens), By Material Type, By Distribution Channel, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM2949

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

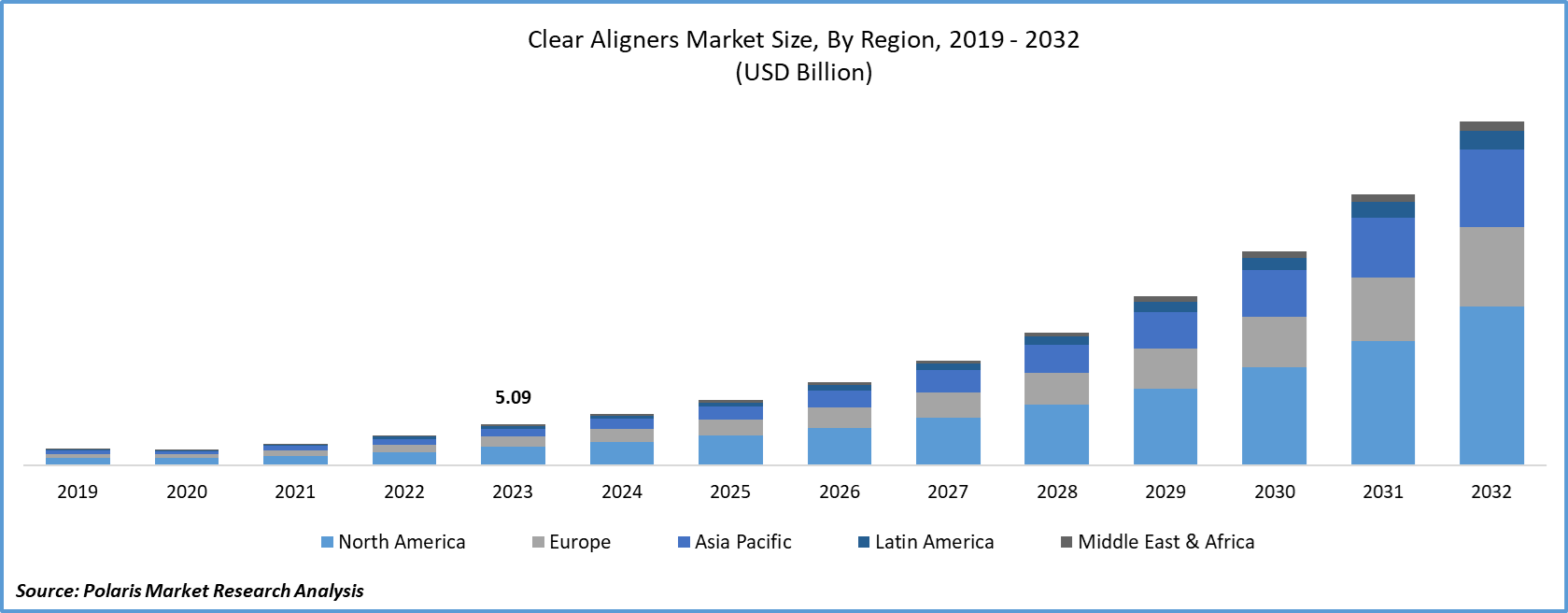

The global clear aligners market size was valued at USD 6.34 billion in 2024, exhibiting a CAGR of 30.9% during 2025–2034. The demand for clean aligners is growing as more patients opt for aligners over conventional options due to increasing awareness about personal appearance.

Key Insights

- The polyurethane segment led the market in 2024. The segment’s dominance is attributed to the excellent mechanical properties and flexibility of clear aligners made from polyurethane.

- The teens segment is anticipated to register the fastest growth during the projection period, owing to rising awareness about early orthodontic intervention.

- North America led the global market in 2024, driven by the region’s advanced healthcare infrastructure and widespread adoption of innovative orthodontic consumables.

- Asia Pacific is anticipated to register the fastest growth during the forecast period. Rising disposable incomes and increasing awareness of dental aesthetics fuel market growth in the region.

Industry Dynamics

- The growing prevalence of malocclusion conditions involving misalignment of teeth and jaws has led to increased demand for corrective treatment options, including clear aligners.

- Advancements in clear aligner technology, including the introduction of AI-driven treatment planning and improved thermoplastic materials, contribute to market expansion.

- The ability of clear aligners to provide personalized treatment plans tailored to individual needs is expected to create several market opportunities.

- High upfront costs and limited efficacy for severe orthodontic cases may hinder market growth.

Market Statistics

2024 Market Size: USD 6.34 billion

2034 Projected Market Size: USD 93.38 billion

CAGR (2025-2034): 30.9%

North America: Largest Market in 2024

AI Impact on Clear Aligners Market

- AI-powered 3D imaging and modeling create highly precise treatment plans tailored to each patient’s dental structure.

- Machine learning predicts tooth movement patterns, enabling more accurate aligner designs and shorter treatment durations.

- AI-driven simulation tools let patients visualize expected results before starting treatment. This improves satisfaction and compliance.

- Continuous AI refinement enhances fit, comfort, and outcome predictability, driving adoption of clear aligners in orthodontic care.

To Understand More About this Research: Request a Free Sample Report

Clear aligners are transparent, removable dental equipment used to straighten teeth as an alternative to traditional metal braces. The clear aligners market is witnessing growth, primarily driven by the rising demand for aesthetic dental solutions. The ADA reported a 2.5% increase in US national dental spending between 2022 and 2023. Modern consumers, particularly adults and young professionals, are increasingly seeking orthodontic treatments that are discreet, comfortable, and minimally invasive. Clear aligners fulfill these preferences by offering a nearly invisible appearance and ease of use without compromising oral hygiene. The growing awareness of personal appearance, fueled by social media influence and professional requirements, is pushing patients to choose aligners over conventional options. This shift in consumer behavior is strongly influencing dental professionals and clinics to adopt aligner-based treatments, contributing to overall market momentum.

The clear aligners market is witnessing the expansion of direct-to-consumer (DTC) models and tele dentistry platforms. In October 2024, TeleDentists launched AI-powered remote dental screenings via smartphone for early detection of cavities and gum disease. In partnership with DentalFriendAI, the platform offers analyzed results reviewed by licensed dentists, improving access to oral care. These models are reshaping how consumers access orthodontic care by reducing the dependency on in-office visits and making aligners more accessible and affordable. Through digital impressions, virtual consultations, and home-delivered treatment kits, companies can bypass traditional clinical settings while maintaining quality and convenience. This evolution aligns with the broader shift toward digital health and remote care, especially appealing to tech-savvy, convenience-oriented customers, further accelerating growth opportunities.

Market Dynamics

Rising Prevalence of Malocclusions

The rising prevalence of malocclusion conditions involving misalignment of teeth and jaws has become a major concern. An October 2021 NCBI report noted that WHO classifies malocclusion as a major oral health issue after caries and periodontal disease, with prevalence ranging from 39% to 93% in children/adolescents. The demand for corrective dental treatments is increasing as orthodontic issues such as overbites, underbites, and crowding become more common across diverse age groups. Clear aligners offer a clinically effective, noninvasive solution that addresses these concerns while ensuring aesthetic appeal and patient comfort. Individuals are proactively seeking orthodontic care with growing awareness of oral health's impact on overall well-being. This growing need for corrective interventions, coupled with the discreet nature of clear aligners, is prompting both dental professionals and patients to prefer them over traditional braces. Hence, the increasing prevalence of malocclusions boosts the clear aligners market expansion.

Advancement in Clear Aligners

Advancements in clear aligner technology enhance the efficiency, precision, and personalization of treatment. Innovations such as 3D digital scanning, AI-driven treatment planning, and improved thermoplastic materials have significantly improved aligner performance and user experience. In September 2023, Align Technology launched Plan Editor for ClinCheck software, enhancing Invisalign treatment customization. This tool allows orthodontists and GPs to modify digital plans with macro adjustments, with changes appearing in minutes via ClinCheck Live Update. These developments allow for faster, more predictable tooth movement and greater comfort, leading to higher patient satisfaction and treatment adherence. Additionally, enhanced design capabilities enable manufacturers to cater to complex malocclusion cases, broadening the potential user base. Therefore, the rising advancements in clear aligners are expected to offer lucrative market growth opportunities in the coming years.

Segment Insights

Market Assessment by Material Type

The global clear aligners market segmentation, based on material type, includes polyurethane, plastic polyethylene terephthalate glycol, and others. The polyurethane segment dominated the market share in 2024 due to its superior mechanical properties and flexibility, which enhance patient comfort and treatment efficiency. Polyurethane materials offer higher elasticity and resistance to stress, allowing for better fit, durability, and sustained force application during tooth movement. Their biocompatibility also makes them safer for long-term intraoral use. These advantages have led manufacturers to increasingly adopt polyurethane in product development, giving it a competitive edge over other materials such as plastic and polyethylene terephthalate glycol. Thus, as clinical outcomes and patient satisfaction continue to drive material preference, polyurethane remains the dominant choice among dental professionals.

Market Evaluation by Age

The global market segmentation, based on age, includes adults and teens. The teens segment is expected to witness a faster growth during the forecast period due to increasing awareness of early orthodontic intervention and rising demand for discreet corrective options among adolescents. Clear aligners present an appealing alternative to metal braces, with social pressure and image consciousness during teenage. In addition, advancements in aligner technology have made treatments more adaptable to complex cases typically seen in growing patients. The convenience of removable aligners, which support better oral hygiene and reduced dietary restrictions, further contributes to their growing popularity among teens and their caregivers.

Regional Analysis

By region, the report provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the clear aligners market revenue share in 2024, driven by the region’s advanced dental care infrastructure, high patient awareness, and widespread adoption of innovative orthodontic consumables. In August 2023, Dental Axess partnered with SoftSmile to integrate its AI-powered aligner software VISION into Dental Axess' cloud platform Xflow, enhancing digital treatment planning workflows and further contributing to the regional market growth. The presence of leading market players and a well-established network of dental professionals supports the rapid adoption of clear aligners across the US and Canada. Furthermore, a strong emphasis on aesthetics and preventive oral health practices among consumers contributes to consistent industry demand. Favorable reimbursement structures and the growing penetration of direct-to-consumer models further consolidate the region’s leadership in the global market.

The Mexico dental aligners market is witnessing substantial growth during the forecast period due to the expanding middle-class population, rising awareness of orthodontic supplies, and increasing demand for dental aligners. There is a notable shift toward noninvasive and discreet options such as clear aligners as consumers in Mexico become more health-conscious and image-aware. The availability of technologically advanced dental services, particularly in urban centers, is further supporting this transition. In addition, the growing influence of social media and digital marketing is raising awareness about treatment benefits, contributing to the steady rise in demand for Mexico dental aligners.

The Asia Pacific clear aligners market is projected to witness the fastest growth during the forecast period, fueled by rising disposable incomes, growing urbanization, and increasing awareness of dental aesthetics. Expanding access to orthodontic services and a growing middle-class population with higher healthcare aspirations are contributing to market acceleration. Moreover, the adoption of digital dentistry and telehealth solutions is making aligner treatments more accessible in emerging economies. Asia Pacific is poised to become a key growth hub for clear aligner manufacturers as regional governments and private providers invest in improving dental care infrastructure.

Key Players and Competitive Analysis

The clear aligner segment demonstrates robust expansion opportunities with Invisalign (Align Technology) maintaining a leadership position through superior product offerings and technological advancements in treatment planning software. The competitive structure exhibits classic oligopolistic dynamics with high barriers to entry due to patent protection and capital-intensive manufacturing requirements. Technological assessment identifies digital scanning integration and AI-driven treatment planning as crucial differentiators. Recent supply chain disruptions have temporarily constrained production capacity among smaller vendors, benefiting established players. Competitive positioning increasingly emphasizes sustainable value chains and price differentiation strategies. Small and medium-sized businesses face challenges against established vendor strategies, though opportunities exist in specialized treatment protocols. Expert insights suggest that potential consolidation through strategic alliances and joint ventures is reshaping the competitive landscape. The industry continues experiencing pricing pressures alongside intensified competition for practitioner partnerships, with business insights pointing toward further digital transformation as a strategic imperative. A few key major players are 3M; Align Technology, Inc.; ClearPath Healthcare Services Pvt Ltd; Dentsply Sirona; Envista; Institut Straumann AG; Invisalign.com; SmileSet; TP Orthodontics, Inc.; and uLab Systems, Inc.

3M is a globally recognized company in dental and orthodontic solutions, and its clear aligner system—3M Clarity Aligners—offers a discreet, removable alternative to traditional braces. These aligners are custom-made of nearly invisible, BPA-free plastic, designed to fit the unique contours of each patient’s teeth. The treatment process begins with a digital scan and a personalized plan, allowing orthodontists to map out the gradual movement of teeth into their ideal positions. Patients receive a series of aligner trays, each to be worn for a prescribed period, gently guiding teeth with controlled force. One of the standout features of 3M Clarity Aligners is their versatility. They can address a wide range of orthodontic issues, from mild to complex cases, such as crowded teeth, gaps, and various bite misalignments. The aligners are removable, making it easy to maintain oral hygiene and enjoy a normal diet without restrictions. 3M’s system also integrates advanced materials and attachment options, enhancing comfort and treatment precision. 3M Clarity Aligners provide an effective, aesthetic solution for both teens and adults seeking to improve their smile without the visibility or inconvenience of metal braces with their nearly invisible appearance and tailored approach.

Dentsply Sirona’s SureSmile Clear Aligners offer a modern, digitally driven approach to orthodontic treatment, providing a discreet and comfortable alternative to traditional braces. SureSmile aligners are custom-fabricated using advanced digital impression technology and proprietary planning software, which allows clinicians to create highly individualized treatment plans tailored to each patient’s unique dental anatomy and goals. The aligners themselves are made from a high-performance, virtually invisible material, ensuring both aesthetics and comfort throughout the treatment process. Patients benefit from the ability to remove their aligners for eating, brushing, and flossing, promoting better oral hygiene and convenience. The SureSmile system is compatible with a range of intraoral scanners, such as Dentsply Sirona’s own Primescan, and integrates seamlessly with cloud-based platforms for efficient case management and collaboration. Additionally, Dentsply Sirona supports the treatment with innovative adjuncts such as the VPro vibration device, which can help accelerate tooth movement and reduce discomfort. Post-treatment, patients have access to custom retainers and ongoing support to maintain their results.

List of Key Companies in Clear Aligners Market

- 3M

- Align Technology, Inc.

- ClearPath Healthcare Services Pvt Ltd

- Dentsply Sirona

- Envista

- Institut Straumann AG

- Invisalign.com

- SmileSet.

- TP Orthodontics, Inc.

- uLab Systems, Inc.

Clear Aligner Industry Developments

May 2025: Align Technology obtained NMPA approval in China for the Invisalign Palatal Expander System, increasing its early treatment offerings.

April 2025: Medit and Graphy collaborated to advance digital orthodontics, combining Medit’s intraoral scanning with Graphy’s 3D-printed aligner materials. The collaboration aims to improve speed, accuracy, and workflow efficiency from diagnosis to appliance production.

April 2025: Angel Aligner and DentalMonitoring integrated their platforms (iOrtho and AI monitoring software) to enable remote refinement scans via SmartSTL technology. This streamlines aligner workflows by eliminating in-office visits for refinements and automating STL file generation for faster treatment adjustments.

June 2023: Virtual Dental Care, Inc. launched Dental.com, a Teledentistry 3.0 platform offering AI-enhanced preventive and diagnostic care via remote visual assessments. The service expands access to comprehensive dental monitoring and personalized treatment plans from home.

Clear Aligners Market Segmentation

By Age Outlook (Revenue, USD Billion, 2020–2034)

- Adults

- Teens

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clear Aligners Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.34 billion |

|

Market Size Value in 2025 |

USD 8.28 billion |

|

Revenue Forecast by 2034 |

USD 93.38 billion |

|

CAGR |

30.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.34 billion in 2024 and is projected to grow to USD 93.38 billion by 2034.

The global market is projected to register a CAGR of 30.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the industry are 3M; Align Technology, Inc.; ClearPath Healthcare Services Pvt Ltd; Dentsply Sirona; Envista; Institut Straumann AG; Invisalign.com; SmileSet; TP Orthodontics, Inc.; and uLab Systems, Inc.

The polyurethane segment dominated the market share in 2024.

The teens segment is expected to witness a faster growth during the forecast period.