Cleanroom Lighting Market Size, Share, Trends, Industry Analysis Report: By Light Source (LED and Fluorescent), Mounting Type, Component, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM5379

- Base Year: 2024

- Historical Data: 2020-2023

Cleanroom Lighting Market Overview

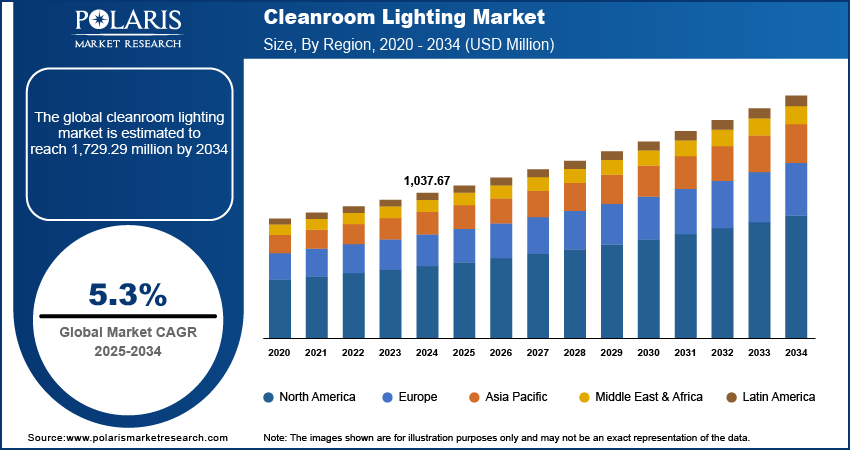

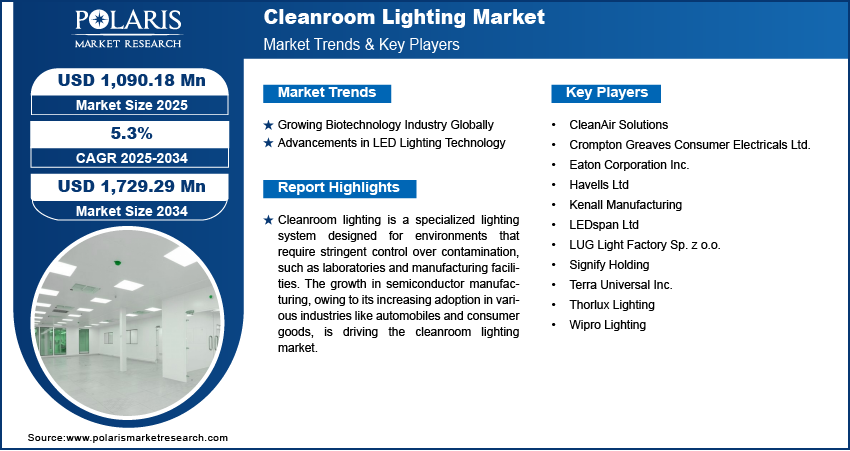

The global cleanroom lighting market size was valued at USD 1,037.67 million in 2024. The market is projected to grow from USD 1,090.18 million in 2025 to USD 1,729.29 million by 2034, exhibiting a CAGR of 5.3 % during 2025–2034.

Cleanroom lighting is a specialized lighting system designed for environments that require stringent control over contamination, such as laboratories and manufacturing facilities. These spaces, often referred to as cleanrooms, are built to maintain low levels of airborne particulates and other contaminants, which makes the choice of lighting critical. The most common types of cleanroom lighting include fluorescent lamps and LED lights. These lights are gaining popularity in cleanrooms due to their energy efficiency, longer lifespan, and reduced maintenance needs.

The growth of semiconductor manufacturing, owing to its increasing adoption in various industries like automobiles and consumer goods, is driving the cleanroom lighting market expansion. The Semiconductor Industry Association (SIA) announced global semiconductor sales hit USD 57.8 billion during November 2024, an increase of 20.7% compared to November 2023. Semiconductor manufacturing is highly sensitive, and even microscopic particles compromise their quality and functionality. This increases the need for cleanroom lighting as it maintains controlled environments with minimal airborne particles and precise temperature and humidity levels by providing high-efficiency, low-contamination, and specialized illumination. Advanced LED cleanroom lighting systems, designed to meet ISO cleanliness standards, help ensure the visibility and precision needed for semiconductor manufacturing processes while minimizing heat emissions and energy consumption. Therefore, as the global demand for semiconductors grows, fueled by advancements in technology such as artificial intelligence (AI), Internet of Things (IoT), and electric vehicles (Evs), the need for sophisticated cleanroom infrastructure, including lighting, rises.

To Understand More About this Research: Request a Free Sample Report

The cleanroom lighting market demand is driven by the rising need for contamination control in industries such as pharmaceuticals, biotechnology, healthcare, electronics, and food production. Contamination, whether from airborne particles, microorganisms, or chemical residues, severely impacts product quality, safety, and regulatory compliance within these industries, thereby propelling the demand for cleanroom lighting systems. These systems are specifically designed to support contamination-controlled environments by offering high-performance, energy-efficient illumination with minimal heat generation and zero particle emissions.

Cleanroom Lighting Market Dynamics

Growing Biotechnology Industry Globally

Biotechnology industries are involved in the production of biologics, vaccines, cell therapies, and other biotechnological products that require highly controlled environments to prevent contamination and ensure product integrity to meet strict regulatory standards, such as ISO and GMP guidelines. Cleanroom lighting systems are a critical component in maintaining these environments, providing uniform, glare-free illumination that enhances visibility for precise operations while minimizing heat generation and particulate emissions. Therefore, as the biotechnology industry expands globally due to advancements in personalized medicine, biopharmaceuticals, and genetic engineering, the need for high-quality cleanroom infrastructure, including specialized lighting systems, continues to grow.

Advancements in LED Lighting Technology

Modern LED lighting solutions provide high-quality, flicker-free illumination with excellent color rendering, ensuring optimal visibility for precision tasks in cleanrooms. These LEDs generate minimal heat, reducing the risk of contamination and maintaining temperature stability in controlled environments. Additionally, innovations in smart LED technology, such as dimming controls, motion sensors, and customizable spectral outputs, allow cleanrooms to optimize energy consumption while maintaining regulatory compliance. These technological advancements make LED lighting a preferred choice for cleanroom applications, driving its adoption as industries such as biotechnology, electronics, and others increasingly prioritize sustainability, efficiency, and stringent contamination control. Thus, advancements in LED lighting technology are propelling the cleanroom lighting market revenue.

Cleanroom Lighting Market Segment Insights

Cleanroom Lighting Market Evaluation by Light Source

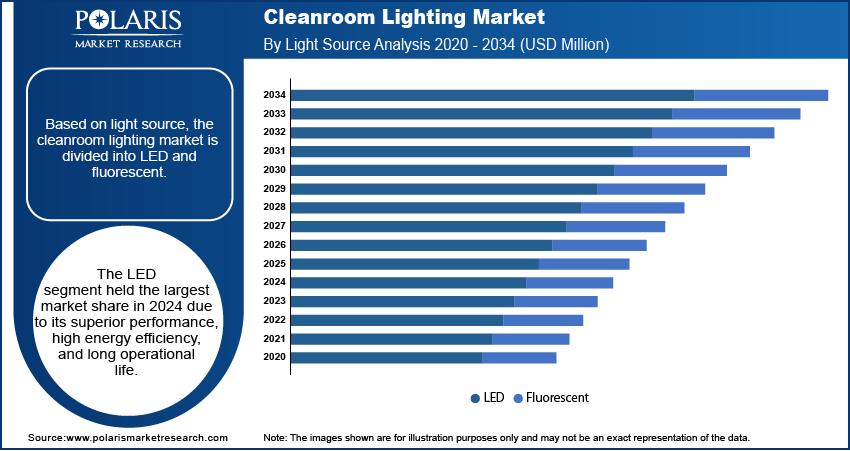

Based on light source, the cleanroom lighting market is divided into LED and fluorescent. The LED segment held the largest market share in 2024 due to its reduced heat emissions, lower energy consumption, and enhanced durability. These features are particularly critical in industries such as pharmaceuticals, biotechnology, and semiconductors, where maintaining precise environmental conditions is essential. The ability of LEDs to deliver high-quality illumination with minimal glare and flickering enhances their suitability for tasks that require accuracy and consistency. Additionally, the rising emphasis on sustainability and cost efficiency has led many organizations to transition from fluorescent systems to LED solutions, as they reduce energy costs and minimize maintenance expenses.

Cleanroom Lighting Market Insight by Component

In terms of component, the cleanroom lighting market is segregated into hardware, software, and services. The hardware segment accounted for a major market share in 2024 due to increasing demand for advanced lighting fixtures, control systems, and accessories. Industries such as pharmaceuticals, biotechnology, and electronics prioritize high-quality, durable lighting hardware to meet stringent regulatory requirements for cleanrooms. Additionally, the need for robust enclosures, diffusers, and sealing mechanisms that prevent particle accumulation and withstand rigorous cleaning processes has boosted the adoption of innovative hardware solutions.

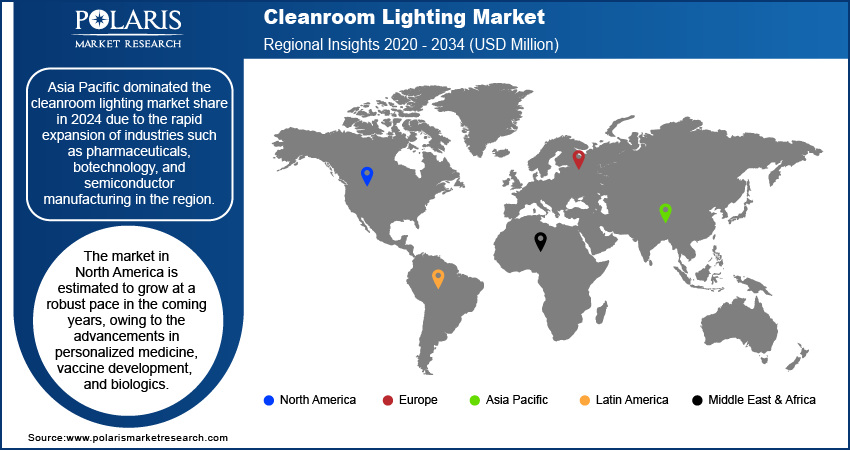

Cleanroom Lighting Market Regional Analysis

By region, the report provides the cleanroom lighting market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominated the global market in 2024 due to the rapid expansion of industries such as pharmaceuticals, biotechnology, and semiconductor manufacturing. Countries such as China, Japan, South Korea, and India are heavily investing in advanced semiconductor production facilities to meet growing global demand, propelling the cleanroom lighting market demand. China, in particular, dominates the region due to its extensive semiconductor production and pharmaceutical manufacturing capacity. Government initiatives to boost high-tech industries and improve healthcare infrastructure have further fueled the demand for cleanroom lighting in the region. Additionally, the availability of cost-effective labor and raw materials has attracted multinational corporations to establish electronic and vaccine production facilities in the Asia Pacific, increasing the need for cleanroom lighting systems.

The North America cleanroom lighting market is estimated to grow at a robust pace in the coming years, owing to the advancements in personalized medicine, vaccine development, and biologics. Stringent regulatory standards imposed by organizations such as the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC) have also necessitated the use of high-quality controlled lighting systems to ensure compliance and product safety. The expanding semiconductor industry in the US further contributes to the market growth in the region, as cleanroom lighting is an essential element in semiconductor manufacturing. For instance, according to Semiconductor Industry Association, the US is projected to more than triple its semiconductor manufacturing capacity from 2022 to 2032.

Cleanroom Lighting Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the cleanroom lighting market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The cleanroom lighting market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Crompton Greaves Consumer Electricals Ltd.; Eaton Corporation Inc.; Havells Ltd; Kenall Manufacturing; LEDspan Ltd; LUG Light Factory Sp. z o.o.; Signify Holding; Terra Universal Inc.; Thorlux Lighting; and Wipro Lighting.

Signify Holding is a major Netherland-based multinational lighting corporation established in 2016 following the spin-off of Philips' lighting division. Headquartered in Eindhoven, the company specializes in manufacturing a wide range of lighting products, including energy-efficient solutions, LED systems, and smart lighting technologies for various applications, including cleanroom environments. Signify's innovative approach to cleanroom lighting focuses on creating fixtures that minimize dust accumulation and enhance visibility while adhering to strict contamination control standards. The company's product offerings are designed to meet the specific needs of cleanrooms, ensuring optimal performance in settings that require high levels of cleanliness and precision.

Crompton Greaves Consumer Electricals Ltd (CGCEL) is a prominent India-based company specializing in consumer electrical products and lighting solutions. The company has a legacy of over 85 years and operates under the brand name "Crompton." CGCEL designs and manufactures a diverse range of products, including fans, water heaters, air coolers, and kitchen appliances, alongside its extensive lighting portfolio that encompasses both LED and non-LED solutions.

List of Key Companies in the Cleanroom Lighting Market

- Crompton Greaves Consumer Electricals Ltd.

- Eaton Corporation Inc.

- Havells Ltd

- Kenall Manufacturing

- LEDspan Ltd

- LUG Light Factory Sp. z o.o.

- Signify Holding

- Terra Universal Inc.

- Thorlux Lighting

- Wipro Lighting

Cleanroom Lighting Industry Developments

November 2023: Kenall Lighting, a company that designs and manufactures lighting products, introduced the CSSGI series: a shallow plenum troffer ideal for cleanrooms and clean spaces, including laboratories, food processing plants, pharmacies, pharmaceutical manufacturing, research centers, and more.

January 2022: Clean Rooms International, a designer, manufacturer, and supplier of a wide range of cleanroom components, workstations, and air handling equipment, launched its flow-thru light troffer specifically designed for cleanroom applications.

Cleanroom Lighting Market Segmentation

By Light Source Outlook (Revenue – USD Million, 2020–2034)

- LED

- Fluorescent

By Mounting Type Outlook (Revenue – USD Million, 2020–2034)

- Recessed Mounted

- Surface Mounted

By Component Outlook (Revenue – USD Million, 2020–2034)

- Hardware

- Software

- Services

By End User Outlook (Revenue – USD Million, 2020–2034)

- Healthcare and Life Sciences

- Semiconductor Manufacturing

- Food and Beverages

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cleanroom Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,037.67 million |

|

Revenue Forecast in 2025 |

USD 1,090.18 million |

|

Revenue Forecast by 2034 |

USD 1,729.29 million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global cleanroom lighting market size was valued at USD 1,037.67 million in 2024 and is projected to grow to USD 1,729.29 million by 2034.

• The global market is projected to register a CAGR of 5.3% during the forecast period.

• Asia Pacific had the largest share of the global market in 2024.

• Some of the key players in the market are Crompton Greaves Consumer Electricals Ltd.; Eaton Corporation Inc.; Havells Ltd; Kenall Manufacturing; LEDspan Ltd; LUG Light Factory Sp. z o.o.; Signify Holding; Terra Universal Inc.; Thorlux Lighting; and Wipro Lighting.

• The LED segment dominated the market in 2024.