Clean Label Ingredients Market Size, Share, Trends, Industry Analysis Report

: By Type, Form, Application (Food, Dairy and Non-Dairy, Beverages, Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 –2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1659

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

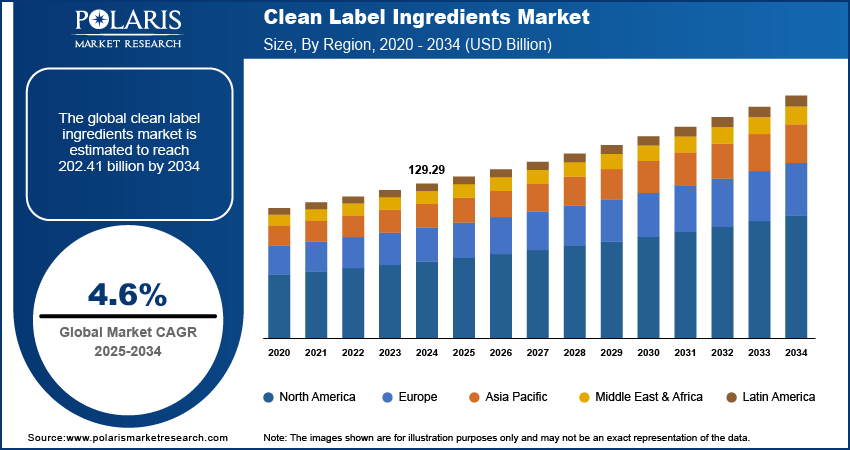

The clean label ingredients market size was valued at USD 129.29 billion in 2024, growing at a CAGR of 4.6% during the forecast period. The growing consumer preference for healthier foods and the introduction of stringent labeling regulations by governments globally are the key factors propelling market growth.

Key Insights

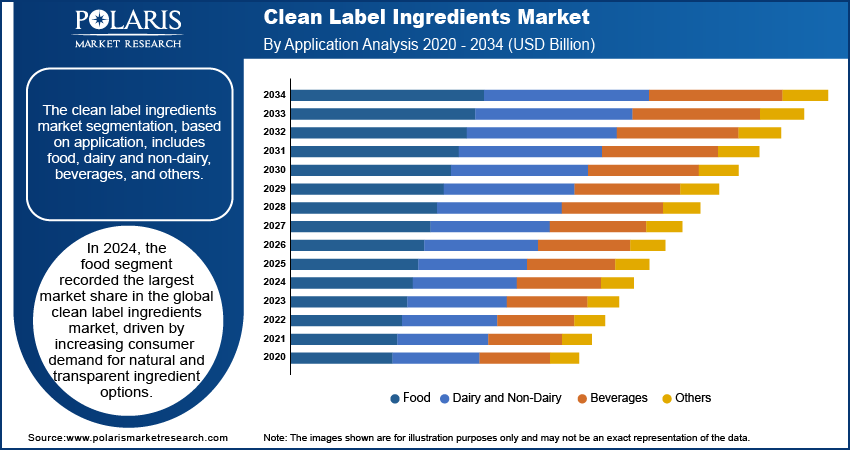

- The food segment accounted for the largest market share in 2024. The segment’s dominance is attributed to the increased consumer demand for natural and transparent ingredient options.

- The dry segment is anticipated to witness significant growth during the projection period. The extended shelf life and ease of storage offered by dry ingredients contribute to the robust growth of the segment.

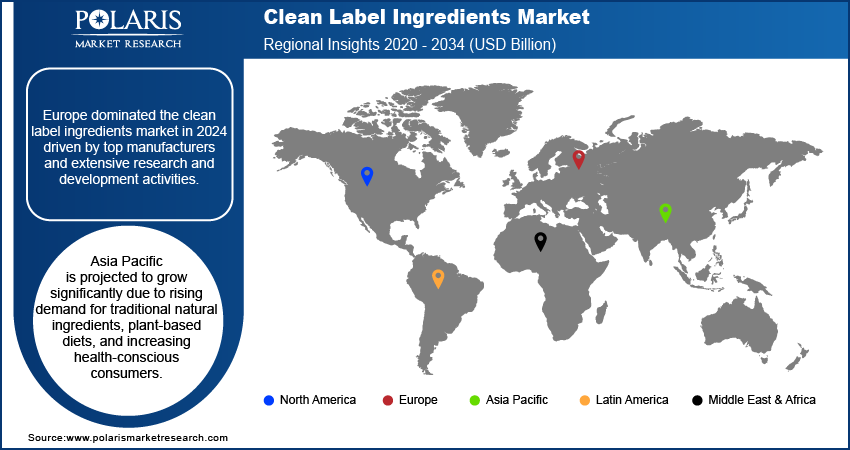

- Europe led the market in 2024, driven by increasing research and development initiatives and the presence of leading clean-label ingredient manufacturers.

- Asia Pacific is anticipated to account for a significant CAGR during the projection period, driven by increasing consumer demand for plant-based diets.

Industry Dynamics

- Rising health awareness among consumers is driving the demand for clean label products. These labels indicate that products are made from recognizable ingredients and are free from artificial additives and preservatives.

- The growing preference for natural and traditional ingredients is another key factor propelling market demand. Consumers are becoming increasingly aware of the health risks associated with artificial additives and seeking products with recognizable ingredients.

- The increased emphasis on the development of cost-effective and readily available clean label ingredients is expected to provide significant market opportunities.

- The high cost of natural ingredients may present challenges to the growth of the market.

Market Statistics

2024 Market Size: USD 129.29 billion

2034 Projected Market Size: USD 202.41 billion

CAGR (2025-2034): 4.6%

Europe: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

A clean label refers to using simple, natural ingredients in products, with transparent labeling that avoids artificial additives, preservatives, and complex chemical names.

The market for clean label ingredients is expanding due to consumer preferences for healthier foods, regulatory demands, and advancements in food technology. This trend is significantly reshaping food production and marketing, driven by a more health-conscious and informed consumer demographic. Consumers are increasingly aware of the potential health risks associated with artificial additives, food preservatives, and genetically modified organisms (GMOs). This heightened awareness encourages consumers to choose products that contain natural and minimally processed ingredients, thereby driving the clean label ingredients market value.

For instance, a 2021 survey conducted by the International Food Information Council (IFIC) found that 63% of consumers are increasingly scrutinizing ingredient lists. This demand for greater transparency in food labeling has prompted companies to embrace clean label practices, ensuring their products align with consumer expectations for clarity and naturalness.

The clean label ingredients market demand is growing due to government strict labeling regulations. These regulations require clear and accurate ingredient disclosures on packaging, which fosters consumer trust and ensures adherence to market standards. This regulatory approach not only protects consumers but also encourages a market that values informed choices and maintains high food safety standards.

Market Dynamics

Consumer Expectations for Health, Transparency, and Sustainability

Growing health awareness is expanding the demand for clean label products. These labels indicate that products are made with simple, recognizable ingredients, and are free from artificial additives and preservatives. Consumers are increasingly prioritizing health, sustainability, and transparency, leading them to choose natural, minimally processed options over synthetic alternatives. In response, food manufacturers are reformulating existing products and releasing new offerings that meet clean label standards to align with this consumer demand, thereby driving the clean label ingredients market demand.

For instance, in March 2023, Ingredion expanded its clean label ingredient solutions portfolio by introducing a new range of texturizers known as Fibertex CF citrus fibers. These innovative texturizers, derived from the peels of citrus fruits such as lemons and limes, leverage the natural properties of citrus peels to help manufacturers address clean label challenges while catering to evolving consumer preferences.

Preference for Natural Alternatives and Health Concerns

The growing preference for natural and traditional ingredients is a major clean label ingredients market driver. Consumers are becoming more aware of the health risks associated with artificial additives, such as gastrointestinal issues and allergic reactions, due to which they are turning to products made with simple, recognizable ingredients. Natural ingredients are safer and gentler on the body, reducing the chances of adverse health effects. This shift toward cleaner, transparent products is encouraging food manufacturers to reformulate their offerings, removing synthetic chemicals in favor of natural alternatives, and meeting the increasing demand for safer, healthier food options, thereby driving the clean label ingredients market growth.

According to the National Institutes of Health, in March 2023, digestive diseases were responsible for 2,276.27 disability-adjusted life years (DALYs) per 100,000 people worldwide. This rise is linked to shifts in diet and lifestyle, notably the intake of chemically processed and preservative-rich foods, which negatively impact health.

Segment Analysis

Assessment by Application Outlook

The clean label ingredients market segmentation, based on application, includes food, dairy and non-dairy, beverages, and others. The food segment recorded the largest clean label ingredients market share in 2024, driven by increasing consumer demand for natural and transparent ingredient options. This preference has driven manufacturers to upgrade their product offerings to align with clean label standards.

For instance, according to Ingredion, in July 2022, a study recorded that 71% of consumers are willing to pay a premium for clean-label products, and 58% saw revenue growth after adopting clean-label formulations, showcasing consumer demand for natural and transparent ingredient options in food. Therefore, growing consumer demand for natural and transparent ingredients is driving the segmental growth in the clean label ingredients market report.

Evaluation by Form Outlook

The clean label ingredients market segmentation, based on form, includes dry, liquid, and others. The dry segment is expected to grow significantly during the forecast period due to the extended shelf life and ease of storage that dry ingredients offer. Dry ingredients are less prone to spoilage, making them a convenient and cost-effective option for manufacturers and consumers alike.

Dry ingredients retain their natural qualities while providing greater flexibility in production and distribution. Therefore, its extended shelf life and ease of storage are driving the dry ingredients segment growth in the global market.

Regional Insights

By region, the study provides the clean label ingredients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the market in 2024 due to the presence of leading clean-label ingredient manufacturers and increasing research and development initiatives. Many established companies in Europe are focused on developing innovative, natural ingredients that meet consumer demand for transparency and health-conscious products. Additionally, heightened research and development efforts are helping to improve the quality and variety of clean label ingredients, making them more accessible to a wider range of industries. This, in turn, is driving the clean label ingredients market in Europe.

The clean label ingredients market in Asia Pacific is expected to register a significant CAGR over the forecast period due to the increasing consumer demand for plant-based diets. More people are shifting toward plant-based eating for health, environmental, and ethical reasons, due to which there is a rising preference for clean, natural ingredients that align with these dietary choices. Consumers are seeking products that are free from artificial additives and preservatives and are looking for transparency in labeling. This growing demand for plant-based, minimally processed foods is encouraging manufacturers in the region to invest in clean label ingredients, thereby driving the market growth.

Key Players & Competitive Analysis Report:

The clean label ingredients industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the clean label ingredients market include Cargill, Archer Daniels Midland, Koninklijke DSM N.V, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Corbion Inc., Frutarom, Sensient Technologies, and Ingredion Incorporated

Archer Daniels Midland Company (ADM) is engaged in the manufacture and distribution of food & beverage, animal feed, industrial chemicals, etc. The company was founded in 1902 and headquartered in Chicago, Illinois, United States. The company has diversified its operations to include oilseeds processing, corn processing, specialty food ingredients, animal nutrition, and bioactives. The company’s operations are classified into three business segments Ag Services & Oilseeds, Carbohydrate Solutions, and Nutrition. The company sells various types of floors and starches through its human nutrition segment. Apart from human nutrition, it also operates animal nutrition and industrial biosolutions. ADM's products are used in a variety of applications, including food and beverages, animal feed, industrial uses, and renewable fuels. The company's customer base includes food and beverage manufacturers, animal nutrition companies, industrial manufacturers, and energy producers, among others. The company operates in over 190 countries and has consolidated subsidiaries in more than 70 countries. It owns more than 160 warehouses and terminals, which are used as bulk storage, and has 62 innovation centers.

Kerry Group is a food and ingredients company that produces various food and beverage ingredients, flavors, and consumer foods. The company's product line includes ingredients for the dairy, meat, bakery, beverage, and convenience food sectors. Kerry Group offers a variety of functional components, such as emulsifiers, stabilizers, and sweeteners, which are used to improve texture, flavor, and nutritional value in food products. The company also produces a range of natural and artificial flavors used in food and beverage applications. The company also offers a product portfolio that includes taste ingredients, nutrition ingredients, functional ingredients, food solutions, beverage products, food services, pharma and biotechnology, food and beverage applications, and animal applications. The company has a total of 147 manufacturing locations in 35 countries and offers about 18,000+ products around the globe, headquartered in Ireland, Europe.

List Of Key Companies

- Archer Daniels Midland

- Cargill

- Corbion Inc.

- Dupont De Nemours and Company

- Frutarom

- Ingredion Incorporated

- Kerry Group Plc

- Koninklijke DSM N.V

- Sensient Technologies

- Tate & Lyle Plc

Clean Label Ingredients Industry Developments

July 2025: Tate & Lyle highlighted its expanded portfolio at IFT FIRST 2025. The company introduced the Dubai Chocolate Ice Cream Parfait, designed for clean-label consumers. It also revealed that its clean-label starch, CLARIA G, is now produced using 34% less water and 35% fewer carbon emissions.

March 2025: Sensient introduced a new clean label alternative to Blue 1 color, Marine Blue Capri. The company stated that the alternative is clear blue and can be combined with reds or yellows for achieving purples or greens.

February 2024: Ingredion introduced its new line of clean-label ingredients called, Ingredion NOVATION. These ingredients help food and beverage manufacturers create clean-label products that meet consumer demands.

March 2024: Kerry Group expanded its clean-label ingredients range with new plant-based solutions, offering natural alternatives to traditional additives and supporting the trend towards more transparent and health-conscious food formulations.

Clean Label Ingredients Market Segmentation

By Type Outlook (Volume, Kilo Tons, Revenue USD Billion, 2020–2034)

- Natural Flavors

- Natural Colors

- Fruit & Vegetable Ingredients

- Starch & Sweeteners

- Flours

- Malt

- Natural Preservatives

- Fermentation Ingredients

- Oils & Shortenings

- Emulsifiers

- Cereal Ingredients

By Form Outlook (Volume, Kilo Tons, Revenue USD Billion, 2020–2034)

- Dry

- Liquid

- Others

By Application Outlook (Volume, Kilo Tons, Revenue USD Billion, 2020–2034)

- Food

- Bakery

- Confectionery

- Cereals & Snacks

- Processed Food

- Others

- Dairy and Non-Dairy,

- Beverages

- Others

By Distribution Channel Outlook (Volume, Kilo Tons, Revenue USD Billion, 2020–2034)

- B2B

- B2C

By Regional Outlook (Volume, Kilo Tons, Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clean Label Ingredients Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 129.29 billion |

|

Market Size Value in 2025 |

USD 135.09 billion |

|

Revenue Forecast in 2034 |

USD 202.41 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume in Kilo Tons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global clean label ingredients market size was valued at USD 129.29 billion in 2024 and is projected to grow to USD 202.41 billion by 2034.

The global market is projected to grow at a CAGR of 4.6% during the forecast period, 2025-2034.

Europe had the largest share in the global market.

The key players in the market are Cargill, Archer Daniels Midland, Koninklijke DSM N.V, Dupont De Nemours and Company, Kerry Group Plc, Tate & Lyle Plc, Corbion Inc., Frutarom, Sensient Technologies, and Ingredion Incorporated

The food segment recorded the largest market share in 2024 in the global clean label ingredients market, driven by increasing consumer demand for natural and transparent ingredient options.

The dry segment is expected to grow significantly in the forecast period due to the extended shelf life and ease of storage that dry ingredients offer.