Cholesterol Testing Products and Services Market Size, Share, Trends, Industry Analysis Report: By Product (Testing Kits, Testing Strips, and Others), Test, Age Group, Application, Service Provider, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5370

- Base Year: 2024

- Historical Data: 2020-2023

Cholesterol Testing Products and Services Market Overview

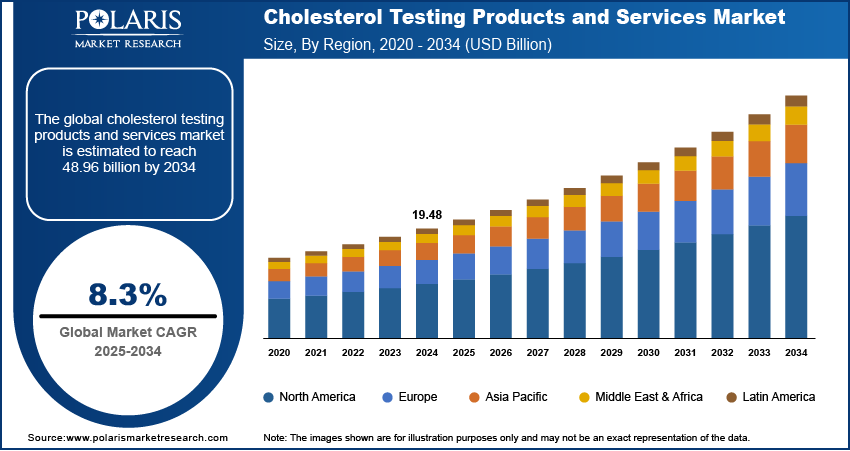

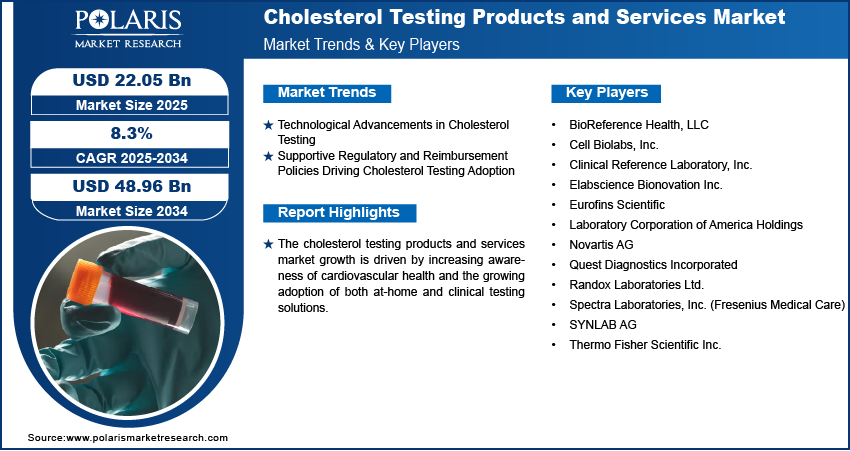

The global cholesterol testing products and services market size was valued at USD 20.21 billion in 2024. The market is projected to grow from USD 22.05 billion in 2025 to USD 48.96 billion by 2034, exhibiting a CAGR of 8.3% during 2025–2034.

Cholesterol testing products and services refer to diagnostic tools and services, such as testing kits, strips, and laboratory tests, used to measure cholesterol levels in the blood. These tests assess various types of cholesterol, including total cholesterol, low density lipoprotein (LDL), high density lipoprotein (HDL), and triglycerides, to help manage cardiovascular health.

The increasing prevalence of cardiovascular diseases and the rising awareness of the importance of regular health screenings boost the cholesterol testing products and services market demand. Innovations in home testing devices and advanced diagnostic tools have expanded the market, offering both professional and self-testing options. The availability of affordable, user-friendly devices has contributed to the widespread adoption of cholesterol testing, especially among health-conscious individuals. In September 2024, the Family Heart Foundation introduced Cholesterol Connect to offer free at-home lipid screening along with access to the Family Heart Care Navigation Center. This program aims to provide individuals with personalized guidance on understanding their cholesterol levels and learning ways to reduce the risk of cardiovascular disease (CVD). Additionally, the growing focus on preventive healthcare and early intervention is supporting market demand. Healthcare facilities and diagnostic centers continue to play a key role in driving growth while emerging economies are witnessing increased market penetration due to improving healthcare infrastructure. Further, government initiatives and guidelines promote cholesterol testing as part of routine health assessments, which boosts the cholesterol testing products and services market development.

To Understand More About this Research: Request a Free Sample Report

Cholesterol Testing Products and Services Market Drivers

Technological Advancements in Cholesterol Testing

Technological advancements in cholesterol testing improve testing accuracy, speed, and convenience. Innovations such as point-of-care testing devices, home test kits, and AI-powered diagnostic tools have made cholesterol testing more accessible and user-friendly. In November 2024, community pharmacies across North East London implemented rapid cholesterol testing services to enhance accessibility to preventative healthcare for residents. This initiative aims to facilitate early detection and management of cardiovascular risks, supporting broader public health objectives. These technologies enable faster results, improve early detection of cardiovascular risks, and promote preventive healthcare. Additionally, advancements in remote monitoring and data analytics are expanding the scope of cholesterol testing services, making them more efficient and integrated into personalized health management solutions. Therefore, the rising focus on technological advancements in cholesterol testing is fuelling the wider adoption of cholesterol testing products across healthcare settings, which propels the cholesterol testing products and services market growth.

Supportive Regulatory and Reimbursement Policies Driving Cholesterol Testing Adoption

Supportive regulatory environments and reimbursement policies boost the adoption of cholesterol testing products and services. Regulations such as the US Affordable Care Act (ACA) and UK National Health Service (NHS) are actively promoting preventive healthcare to encourage regular cholesterol screening as a standard practice, assisting early diagnosis and treatment of cardiovascular diseases. Reimbursement policies further make these tests financially accessible, especially in regions with government-backed healthcare programs. In November 2024, the Centers for Medicare & Medicaid Services announced plans to introduce coding and reimbursement for Atherosclerotic Cardiovascular Disease (ASCVD) risk assessment and management services starting in 2025. The initiative will cover evidence-based tools assessing factors such as cholesterol levels, blood pressure, and lifestyle habits alongside management services for beneficiaries at medium to high cardiovascular risk. These measures increase patient compliance and drive the demand for advanced cholesterol testing solutions, fostering market growth. These frameworks incentivize providers and patients to prioritize regular cholesterol monitoring, aligning with broader public health goals.

Cholesterol Testing Products and Services Market Segment Analysis

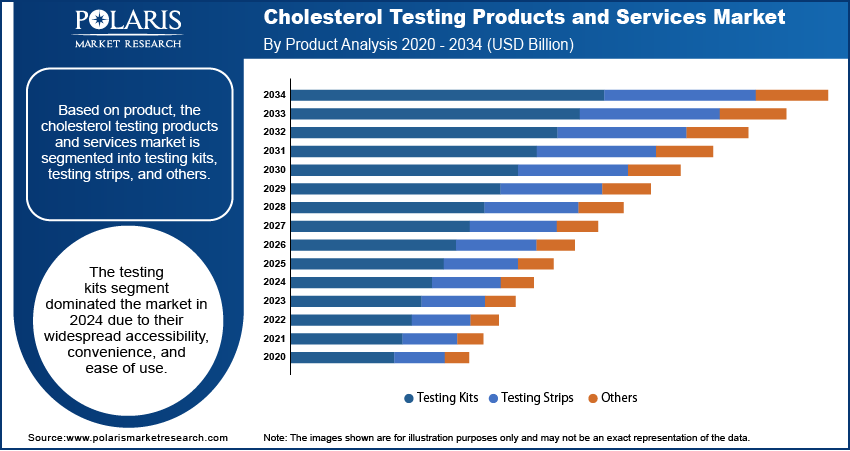

Cholesterol Testing Products and Services Market Assessment by Product Outlook

The global cholesterol testing products and services market segmentation, based on product, includes testing kits, testing strips, and others. The testing kits segment dominated the cholesterol testing products and services market share in 2024 due to their widespread accessibility, convenience, and ease of use. These kits allow individuals to perform tests at home or in nonclinical settings, promoting preventive care and regular monitoring of cholesterol levels. Their portability and ability to deliver rapid results have made them popular among patients managing chronic conditions such as cardiovascular diseases. Additionally, advancements in testing kit technology have improved accuracy and reliability, driving their adoption across the healthcare industry. These factors collectively position testing kits as a preferred choice for cholesterol monitoring.

Cholesterol Testing Products and Services Market Evaluation by Test Outlook

The global cholesterol testing products and services market segmentation, based on test, includes total cholesterol tests, high density lipoprotein (HDL) cholesterol tests, low density lipoprotein (LDL) cholesterol tests, triglyceride tests, and others. Low-density lipoprotein (LDL) cholesterol tests are anticipated to register the highest CAGR during the forecast period due to the increasing majority of cardiovascular diseases and the critical role of LDL cholesterol in assessing heart disease risk. Growing awareness about the health implications of bad cholesterol and its association with atherosclerosis has boosted the demand for regular LDL monitoring. Additionally, advancements in diagnostic technologies and point-of-care testing devices have made LDL testing more accessible and accurate. The emphasis on preventive healthcare and early detection further supports the rapid growth of this segment in the cholesterol testing market.

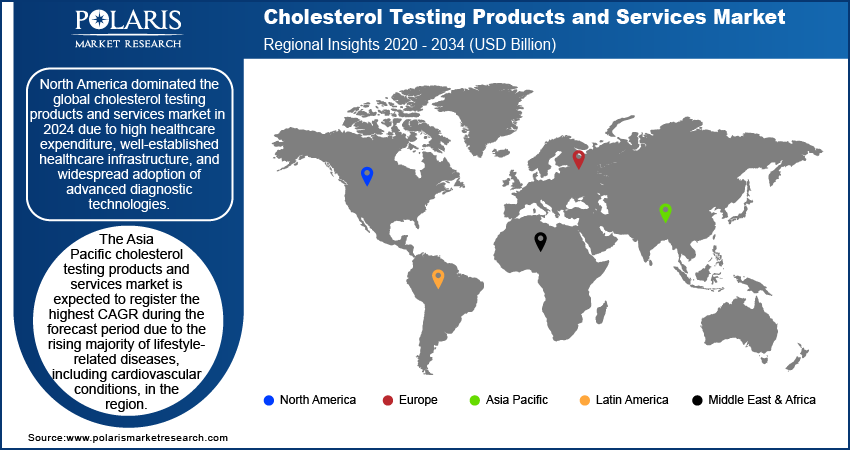

Cholesterol Testing Products and Services Market Regional Analysis

By region, the study provides cholesterol testing products and services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global cholesterol testing products and services market revenue share in 2024 due to the significant expenditure on healthcare, coupled with a well-developed healthcare infrastructure and the widespread adoption of advanced diagnostic technologies. The region benefits from strong regulatory frameworks that support preventive healthcare initiatives and regular cholesterol screening. Additionally, the majority of cardiovascular diseases and the growing awareness about the risks associated with high cholesterol drive the demand for cholesterol testing. Further, the presence of leading market players and ongoing research and development contribute to North America's dominant position in the market. In September 2024, Labcorp acquired select assets from BioReference Health, a subsidiary of OPKO Health. The transaction, valued at USD 237.5 billion, involves BioReference’s clinical diagnostics and reproductive health testing operations outside New York and New Jersey. This acquisition, which includes patient service centers, customer contracts, and operating assets, is expected to generate around USD 100 billion in annual revenue.

The Asia Pacific cholesterol testing products and services market is expected to register the highest CAGR during the forecast period due to the rising prevalence of lifestyle-related diseases, including cardiovascular conditions, in the region. Increasing awareness about the importance of preventive healthcare and cholesterol monitoring is driving demand for cholesterol tests. Moreover, expanding healthcare infrastructure, government initiatives promoting regular screenings, and growing disposable incomes in emerging economies are fueling the Asia Pacific cholesterol testing products and services market growth. The adoption of advanced diagnostic technologies and increasing healthcare accessibility in countries such as India and China also contribute to the regional market growth.

Cholesterol Testing Products and Services Market – Key Players and Competitive Analysis Report

The competitive landscape of the cholesterol testing products and services market is characterized by a mix of global leaders and regional players striving for market share through innovation, strategic partnerships, and geographic expansion. Major companies in this market, such as Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, and others, leverage their strong research and development capabilities, as well as extensive distribution networks, to deliver advanced solutions catering to applications across healthcare sectors such as hospitals, clinics, diagnostic laboratories, and home healthcare. Leading players emphasize product innovation, focusing on improving testing accuracy, speed, and convenience to meet the growing demand for personalized and preventive healthcare. These advancements include the development of point-of-care testing devices, home cholesterol test kits, and AI-powered diagnostic solutions. Additionally, companies are integrating technologies such as connected devices for remote monitoring and data analysis. Further, smaller regional firms are gaining traction by offering specialized products tailored to specific demographics or regional healthcare needs. These companies often focus on affordability, user-friendly designs, and compatibility with existing healthcare systems. Key competitive strategies in the market are mergers and acquisitions to consolidate market positions, partnerships with healthcare providers and technology firms to enhance service delivery, and the expansion of product portfolios to cater to a broader range of customers. A few key major players are Laboratory Corporation of America Holdings; SYNLAB AG; Clinical Reference Laboratory, Inc.; Cell Biolabs, Inc.; Randox Laboratories Ltd.; Thermo Fisher Scientific Inc.; Quest Diagnostics Incorporated; BioReference Health, LLC; Novartis AG; Spectra Laboratories, Inc. (Fresenius Medical Care); Eurofins Scientific; and Elabscience Bionovation Inc.

Novartis AG is a Swiss multinational pharmaceutical company headquartered in Basel, Switzerland. The company operates primarily through two divisions—Innovative Medicines and Sandoz. The Innovative Medicines division focuses on patented drugs, addressing various health conditions such as cancer, cardiovascular diseases, and neurological disorders. In contrast, Sandoz specializes in high-quality generics and biosimilars, making healthcare more accessible by providing affordable alternatives. Novartis AG has made advancements in cholesterol management through its innovative product, Leqvio (inclisiran). This medication is notable for being the first small interfering RNA (siRNA) therapy approved by the US Food and Drug Administration (FDA) to lower low-density lipoprotein cholesterol (LDL-C), commonly referred to as bad cholesterol. Leqvio is administered via subcutaneous injection, with an initial dose followed by another at three months and then every six months after that.

Thermo Fisher Scientific Inc. is an American company specializing in life sciences and clinical research, headquartered in Waltham, Massachusetts. The company provides analytical instruments and laboratory services and offers a diverse range of products and solutions, including specialty diagnostics, clinical development services, and pharmaceutical and biotechnology services. It offers a comprehensive range of cholesterol testing products and services, crucial for clinical diagnostics and research applications.

The portfolio of Thermo Fisher Scientific includes various assay kits designed to measure total cholesterol, high-density lipoprotein (HDL), and low-density lipoprotein (LDL) levels in serum and plasma. The Total Cholesterol Reagents allow for the quantitative determination of cholesterol levels in serum samples. This assay is vital for assessing liver function, cardiovascular risk, and other metabolic conditions. The reagents are compatible with various automated clinical chemistry analyzers, enhancing workflow efficiency in laboratories. Additionally, the Amplex Red Cholesterol Assay Kit provides a sensitive fluorometric method for detecting low concentrations of cholesterol, measuring both free cholesterol and cholesteryl esters. This kit is particularly useful for research settings where precision is paramount. Thermo Fisher also offers specialized kits for HDL and LDL cholesterol measurement, employing enzyme-coupled reactions to produce quantifiable results. These assays are essential tools for evaluating cardiovascular health and understanding lipid metabolism.

List of Key Companies in Cholesterol Testing Products and Services Market

- BioReference Health, LLC

- Cell Biolabs, Inc.

- Clinical Reference Laboratory, Inc.

- Elabscience Bionovation Inc.

- Eurofins Scientific

- Laboratory Corporation of America Holdings

- Novartis AG

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Spectra Laboratories, Inc. (Fresenius Medical Care)

- SYNLAB AG

- Thermo Fisher Scientific Inc.

Cholesterol Testing Products and Services Industry Development

In October 2024, Novartis launched a therapy in the Philippines aimed at lowering LDL cholesterol levels, a significant step toward reducing heart attack risks and tackling the widespread issue of cardiovascular diseases in the country.

In December 2023, Abbott received FDA approval for its GLP Systems Track laboratory automation system, designed to improve the efficiency and safety of diagnostic testing in laboratories.

Cholesterol Testing Products and Services Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Testing Kits

- Testing Strips

- Others

By Test Outlook (Revenue, USD Billion, 2020–2034)

- Total Cholesterol Tests

- High Density Lipoprotein (HDL) Cholesterol Tests

- Low Density Lipoprotein (LDL) Cholesterol Tests

- Triglyceride Tests

- Others

By Age Group Outlook (Revenue, USD Billion, 2020–2034)

- Geriatric

- Adult

- Pediatric

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cardiovascular Diseases

- Diabetes

- Obesity

- Hyperlipidemia

- Others

Service Provider Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Diagnostic Laboratories

- Ambulatory Care Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cholesterol Testing Products and Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.21 billion |

|

Market Size Value in 2025 |

USD 22.05 billion |

|

Revenue Forecast by 2034 |

USD 48.96 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 20.21 billion in 2024 and is projected to grow to USD 48.96 billion by 2034.

• The global market is projected to register a CAGR of 8.3% during the forecast period.

• North America dominated the global market in 2024.

• A few key players in the market are Laboratory Corporation of America Holdings; SYNLAB AG; Clinical Reference Laboratory, Inc.; Cell Biolabs, Inc.; Randox Laboratories Ltd.; Thermo Fisher Scientific Inc.; Quest Diagnostics Incorporated; BioReference Health, LLC; Novartis AG; Spectra Laboratories, Inc. (Fresenius Medical Care); Eurofins Scientific; and Elabscience Bionovation Inc

• The testing kits segment dominated the market revenue share in 2024.

• The low-density lipoprotein (LDL) cholesterol tests segment is anticipated to register the highest CAGR during the forecast period.