Chlorinated Polyethylene Market Size, Share, Trends, Industry Analysis Report: By Product (CPE 135A, CPE 135B, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025– 2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM5369

- Base Year: 2024

- Historical Data: 2020-2023

Chlorinated Polyethylene Market Overview

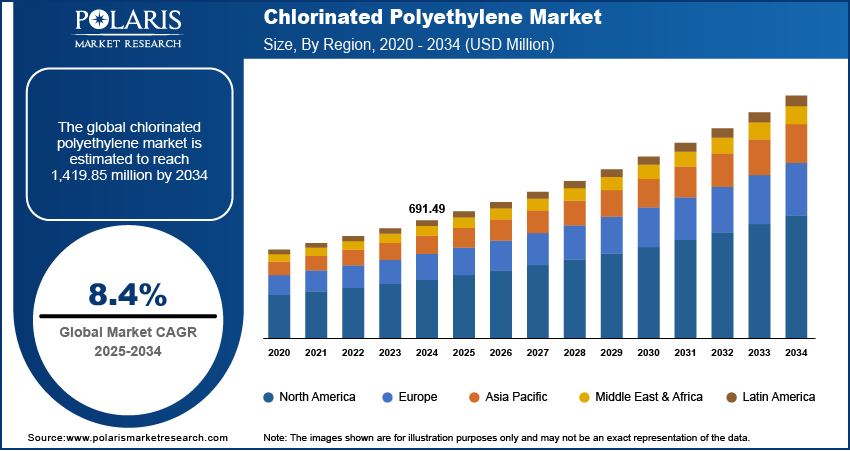

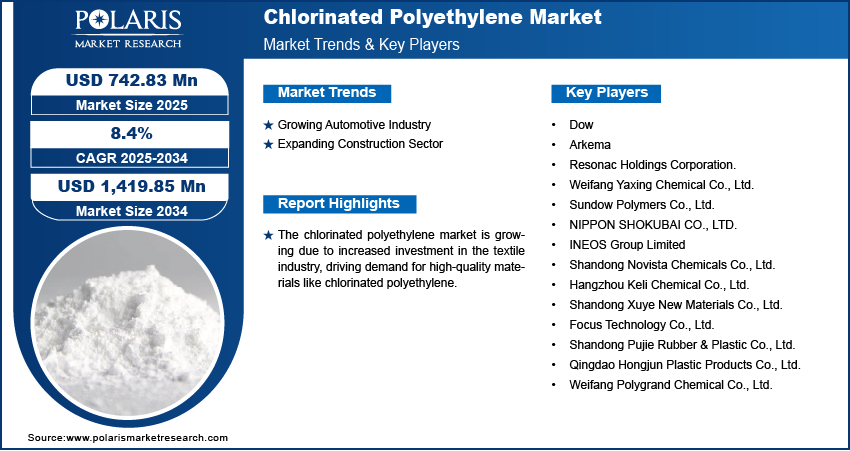

The global chlorinated polyethylene market size was valued at USD 691.49 million in 2024. The market is projected to grow from USD 742.83 million in 2025 to USD 1,419.85 million by 2034, exhibiting a CAGR of 8.4% from 2025 to 2034.

Chlorinated polyethylene (CPE) is a thermoplastic elastomer produced by chlorinating polyethylene to improve chemical resistance, heat stability, and mechanical properties. The elastomer is commonly used in applications such as cable insulation, roofing membranes, and automotive components due to its durability and flexibility.

The chlorinated polyethylene market is growing due to the expansion of the flexible packaging industry. For instance, according to the Flexible Packaging Association, the flexible packaging industry employs 85,000 people in the US, highlighting its growth. Chlorinated polyethylene is valued for its strength, durability, and resistance to chemicals, making it an ideal choice for flexible packaging solutions such as bags, wraps, and pouches. This has led to increased demand for chlorinated polyethylene-based packaging. Consequently, the growth of the flexible packaging industry is significantly propelling the chlorinated polyethylene market.

To Understand More About this Research: Request a Free Sample Report

The chlorinated polyethylene market expansion is being fueled by increased investments in the textile industry. As more capital flows into the industry, manufacturers are looking for high-quality materials to improve their products. This has led to a higher demand for chlorinated polyethylene, which is valued for its desirable characteristics, such as durability and resistance to chemicals, making it ideal for applications like waterproofing and protective coatings in textiles.

Chlorinated Polyethylene Market Dynamics

Growing Automotive Industry

The automotive industry is growing, driven by rising disposable income and need for efficient transportation modes, due to which the demand for the raw material required for manufacturing parts is rising. According to the International Organisation of Motor Vehicle Manufacturers, global vehicle sales saw a 12% increase between 2022 and 2024, reflecting strong demand for cars. Chlorinated polyethylene is commonly used in automotive parts such as seals, hoses, and interior components due to its durability and resistance to heat and chemicals, thereby driving chlorinated polyethylene market demand.

Expanding Construction Sector

Data from the UK Office for National Statistics shows a 0.4% increase in construction output in Great Britain in August 2024 compared to July 2024, indicating a rise in building and infrastructure development. Chlorinated polyethylene is used in various construction applications, including roofing membranes, waterproofing membranes, and seals as it is strong and resistant to weather and chemicals. The increase in construction activity is boosting the demand for durable materials such as chlorinated polyethylene, thereby driving the growth of the chlorinated polyethylene market.

Chlorinated Polyethylene Market Segment Insights

Chlorinated Polyethylene Market Assessment by Product Outlook

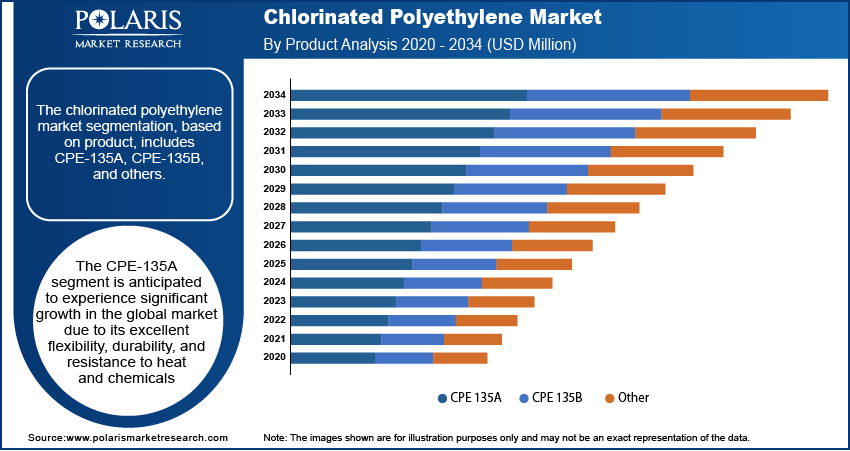

The chlorinated polyethylene market segmentation, based on product, includes CPE 135A, CPE 135B, and others. The CPE 135A segment is expected to experience significant growth with a high CAGR in the global market due to its excellent flexibility, durability, and resistance to heat and chemicals. These qualities make CPE 135A ideal for various applications, including automotive parts, construction materials, and flexible packaging. As industries increasingly focus on using strong and reliable materials, the demand for CPE 135A is expected to rise.

Chlorinated Polyethylene Market Evaluation by Application Outlook

The chlorinated polyethylene market segmentation, based on application, includes impact modifier, wire & cable jacketing, hose & tubing, adhesives, magnetics, IR ABS, and others. The impact modifier segment dominated the global market in 2024 because of its important role in the automotive and construction industries. Impact modifiers enhance the toughness and flexibility of materials, making them less likely to break or crack. This ability of impact modifier is especially valuable in automotive parts, where durability is crucial, and in construction materials, which need to withstand various weather conditions. As manufacturers focus on creating stronger and more reliable products, the demand for impact modifiers continues to rise.

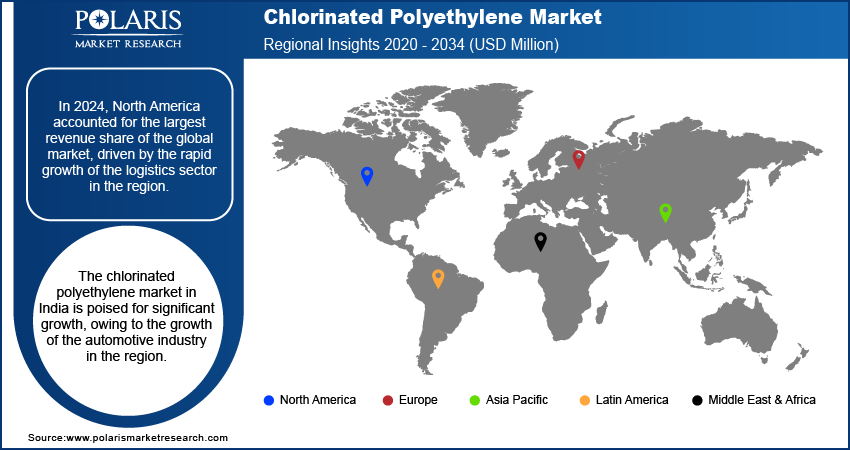

Chlorinated Polyethylene Market Regional Analysis

By region, the study provides the chlorinated polyethylene market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America had the largest revenue share of the global market due to the growth of the logistics sector in the region. For instance, according to the Bureau of Transportation Statistics, in 2021, the US transportation system moved an average of 53.6 billion tons of freight daily, highlighting the increasing demand for durable materials in shipping and packaging. Chlorinated polyethylene is valued for its strength and resistance to harsh conditions, making it ideal for various logistics applications. As the logistics sector continues to expand, the need for reliable materials like chlorinated polyethylene will rise, further driving market growth in North America.

The Asia Pacific chlorinated polyethylene market is expected to experience significant growth during the forecast period, driven by an increase in mergers and strategic collaborations. These partnerships enable companies to expand their presence in various industries, such as textiles and construction. By joining forces, businesses can develop new products and enter new markets, which in turn enhances overall demand. This surge in activity creates more opportunities across different sectors, contributing to the market expansion in the region.

The chlorinated polyethylene market in India is poised for significant growth, driven by the expanding automotive sector. According to the International Organisation of Motor Vehicle Manufacturers, vehicle sales in the country rose by 7.5% from 2022 to 2023, highlighting a robust demand for cars and other vehicles. This increase in sales creates a need for more materials to produce high-quality automotive components, with chlorinated polyethylene being a preferred choice due to its durability and resistance to heat and chemicals.

Chlorinated Polyethylene Market – Key Players and Competitive Insights

The chlorinated polyethylene market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative manufacturing techniques to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the chlorinated polyethylene market includes Dow; Arkema; Resonac Holdings Corporation; Weifang Yaxing Chemical Co., Ltd.; Sundow Polymers Co., Ltd.; NIPPON SHOKUBAI CO., LTD.; INEOS Group Limited, Shandong Novista Chemicals Co., Ltd.; Hangzhou Keli Chemical Co., Ltd.; Shandong Xuye New Materials Co., Ltd.; Focus Technology Co., Ltd.; Shandong Pujie Rubber & Plastic Co., Ltd.; Qingdao Hongjun Plastic Products Co., Ltd. and Weifang Polygrand Chemical Co., Ltd.

Arkema is a manufacturer of specialty materials headquartered in Colombes, France. Founded in 2004 as a spin-off from Total, the company was publicly listed in 2006. The company has a workforce of approximately 21,100 employees and operations in 55 countries. The company operates through four main business segments: adhesive solutions, advanced materials, coating solutions, and intermediates. The adhesive solutions segment specializes in high-performance adhesives used across various applications, including construction and industrial assembly. Advanced materials focus on specialty polymers and fluoropolymers for industries such as automotive and electronics, emphasizing innovation and performance. Arkema's product lines of chlorinated polyethylene (CPE), a thermoplastic elastomer, are recognized for their resistance to heat, chemicals, and environmental factors. Arkema's CPE is utilized in various applications, including automotive components, electrical insulation, roofing membranes, and sealantsThe coating solutions segment provides coating resins and additives utilized in sectors like automotive and construction. Geographically, Arkema has operations in North America, Europe, and Asia.

Dow Inc. is a materials science company based in Midland, Michigan, USA, operating primarily through its subsidiary, The Dow Chemical Company (TDCC). The company has diverse product offerings, such as plastics, performance materials, coatings, silicones, and industrial intermediates. Its product portfolio includes packaging, infrastructure, mobility, and consumer care. Key applications of Dow’s products span home and personal care, durable goods, adhesives, sealants, coatings, and food packaging. The company operates through three main business segments, which include packaging & specialty plastics for packaging solutions, industrial intermediates, which provide essential materials for manufacturing across multiple industries, and performance materials & coatings. Dow's polyethylene (PE) products offer versatile solutions for various applications, including HDPE, MDPE, LDPE, and LLDPE, The company provide chlorinated polyethylene with the name of Dow Chlorinated Polyethylene Cpe6000. Dow's region of operation includes North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

List of Key Companies in Chlorinated Polyethylene Market

- Dow

- Arkema

- Resonac Holdings Corporation.

- Weifang Yaxing Chemical Co., Ltd.

- Sundow Polymers Co., Ltd.

- NIPPON SHOKUBAI CO., LTD.

- INEOS Group Limited

- Shandong Novista Chemicals Co., Ltd.

- Hangzhou Keli Chemical Co., Ltd.

- Shandong Xuye New Materials Co., Ltd.

- Focus Technology Co., Ltd.

- Shandong Pujie Rubber & Plastic Co., Ltd.

- Qingdao Hongjun Plastic Products Co., Ltd.

- Weifang Polygrand Chemical Co., Ltd.

Chlorinated Polyethylene Market Developments

In July 2022, The new chlorinated polyethylene resin type B, QL565P, was launched by Daqing Sinopec, offering enhanced processability and meeting market demands, filling a significant product gap for PetroChina.

Chlorinated Polyethylene Market Segmentation

By Product Outlook (USD Million, 2020–2034)

- CPE 135A

- CPE 135B

- Others

By Application Outlook (USD Million, 2020–2034)

- Impact Modifier

- Wire & Cable Jacketing

- Hose & Tubing

- Adhesives

- Magnetics

- IR ABS

- Others

By Regional Outlook (USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Chlorinated Polyethylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 691.49 million |

|

Market Size Value in 2025 |

USD 742.83 million |

|

Revenue Forecast by 2034 |

USD 1,419.85 million |

|

CAGR |

8.4% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market was valued at USD 691.49 million in 2024 and is projected to grow to USD 1,419.85 million by 2034.

• The global market is projected to register a CAGR of 8.4% from 2025 to 2034.

• North America had the largest share of the global market in 2024.

• A few of the key players in the market are Dow, Arkema, Resonac Holdings Corporation, Weifang Yaxing Chemical Co., Ltd.; Sundow Polymers Co., Ltd.; NIPPON SHOKUBAI CO., LTD.; INEOS Group Limited; Shandong Novista Chemicals Co., Ltd.; Hangzhou Keli Chemical Co., Ltd.; Shandong Xuye New Materials Co., Ltd.; Focus Technology Co., Ltd.; Shandong Pujie Rubber & Plastic Co., Ltd.; Qingdao Hongjun Plastic Products Co., Ltd; and Weifang Polygrand Chemical Co., Ltd.

• The CPE-135A segment is expected to experience significant growth with a high CAGR in the global market due to its excellent flexibility, durability, and resistance to heat and chemicals.

• The impact modifier segment dominated the market in 2024 because of its important role in the automotive and construction industries.