Chiplets Market Share, Size, Trends, Industry Analysis Report, By Processor; By Packaging Technology; By Industry Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4674

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

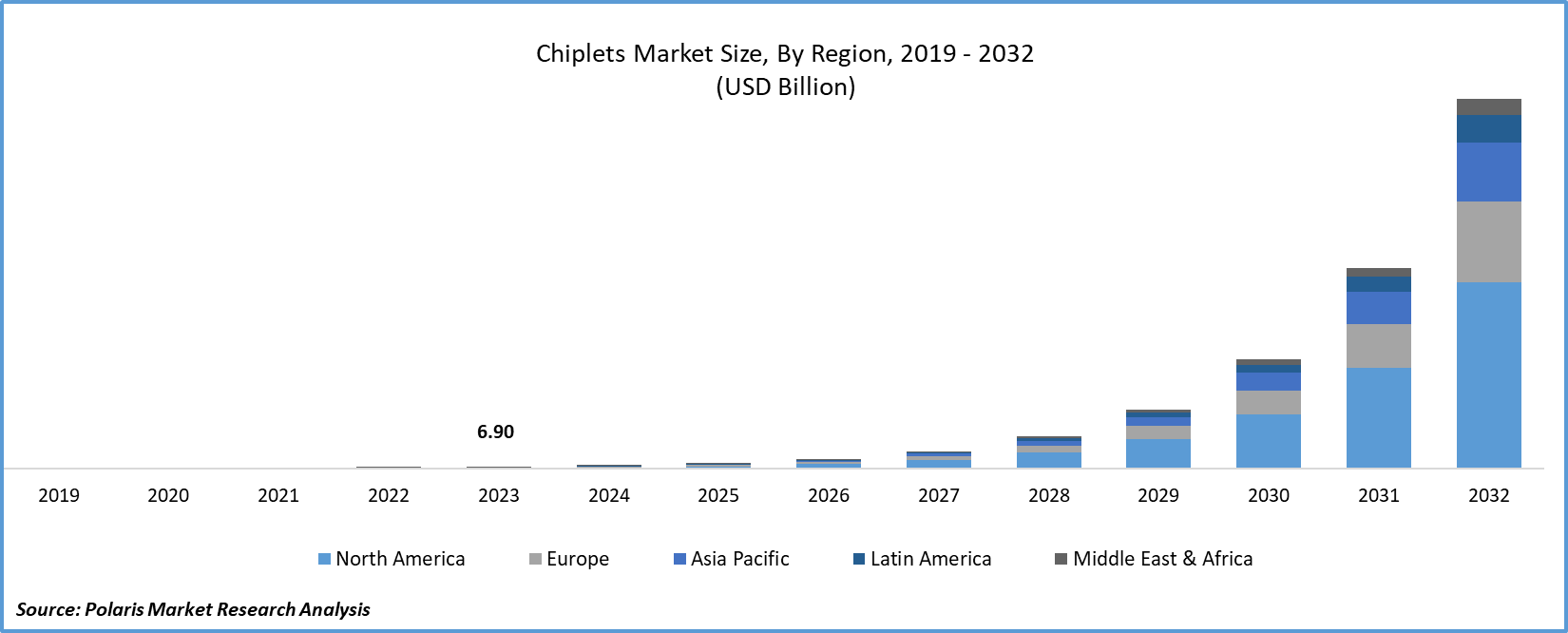

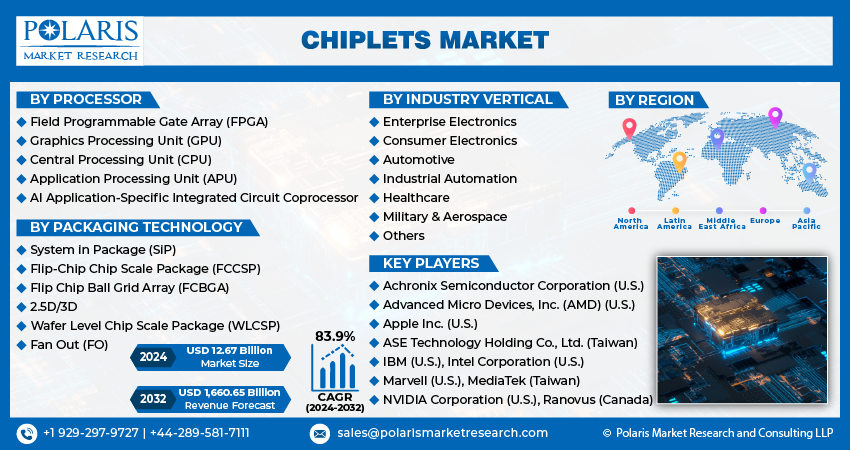

Chiplets market size was valued at USD 6.90 billion in 2023. The market is anticipated to grow from USD 12.67 billion in 2024 to USD 1,660.65 billion by 2032, exhibiting the CAGR of 83.9% during the forecast period.

Market Overview

The growing demand for cutting-edge semiconductor technology coupled with the consumer electronics industry's expanding need for chiplets drive the market growth. Moreover, the customization and scalability of integrated circuits (ICs) enabled by chiplets, enhanced performance, cost-effective manufacturing, and higher yield rates are some of the advantages that contribute to the expansion of chiplets market. Furthermore, current research activities on the use of chiplet technology in automotive sector will expand the market during the forecast period.

The increasing use of this technology in desktop PCs, workstations, and servers is expected to propel the market growth throughout the forecast period. Moreover, the economic cost of 5G devices and the deployment of new networks lead to an increase the adoption of 5G technology thereby, providing the long-term opportunity for the market growth. Furthermore, the global expansion of data centers, increasing adoption of revolutionary packaging technologies, and growing demand for high-performance computing (HPC) servers from various industries are the major factors responsible for the growth of global chiplets market.

To Understand More About this Research:Request a Free Sample Report

- For instance, in June 2023, Stony Brook University announced their intention to deploy a new High-Performance Computing (HPC) system. This system will be based on the technologies launched by Hewlett Packard Enterprise (HPE) and Intel.

However, the chiplets market is expected to witness hindrances owing to the testing & bonding challenges. For instance, testing chiplets with tiny microbumps presents considerable financial and technical challenges. Moreover, one of the primary difficulties with chiplet technology is inter-chiplet communication and integration. In order to achieve high integration, technological challenges pertaining to packaging, heat dissipation, and reliability must be addressed. Furthermore, the high preference for monolithic chips in developing and under-developed countries hampers the market growth.

Growth Factors

Several advantages of chiplets over monolithic design will propel the market growth

Chiplets are smaller functional units made up of parts of an integrated circuit that eliminates the need of creation of single monolithic chips. The combination of different chiplets having specific functionalities, such as memory, processors, and input/output components allows designers to create an efficient and highly customized system. Thus, the chiplet technology is considered as the future of semiconductor design. Moreover, benefits such as modular approach to chip design, parallel development of different components, reduction in manufacturing costs, and improvement in yield rates are expected to fuel the overall chiplets market during the forecast period.

Growing use of high-performance computing (HPC) servers is contributing to the chiplets market expansion

The ability to analyze data and carry out complex calculations at high speeds is known as high performance computing (HPC). With the utilization of chiplet-based technology, the HPCs allow for the efficient integration of specialized processing units, accelerators, and memory. The growing need to design powerful chips and increasing adoption of HPCs in various fields such as finance, research, weather forecasting, manufacturing, pharmaceuticals, energy, government, automotive, and telecommunications will fuel the market growth in the coming years. As chiplets have the ability to revolutionize the HPC sector, companies are focusing on the strategic initiatives such as new product launches and acquisitions.

- For instance, in January 2022, NVIDIA Corporation completed the acquisition of Bright Computing, a leading company providing software for managing high performance computing systems.

Restraining Factors

Problems associated with chiplets technology limits the market growth

Despite the technologically-advanced nature of chiplets, there are several problems that may hinder its adoption in the market. Wafer management, testing efficiency, yield challenges, cost implications, and human resource requirements are some of the major hurdles in the adoption of chiplet technology. For instance, merging of diverse wafers into a cohesive package through heterogeneous integration leads to the problems such as time sensitivity, complexity, and a high risk of errors. Moreover, the high costs associated with the chiplet designing and testing restrains the market growth. Furthermore, lack of focus on streamlining of testing processes for maximum efficiency also hampers the chiplets market.

Report Segmentation

The market is primarily segmented based on processor, packaging technology, industry vertical, and region.

|

By Processor |

By Packaging Technology |

By Industry Vertical |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Processor Insights

The CPU segment is projected to grow at a significant CAGR during the forecast period

The Central Processing Unit (CPU) segment is anticipated to expand at a considerable CAGR in the projected years. CPU is an essential processor for many computing devices. Increasing focus of CPU manufacturers towards energy efficiency, scalability, and higher processing power will significantly contribute to the growth of this segment in the upcoming years. Moreover, the ability of chiplets to increase efficiency and organize CPU design allows CPU manufacturers to concentrate on the adoption of this technology. Thus, with the increasing need of CPU in a wide range of applications from consumer electronics to data centers, the demand for chiplets is expected to increase in the coming years.

By Packaging Technology Insights

2.5D/3D technology emerged as the largest segment in the chiplets market

The 2.5D/3D segment held the dominant share of the market in 2023. The assurance of excellent performance, miniaturization, and bandwidth provided by this packaging technology owing to the vertical stacking of chiplets contributes to the largest share of this segment. Moreover, this technology makes it possible to include multiple ICs into the same package. Thus, the benefits in accomplishing high package density and energy efficiency have made 2.5D/3D technology an ideal chiplet integration platform. Such factors have contributed to the dominance of this segment in 2023.

By Application Insights

The consumer electronics segment held the significant share of chiplets market

Based on application, the consumer electronics segment generated the significant revenue in 2023. Increasing demand for thinner and lighter designs of portable laptops and ultrabooks owing to the use of chiplet technology will contribute to the segmental growth. Moreover, factors such as rising use of chiplets for viewing higher quality video-content on smart TVs coupled with the rapid growth of consumer electronics sector are expected to fuel the segmental growth during the forecast period.

- For instance, according to the statistics published by the Indian Brand Equity Foundation (IBEF), 4.5 million televisions were shipped to India in the first half of 2023.

Regional Insights

Asia Pacific generated the largest market revenue in 2023

Asia Pacific dominated the global chiplets market in 2023 and is projected to register the highest CAGR during the forecast timeframe. The dominance of this region is attributed to the factors such as investments in research & development, supportive regulatory framework, government-led programs for digital transformation, and expansion of the consumer electronics industry. Moreover, the growth of chiplets market is also driven by the Asia Pacific semiconductor industry, which is a home to a strong network of manufacturers, technology innovators, and foundries.

An increasing demand for electronic devices from the highly populous countries such as China and India will prove beneficial for the growth of chiplets market during the forecast period. Moreover, increasing government support for the research & development of this technology is expected to fuel the market growth.

- For instance, in August 2023, the National Natural Science Foundation of China (NSFC), a major domestic funding source for basic research and frontier exploration, launched a new programme to provide fundings to numerous projects focused on chiplet technology.

Key Market Players & Competitive Insights

Launch of new products based on chiplet technology will strengthen the market share of companies

In terms of competition, the chiplets market is consolidated. The consolidated nature of the market is owing to the majority of the shares captured by the key companies such as Intel Corporation, Advanced Micro Devices, Inc. (AMD), Apple Inc., Marvell, and IBM. These companies have strong strategic focus on chiplet technology. The companies are concentrating on improving their market shares through the strategies such as acquisition, and new product launches with chiplet technology.

- For instance, in November 2022, Advanced Micro Devices, Inc. (AMD) unveiled new gaming graphics cards that featured an advanced AMD chiplet design.

Some of the major players operating in the global market include:

- Achronix Semiconductor Corporation (U.S.)

- Advanced Micro Devices, Inc. (AMD) (U.S.)

- Apple Inc. (U.S.)

- ASE Technology Holding Co., Ltd. (Taiwan)

- IBM (U.S.)

- Intel Corporation (U.S.)

- Marvell (U.S.)

- MediaTek (Taiwan)

- NVIDIA Corporation (U.S.)

- Ranovus (Canada)

Recent Developments in the Industry

- In July 2023, Marvell announced that it has joined the automotive chiplet initiative coordinated by imec. This initiative has been launched in order to meet the design challenge of bringing multi-chiplet compute modules to the automotive market.

- In November 2022, Eliyan Corporation announced that its technology for multi-die chiplet integration received the funding USD 40 million in Series A funding round.

Report Coverage

The chiplets market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, processor, packaging technology, application, and their futuristic growth opportunities.

Chiplets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.67 billion |

|

Revenue forecast in 2032 |

USD 1,660.65 billion |

|

CAGR |

83.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Chiplets Market report covering key segments are processor, packaging technology, industry vertical, and region.

Chiplets Market Size Worth $1,660.65 Billion By 2032

Chiplets market , exhibiting a CAGR of 83.9% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Chiplets Market are growing use of high-performance computing (HPC) servers