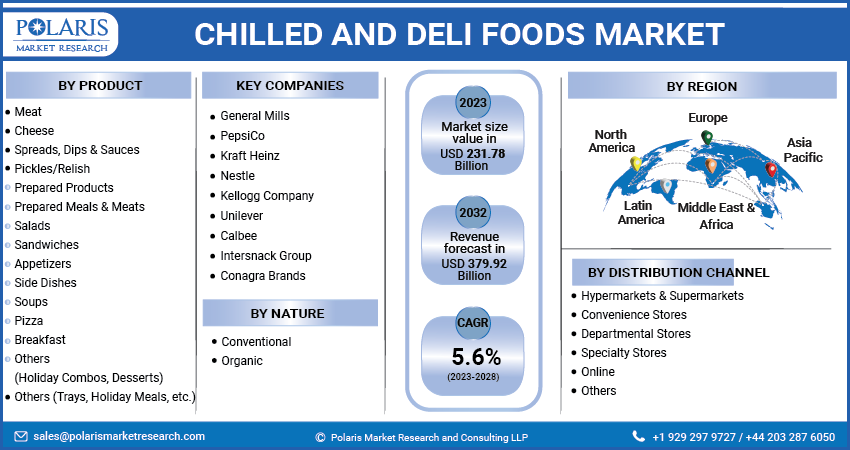

Chilled and Deli Foods Market Share, Size, Trends, Industry Analysis Report, By Product (Meat, Cheese, Prepared Products), By Nature (Conventional, Organic), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3780

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

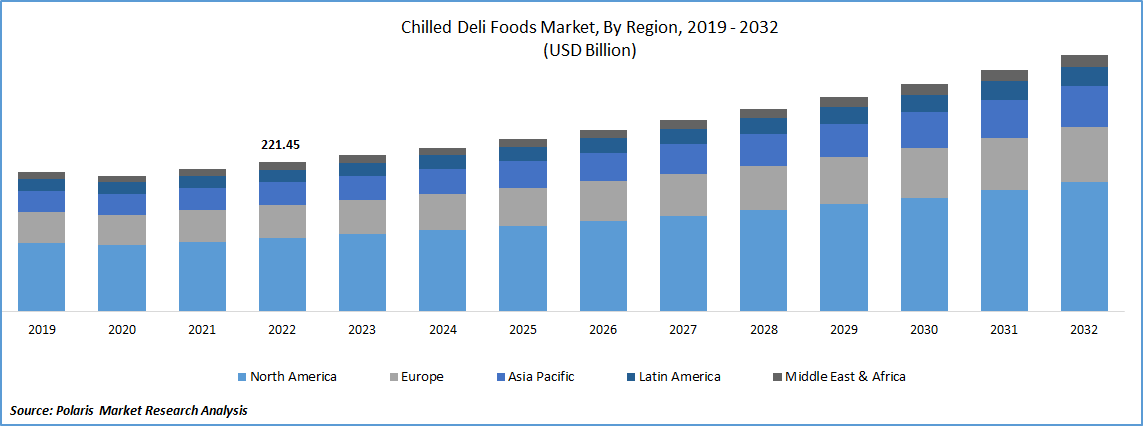

The global chilled and deli foods market was valued at USD 221.45 billion in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period.

Consumer preferences have evolved, with a growing demand for health-conscious products featuring clean label attributes like 'all-natural, 100% natural,' 'made with real' & 'organic.' This trend has gained even more momentum during the pandemic. Brands are under increasing pressure to diversify their offerings, leading to a shift in the frozen deli concept towards incorporating more plant-based, vegan, & organic ingredients. There is a rising demand for super foods that are organic, sourced locally, & additive-free, which has further contributed to the market expansion. As per the report published by the, Kerry Group, in 2020, around 26% of the consumers prioritize prepared foods as the most important factor when shopping for fresh foods, and 66% of the consumers purchase prepared snacks, meals, & other products from retail stores every month.

To Understand More About this Research: Request a Free Sample Report

Supermarket delis have experienced a surge in demand for prepared meals and superfoods, becoming a significant growth driver in recent years. Ready-to-serve meals, pre-sliced meats and cheeses, salads, and ready-to-heat-and-serve sides have become popular choices for consumers due to their convenience and time-saving benefits.

According to a report by the International Dairy Deli Bakery Association (IDDBA) for the year 2020, prepared meats, including pre-sliced ham, beef, bologna, salami, and pepperoni, witnessed substantial sales increases across various categories during that year.

Industry Dynamics

Growth Drivers

Technological Advancements

As new frozen food brands enter the market, brands are adopting various strategies to attract a new set of consumers. Online campaigns, re-branding, & innovative packaging are among the tactics being employed. For instance, Land O’Frost, experienced a significant 42% growth in sales for its Bistro Favorites meat brand in 2020. In response to this success, the company introduced 3 new flavors for the Bistro Favorites line, in April 2021. The new brand design features a hand-drawn logo and imagery of ingredients and sandwiches, emphasizing the brand's unique, handcrafted offerings. These innovative marketing strategies are expected to create artisanal and engaging experiences for shoppers.

Report Segmentation

The market is primarily segmented based on product, nature, distribution channel, and region.

|

By Product |

By Nature |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Prepared Foods Segment Accounted for the Largest Share in 2022

Prepared foods accounted for major global share. This segment is projected to maintain its leading position throughout the forecast period. The fast-paced lifestyles of individuals in both developed and developing countries are driving a notable shift among the working class towards convenient and ready-to-eat options, such as prepared meals, meats, salads, and sandwiches, which cater to the demand for chilled and deli foods. Prepared meals offer customers the assurance of high-quality food with delicious flavors and locally or organically sourced ingredients, all within an affordable price range. This consumer preference for convenient, yet quality food options is contributing to the sustained dominance of the prepared products segment in the market.

Increasing preference of consumers, particularly millennials, for prepared meals as a result of their busy lifestyles is expected to drive the growing demand in the chilled and deli foods market. Recognizing this trend, major brands operating in this segment are likely to seize the opportunity to expand their market share by introducing new and innovative prepared meal options. By catering to the needs of consumers seeking convenient and time-saving food choices, these brands aim to tap into the potential of the prepared meals segment and strengthen their presence in the market.

Spreads segment is likely to register highest growth rate. This surge in demand is attributed to the convenience and extended shelf-life offered by these products. Sauces, dips, and spreads provide consumers with ready-to-use options that enhance the taste and enjoyment of various dishes. As consumers' lifestyles become more fast-paced, there is an increasing preference for convenient and easy-to-consume products, making sauces, dips, and spreads a popular choice. Moreover, consumers are becoming more adventurous in their culinary preferences, seeking new and diverse flavors to enhance their dining experiences. Sauces, dips, and spreads cater to this demand by offering a wide range of flavors and options, allowing consumers to explore different cuisines and tastes.

By Nature Analysis

Conventional Segment Held Substantial Market Share in 2022

Conventional segment is projected to hold significant market share. This segment is expected to continue its stronghold over the forecast period, driven by the increasing consumer demand for chilled and premium foods, particularly in major countries like the U.S. & the UK. Consumers' preference for conventional products in supermarkets is expected to sustain their significant presence on the shelves. Furthermore, major players in the industry are actively engaged in strategic partnerships, launching new products, and implementing expansion strategies specifically targeting the conventional segment. These efforts are anticipated to contribute positively to the future growth of the market, ensuring the continued dominance of the conventional segment in the food and retail industry.

Organic segment witnessed steady growth. Segment’s growth is primarily due to increasing health and wellness consciousness among millennials. This consumer demographic is showing a strong inclination towards organic ingredients and is willing to invest in products that promote their well-being. According to a YouGov report from September 2019, approximately 51% of millennials in the U.S. reported purchasing more organic products, while 60% (aged 33-37 years) stated were frequently buying these products.

By Distribution Channel Analysis

Online Channels Segment is Anticipated to Witness Highest Growth During Forecast Period

Online segment is expected to grow at highest CAGR. Delicatessen brands have recognized the potential of online channels and have actively embraced this mode of distribution. As a result, many deli brands have expanded their presence to include online sales platforms, offering their products to consumers through e-commerce platforms. This shift towards online distribution channels has allowed producers of chilled and deli foods to directly reach consumers, bypassing traditional retail channels. As a result, consumers now have the convenience of purchasing these products directly from the producers through online platforms. This trend is expected to contribute to the higher growth rate of chilled and deli foods sold through online distribution channels during the forecast period.

Regional Insights

North America Region Dominated the Global Market in 2022

North America region dominated the global market. This dominance can be attributed to the increasing demand for convenient food products that can be consumed on the go. In the region, many consumers have incorporated chilled products, such as prepackaged sandwiches and prepared salads, into their regular meals as convenient options. Additionally, time-pressed individuals often rely on these chilled and deli foods as substitutes for their regular meals.

APAC is likely to emerge as fastest growing region. This growth is driven by the increasing sales of chilled and deli offerings, particularly in emerging economies, where modern retailers are expanding their presence. Companies in the region are investing in cold chain infrastructure to support the distribution of fresh and chilled packaged products, which has further fueled the market's expansion. The demand for convenience products that require minimal preparation or consumption time is a key driver of the market's growth in the region.

Key Market Players & Competitive Insights

The chilled deli foods market is fragmented and is anticipated to witness competition due to several players' presence. Major manufactuirers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Calbee

- Conagra Brands

- General Mills

- Kellogg Company

- Kraft Heinz

- Intersnack Group

- ITC Limited.

- Nestle

- PepsiCo

- Unilever

Recent Developments

- In June 2023, MamaMancini's Holdings, has recently introduced Mama's Creations, a new international deli foods platform.

- In June 2023, Prime Roots has made its entry into the New York City market by introducing plant-based deli meat. What sets Prime Roots apart is its successful recreation of the microscopic texture and umami taste of meat using entirely plant-based ingredients.

Chilled and Deli Foods Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 231.78 billion |

|

Revenue forecast in 2032 |

USD 379.92 billion |

|

CAGR |

5.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Nature, By Distribution Channel By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

General Mills, PepsiCo, Kraft Heinz, Nestle, Kellogg Company, Unilever, Calbee, Intersnack Group, Conagra Brands, and ITC Limited. |

FAQ's

The global chilled and deli foods market size is expected to reach USD 379.92 billion by 2032.

Key players in the chilled and deli foods market are General Mills, PepsiCo, Kraft Heinz, Nestle, Kellogg Company.

North America contribute notably towards the global chilled and deli foods market.

The global chilled and deli foods market is expected to grow at a CAGR of 5.6% during the forecast period.

The chilled and deli foods market report covering key segments are on product, nature, distribution channel, and region.