Chemiluminescence Immunoassay Market Size, Share, Trends, Industry Analysis Report: By Product (Instruments, Consumables, Reagents, and Others), Sample Type (Blood, Urine, Saliva, and Others), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1769

- Base Year: 2024

- Historical Data: 2020-2023

Chemiluminescence Immunoassay Market Overview

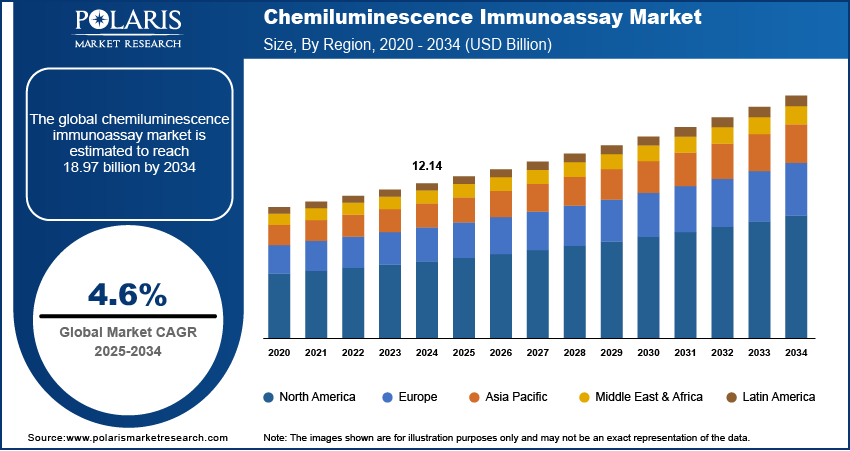

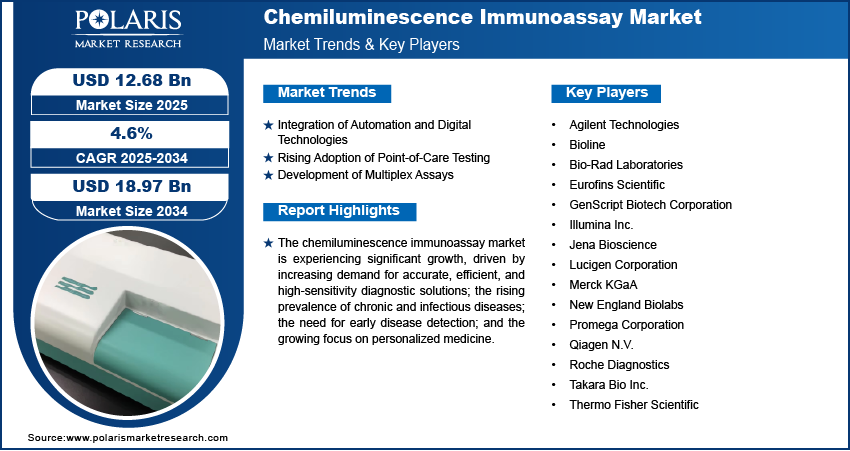

The chemiluminescence immunoassay market size was valued at USD 12.14 billion in 2024. The market is projected to grow from USD 12.68 billion in 2025 to USD 18.97 billion by 2034, exhibiting a CAGR of 4.6% during 2025–2034.

The chemiluminescence immunoassay (CLIA) market involves the application of chemiluminescence detection techniques in immunoassays to measure analytes with high sensitivity and specificity. This market is primarily driven by the growing prevalence of chronic diseases, increasing demand for advanced diagnostic solutions, and technological advancements in assay automation. Additionally, rising investments in healthcare infrastructure and a shift toward early disease detection contribute to its growth. Key chemiluminescence immunoassay market trends include the integration of CLIA systems with digital technologies, the development of multiplex assays, and the expansion of point-of-care testing applications, enhancing diagnostic efficiency and accessibility.

To Understand More About this Research: Request a Free Sample Report

Chemiluminescence Immunoassay Market Dynamics

Integration of Automation and Digital Technologies

The chemiluminescence immunoassay market is experiencing significant adoption of automated systems and digital technologies, enhancing laboratory workflow efficiency and accuracy. Automated CLIA analyzers are increasingly preferred due to their ability to process high sample volumes with minimal manual intervention. Digital integration enables real-time monitoring and data management, improving diagnostic precision. A report by the Clinical and Laboratory Standards Institute indicates that automation in diagnostic laboratories has reduced error rates by approximately 40%, streamlining clinical decision-making processes. Thus, the integration of automation and digital technologies drives the chemiluminescence immunoassay market development.

Rising Adoption of Point-of-Care Testing

Point-of-care (POC) testing is gaining momentum as healthcare systems prioritize rapid and decentralized diagnostics. Chemiluminescence-based POC devices provide accurate and timely results for critical markers such as cardiac troponins and thyroid-stimulating hormones. According to a study published in the Journal of Clinical Pathology, POC testing reduced turnaround times by up to 60% compared to centralized laboratory methods. This trend aligns with the growing emphasis on patient-centered care and the need for diagnostics in remote and resource-limited settings, which is expected to boost the chemiluminescence immunoassay market demand in the coming years.

Development of Multiplex Assays

The demand for multiplex assays, which allow simultaneous detection of multiple biomarkers, is driving innovation in the CLIA market. These assays offer enhanced diagnostic capabilities while reducing sample and reagent requirements. A study in the American Journal of Clinical Pathology highlighted that multiplex CLIA panels improved the detection rate of infectious diseases by 30% compared to single-analyte assays. The expanding application of multiplex systems in oncology, infectious diseases, and autoimmune disorders underscores their growing importance in the diagnostic landscape. Hence, the development of multiplex assays propels the chemiluminescence immunoassay market growth.

Chemiluminescence Immunoassay (CLIA) Market Segment Insights

Chemiluminescence Immunoassay Market Outlook – Product-Based Insights

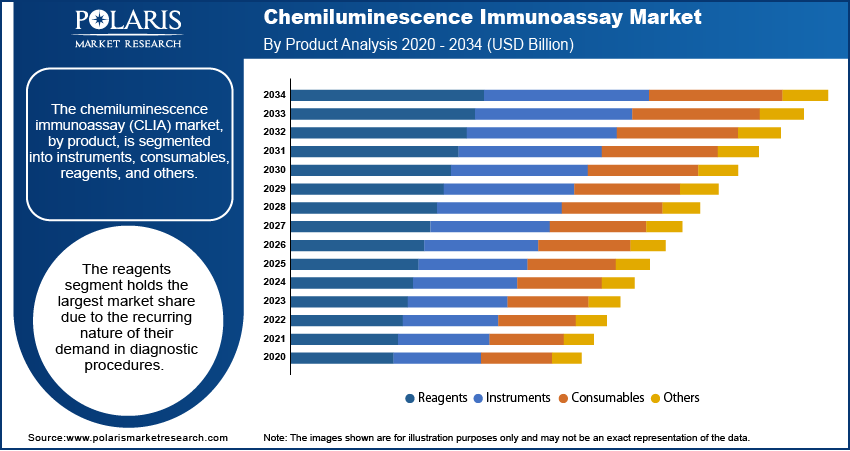

The CLIA market, by product, is segmented into instruments, consumables, reagents, and others. The reagents segment holds the largest market share due to the recurring nature of their demand for diagnostic procedures. Reagents are essential for assay workflows and are consumed continuously, driven by the increasing prevalence of chronic and infectious diseases requiring regular diagnostic monitoring. Additionally, the growing number of diagnostic laboratories and their adoption of CLIA technology contribute to the sustained dominance of this segment.

The consumables segment is expected to register the highest growth rate during the forecast period. The rising adoption of disposable consumables such as cartridges and microplates aligns with the growing emphasis on infection control and operational efficiency in laboratories and point-of-care settings. Innovations in consumable design, enhancing assay sensitivity and throughput, are further propelling this segment’s growth. The increasing focus on personalized medicine and high-throughput screening also drives demand for advanced consumables tailored for specific diagnostic applications.

Chemiluminescence Immunoassay Market Assessment – Sample Type-Based Insights

The chemiluminescence immunoassay (CLIA) market, by sample type, is segmented into blood, urine, saliva, and others. The blood sample segment dominates the CLIA market revenue share. Blood samples are extensively used due to their reliability and ability to provide comprehensive diagnostic insights for a wide range of conditions, including chronic diseases, infectious disorders, and metabolic irregularities. The high accuracy of blood-based assays in detecting biomarkers and the routine use of blood tests in healthcare facilities contribute to this segment’s prominence.

The saliva sample segment is projected to exhibit the highest growth rate during the forecast period, driven by its noninvasive nature and increasing acceptance in diagnostics. Saliva-based CLIA tests are gaining traction for applications such as hormone level assessments, drug testing, and infectious disease diagnostics. The growing demand for patient-friendly diagnostic solutions and advancements in saliva sample collection technologies further support the rapid growth of this segment. Expanding research into saliva as a diagnostic medium for conditions such as COVID-19 and other respiratory illnesses is also contributing to its rising adoption.

Chemiluminescence Immunoassay Market Evaluation – Technology-Based Insights

The CLIA market, by technology, is segmented into chemiluminescence enzyme technology, electrochemiluminescence immunoassay (ECLIA), and microparticle chemiluminescence immunoassay. ECLIA is widely recognized for its superior sensitivity, precision, and ability to detect low concentrations of analytes, making it a preferred choice for high-accuracy diagnostics. Its extensive application in oncology, endocrinology, and infectious disease testing, coupled with the growing availability of advanced ECLIA systems, underpins its dominant position.

The microparticle chemiluminescence immunoassay (MCLIA) segment is anticipated to register the highest growth rate due to its ability to enhance assay efficiency and throughput. MCLIA utilizes microparticles to increase the surface area for antigen-antibody interactions, improving sensitivity and reducing assay time. This technology is increasingly being adopted in laboratories handling large sample volumes and in point-of-care settings, where rapid and accurate diagnostics are essential. Advancements in microparticle-based assay platforms and their expanding application in multiplex testing further drive the growth of this segment.

Chemiluminescence Immunoassay Market Outlook – Application-Based Insights

The CLIA market, by application, is segmented into therapeutic drug monitoring, oncology, cardiology, endocrinology, infectious diseases, and others. The market is dominated by the infectious diseases segment, which holds the largest market share. This dominance is attributed to the high incidence of infectious diseases globally and the critical need for accurate and rapid diagnostics. CLIA’s high sensitivity and specificity make it an essential tool in identifying pathogens and monitoring disease progression, driving its widespread adoption in clinical and laboratory settings.

The oncology segment is expected to register the highest growth rate during the forecast period, fueled by the rising prevalence of cancer and the increasing focus on early detection and personalized medicine. CLIA assays are extensively used for tumor marker identification, aiding in early diagnosis, prognosis, and treatment monitoring. Continuous advancements in CLIA technologies and the growing demand for noninvasive diagnostic methods further contribute to the rapid expansion of this segment. Enhanced awareness of cancer screening programs and increased healthcare investments are also key factors supporting its growth.

Chemiluminescence Immunoassay Market Regional Insights

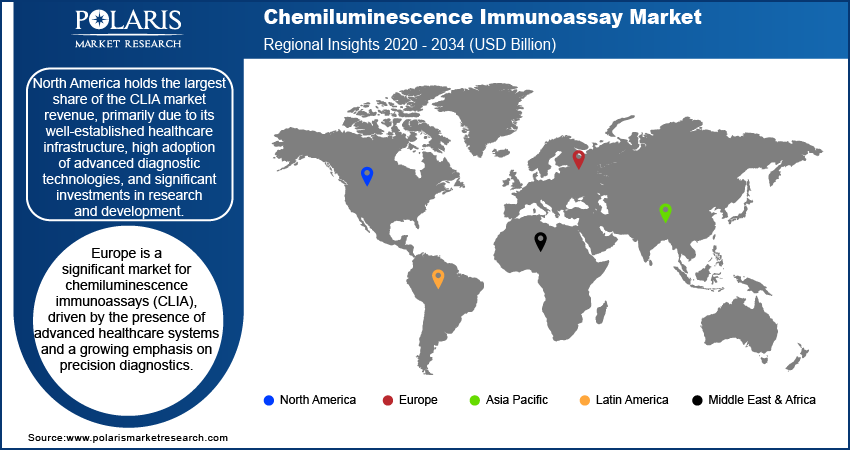

By region, the study provides chemiluminescence immunoassay market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to its well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, and significant investments in research and development. The presence of leading market players and the rising prevalence of chronic and infectious diseases further boost the region's dominance. Additionally, supportive government policies and the growing focus on personalized medicine contribute to the sustained demand for CLIA systems in North America.

Europe is a significant market for chemiluminescence immunoassays (CLIA), driven by the presence of advanced healthcare systems and a growing emphasis on precision diagnostics. The regional market benefits from strong governmental support for research and healthcare innovations and the rising prevalence of chronic diseases, mostly among the aging population. Countries such as Germany, France, and the UK contribute significantly to the market due to their robust diagnostic infrastructure and the adoption of advanced diagnostic technologies.

The Asia Pacific CLIA market is expected to witness the highest growth, owing to the expanding healthcare infrastructure, rising prevalence of chronic and infectious diseases, and increasing healthcare expenditure in emerging economies such as China and India. The region’s large population base and growing awareness of advanced diagnostic solutions further fuel demand. Additionally, the ongoing localization of manufacturing by key players and government initiatives to improve diagnostic access in rural areas are accelerating the chemiluminescence immunoassay market growth in Asia Pacific.

Chemiluminescence Immunoassay Market – Key Players and Competitive Insights

The chemiluminescence immunoassay (CLIA) market includes several prominent companies that actively develop and supply innovative solutions for diagnostic needs. A few key players include Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Beckman Coulter (a Danaher Corporation subsidiary), Ortho Clinical Diagnostics (now part of QuidelOrtho), DiaSorin, BioMérieux, Mindray Medical International, Sysmex Corporation, Tosoh Corporation, Shenzhen New Industries Biomedical Engineering (Snibe), Randox Laboratories, Biokit (a subsidiary of Werfen), PerkinElmer, and Fujirebio Diagnostics. These companies are engaged in offering diverse product portfolios, including reagents, instruments, and consumables, catering to various healthcare applications.

In terms of competitive analysis, major players such as Roche Diagnostics and Abbott Laboratories maintain significant market presence due to their well-established distribution networks, continuous product innovation, and strong research and development capabilities. These companies emphasize developing high-sensitivity assays and automated systems to address the growing demand for accurate and efficient diagnostics. Mid-sized players such as DiaSorin and Snibe have gained traction by focusing on niche markets and expanding their geographic footprint, particularly in emerging economies. Companies such as Sysmex and Mindray are leveraging their expertise to capture a significant share of the Asia Pacific CLIA market.

The chemiluminescence immunoassay market insights into the competitive landscape reveal that the market is characterized by a mix of global giants and regional specialists. Larger companies are increasingly pursuing strategic collaborations, acquisitions, and technological advancements to expand their offerings and maintain a competitive edge. Meanwhile, smaller players are focusing on cost-effective solutions and localized manufacturing to penetrate price-sensitive markets. The rising trend of integrating digital technologies into CLIA systems has intensified competition, prompting all players to enhance their capabilities in data management and connectivity to meet evolving customer needs.

Roche Diagnostics, a prominent player in the chemiluminescence immunoassay (CLIA) market, offers a wide range of diagnostic solutions for healthcare providers worldwide. The company focuses on developing high-precision CLIA systems and reagents tailored for various medical applications, including oncology, infectious diseases, and endocrinology.

Abbott Laboratories is another major contributor to the CLIA market, recognized for its innovative diagnostic technologies. Abbott’s portfolio includes a variety of CLIA-based assays designed for accurate detection and monitoring of health conditions.

List of Key Companies in Chemiluminescence Immunoassay Market

- Abbott Laboratories

- Beckman Coulter

- Biokit

- BioMérieux

- DiaSorin

- Fujirebio Diagnostics

- Mindray Medical International

- Ortho Clinical Diagnostics

- PerkinElmer

- Randox Laboratories

- Roche Diagnostics

- Shenzhen New Industries Biomedical Engineering

- Siemens Healthineers

- Sysmex Corporation

- Tosoh Corporation

Chemiluminescence Immunoassay Industry Developments

- In September 2023, Abbott introduced a next-generation diagnostic platform for chemiluminescence assays, enhancing test sensitivity and turnaround times to meet the growing demand for precise diagnostics in clinical laboratories.

- In June 2023, Roche announced the launch of a new set of assays for its cobas e immunoassay analyzer series, aimed at improving efficiency in high-throughput laboratory settings.

Chemiluminescence Immunoassay Market Segmentation

By Product Outlook

- Instruments

- Consumables

- Reagents

- Others

By Sample Type Outlook

- Blood

- Urine

- Saliva

- Others

By Technology Outlook

- Chemiluminescence Enzyme Technology

- Electrochemiluminescence Immunoassay

- Microparticle Chemiluminescence Immunoassay

By Application Outlook

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious diseases

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Chemiluminescence Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.14 billion |

|

Market Size Value in 2025 |

USD 12.68 billion |

|

Revenue Forecast by 2034 |

USD 18.97 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The chemiluminescence immunoassay market has been broadly segmented on the basis of product, sample type, technology, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at global and regional levels.

Growth/Marketing Strategy: The chemiluminescence immunoassay (CLIA) market growth strategy is centered around expanding product portfolios, technological advancements, and geographic reach. Companies are increasingly investing in research and development to enhance the sensitivity, speed, and automation of CLIA systems. Strategic partnerships, acquisitions, and collaborations with healthcare providers and research institutions also play a critical role in market expansion. Additionally, players are focusing on entering emerging markets, particularly in Asia Pacific and Latin America, where there is a rising demand for advanced diagnostic solutions. Furthermore, the integration of digital technologies and AI in diagnostic platforms is a key focus to improve efficiency and data management capabilities.

FAQ's

? The chemiluminescence immunoassay market size was valued at USD 12.14 billion in 2024 and is projected to grow to USD 18.97 billion by 2034.

? The market is projected to register a CAGR of 4.6% during 2025–2034.

? North America held the largest share of the market in 2024.

? A few key market players are Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Beckman Coulter (a Danaher Corporation subsidiary), Ortho Clinical Diagnostics (now part of QuidelOrtho), DiaSorin, BioMérieux, Mindray Medical International, Sysmex Corporation, Tosoh Corporation, Shenzhen New Industries Biomedical Engineering (Snibe), Randox Laboratories, Biokit (a subsidiary of Werfen), PerkinElmer, and Fujirebio Diagnostics.

? The reagents segment accounted for the largest share of the market in 2024.

? The blood sample segment accounted for the largest share of the market in 2024.

? Chemiluminescence Immunoassay (CLIA) is a diagnostic technique used to measure the concentration of specific substances, such as hormones, proteins, or antibodies, in biological samples. It works by using chemiluminescent reagents that emit light when they undergo a chemical reaction. In a typical CLIA test, an antigen (such as a disease marker) in the sample binds to a specific antibody tagged with a chemiluminescent substance. The light emitted from this reaction is then measured, and the intensity of the light is directly proportional to the amount of the target substance in the sample. CLIA is widely used in clinical laboratories for its high sensitivity, accuracy, and ability to process multiple samples quickly.

? A few key chemiluminescence immunoassay market trends are described below: Automation and Digital Integration: Increasing adoption of automated systems and digital platforms for real-time data analysis and improved diagnostic efficiency. Point-of-Care Testing Growth: Rising demand for CLIA-based point-of-care diagnostic solutions for faster results and better patient accessibility. Multiplex Assays Development: Growing preference for multiplex assays that allow the simultaneous detection of multiple biomarkers in a single test. Technological Advancements: Continuous improvements in chemiluminescent reagents and assay platforms to enhance sensitivity, speed, and accuracy.

? A new company entering the chemiluminescence immunoassay (CLIA) market must focus on developing innovative, cost-effective solutions that improve assay sensitivity and reduce turnaround times. Investing in automation and AI-driven platforms to streamline diagnostic processes and enhance data analysis could provide a competitive edge. Additionally, exploring noninvasive sample types, such as saliva-based assays, and expanding into emerging markets with high growth potential would be strategic. Forming partnerships with healthcare providers and research institutions to create tailored, region-specific diagnostic solutions could also help differentiate the company in the market.

? Companies manufacturing, distributing, or purchasing chemiluminescence immunoassay and related products and other consulting firms must buy the report.