Chemical Injection Skids Market Share, Size, Trends, Industry Analysis Report

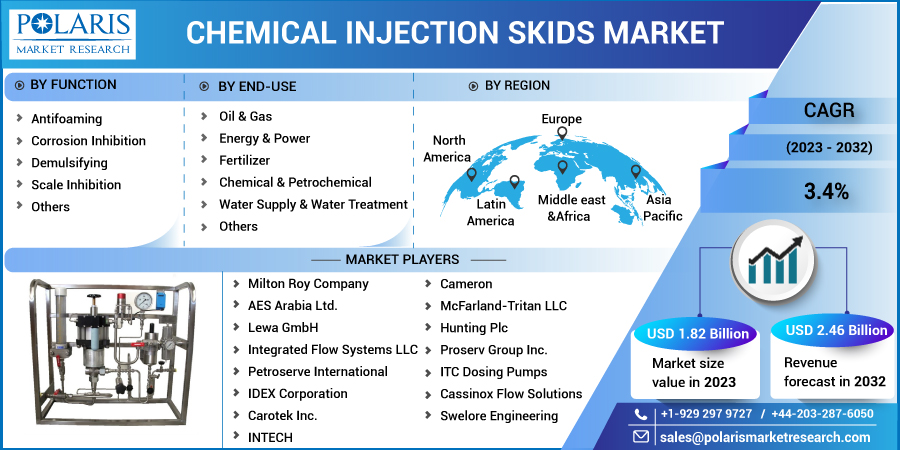

By Function (Antifoaming, Corrosion Inhibition, Demulsifying, Scale Inhibition, Others); By End-Use, By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 116

- Format: PDF

- Report ID: PM2987

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

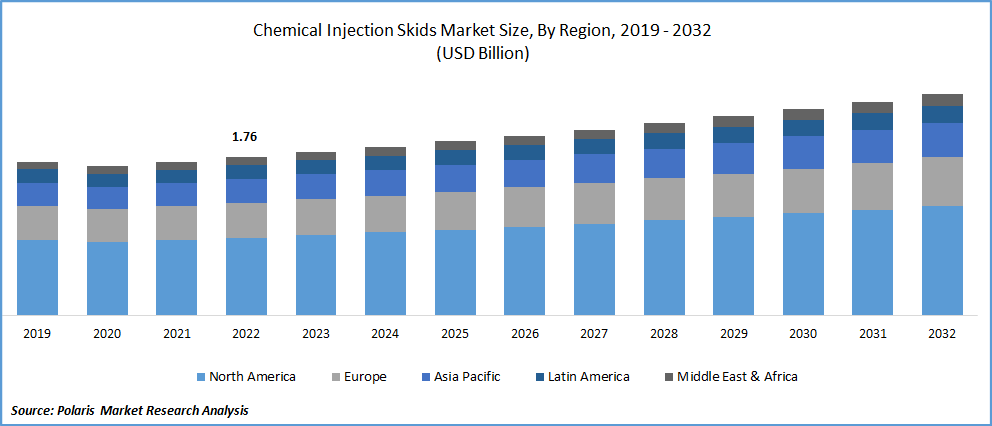

The global chemical injection skids market was valued at USD 1.76 billion in 2022 and is expected to grow at a CAGR of 3.4% during the forecast period.

The continuously growing prevalence and adoption of chemical injection skids in wastewater treatment and oil & gas industries across the globe, as it helps to inject precise amounts of specific chemicals into a system at the required temperature, flowrates, and pressure that improves the overall treatment process, is a key factor boosting the growth of the global market.

Know more about this report: Request for sample pages

Moreover, rapid growth in the usage of these types of skids in various end-use industries including fertilizer, energy & power, chemical, and many others coupled with the rising investment by both government and private organizations to innovate and develop more technologically advanced products are likely to contribute positively to the chemical injection skids market growth.

For instance, in July 2022, SPX Flow expanded its innovation center in Xidu, China by featuring state-of-the-art equipment. The innovation center will be specialized in testing and designing clients’ mixing requirements, mainly in the field of chemical processing, water treatment, and pharmaceuticals.

In addition, in the last few years, modular integrated chemical injection skids are gaining comparatively high popularity and traction due to their wide range of beneficial features such as space efficiency, improved safety features, faster fabrication, cost-effectiveness, Increased applications in hazardous areas, and installation process. Due to these functions, companies that operate and build processing systems are extensively looking for higher integration of these types of skids into their processes for higher efficiencies, which is expected to create high growth opportunities for the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the chemical injection skids market. The emergence of deadly virus confronted a lot of difficulties and problems in operating businesses and manufacturing facilities, as most countries have imposed lockdowns and many other restrictions on trade activities due to which, there were huge disturbances in production and even in global supply chain. The gathering of raw materials, delivery of the end product, and receiving the desired workforce all was at stake during the pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing demand for chemical injection skids in the formulation of a variety of deposits including wax, foam, and scales in the liquid chemical treatment systems along with the demand for hydrate control processes due to its application of removing and preventing blockages in oil & gas industries to reduce the loss of production and enhancement of flow are key factors favoring market growth.

Furthermore, several manufacturers of chemical injection skids are emphasizing providing that type of system, which easily complies with consumer-specific needs and requirements and design regulations along with improved 3D modeling and extensive after-sales service & support to stay ahead of its competitors and strengthen its market position, are expected to fuel the demand and adoption of these skids rapidly across the globe.

Report Segmentation

The market is primarily segmented based on function, end-use, and region.

|

By Function |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Corrosion inhibition function segment accounted for the largest market share

The corrosion inhibition function segment accounted for a major global market share in 2022 and is likely to grow considerably over the coming years owing to its ability to extend the lifespan of the equipment up to 250%, reduce the overall repairing cost due to corrosive damage, and high adsorbing and solubility. Corrosion inhibition has found its extensive applications including cooling tower water treatment, open recirculating cooling systems, boiler heat transfer surfaces, and closed-circuit cooling and heating systems across various end-use industries, and is projected to gain significant growth.

However, the scale inhibition segment is expected to register the fastest growth over the forecast period, which is mainly accelerated by its high usage in the fluid flow systems for the purpose to avoid the aggregation of various insoluble compounds. It mainly consists of a technique, which is specifically created and developed to minimize the rate of scale development for increasing oil, gas, and water production in the industries.

Oil & gas segment dominated the global market in 2022

The oil & gas segment dominated the market. This is due to growing use of chemical injection to inject various types of specialty chemicals to increase separation, prevent corrosion, and decrease foaming along with its growing demand wide range of offshore and onshore activities to enhance oil recovery applications. Moreover, continuously growing investments in oil & gas sector development by governments of various countries across the globe and a surge in oil & gas trade activities among many countries, will augment the demand for chemical injection skids significantly shortly.

For instance, according to an analysis by Rystad Energy, world’s total investment in oil & gas sector increased by about USD 26 billion in 2022, an overall rise of 4% to USD 628 billion from USD 602 billion in 2021. Upstream oil investments are estimated to rise to nearly USD 307 million this year with a significant rise of 7% from 2021.

Furthermore, the water supply & water treatment segment is anticipated to witness highest CAGR throughout the projected period on account of rapidly growing need and demand for these skids to treat the wastewater produced and also for inhibition of various other gasoline and other additives. Moreover, increasing prevalence of coagulant dosing with the help of chemical injection skids to aid in the coagulation of solids is likely to fuel the demand for the market in the coming years.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is anticipated to expand at the fastest growth rate during the forecast period, which is mainly driven by extensive growth in various end-use industries including energy & power and oil & gas and high consumption of oil & gas with the availability of large refinery capacity. In addition, rising number of water treatment and power plants in countries like China, India, and Indonesia coupled with the surge in innovations in several sectors including automotive, energy transformation, electronic, and construction in the region are likely to augment the growth of the market.

However, North America led the industry and accounted for the maximum market share in 2022 and is expected to maintain its dominance throughout the anticipated period. The growing penetration of water quality inspections and regulations and increasing government favorable initiatives are major factors driving the growth of the market. Additionally, the growing expansion of the petrochemicals industry, which fuels the demand for these kids for injecting inhibitors and gasoline to fuel oils across the region is likely to propel the market over the coming years.

Competitive Insight

Key players include Milton Roy Company, AES Arabia, Lewa GmbH, Integrated Flow Systems, Petroserve International, IDEX Corporation, Carotek Inc., INTECH, SPX FLOW, Proserv UK, SEKO, Cameron, McFarland-Tritan, Hunting Plc, Proserv Group, ITC Dosing Pumps, Cassinox Flow Solutions, and Swelore Engineering.

Recent Developments

In August 2021, Ingersoll Rand acquired Maximus Solutions with an enterprise value of around USD 100 million. With this acquisition, the company is expected to transform its precision and science technologies by using Ingersoll Rand Execution Excellence as a catalyst.

In May 2022, IDEX Corporation acquired KZValve LLC. The acquisition has been aimed at, enhancing the company’s portfolio of products, empowering OEMs, and providing efficient crops to the farmers.

Chemical Injection Skids Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.82 billion |

|

Revenue forecast in 2032 |

USD 2.46 billion |

|

CAGR |

3.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Function, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Milton Roy Company, AES Arabia Ltd., Lewa GmbH, Integrated Flow Systems LLC, Petroserve International, IDEX Corporation, Carotek Inc., INTECH, SPX FLOW Inc., Proserv UK Ltd., SEKO S.p.A., Cameron, McFarland-Tritan LLC, Hunting Plc, Proserv Group Inc., ITC Dosing Pumps, Cassinox Flow Solutions, and Swelore Engineering. |

FAQ's

Chemical Injection Skids Market Size Worth $2.46 Billion By 2032

key players are Milton Roy Company, AES Arabia, Lewa GmbH, Integrated Flow Systems, Petroserve International, IDEX Corporation, Carotek Inc., INTECH, SPX FLOW, Proserv UK, SEKO.

Asia Pacific contribute notably towards the global chemical injection skids market.

The global chemical injection skids market expected to grow at a CAGR of 3.4% during the forecast period.

key segments are function, end-use, and region.