Central Lab Market Share, Size, Trends, Industry Analysis Report, By Service, By End-use (Pharmaceutical Companies, Biotechnology Companies, Academic & Research Institutes), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4419

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

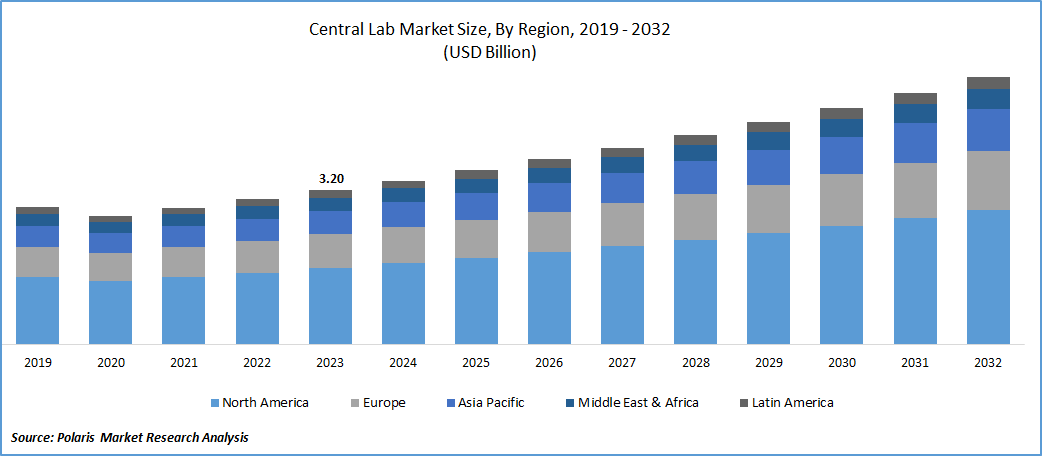

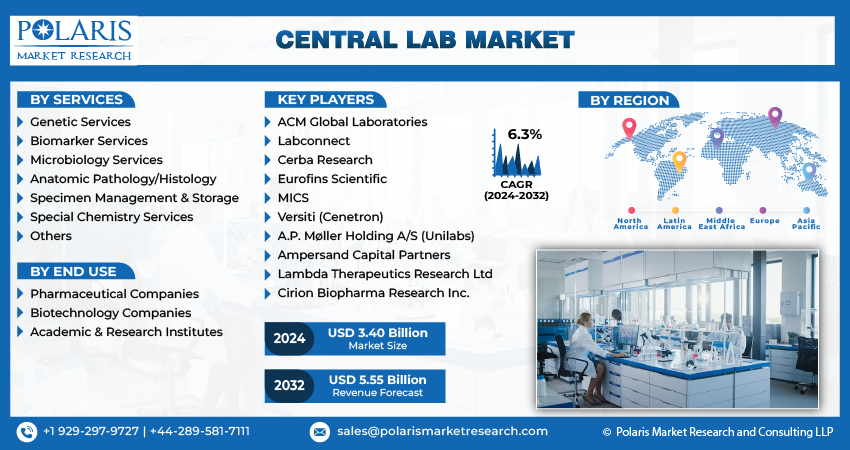

The global central lab market was valued at USD 3.20 billion in 2023 and is expected to grow at a CAGR of 6.3% during the forecast period.

Growth is driven by the increased investments in research and development (R&D) and a heightened focus of sponsors and investigators on reducing research costs. Additionally, the rising trend of pharmaceutical and biotechnology companies, as well as other end users, opting for outsourcing laboratory services to curtail overall research expenses is contributing to the market's growth over the forecast period. Insights from a 2022 survey conducted with biopharmaceutical companies indicate that the outsourcing trend is expected to persist in the coming years, enabling investigators to concentrate on trial-related activities.

The increasing demand for novel drugs to treat various diseases is driven by growing awareness and a trend towards personalized treatment approaches. Additionally, the rapid pace of innovation cycles is enabling products to advance into preclinical stages, presenting opportunities for central labs. The heightened demand is also influenced by technological advancements, which not only facilitate treatments but also offer potential cures for diseases. A significant part of this progress is linked to the growing popularity of personalized medicine and therapies. The expansion of biotechnology-based treatments, including cell and gene therapy, is expected to contribute to the market's growth, supported by the stringent guidelines associated with clinical trials in the biotechnology sector.

To Understand More About this Research:Request a Free Sample Report

In the realm of clinical trials, a vital component is the collection, analysis, and documentation of specimens from the participants. These tasks are commonly delegated to central labs, which offer services such as specimen collection kits, logistics, safety alerts, & comprehensive array of testing and reporting services. Approximately 80% of the central lab work in the clinical trials is outsourced, and there is a preference for labs that provide integrated services. The findings of a 2022 survey with bio-pharmaceutical companies indicate that the trend of outsourcing is anticipated to persist in the coming years, allowing investigators to concentrate on the trial itself.

Consumers' inclination towards small- and medium-scale enterprises is growing due to the availability of comprehensive and specialized laboratory solutions.

- For instance, in February 2023, Cerba Research formalized a Memorandum of Understanding (MoU) with Teddy Clinical Research Laboratory to establish a joint venture. This collaboration aims to leverage Teddy's well-established reputation in mainland China, particularly for delivering high-quality central lab solutions with over 12 years of clinical trial experience.

Cerba Research, known for its technical capabilities and scientific expertise, excels in areas such as vaccines, immuno-oncology, cell & gene therapy, and infectious disease research drug development.

The introduction of state-of-the-art and innovative instruments in the new laboratory is anticipated to enhance automation, leading to more efficient results and high-quality data. In May 2023, the China Association of Clinical Laboratory Practice Expo emerged as the foremost exhibition for In Vitro Diagnostics (IVD) within China. Attracting over 30,000 experts, including entrepreneurs, scholars, users, and thought leaders in the clinical laboratory sector from around the world, CACLP facilitates the exchange of industry advancements. It serves as a platform for strengthening collaborations and collectively shaping the future of the IVD industry. However, fluctuations in government regulations have the potential to negatively impact the growth of the central lab market.

Industry Dynamics

Growth Drivers

- Increasing Clinical Trials

The growing number of clinical trials, especially in the pharmaceutical and biotechnology sectors, is a significant driver for the central lab market. Central laboratories play a crucial role in providing standardized testing services, ensuring data accuracy and reliability.

The heightened emphasis on diagnostics due to the impact of COVID-19 has resulted in increased funding for innovative diagnostics that have the potential to enhance diagnostic capabilities. In April 2023, as highlighted in the LabCentral 2022 Impact Report, companies secured a total funding amount of USD 6.1 billion, representing 21% of early-stage funding globally. Additionally, these companies enrolled 4,504 participants in 37 clinical trials and were granted nearly, 56 patents. These strategic initiatives are expected to contribute to an increased demand for central laboratory services for clinical studies in the country.

Report Segmentation

The market is primarily segmented based on services, end use, and region.

|

By Services |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Services Analysis

- Biomarkers segment accounted for the largest market share in 2023

Biomarkers segment accounted for the largest share. Biomarkers offer a promising avenue for clinical development programs, providing insights into new diagnostic pathways and understanding disease mechanisms for the development of improved therapeutics. Biomarker studies play a crucial role in early disease detection, assessing the risk of side effects associated with investigational therapies, and monitoring disease progression in patients during clinical trials.

Additionally, market players are enhancing their biomarker service offerings to bolster their position in the market. For instance, in January 2023, Unilabs collaborated with the Ambry Genetics to enhance its high-quality genetic testing services for biopharmaceutical companies conducting clinical trials in Europe, Latin America, and the Middle East.

Genetic services segment will grow rapidly. The market's expansion is attributed to the growing importance of genetic analysis in clinical studies. Unraveling the underlying genetic factors can contribute to the development of targeted therapies for various diseases, including cancer and inherited conditions. Moreover, genetic variations in drug metabolism pathways may impact a patient's response to treatment. The increasing focus on research activities in genetic testing is anticipated to drive the demand for central lab genetic services. In December 2022, the Cystic Fibrosis Foundation Therapeutics Lab announced initiatives to facilitate the development of genetic-based therapies for individuals with cystic fibrosis.

By End Use Analysis

- Pharmaceutical companies segment held the significant market share in 2023

Pharmaceutical companies segment held the significant market share. Pharmaceutical companies heavily depend on central laboratory service providers for assessing the effectiveness of new drug products. These service providers offer a range of tests, including biochemistry, hematology, immunology, real-time PCR, & clinical pathology, to evaluate investigational drugs. Additionally, market participants are engaging in partnerships with pharmaceutical companies to enhance their service offerings and broaden their geographical presence.

Biotechnology companies’ segment is expected to gain substantial growth rate during the course of study period. This growth is attributed to the heightened focus on developing biological therapies in the upcoming years. It is projected that by 2025, the U.S. FDA will approve 10 to 20 cell and gene therapy products annually. The market for services related to cell and gene therapy, encompassing contract development and manufacturing, analytical testing, and regulatory consulting, is also experiencing rapid expansion to meet the increasing demand for these advanced therapies.

Regional Insights

- North America region dominated the global market in 2023

The North America region dominated the global market. The driving force behind this market dominance is the increasing adoption of molecular testing, renowned for its high accuracy, sensitivity, and specificity. Additionally, the region is experiencing a high prevalence of infections, particularly Sexually Transmitted Infections (STIs) and tuberculosis. This prevalence is expected to fuel the demand for clinical research focused on the development of diagnostic devices and therapeutics. For instance, as per the Centers for Disease Control and Prevention (CDC), the U.S. is anticipated to witness over 20 million new cases of STIs annually by March 2022, incurring costs ranging from USD 10 billion to USD 17 billion per year. This prevalence is expected to further escalate.

The Asia Pacific will grow with substantial pace. This surge is attributed to the escalating adoption of central lab services in the region. Factors contributing to this growth include urbanization, rising disposable income, increased awareness about the prevention of severe diseases, and enhanced education. As a result, the market is anticipated to flourish in the region.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- ACM Global Laboratories

- Labconnect

- Cerba Research

- Eurofins Scientific

- Medicover Integrated Clinical Services (MICS) (Synevo Central Labs)

- Versiti (Cenetron)

- A.P. Møller Holding A/S (Unilabs)

- Ampersand Capital Partners (Pacific Biomarkers)

- Lambda Therapeutics Research Ltd

- Cirion Biopharma Research Inc.

Recent Developments

- In May 2023, LabConnect has formed a strategic alliance with Labor Dr. Wisplinghoff to deliver customized and high-quality central lab services in Europe.

Central Lab Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.40 billion |

|

Revenue forecast in 2032 |

USD 5.55 billion |

|

CAGR |

6.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Services, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Central Lab Market Size Worth $ 5.55 Billion By 2032.

The top market players in Central Lab Market include ACM Global Laboratories, Labconnect, Cerba Research.

North America contribute notably towards the Central Lab Market

The global central lab market and is expected to grow at a CAGR of 6.3% during the forecast period.

Central Lab Market report covering key segments are services, end use, and region.