Cellulosic Fire Protection Intumescent Coatings Market Share, Size, Trends, Industry Analysis Report, By Type (Water Borne, Solvent Borne); By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 121

- Format: PDF

- Report ID: PM2008

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

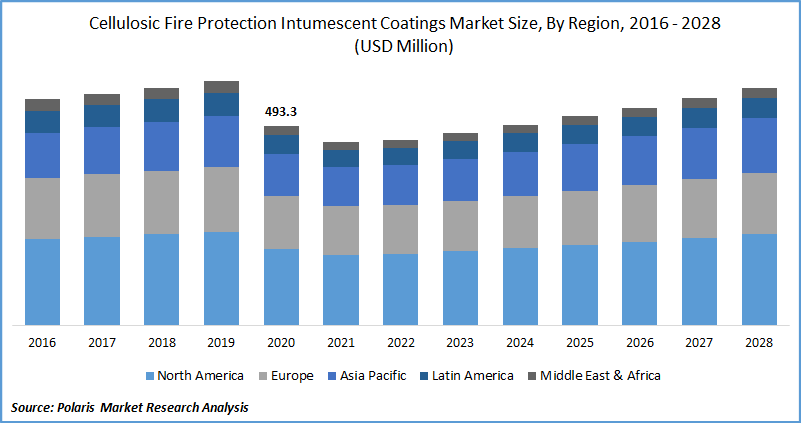

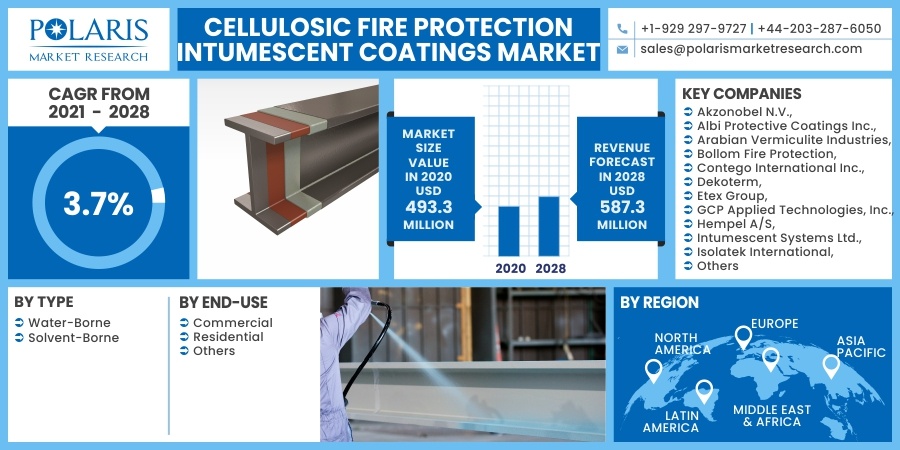

The global cellulosic fire protection intumescent coatings market size was valued at USD 493.9 million in 2020 and is expected to grow at a CAGR of 3.7% during the forecast period. Cellulosic flame protection intumescent coatings are used as passive combustion safety to safeguard buildings and structural steel. These products provide a smooth aesthetic finish, adaptability, and ease of application. They decrease application time while also reducing associated costs. They offer mechanical strength for avoiding impact damage and flexibility to adjust to structural movements due to load modifications and temperature alterations. The solutions are used in residential and commercial buildings, drilling platforms, petrochemical plants, storage plants, and refineries.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 outbreak has restricted the market growth for cellulosic flame protection intumescent coatings. The construction industry has been impacted by operational challenges, disruption of supply chain, delayed installations, deferred maintenance, and workforce impairment. Manufacturing activities have been halted due to various government regulations across the globe. The market is expected to gain traction post-COVID-19 driven by supportive government regulations, favorable safety regulations, and the development of energy-efficient and intelligent buildings.

Industry Dynamics

Growth Drivers

The increasing use of these solutions in residential and commercial buildings, growing investment in the construction industry, and development of public infrastructure are factors driving the growth of the market. Increasing safety concerns and the introduction of stringent building regulations have resulted in greater demand for cellulosic protection intumescent coatings. Technological advancements associated with material and coating, and rising investments in R&D have increased the application of cellulosic protection intumescent coatings. The rise in industrialization and urbanization across the globe, increasing disposable income, and improving living standards have strengthened the construction sector in countries such as China, Japan, South Korea, and India.

Cellulosic protection intumescent coatings enhance the flame resistance of building structures, delaying damage, and prolonging rescue operation time. In contact with the flames, these solutions increase their volume to form a layer of char with protective and insulating properties on the metal. This leads to a rise in steel temperature, thereby maintaining the load capacity of the structure. Market players are developing new innovative products to cater to growing consumer demands.

In May 2021, Hempel introduced its new product, Hempafire Pro 400, a new passive flames protection coating. The new product aims to provide safety and maintain the stability of steel structures against fire for up to 120 minutes. These solutions offer low loadings to improve efficiency. They provide insulation to steel during a fire, thereby strengthening its load-bearing capacity to provide time for emergency response.

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

The type segment has been divided into water-borne cellulosic fire protection intumescent coatings and solvent-borne cellulosic fire protection intumescent coatings. Water-borne cellulosic fire protection intumescent coatings are widely used owing to their ease of use and decreased fire risks. These solutions are used owing to greater environmental concerns and reduced VOC emissions associated with water-borne solutions.

Insight by End-Use

On the basis of end-use, the market for cellulosic fire protection intumescent coatings is segmented into commercial, residential, and others. The commercial segment accounted for a major market share of cellulosic fire protection intumescent coatings in 2020. Increasing investments in the construction sector, development of public infrastructure, rising adoption of energy-efficient buildings, and use of less toxic materials have increased the demand for cellulosic fire protection intumescent coatings. Governments across the globe are investing significantly towards the development of sustainable and green buildings and offering incentives and schemes to promote its adoption, supplementing the growth of the segment.

Geographic Overview

North America dominated the global cellulosic fire protection intumescent coatings market in 2020. Stringent regulation regarding fire safety in buildings, strengthening the construction sector, and the presence of leading players in the market for cellulosic fire protection intumescent coatings drive the growth in the region. Growing research and development activities and policies regarding low VOC emissions further support the market growth. Rising applications in residential as well as commercial applications have increased the demand for these coatings in the region. Increasing environmental concerns and the growing construction of green and smart buildings are expected to offer growth opportunities for cellulosic fire protection intumescent coatings during the forecast period.

Competitive Landscape

The leading players in the cellulosic fire protection intumescent coatings market include Isolatek International, Teknos Group Oy, Hempel A/S, Jotun Group, Sika AG, Etex Group, Akzo Nobel N.V., RPM International Inc, PPG Industries, Inc., Isolatek International, Contego International Inc., 3M, The Sherwin-Williams Company.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Cellulosic Fire Protection Intumescent Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 493.3 million |

|

Revenue forecast in 2028 |

USD 587.3 million |

|

CAGR |

3.7% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Akzonobel N.V., Albi Protective Coatings Inc., Arabian Vermiculite Industries, Bollom Fire Protection, Contego International Inc., Dekoterm, Etex Group, GCP Applied Technologies, Inc., Hempel A/S, Intumescent Systems Ltd., Isolatek International, J.F. Amonn Srl, Jotun Group, Kansai Paints Co. Ltd., PPG Industries, Inc., RPM International Inc., Rudolf Hansel GmbH, Sika AG, Teknos Group, The Sherwin-Williams Company |