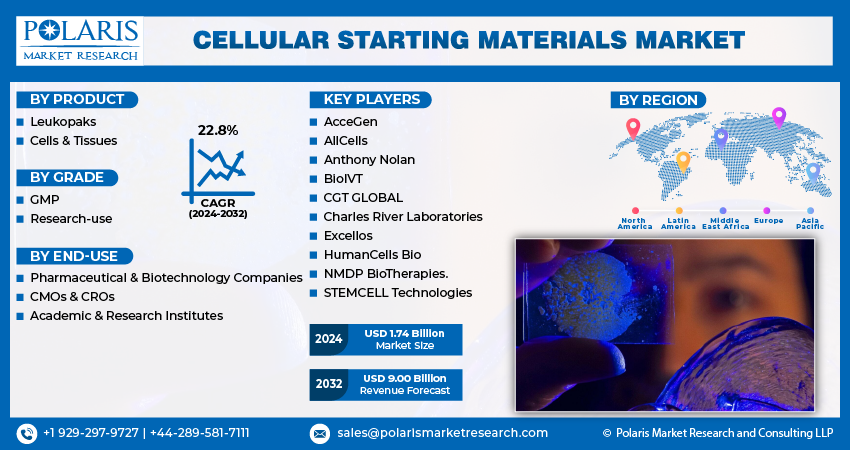

Global Cellular Starting Materials Market Size, Share, Trends, Industry Analysis Report: Information By Product (Leukopaks, Cells & Tissues), By Grade, By End-Use and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 116

- Format: PDF

- Report ID: PM4986

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Global cellular starting materials market size was valued at USD 1.43 billion in 2023. The cellular starting materials industry is projected to grow from USD 1.74 billion in 2024 to USD 9.00 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.8% during the forecast period (2024 - 2032). The cellular starting materials market encompasses a wide range of biological substances used as the foundation for manufacturing cellular therapies. These materials, such as stem cells, primary cells, and cell lines derived from various sources including human, animal, or microbial origins, play a crucial role in the development of advanced therapies and regenerative medicine. They serve as the fundamental building blocks for generating therapeutic products aimed at treating diseases and disorders at the cellular level. The growing number of chronic diseases such as cancer, diabetes, and autoimmune disorders is a major factor driving the cellular starting materials market. There is a rising demand for high-quality cellular starting materials to support innovative cell and gene-based therapies due to the global increase in chronic disease cases. Currently, there are over 1,000 ongoing clinical trials for cell and gene therapies, with a focus on cancer treatments like chimeric antigen receptor (CAR)-T cell therapies. For example, in March 2024, the FDA approved lifileucel (Amtagvi), the first TIL therapy for advanced melanoma, marking a significant advancement in cancer treatment with immune cell therapies.

To Understand More About this Research: Request a Free Sample Report

In addition, technological advancements have played a crucial role in the growth of the cellular starting materials market. Ongoing improvements in bioprocessing technologies have enhanced the efficiency and scalability of manufacturing cellular starting materials. Furthermore, advances in cell culture techniques and quality control measures have also enabled companies to meet the increasing demand for cellular starting materials. The technological breakthroughs have been instrumental in supporting the development and production of high-quality cellular starting materials, which are essential for the success of cell and gene-based therapies. This, in turn, drives the growth of the cellular starting materials market.

Cellular Starting Materials Market Trends:

Increasing Demand for Biopharmaceuticals is Driving the Market Growth

The demand for cellular starting materials (CSMs) is experiencing substantial growth driven by the increasing prominence of biopharmaceutical products in healthcare. Biopharmaceuticals, including monoclonal antibodies and vaccines, are crucial for treating a wide range of diseases, such as cancer, autoimmune disorders, and infectious diseases. These complex therapies often rely on CSMs as essential raw materials for their production processes.

The advancements in biotechnology and immunotherapy expand the scope of biopharmaceutical applications, resulting in rising demand for high-quality CSMs for manufacturing, which fueled the cellular starting materials market CAGR. For instance, in September 2022, Cryoport and Takeda's BioLife Plasma Services partnered to enhance the supply chain for cellular therapies, aiming to standardize apheresis collection and improve access to high-quality cellular starting materials.

Growing Awareness and Acceptance of Personalized Medicine Propels the Market

The paradigm shift towards personalized medicine is revolutionizing healthcare by focusing on treatments tailored to the unique genetic, molecular, and physiological characteristics of individual patients. This approach not only aims to improve treatment outcomes but also minimizes adverse effects by targeting therapies more precisely. Cellular starting materials (CSMs) play a crucial role in personalized medicine, as they serve as the essential components for creating therapies that are customized to each patient's specific needs.

Personalized medicine often involves therapies such as cell-based treatments, gene therapies, and personalized vaccines, all of which require CSMs that match the patient's biological profile. For example, in cell therapy, patient-derived cells are often modified or expanded ex vivo before being reintroduced into the patient. These cellular therapies rely heavily on high-quality CSMs to ensure that the cells used in treatment are potent, safe, and effective. The demand for CSMs is expected to increase, driven by the need for reliable and standardized starting materials that can support the development and delivery of these innovative therapies.

In response to this growing demand, biopharmaceutical companies and research institutions are investing in technologies and infrastructure to enhance the production and quality control of CSMs. Regulatory agencies are also adapting to support the development and commercialization of personalized therapies, which is driving the cellular starting materials market revenue.

Cellular Starting Materials Market Segment Insights:

Cellular Starting Materials Type Insights:

The global cellular starting materials market segmentation, based on type, includes leukopaks and cells & tissues. In 2023, the cellular starting materials market was mainly dominated by the leukopaks segment. This growth is primarily fueled by their essential role in biomedical and biotechnological applications. Leukopaks, comprised of concentrated leukocytes collected from donors, are crucial resources for various cell therapies and research efforts. The increasing demand for cell-based therapies, particularly in the advancement of treatments such as CAR-T cell therapies, emphasizes the necessity of leukopaks. These therapies utilize modified white blood cells to precisely target and fight cancer cells, highlighting the vital role of leukopaks in modern oncological treatments.

Moreover, leukopaks are pivotal in biomedical research, where they facilitate the study of immune responses, inflammatory diseases, and other conditions requiring the use of human leukocytes. In addition, in biotechnology, the demand for leukopaks is driven by advancements in genetic engineering and cell culture techniques. These techniques require high-quality starting materials to support the development and production of biopharmaceuticals and vaccines. Leukopaks, meeting stringent quality and regulatory standards, provide biotechnological firms with the necessary raw materials to advance their research and manufacturing processes effectively. For instance, in January 2021, Lonza's new cryopreserved Leukopaks enhanced flexibility and extended viability for global immunology and cell therapy research, mitigating logistical challenges and ensuring high-quality cellular resources for biopharmaceutical development.

Cellular Starting Materials Grade Insights:

The global cellular starting materials market segmentation, based on grade, includes GMP and research-use. The GMP segment held the largest share of the market in 2023. The demand for GMP (Good Manufacturing Practice) grade cellular starting materials is steadily increasing within the biopharmaceutical industry. This is largely driven by the stringent regulatory requirements and the growing emphasis on product quality and safety. GMP guidelines ensure that cellular starting materials are produced, controlled, and distributed in a consistent and reproducible manner, playing a significant role in driving the market. GMP sets rigorous standards for purity, identity, and potency, thereby influencing the industry's focus on quality and safety.

The demand for GMP-compliant in the cellular starting materials market is further bolstered by the expanding scope of personalized medicine and the increasing adoption of innovative biotechnologies. These trends necessitate reliable and standardized sources of cellular starting materials that can be seamlessly integrated into manufacturing processes while meeting stringent regulatory requirements, according to GMP.

Global Cellular Starting Materials Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

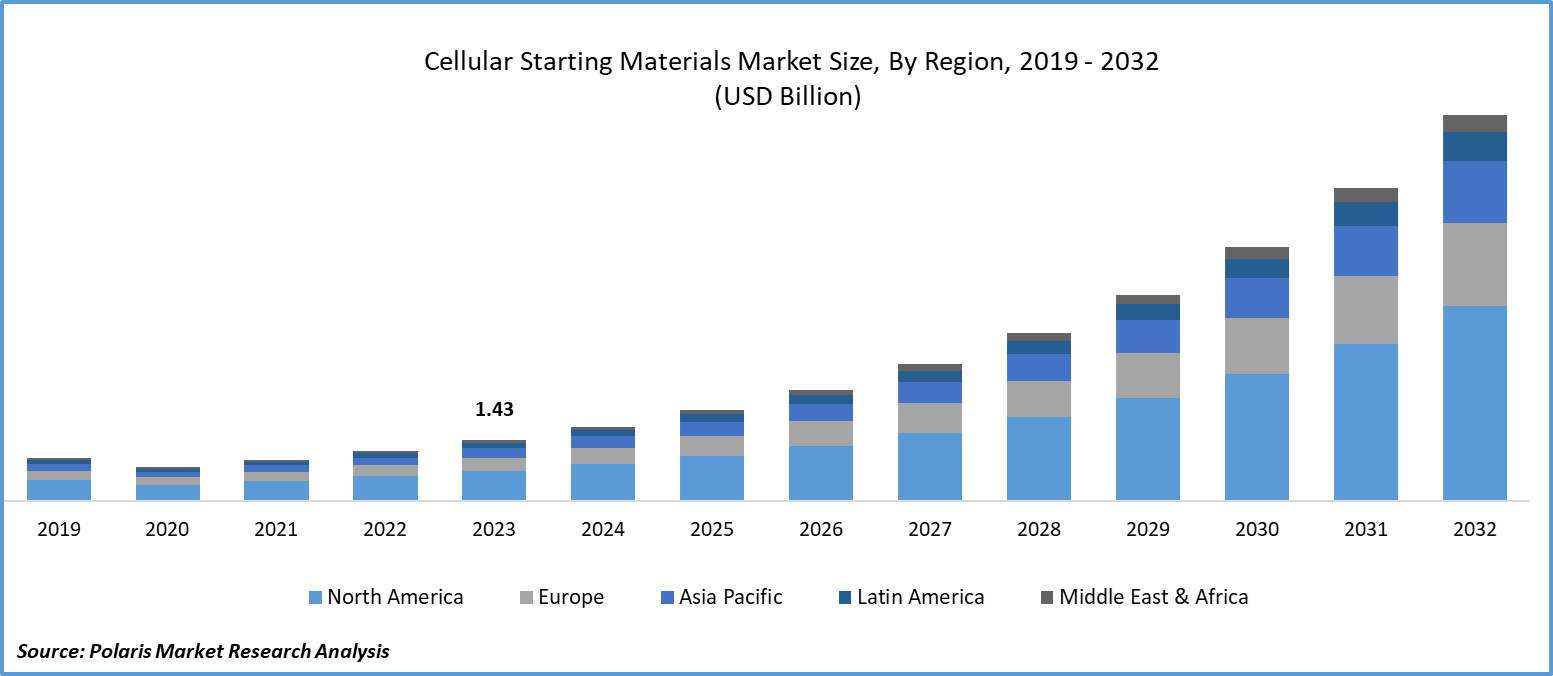

Cellular Starting Materials Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region dominated the global cellular starting materials market, owing to advancements in biotechnology and increasing applications in regenerative medicine and drug discovery. Stem cells and primary cells serve as foundational components for therapies aimed at treating various diseases and conditions, fueling demand across the pharmaceutical and biotechnology sectors. The region benefits from a well-established infrastructure supporting research and development, with leading academic institutions and biotech companies collaborating to innovate and commercialize new technologies.

Investment in biotechnology startups and research initiatives further accelerates market expansion, with North America continuing to attract significant funding for advancements in cell therapy and personalized medicine. For instance, in October 2023, the government announced New York's first cell and gene therapy hub at Roswell Park Comprehensive Cancer Center, Buffalo, aiming to bolster the research and development of cell therapies in life sciences with a $98 million investment.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Asia Pacific cellular starting materials market is projected to account for the fastest growth with the highest CAGR rate over the forecast period. The growth is driven by various factors, such as increasing investments in biotechnology, rising prevalence of chronic diseases, and advancements in healthcare infrastructure. Countries like China, Japan, South Korea, and India are emerging as key players in this market, with expanding research and development activities in regenerative medicine and cell-based therapies.

Furthermore, supportive government initiatives, growing collaborations between academia and industry, and a rising focus on personalized medicine are factors contributing to the market's growth. The region's large population base also provides a substantial patient pool for clinical trials and therapeutic applications, further propelling market expansion.

Global Cellular Starting Materials Market, Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Cellular Starting Materials Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the cellular starting materials market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the cellular starting materials industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global cellular starting materials industry to benefit clients and increase the market sector. In recent years, the cellular starting materials industry has witnessed some technological advancements. Major players in the cellular starting materials market include AcceGen, AllCells, Anthony Nolan, BioIVT, CGT GLOBAL, Charles River Laboratories, Excellos, HumanCells Bio, NMDP BioTherapies, and STEMCELL Technologies.

BioIVT advances scientific research and expedites medical discoveries through tailored biospecimen solutions and research services for the life science and diagnostic sectors. BioIVT offers a unique range of clinical specimens specializing in control and disease state samples, including human and animal tissues, ADME-Tox products, cell and gene therapy offerings, as well as blood and other biofluids. In May 2024, BioIVT focused on advancing cell and gene therapy through global research partnerships and biospecimen solutions.

Stem Cell Technologies, Inc. is a biotechnology research company with expertise in a diverse range of areas, including cell isolation, antibody production, primary cell cultures, cytokines, cryopreservation media, small molecule development, stem cell detection kits, and precision instruments. Also, the firm specializes in software solutions, contract services, comprehensive training courses, proficiency testing, cell culture media, stem cell technologies, organoid research, and advanced studies in cell biology and immunology. In January 2024, STEMCELL Technologies acquired Propagenix Inc., enhancing its regenerative medicine capabilities and expanding its product suite with EpiX and Conditional Reprogramming technologies.

Key companies in the cellular starting materials market include:

- AcceGen

- AllCells

- Anthony Nolan

- BioIVT

- CGT GLOBAL

- Charles River Laboratories

- Excellos

- HumanCells Bio

- NMDP BioTherapies.

- STEMCELL Technologies

Cellular Starting Materials Industry Developments

- February 2024: BioIVT expanded its European operations to offer high-quality fresh leukopaks, enhancing therapeutic development capabilities in the region.

- November 2023: Charles River introduced CliniPrime Cryopreserved Leukopaks, enhancing GMP-compliant cellular products for gene-modified cell therapy development and manufacturing.

- September 2023: The Novo Nordisk Foundation invested $136m in Cellerator, a new cell therapy manufacturing facility in Denmark aimed at advancing stem cell therapies into early clinical trials.

Cellular Starting Materials Market Segmentation:

Cellular Starting Materials Product Outlook

- Leukopaks

- Cells & Tissues

Cellular Starting Materials Grade Outlook

- GMP

- Research-use

Cellular Starting Materials End-Use Outlook

- Pharmaceutical & Biotechnology Companies

- CMOs & CROs

- Academic & Research Institutes

Cellular Starting Materials Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cellular Starting Materials Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1.43 billion |

|

Market Size Value in 2024 |

USD 1.74 billion |

|

Revenue Forecast in 2032 |

USD 9.00 billion |

|

CAGR |

22.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cellular starting materials market size was valued at USD 1.43 billion in 2023 and is projected to grow to USD 9.00 billion by 2032.

The global market is projected to grow at a CAGR of 22.8% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are AcceGen, AllCells, Anthony Nolan, BioIVT, CGT GLOBAL, Charles River Laboratories, Excellos, HumanCells Bio, NMDP BioTherapies, and STEMCELL Technologies.

The leukopaks segment dominated the market in 2023.

The GMP had the largest share in the global market.