Cellular IoT Module Shipments Market Size, Share, Trends, Industry Analysis Report: By Technology (3G, 4G/LTE, and 5G), Application, Frequency Band, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5424

- Base Year: 2024

- Historical Data: 2020-2023

Cellular IoT Module Shipments Market Overview

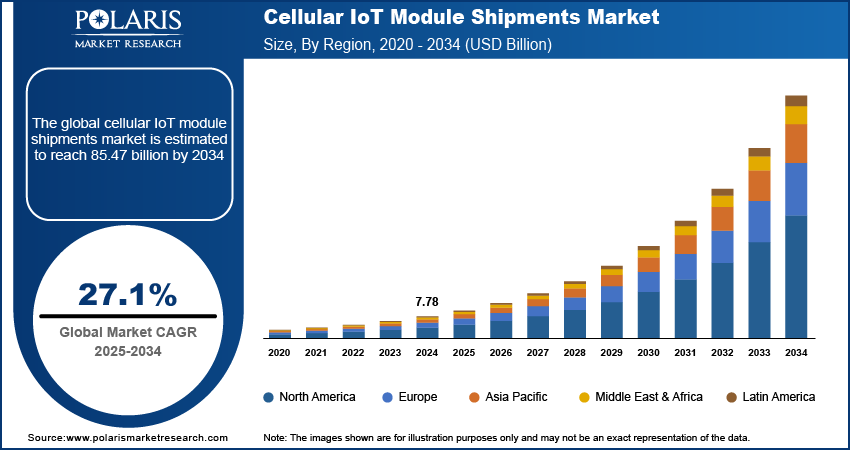

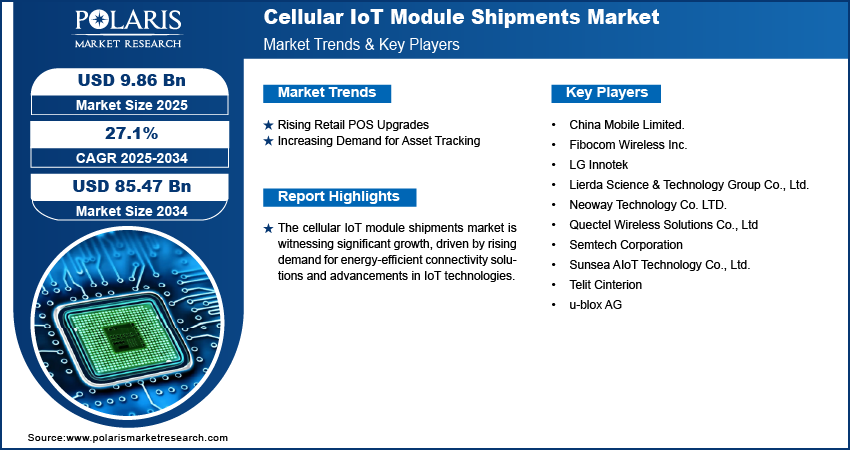

The global cellular IoT module shipments market size was valued at USD 7.78 billion in 2024. The market is expected to grow from USD 9.86 billion in 2025 to USD 85.47 billion by 2034, at a CAGR of 27.1% from 2025 to 2034.

Cellular IoT module shipments refer to the distribution of modules that enable Internet of Things (IoT) devices to communicate over cellular networks, facilitating real-time data transmission and remote monitoring.

The rising implementation of smart meters across utilities to enhance energy efficiency and resource management is shaping the cellular IoT module shipments market development. For instance, as per a March 2025 report by the National Smart Grid Mission (NSGM), a total of 2,29,29,954 smart meters have been installed in India. This deployment highlights the growing reliance on cellular IoT technology to modernize energy infrastructure. Smart meters, equipped with cellular IoT modules, enable precise monitoring and reporting of energy consumption, supporting grid optimization and demand response strategies. Governments and utility companies are increasingly deploying these meters to modernize infrastructure and comply with regulatory mandates for energy conservation. This surge in smart meter adoption directly fuels the demand for cellular IoT modules, improving their shipment volumes.

To Understand More About this Research: Request a Free Sample Report

The automotive and telematics sectors are rapidly growing, with cellular IoT modules playing a crucial role in enabling connected vehicle technologies. Automotive manufacturers are integrating these modules to support features such as real-time navigation, vehicle diagnostics, and fleet management. For instance, in March 2024, Cavli Wireless and Sibros collaborated to improve IoT connectivity across sectors such as automotive and logistics. Their integrated solution combines Cavli's IoT modules and Sibros' software stack, enabling secure data transmission, remote management, and advanced analytics for seamless IoT integration. Additionally, telematics systems leverage cellular IoT to ensure continuous data exchange for monitoring vehicle performance and enhancing safety features. The push for autonomous and connected vehicles, coupled with evolving regulations around vehicle safety and emissions, further accelerates the adoption of cellular IoT modules, thus creating several cellular IoT module shipments market opportunities.

Cellular IoT Module Shipments Market Dynamics

Rising Retail POS Upgrades

Retailers are increasingly adopting advanced point-of-sale (POS) systems integrated with cellular IoT technology to enhance operational efficiency and customer experience. These systems enable seamless mobile payments, real-time inventory management, and secure transaction processing without relying on fixed network infrastructure. For instance, in February 2025, RPOWER POS launched its handheld POS solution OmniTab. The solution enhances order accuracy, payment processing, and operational efficiency with features such as table-side ordering, real-time menu updates, and payment flexibility, addressing the growing demand for mobile POS systems in the hospitality industry. This shift optimizes retail operations and also supports omnichannel strategies, driving the cellular IoT module shipments market demand as retailers aim to stay competitive and responsive to consumer expectations.

Increasing Demand for Asset Tracking

Businesses across various sectors are increasingly prioritizing accurate and real-time tracking of assets across supply chains. Cellular IoT modules empower these businesses to monitor the location, condition, and movement of assets, ensuring improved visibility and reduced operational risks. For instance, in November 2024, Airgain, Inc. launched the AT-Flight asset tracker for healthcare and life sciences IoT markets. It enables real-time tracking of high-value, temperature-sensitive assets during ground and air transport, ensuring compliance, operational efficiency, and suitability for cold chain logistics and medical applications. This capability is particularly valuable for logistics, manufacturing, and retail sectors where timely information is critical. As organizations expand their logistics networks and embrace just-in-time inventory models, the need for reliable asset tracking solutions continues to grow, thereby boosting the adoption of cellular IoT modules. Thus, the rising demand for asset tracking is fueling the cellular IoT module shipments market expansion.

Cellular IoT Module Shipments Market Segment Insights

Cellular IoT Module Shipments Market Assessment by Technology Outlook

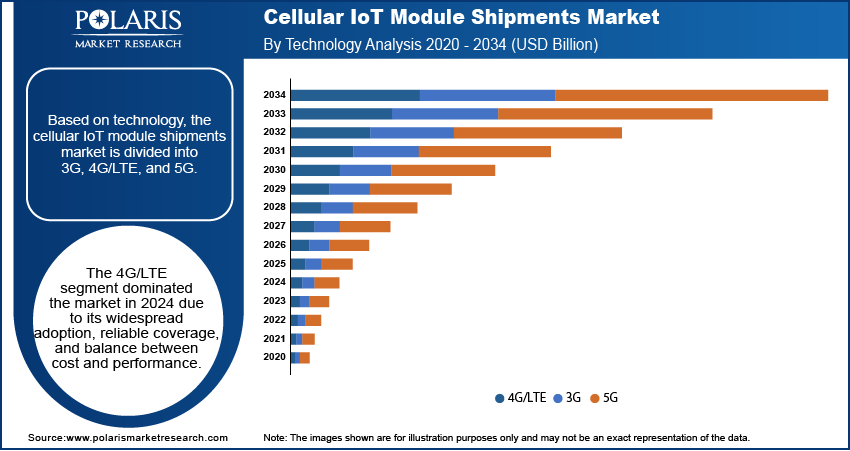

The global cellular IoT module shipments market assessment, based on technology, includes 3G, 4G/LTE, and 5G. The 4G/LTE segment dominated the market in 2024 due to its widespread adoption, reliable coverage, and balance between cost and performance. Unlike 3G, which offers limited speed and capacity, and 5G, which is still in the early stages of deployment in many regions, 4G/LTE provides an optimal solution for a broad range of IoT applications. Its ability to support both high-bandwidth use cases, such as video surveillance, and low-power applications, like smart meters, makes it a versatile choice. Additionally, the extensive infrastructure and established ecosystem around 4G/LTE have contributed to its dominance in the market.

Cellular IoT Module Shipments Market Evaluation by Application Outlook

The global cellular IoT module shipments market evaluation, based on application, includes smart meters & utilities, telematics & automotive, healthcare, retail, smart cities, and others. The telematics & automotive segment is expected to witness the fastest growth during the forecast period, driven by the rising adoption of connected vehicles and advancements in telematics solutions. Cellular IoT modules facilitate real-time data exchange for vehicle diagnostics, navigation, and fleet management, enhancing both safety and efficiency. The demand for cellular IoT modules is expected to surge as automotive manufacturers increasingly integrate IoT capabilities for remote monitoring, driven by the rise of predictive maintenance and autonomous driving features. This growth is further amplified by regulatory pressures for vehicle safety and emissions compliance, positioning the telematics & automotive segment for rapid expansion.

Cellular IoT Module Shipments Market Regional Analysis

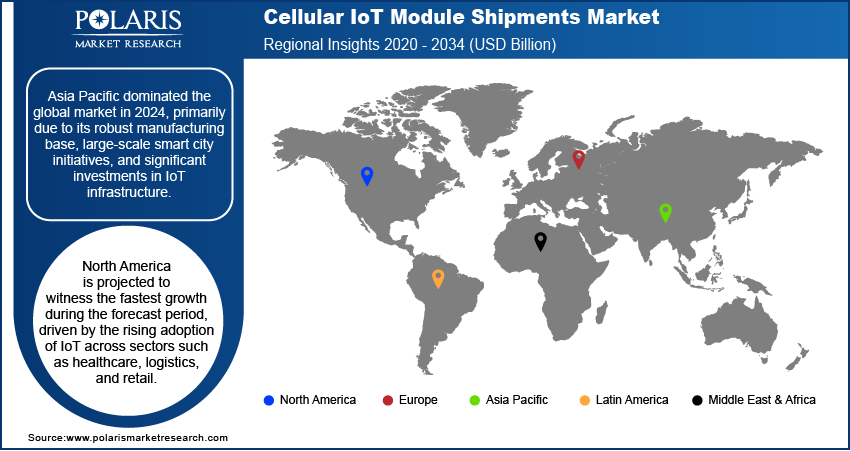

By region, the report provides the cellular IoT module shipments market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024, primarily due to its robust manufacturing base, large-scale smart city initiatives, and significant investments in IoT infrastructure. Countries such as China, Japan, and South Korea have been at the forefront of deploying IoT solutions across industries such as automotive, utilities, and retail. The region's focus on digital transformation, coupled with the increasing penetration of smartphones and cellular networks, has accelerated the adoption of IoT modules. For instance, the number of mobile telephone connections in India reached 1,151.18 million by the end of October 2024. Similarly, the overall tele-density in India, which was 75.23% in March 2014, increased to 84.49% in October 2024, reflecting the region's growing connectivity and digital readiness. Government policies supporting IoT deployment and the presence of leading module manufacturers have further reinforced Asia Pacific's leadership in the global market.

The North America cellular IoT module shipments market is projected to witness the fastest growth during the forecast period, driven by the rising adoption of IoT across sectors such as healthcare, logistics, and retail. The region's advanced technology landscape, combined with substantial investments in 5G networks, provides a strong foundation for IoT expansion. For instance, a report by US Telecom indicated that the American broadband industry invested USD 94.7 billion in communications infrastructure in 2023 to connect communities to high-speed networks, highlighting the region's commitment to technological advancement. Moreover, the focus on improving supply chain efficiency and asset tracking in industries such as logistics and manufacturing has strengthened the demand for cellular IoT modules. Regulatory support for smart infrastructure and a strong focus on cybersecurity also contribute to the rapid growth outlook for the North American market.

Cellular IoT Module Shipments Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for cellular IoT module shipments market share through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Cellular IoT module shipments market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking in the cellular IoT module shipments market includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the growth of the cellular IoT module shipments market is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, ensuring sustained growth in a hypercompetitive global market. A few key major players are China Mobile Limited; Fibocom Wireless Inc.; LG Innotek; Lierda Science & Technology Group Co., Ltd.; Neoway Technology Co. LTD.; Quectel Wireless Solutions Co., Ltd; Semtech Corporation; Sunsea AIoT Technology Co., Ltd.; Telit Cinterion; and u-blox AG.

Quectel Wireless Solutions Co., Ltd. is a global supplier of cellular IoT modules, such as GSM/GPRS, UMTS/HSPA (+), LTE, LTE-A, LPWA, and GNSS modules. Founded in 2010, Quectel has established itself in the IoT industry, offering a wide range of products that cater to various sectors, such as automotive, asset tracking, smart energy, and healthcare. The company's modules are designed to provide reliable and efficient connectivity solutions for IoT applications, enabling seamless integration into diverse industries such as commercial telematics, digital signage, and telehealth. Quectel's commitment to innovation and customer-centric approach positions it well for future growth in the evolving IoT landscape. The company's diverse product portfolio, including LPWA modules for low-power applications and Wi-Fi 6 modules for high-speed connectivity, further solidifies its presence in the market.

Semtech Corporation is a provider of analog and mixed-signal semiconductors, IoT systems, and cloud connectivity services. Founded in 1960, the company is headquartered in Camarillo, California. Semtech is renowned for its LoRa technology, a long-range, low-power networking platform widely used in IoT applications such as smart cities, utilities, and industrial automation. Semtech has strengthened its position in the IoT market through strategic acquisitions, notably the purchase of Sierra Wireless in January 2023. This acquisition enhanced Semtech's cellular IoT capabilities by integrating Sierra Wireless's expertise in cellular connectivity solutions. The company now offers a more versatile portfolio of IoT connectivity options by combining Sierra's cellular IoT modules with Semtech's existing LoRa technology. This integration is expected to drive growth in Semtech's cellular IoT module shipments, catering to diverse IoT applications with advanced and flexible solutions. Semtech's commitment to innovation and sustainability is evident in its product offerings, which include circuit protection, signal integrity, power management, and smart sensing solutions. The company's focus on creating a smarter, more connected, and sustainable planet aligns with its mission to empower solution architects and application developers across various industries.

List of Key Companies in Cellular IoT Module Shipments Market

- China Mobile Limited.

- Fibocom Wireless Inc.

- LG Innotek

- Lierda Science & Technology Group Co., Ltd.

- Neoway Technology Co. LTD.

- Quectel Wireless Solutions Co., Ltd

- Semtech Corporation

- Sunsea AIoT Technology Co., Ltd.

- Telit Cinterion

- u-blox AG

Cellular IoT Module Shipments Industry Developments

January 2025: u-blox launched RUBY-W2, its first automotive-grade Wi-Fi 7 module, enhancing connectivity and enabling advanced in-vehicle applications.

December 2024: STMicroelectronics launched the ST67W611M1 module, the first product of its strategic collaboration with Qualcomm Technologies, to simplify IoT development. According to STMicroelectronics, the new module supports Wi-Fi 6, Bluetooth 5.3, and Thread, enabling seamless integration with STM32 microcontrollers and Matter protocol compatibility.

Cellular IoT Module Shipments Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- 3G

- 4G/LTE

- 5G

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Smart Meters & Utilities

- Telematics & Automotive

- Healthcare

- Retail

- Smart Cities

- Others

By Frequency Band Outlook (Revenue, USD Billion, 2020–2034)

- Licensed Spectrum

- Unlicensed Spectrum

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Transportation & Logistics

- Energy & Utilities

- Healthcare

- Manufacturing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cellular IoT Module Shipments Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.78 billion |

|

Market Size Value in 2025 |

USD 9.86 billion |

|

Revenue Forecast by 2034 |

USD 85.47 billion |

|

CAGR |

27.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cellular IoT module shipments market size was valued at USD 7.78 billion in 2024 and is projected to grow to USD 85.47 billion by 2034.

The global market is projected to register a CAGR of 27.1% during the forecast period

Asia Pacific dominated the global market in 2024.

Some of the key players in the market are China Mobile Limited; Fibocom Wireless Inc.; LG Innotek; Lierda Science & Technology Group Co., Ltd.; Neoway Technology Co. LTD.; Quectel Wireless Solutions Co., Ltd; Semtech Corporation; Sunsea AIoT Technology Co., Ltd.; Telit Cinterion; and u-blox AG.

The 4G/LTE segment dominated the market in 2024.

The telematics & automotive segment is expected to witness the fastest growth during the forecast period.