Cell Signaling Market Share, Size, Trends & Industry Analysis Report

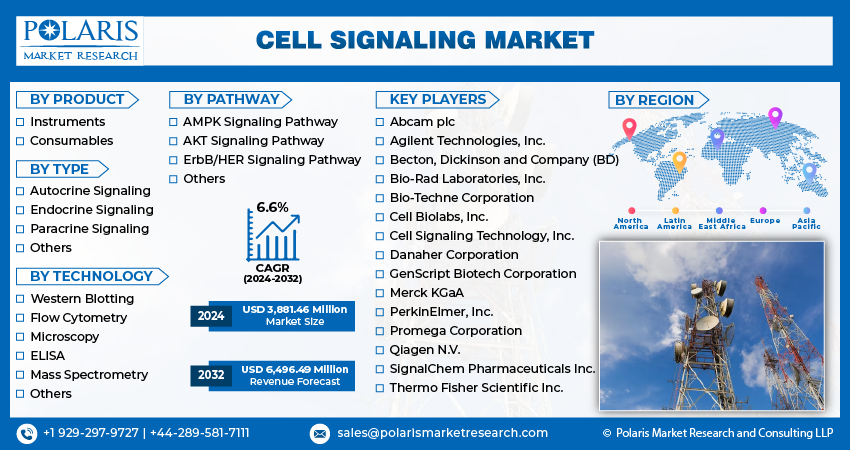

By Product (Instruments, Consumables); By Type; By Technology; By Pathway; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM4694

- Base Year: 2024

- Historical Data: 2020-2023

The global Cell Signaling Market was valued at USD 4.5 billion in 2024 and is expected to grow at a CAGR of 13.10% from 2025 to 2034. Advances in cancer research and drug discovery are major growth contributors.

Market Introduction

The increasing incidence of chronic diseases worldwide is a key driver of the cell signaling market growth. Conditions such as cancer and diabetes demand a deep understanding of cellular signaling for effective treatment. Moreover, rising chronic disease prevalence prompts the development of advanced diagnostic tools for early detection. By exploring cell signaling pathways, researchers uncover disease biomarkers, facilitating sensitive diagnostic assays. Additionally, personalized medicine gains traction, with tailored treatments addressing individual signaling variations, promising optimized therapeutic outcomes.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research:Request a Free Sample Report

For instance, in September 2023, Cell Signaling Technology unveiled its SignalStar Multiplex IHC technology, an innovation for spatial biology investigations through mid-plex, high-capacity immunohistochemistry (IHC) assays.

Drug discovery and development are pivotal in propelling the cell signaling market size and reshaping pharmaceutical innovation. Cell signaling regulates physiological processes and disease pathways. Advancements in proteomics, genomics, and high-throughput screening facilitate the identification and targeting of crucial signaling molecules implicated in disease progression. Targeted therapies modulating specific signaling pathways show promise for efficacy and reduced side effects, particularly in cancer, inflammatory disorders, and metabolic syndromes.

Industry Growth Drivers

Increasing Research Activities are Projected to Spur the Product Demand

Increasing research activities drive the cell signaling market share. Advanced research fosters drug discovery, identifying novel targets within signaling pathways and innovating pharmaceuticals. Research advancements enable personalized medicine, tailoring treatments based on individual patient profiles. Technological progress provides sophisticated tools for studying complex signaling networks. Collaborative initiatives accelerate discoveries in cell signaling, translating them into clinical applications. Additionally, research contributes to regenerative medicine, including stem cell therapies and tissue engineering. Increased funding for biomedical research further propels innovation, expanding knowledge in cellular processes for health and disease.

Advancements in Proteomics and Genomics is Expected to Drive Cell Signaling Market Growth

Advancements in proteomics and genomics propel the cell signaling market size by deepening the understanding of cellular communication pathways. These advancements identify novel signaling molecules, expanding drug discovery possibilities. Precision medicine benefits from personalized treatment strategies targeting individualized signaling profiles. Additionally, proteomic and genomic technologies drive drug development by revealing new targets for therapies. They also aid biomarker discovery, enabling early disease detection and treatment monitoring. Continuous improvements in these technologies enhance sensitivity, facilitating comprehensive analysis of cell signaling dynamics. Interdisciplinary collaborations accelerate translational research, advancing knowledge of cell signaling networks in health and disease.

Industry Challenges

High Cost of Research is Likely to Impede the Market Growth

The high cost of research is a significant barrier to market expansion, limiting innovation and access to advanced therapies. Comprehensive studies and the development of treatments targeting cell signaling pathways require substantial investment in specialized equipment, reagents, and skilled personnel. Advanced technologies such as mass spectrometry and next-generation sequencing incur significant upfront and maintenance costs, while regulatory approval processes for new therapies involve expensive preclinical studies and clinical trials. These financial barriers restrict involvement from smaller biotech firms and academic research groups, hindering their contribution to advancements. Addressing this challenge requires collaborative efforts to allocate funding, streamline regulatory procedures, and promote cost-effective research methods, ensuring broader access to innovative treatments and fostering progress in healthcare outcomes.

Report Segmentation

The market analysis is primarily segmented based on product, type, technology, pathway, and region.

|

By Product |

By Type |

By Technology |

By Pathway |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

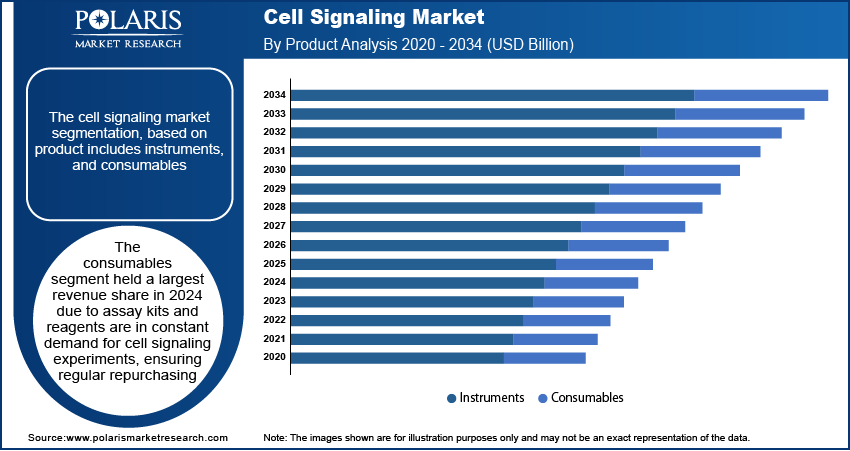

Consumables Segment Held Significant Market Revenue Share in 2024

The consumables segment held a significant revenue share in 2023. Assay kits and reagents are in constant demand for cell signaling experiments, ensuring regular repurchasing. They are widely utilized across academic and industrial research laboratories globally, spanning diverse applications like drug discovery and cancer research. Continuous technological advancements result in more sensitive and specific assays, driving demand for upgraded tools. Moreover, consumables often complement high-value equipment, enhancing functionality and incentivizing customers to invest in both, thereby strengthening the revenue share of the consumables segment.

By Type Analysis

Endocrine Signaling Segment Held Significant Market Revenue Share in 2024

The endocrine signaling segment held a significant revenue share in 2023. These pathways are therapeutically relevant and crucial in regulating physiological processes such as metabolism and growth. This relevance extends across various disease areas, driving demand for targeted therapies. Diseases such as diabetes and thyroid disorders contribute substantially to this demand. Additionally, established drugs such as insulin ensure a consistent market presence. Ongoing research uncovers new therapeutic targets, fostering market growth. Technological advancements further enhance therapy development, catering to the rising prevalence of endocrine disorders driven by lifestyle changes and an aging population.

By Technology Analysis

Microscopy Segment Held Significant Market Revenue Share in 2024

The microscopy segment held a significant revenue share in 2023 due to its pivotal role in visualizing cellular processes. Microscopy techniques offer high-resolution imaging, facilitating detailed observation of subcellular structures and signaling events. This capability aids in understanding cellular communication pathways and supports drug discovery by enabling compound screening and target identification. In disease diagnosis, microscopy detects abnormal signaling patterns in tissue samples, informing prognosis and treatment planning. Live-cell imaging provides real-time monitoring of dynamic signaling events. The market demand for advanced imaging technologies, coupled with ongoing technological advancements, drives the segment growth.

By Pathway Analysis

Akt Signaling Pathway Segment Held Significant Revenue Share in 2024

The AKT signaling pathway segment held a significant revenue share in 2023. It plays a central role in regulating crucial cellular functions like survival, proliferation, and growth. Additionally, its dysregulation is implicated in various diseases, making it a prime target for therapeutic intervention and driving demand for related products. Pharmaceutical companies prioritize the AKT pathway in drug discovery efforts, leading to substantial investment in research tools and technologies targeting this pathway. Furthermore, biomarker research and diagnostic assays focusing on AKT pathway components are essential for disease diagnosis and treatment selection, further boosting revenue within this segment.

Regional Insights

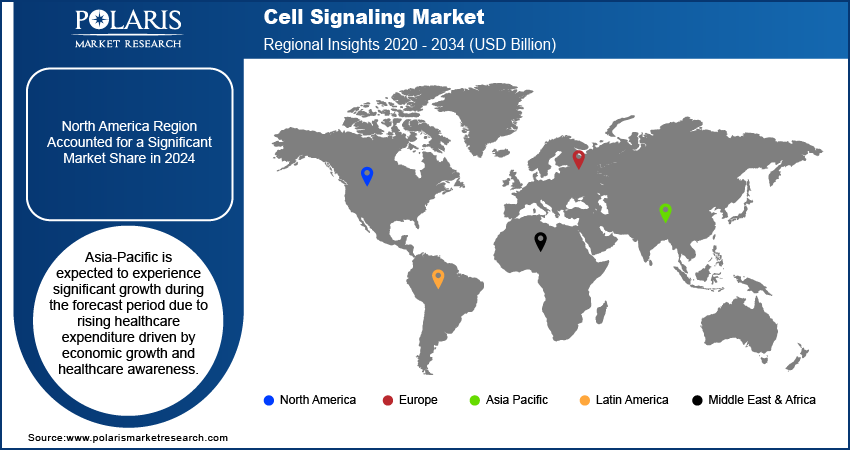

North America Region Accounted for a Significant Market Share in 2024

In 2023, the North American region accounted for a significant market share. Its robust biopharmaceutical industry, advanced healthcare infrastructure, and strategic partnerships drive substantial demand for cell signaling products. Additionally, favorable regulatory frameworks and government funding initiatives incentivize investment in research and development. High healthcare expenditure further underscores the region's strong demand for advanced cell signaling technologies.

Asia-Pacific is expected to experience significant growth during the forecast period due to rising healthcare expenditure driven by economic growth and healthcare awareness. The increasing prevalence of chronic diseases such as cancer and diabetes necessitates innovative therapies targeting cell signaling pathways. Ongoing technological advancements and investment in research infrastructure foster the development of novel cell signaling technologies. The expanding pharmaceutical industry in countries such as China, India, and Japan fuels demand for cell signaling products for drug discovery and development applications, further propelling market growth in the region.

Key Market Players & Competitive Insights

The cell signaling market players comprises a diverse array of players, and the expected influx of new contenders is poised to intensify competitive forces. Key leaders in the market continually innovate their technologies, striving to maintain a competitive advantage by emphasizing effectiveness, reliability, and security. These organizations prioritize strategic endeavors, including forging partnerships, enriching product offerings, and participating in joint ventures. Their primary goal is to outperform industry rivals, capturing a significant cell signaling market share.

Some of the major players operating in the global cell signaling market report include:

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Cell Biolabs, Inc.

- Cell Signaling Technology, Inc.

- Danaher Corporation

- GenScript Biotech Corporation

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- Qiagen N.V.

- SignalChem Pharmaceuticals Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In February 2023, Bio-Techne Corporation and Cell Signaling Technology (CST) have revealed the integration of Simple Western validation into CST antibodies, which will provide researchers across different fields with a simpler method to examine crucial molecular signaling pathways on a reliable and validated platform.

- In December 2022, Merck disclosed a partnership in research and a licensing deal with Mersana Therapeutics, Inc. to explore new antibody-drug conjugates (ADCs) utilizing Mersana’s unique Immunosynthen STING-agonist ADC platform. The Immunosynthen platform is crafted to produce ADCs that activate STING signaling locally in immune cells residing within tumors and in tumor cells expressing antigens, through systemic administration.

Report Coverage

The cell signaling market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, types, technologies, pathways, and their futuristic growth opportunities.

Cell Signaling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.1 billion |

|

Revenue forecast in 2034 |

USD 14.6 billion |

|

CAGR |

13.10% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Cell Signaling market size is expected to reach USD 6,496.49 Million by 2032

Key players in the market are Bio-Rad Laboratories, Inc., Bio-Techne Corporation, Danaher Corporation

North America contribute notably towards the global Cell Signaling Market

Cell Signaling Market exhibiting the CAGR of 13.10% during the forecast period.

The Cell Signaling Market report covering key segments are product, type, technology, pathway, and region.