Cell Processing Instruments Market Share, Size, Trends, Industry Analysis Report – By Type (Cell Counters, Cell Imaging Systems, Flow Cytometers, Cell Separator Systems, Automated Cell Processing Systems, and Others), Application, End Use, and Region; Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 119

- Format: PDF

- Report ID: PM5161

- Base Year: 2024

- Historical Data: 2020-2023

Cell Processing Instruments Market Outlook

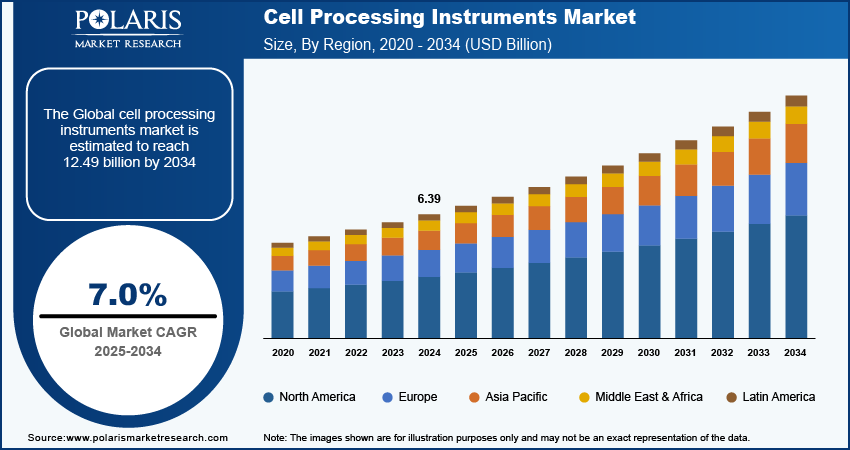

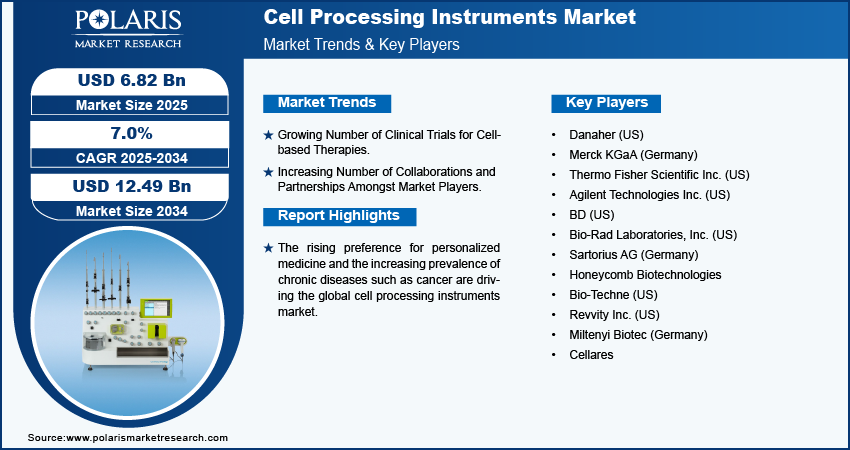

The cell processing instruments market size was valued at USD 6.39 billion in 2024. The market is anticipated to grow from USD 6.82 billion in 2025 to USD 12.49 billion by 2034, exhibiting a CAGR of 7.0% during 2025–2034.

Cell Processing Instruments Market Overview

The cell processing instruments market is growing due to the rising prevalence of chronic diseases. Chronic diseases such as cancer, diabetes, and autoimmune disorders often require advanced treatments, including cell-based therapies. These therapies, such as CAR-T cell therapy or stem cell therapy, rely heavily on cell processing instruments to prepare and modify cells for treatment. Therefore, the rising prevalence of chronic diseases is propelling the market. For instance,

The burden of chronic diseases is increasing globally, with the World Health Organization (WHO) estimating that chronic diseases are responsible for 61% of all deaths and is expected to increase to 70% by 2030.

To Understand More About this Research: Request a Free Sample Report

The increasing investments in research and development activities by key companies in the market create an immense opportunity in the market. Companies in the market are rigorously innovating and introducing advanced cell processing instruments to expand their consumer base. This is estimated to enhance the application and adoption of cell processing instruments. For instance, in April 2024, LICORbio, a global pioneer in life science instrumentation, launched a pair of brand-new Odyssey F biomolecular imaging systems to provide researchers with significantly faster scans, greater value, and expanded assay support.

The rising preference for personalized medicine is fueling the global cell processing instruments market revenue. Personalized medicine typically involves tailoring treatments to individual patients based on their genetic, biological, and environmental profiles. This customization requires precise and sophisticated cell processing techniques to isolate, modify, and prepare patient-specific cells, driving demand for advanced cell processing instruments.

Cell Processing Instruments Growth Drivers

Growing Number of Clinical Trials for Cell-based Therapies

The growing number of clinical trials for cell-based therapies is expanding the global cell processing instruments market. Clinical trials for cell-based therapies often require large numbers of cells to be isolated, expanded, and prepared for treatment. This drives demand for high-throughput cell processing instruments that efficiently handle large volumes of cells while maintaining high quality and consistency. For instance, according to a published report, around 2,000 clinical trials for cell and gene therapies were launched globally between 2018 and 2022.

Increasing Number of Collaborations and Partnerships Amongst Market Players

The increasing number of collaborations and partnerships among market players is propelling the market. Collaborative efforts frequently aim to establish standardized protocols and integrated workflows across different organizations. This requires cell processing instruments that operate consistently and reliably across various settings and meet common standards to ensure compatibility and reproducibility. For instance, in February 2024, Thermo Fisher Scientific Inc. and Multiply Labs expanded their partnership to automate cell therapy production through a combination of robotics and automation of instruments.

Restraining Factors

Strict Regulation Restrains Cell Processing Instruments Market

The strict regulation in the healthcare sector is projected to hinder the market growth. Compliance with stringent regulatory standards usually requires high-quality, validated instruments that are more expensive. The cost of meeting these regulatory requirements is prohibitive, especially for smaller companies or startups, potentially slowing down investment in new cell processing instruments, thereby hampering the market.

Report Segmentation

The cell processing instruments market is primarily segmented on the basis of type, application, end use, and region.

|

By Type |

By Applications |

By End-use |

By Region |

|

|

|

|

By Type Analysis

Cell Separator Systems Segment Accounted for Largest Market Share in 2024

The cell separator systems segment held the largest revenue share in 2024. The dominance is primarily attributed to its critical role in separating specific cell types from complex mixtures, which is essential for various applications in research, diagnostics, and therapeutic procedures. The increasing adoption of cell separator systems in stem cell research, immunotherapy, and regenerative medicine contributed significantly to their market position. These systems offer high efficiency and precision in cell isolation, which supports the production of high-quality cells for downstream applications. The continual advancements in technology, such as the development of automated and high-throughput separation systems, further enhanced their market appeal by increasing throughput and reducing processing times.

The cell imaging systems segment is expected to grow at a robust pace in the coming years, owing to the rising need for advanced imaging technologies that provide detailed and dynamic insights into cellular processes. Innovations in imaging technologies, such as high-resolution microscopy and live-cell imaging, enable more comprehensive studies of cellular phenomena in real time. These advancements are driving demand for imaging systems, particularly in cancer research, drug development, and stem cell studies. Cell imaging systems are further estimated to gain a significant share of the market as the focus on personalized medicine and detailed cellular analysis intensifies.

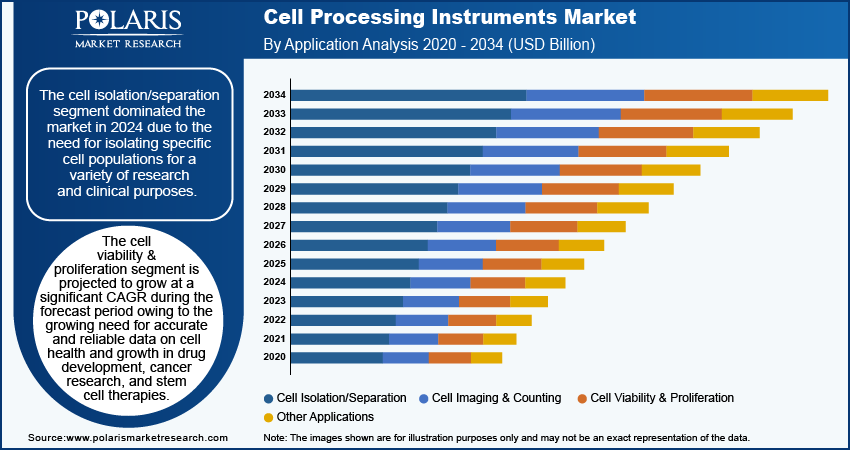

By Application Analysis

The Cell Isolation/Separation Segment Dominated the Market in 2024

The cell isolation/separation segment dominated the market in 2024 due to the need for isolating specific cell populations for a variety of research and clinical purposes. Techniques such as flow cytometry, magnetic bead separation, and microfluidics play a crucial role in obtaining pure and viable cell samples, which are essential for accurate diagnostics, therapeutic development, and research into cell-based therapies. The increased focus on advanced therapies, including immunotherapy and regenerative medicine, has significantly boosted demand for these separation technologies.

The cell viability & proliferation segment is projected to grow at a significant CAGR during the forecast period owing to the growing need for accurate and reliable data on cell health and growth in drug development, cancer research, and stem cell therapies. Researchers and clinicians increasingly prioritize cell viability & proliferation measurements to understand cell health, growth rates, and responses to various treatments.

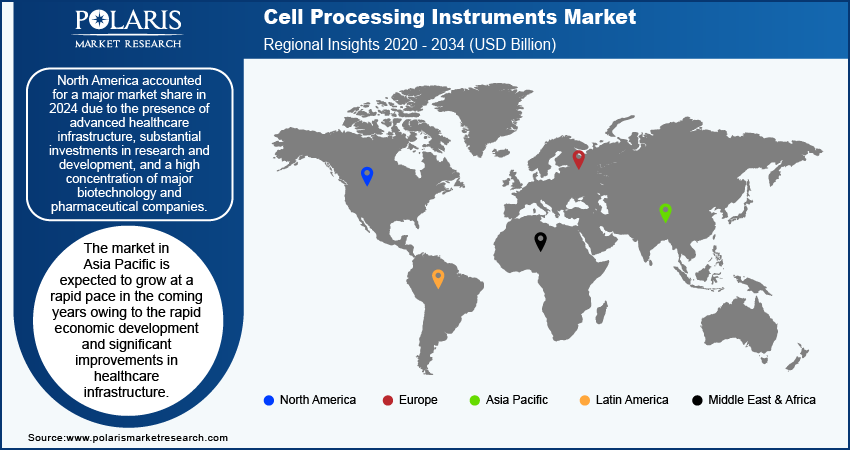

Cell Processing Instruments Market Regional Insights

North America Held Largest Share of Cell Processing Instruments Market in 2024

North America accounted for a major market share in 2024 due to the presence of advanced healthcare infrastructure, substantial investments in research and development, and a high concentration of major biotechnology and pharmaceutical companies. The presence of numerous renowned research institutions and hospitals in the US and Canada has driven demand for advanced cell processing technologies. Additionally, North America benefits from a strong regulatory environment that supports innovation and facilitates the approval of cutting-edge technologies. The region’s early adoption of new technologies and its focus on personalized medicine and cell-based therapies have further bolstered its market position.

The market in Asia Pacific is expected to grow at a rapid pace in the coming years owing to the rapid economic development and significant improvements in healthcare infrastructure, which increase the adoption of advanced cell processing technologies. Countries such as China and India are expanding their biotechnology sectors and investing heavily in research and development. The region's large and diverse patient population also provides a substantial market for cell-based therapies and diagnostic technologies. Additionally, the rising prevalence of chronic diseases and the growing focus on personalized medicine drive the demand for sophisticated cell processing solutions. For instance, according to a published report, approximately 434.3 million people have chronic kidney disease (CKD) across the eastern, southern, and south-eastern regions of Asia.

Key Market Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the cell processing instruments market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the cell processing instruments market include Danaher; Merck KGaA; Thermo Fisher Scientific Inc.; BD; Sartorius; Bio-Rad Laboratories; and others.

List of Major Players Operating in the Global Cell Processing Instruments Market

- Danaher (US)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (US)

- Agilent Technologies Inc. (US)

- BD (US)

- Bio-Rad Laboratories, Inc. (US)

- Sartorius AG (Germany)

- Honeycomb Biotechnologies

- Bio-Techne (US)

- Revvity Inc. (US)

- Miltenyi Biotec (Germany)

- Cellares

Recent Developments in Industry

- In April 2024, Cellares, the first integrated development and manufacturing organization (IDMO) dedicated to clinical and industrial-scale cell therapy, announced the launch of Cell Q. Cell Q is the first automated quality control (QC) work cell for therapy manufacturing.

- In June 2023, Honeycomb Biotechnologies, a company that develops technologies to help researchers analyze single cells in clinical, pre-clinical, translational, and basic research, collaborated with Revvity to launch a suite of new solutions and services that expand the frontiers of single-cell biology.

Report Coverage

The cell processing instruments market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, end-use, and futuristic growth opportunities.

Cell Processing Instruments Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 6.82 billion |

|

Revenue Forecast in 2034 |

USD 12.49 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Cell Processing Instruments Industry Trends Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cell processing instruments market size was valued at USD 6.39 billion in 2024 and is projected to grow to USD 12.49 billion by 2034.

The global market is projected to grow at a CAGR of 7.0% during the forecast period.

North America had the largest share of the global market in 2024.

The key players in the market are Danaher; Merck KGaA; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; BD; Sartorius; Bio-Rad Laboratories; Honeycomb Biotechnologies; Bio-Techne; Revvity Inc.; Miltenyi Biotec; and Cellares.

The call imaging systems type segment is projected for significant growth in the global market.

The cell isolation/separation segment dominated the cell processing instruments market in 2024.