Cell Harvesting Systems Market Size, Share, Trends, Industry Analysis Report: By Technology (Blastomere Extraction and Altered Nuclear Transfer), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1654

- Base Year: 2024

- Historical Data: 2020-2023

Cell Harvesting Systems Market Overview

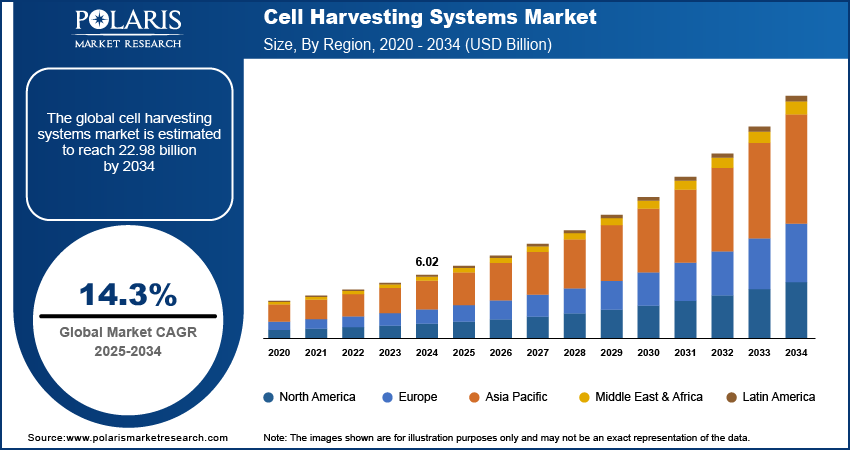

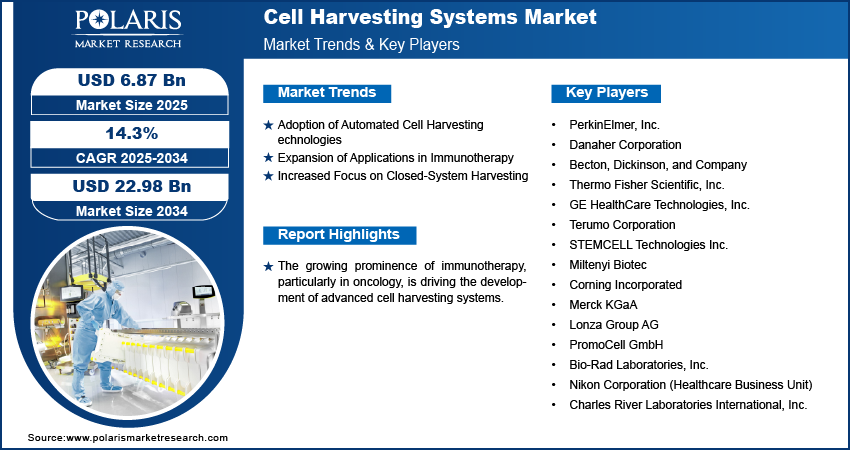

The global cell harvesting systems market size was valued at USD 6.02 billion in 2024. The market is projected to grow from USD 6.87 billion in 2025 to USD 22.98 billion by 2034, exhibiting a CAGR of 14.3% from 2025 to 2034.

The cell harvesting systems market focuses on technologies and devices used to collect, isolate, and prepare cells for applications in research, therapeutics, and diagnostics. These systems are essential in regenerative medicine, cell-based therapies, and biopharmaceutical production.

The rising prevalence of chronic diseases, increasing demand for personalized medicine, and advancements in biotechnology are a few of the key factors driving the cell harvesting systems market growth. Notable trends in the market include the adoption of automated and closed-system cell harvesting technologies, growing investments in stem cell research, and expanding applications in immunotherapy. The need for efficient and contamination-free cell recovery processes also shapes the market.

To Understand More About this Research: Request a Free Sample Report

Cell Harvesting Systems Market Dynamics

Adoption of Automated Cell Harvesting Technologies

The increasing adoption of automated systems is transforming the cell harvesting systems market, driven by their ability to enhance efficiency and reduce human error in cell recovery processes. These technologies are particularly beneficial in large-scale biopharmaceutical production, where precision and reproducibility are critical. Automated systems also support scalability, enabling seamless transitions from research to clinical and commercial manufacturing. According to a study published in Nature Biotechnology (2022), automation in bioprocessing has improved cell yield by up to 30% compared to manual methods. This growing reliance on automation in bioprocessing aligns with the broader push for integrating automation and robotics in life sciences to optimize productivity and minimize contamination risks.

Expansion of Applications in Immunotherapy

The growing prominence of immunotherapy, particularly in oncology, is driving the development of advanced cell harvesting systems. Techniques such as CAR-T cell therapy and other cell-based immunotherapies require efficient and sterile cell collection methods to ensure therapeutic efficacy. As per a report from the National Cancer Institute, over 1,000 clinical trials involving CAR-T therapies were ongoing globally in 2023, highlighting the expanding demand for supporting technologies like cell harvesting systems. Manufacturers are increasingly focusing on developing systems compatible with personalized treatments, addressing the specific needs of immunotherapy workflows. Thus, the expanding applications of cell harvesting systems in immunotherapy are driving the cell harvesting systems market development.

Increased Focus on Closed-System Harvesting

The shift toward closed-system cell harvesting is gaining momentum due to its ability to prevent contamination and maintain sterility throughout the cell collection process. Closed systems are essential for meeting stringent regulatory requirements and ensuring product safety, particularly in clinical and commercial production environments. For instance, a 2021 study in the Journal of Bioprocessing and Biotechnology noted that closed systems reduce contamination risks by over 80% compared to open systems, underscoring their value in high-stakes applications such as regenerative medicine and stem cell therapies. This shift is expected to continue as industry standards increasingly favor aseptic processes in cell harvesting, thereby boosting the cell harvesting systems market revenue.

Cell Harvesting Systems Market Segment Insights

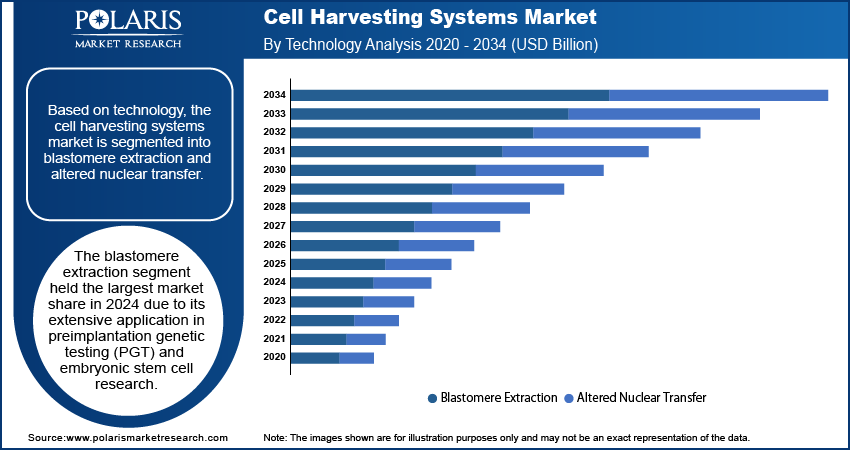

Cell Harvesting Systems Market Assessment Based on Technology

The cell harvesting systems market, based on technology, is segmented into blastomere extraction and altered nuclear transfer. The blastomere extraction segment held the largest market share in 2024 due to its extensive application in preimplantation genetic testing (PGT) and embryonic stem cell research. This technology is widely utilized in assisted reproductive technologies (ART), benefiting from increasing awareness and adoption of genetic testing to prevent hereditary conditions. The rising prevalence of infertility and the growing demand for ART procedures further contribute to the dominance of this segment. According to data from the World Health Organization (2023), infertility affects approximately 15% of reproductive-aged couples worldwide, driving the need for advanced cell harvesting technologies like blastomere extraction.

The altered nuclear transfer segment is anticipated to register the highest CAGR from 2025 to 2034, propelled by its emerging role in regenerative medicine and therapeutic cloning. This technology offers significant potential for generating patient-specific pluripotent stem cells without the ethical concerns associated with embryonic stem cell research, making it an attractive option for therapeutic applications. Increased investments in regenerative medicine research and advancements in nuclear reprogramming techniques are further accelerating the growth of this segment. For instance, a 2022 study in the Stem Cell Reports journal highlights ongoing progress in nuclear transfer methods for developing customized cellular therapies, underscoring the segment’s rapid advancement in the market.

Cell Harvesting Systems Market Evaluation Based on Application

The cell harvesting systems market, based on application, is segmented into bone marrow, umbilical cord, adipose tissue, and peripheral blood. The bone marrow segment dominated the market in 2024, driven by its critical role in hematopoietic stem cell transplantation (HSCT) for treating blood-related disorders such as leukemia, lymphoma, and aplastic anemia. Bone marrow-derived cells are a cornerstone in regenerative medicine and oncology, with increasing adoption of cell-based therapies globally. According to the Center for International Blood and Marrow Transplant Research (CIBMTR), approximately 50,000 allogeneic and autologous bone marrow transplants are performed annually worldwide, emphasizing the importance of efficient cell harvesting technologies tailored to this application.

The umbilical cord segment is projected to experience the fastest growth during the forecast period due to the rising use of cord blood-derived stem cells in therapeutic and regenerative medicine applications. Umbilical cord blood is a rich source of hematopoietic stem cells, and its collection is minimally invasive, making it an increasingly preferred option for cell-based treatments. The growing establishment of cord blood banks and advancements in cryopreservation technologies are further driving the segment expansion. A report from the American Academy of Pediatrics (AAP) highlights that over 80 diseases, including genetic, hematologic, and immunologic disorders, can be treated using cord blood stem cells, underlining its growing significance in the market.

Cell Harvesting Systems Market Outlook Based on End User

The cell harvesting systems market, based on end user, is segmented into research centers, biotechnology and biopharmaceutical companies, diagnostic labs, and others. The biotechnology and biopharmaceutical companies segment dominated the market with the largest revenue share in 2024, driven by the extensive use of cell harvesting technologies in drug development, biopharmaceutical production, and cell-based therapy manufacturing. These companies are increasingly investing in advanced cell harvesting systems to ensure high-quality cell recovery and compliance with regulatory standards in clinical and commercial production. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), biopharmaceutical companies invested over USD 100 billion globally in research and development in 2022, highlighting the sector's focus on adopting advanced technologies.

The research centers segment is anticipated to register the highest growth rate during the projection period, fueled by the expansion of cell biology and regenerative medicine research. The increasing focus on exploring novel therapeutic applications of stem cells and immune cells is contributing to the demand for efficient and reliable cell harvesting systems in academic and research institutions. Government funding and private investments in scientific research are also fostering growth in this segment. For instance, the National Institutes of Health (NIH) allocated over USD 2 billion to stem cell research funding in 2023, reflecting the rising importance of cell harvesting systems in driving scientific innovation and discovery.

Cell Harvesting Systems Market Regional Analysis

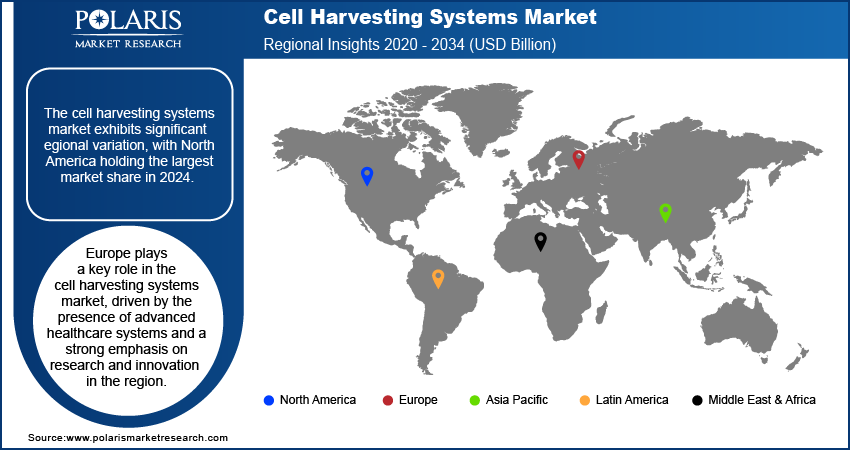

By region, the study provides cell harvesting systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The cell harvesting systems market exhibits significant regional variation, with North America holding the largest market share in 2024. This dominance is attributed to the well-established biotechnology and biopharmaceutical industries, robust healthcare infrastructure, and extensive funding for research and development in the region. The presence of leading market players and ongoing advancements in cell-based therapies, particularly in the US, further support the leading market position of North America. Additionally, initiatives such as the 21st Century Cures Act and increased investment in regenerative medicine and stem cell research contribute to the regional market growth. Europe and Asia Pacific are also experiencing notable growth, driven by rising healthcare expenditure and expanding research initiatives. Still, North America remains the primary hub for innovation and adoption of advanced cell harvesting technologies.

Europe plays a key role in the cell harvesting systems market, driven by the presence of advanced healthcare systems and a strong emphasis on research and innovation in the region. Countries such as Germany, the United Kingdom, and France are leading contributors, with well-established biotechnology sectors and increased adoption of cell-based therapies. The European Union's funding initiatives, such as Horizon Europe, provide substantial support for stem cell and regenerative medicine research, boosting demand for cell harvesting systems. Additionally, growing awareness about personalized medicine and the rising number of biopharmaceutical production facilities contribute to the market growth in the region.

The Asia Pacific cell harvesting systems market is projected to witness rapid growth during the forecast period, fueled by expanding healthcare infrastructure and increased investments in biotechnology and regenerative medicine. Countries such as China, Japan, and India are at the forefront, with government support for research and a growing focus on developing cell-based therapies. The rising prevalence of chronic diseases and increasing medical tourism further drive demand for advanced cell harvesting technologies in this region. Additionally, collaborations between local and international players and the establishment of stem cell banks are strengthening the market growth trajectory in Asia Pacific.

Cell Harvesting Systems Market – Key Players and Competitive Insights

Key players in the cell harvesting systems market include companies that provide advanced technologies and innovative solutions for efficient cell collection. Notable players include PerkinElmer, Inc.; Danaher Corporation; Becton, Dickinson and Company; Thermo Fisher Scientific, Inc.; GE HealthCare Technologies, Inc.; Terumo Corporation; STEMCELL Technologies Inc.; Miltenyi Biotec; Corning Incorporated; Merck KgaA; Lonza Group AG; PromoCell GmbH; Bio-Rad Laboratories, Inc.; Nikon Corporation (Healthcare Business Unit); and Charles River Laboratories International, Inc. Each of these companies plays a crucial role in meeting the growing demand for cell harvesting systems across various applications. While some focus on biopharmaceutical and therapeutic research, others specialize in academic and diagnostic solutions.

Competition in the market is characterized by a focus on technological innovation, with companies developing automated and closed-system solutions to improve cell yield and minimize contamination. For example, Miltenyi Biotec is well-regarded for its magnetic cell sorting technologies, while Thermo Fisher Scientific offers comprehensive platforms integrating harvesting and processing. Strategic partnerships and collaborations are also prevalent, enabling firms to enhance their global reach and strengthen product portfolios. Lonza Group AG and STEMCELL Technologies, for instance, emphasize supporting research and clinical applications, addressing the needs of both academic and industrial sectors.

Insights reveal that the market is dynamic, with companies heavily investing in research and development to cater to emerging fields like immunotherapy and regenerative medicine. Regional expansion is another key strategy, with businesses targeting high-growth regions such as Asia Pacific to leverage the increasing focus on biotechnology and personalized medicine. While established firms dominate, mid-sized and emerging players such as PromoCell GmbH and Nikon Corporation are gaining traction by offering niche products and services tailored to specific research and therapeutic applications.

Thermo Fisher Scientific is a prominent company in the cell harvesting systems market, offering a range of solutions for cell isolation, harvesting, and processing across research, clinical, and industrial applications. The company is known for its focus on integrating advanced technologies with user-friendly systems to support biopharmaceutical production and regenerative medicine.

Miltenyi Biotec specializes in providing magnetic cell separation technologies and automated systems designed for research and clinical applications. Its products are widely used in immunology, stem cell research, and cancer therapies. The company focuses on enabling efficient and contamination-free cell harvesting processes.

List of Key Companies in Cell Harvesting Systems Market

- PerkinElmer, Inc.

- Danaher Corporation

- Becton, Dickinson and Company

- Thermo Fisher Scientific, Inc.

- GE HealthCare Technologies, Inc.

- Terumo Corporation

- STEMCELL Technologies Inc.

- Miltenyi Biotec

- Corning Incorporated

- Merck KGaA

- Lonza Group AG

- PromoCell GmbH

- Bio-Rad Laboratories, Inc.

- Nikon Corporation (Healthcare Business Unit)

- Charles River Laboratories International, Inc.

Cell Harvesting Systems Industry Developments

- In October 2024, Miltenyi Biotec introduced a new high-throughput platform for cell enrichment to support large-scale immunotherapy production, highlighting its emphasis on innovation in cell-based technologies.

- In September 2024, Thermo Fisher announced the expansion of its manufacturing capabilities in Massachusetts to support the development of cell and gene therapies, reinforcing its commitment to advancing cell-based treatment solutions.

Cell Harvesting Systems Market Segmentation

By Technology Outlook

- Blastomere Extraction

- Altered Nuclear Transfer

By Application Outlook

- Bone Marrow

- Umbilical Cord

- Adipose Tissue

- Peripheral Blood

By End User Outlook

- Research Centers

- Biotechnology

- Biopharmaceutical Companies

- Diagnostic Labs

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Harvesting Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.02 billion |

|

Market Size Value in 2025 |

USD 6.87 billion |

|

Revenue Forecast in 2034 |

USD 22.98 billion |

|

CAGR |

14.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The cell harvesting systems market has been segmented into detailed segments of technology, application, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: The growth strategy in the cell harvesting systems market focuses on technological innovation, strategic partnerships, and geographic expansion. Companies are investing heavily in research and development to create advanced, automated systems that improve efficiency and reduce contamination risks. Many firms are also forming collaborations with biopharmaceutical companies and research institutions to enhance their product offerings and reach new markets. Additionally, increasing investments in emerging regions, particularly in Asia Pacific, are helping expand market presence. Marketing efforts often emphasize the integration of cell harvesting technologies with regenerative medicine and personalized therapies, catering to the growing demand in these fields.

FAQ's

? The cell harvesting systems market size was valued at USD 6.02 billion in 2024 and is projected to grow to USD 22.98 billion by 2034.

? The market is projected to register a CAGR of 14.3% from 2025 to 2034.

? North America accounted for the largest share of the market in 2024.

? Key players in the cell harvesting systems market include companies that provide advanced technologies and innovative solutions for efficient cell collection. Notable players include PerkinElmer, Inc.; Danaher Corporation; Becton, Dickinson and Company; Thermo Fisher Scientific, Inc.; GE HealthCare Technologies, Inc.; Terumo Corporation; STEMCELL Technologies Inc.; Miltenyi Biotec; Corning Incorporated; Merck KgaA; Lonza Group AG; PromoCell GmbH; Bio-Rad Laboratories, Inc.; Nikon Corporation (Healthcare Business Unit); and Charles River Laboratories International, Inc.

? The blastomere extraction segment accounted for the largest share of the market in 2024.

? The bone marrow segment dominated the market in 2024.

? Cell harvesting systems refer to technologies and equipment used to collect, isolate, and process cells from various biological sources, such as blood, bone marrow, adipose tissue, and umbilical cord. These systems are critical in applications like stem cell research, regenerative medicine, immunotherapy, and biopharmaceutical production. The primary goal of cell harvesting is to efficiently recover high-quality cells while minimizing contamination and loss of cell integrity. These systems are widely used in medical research, therapeutic treatments, and the production of biological drugs, ensuring that cells are properly handled for clinical and research applications.

? A few key trends in the cell harvesting systems market are described below: Adoption of Automated Technologies: Increasing demand for automated systems to improve efficiency and scalability and reduce human error in cell harvesting processes. Growth of Immunotherapy Applications: Expanding uses of cell-based therapies, particularly in oncology, driving the need for advanced cell harvesting systems. Shift Towards Closed-Systems: Rising preference for closed-system technologies to prevent contamination and ensure sterile environments during cell collection. Personalized Medicine Focus: Growing emphasis on tailored treatments, especially in stem cell therapies, requiring specialized cell harvesting solutions.

? A new company entering the cell harvesting systems market could focus on developing automated and closed-system solutions that improve efficiency and scalability and ensure contamination-free cell collection. Emphasizing integration with regenerative medicine and immunotherapy applications could be a key differentiator, as these sectors are experiencing rapid growth. The company should also invest in customized solutions for personalized medicine, addressing the need for patient-specific therapies. Additionally, focusing on cost-effective and user-friendly systems that cater to both research centers and small-scale biopharma companies could help tap into emerging markets, particularly in Asia Pacific. Ensuring strong regulatory compliance and offering post-sale support would also enhance the company’s competitive edge.

? Companies manufacturing, distributing, or purchasing cell harvesting systems and related products, and other consulting firms must buy the report.