Cell Culture Market Share, Size, Trends, Industry Analysis Report: By Product (Consumables and Instruments), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1013

- Base Year: 2024

- Historical Data: 2020-2023

Cell Culture Market Overview

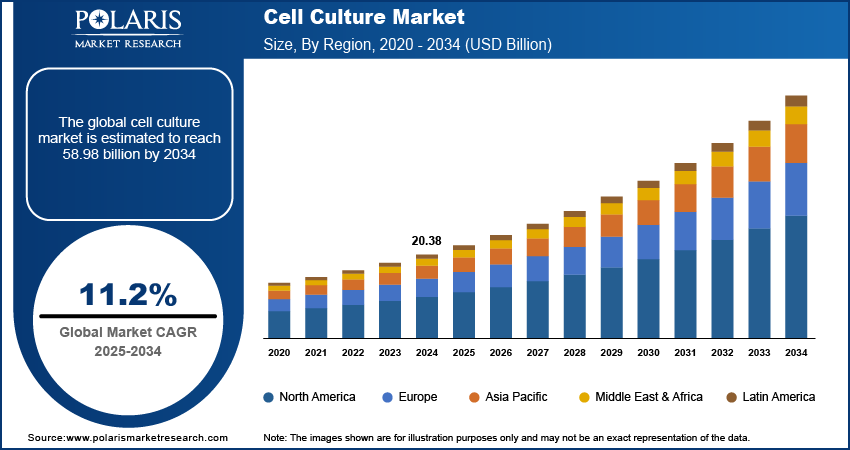

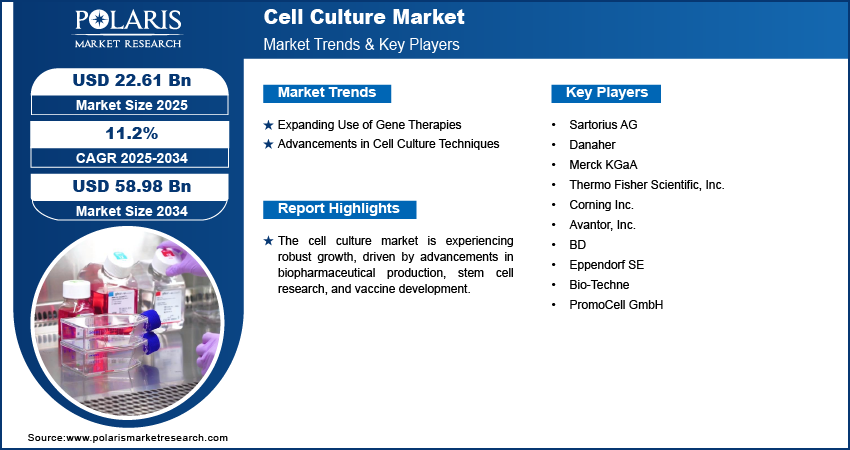

The global cell culture market size was valued at USD 20.38 billion in 2024. The market is projected to grow from USD 22.61 billion in 2025 to USD 58.98 billion by 2034, exhibiting a CAGR of 11.2% during 2025–2034.

Cell culture is a lab technique used for growing microorganisms or human, plant, or animal cells in a controlled environment. It helps study cell behavior, diagnose infections, test drugs, and support diverse research efforts.

The cell culture market demand is growing significantly due to increased research and development (R&D) efforts focused on developing monoclonal antibodies. This is in response to the growing incidence of chronic illnesses such as cardiovascular diseases and autoimmune disorders. According to the World Health Organization (WHO) report published in June 2021, cardiovascular diseases (CVDs) are among the top global causes of death, accounting for 17.9 million fatalities each year, which is 32% of total deaths. The rise in prevalence of these chronic conditions is creating a high demand for advanced therapeutic solutions, leading to increased reliance on cell culture techniques for the development and production of innovative treatments.

To Understand More About this Research: Request a Free Sample Report

Major pharmaceutical companies worldwide are expanding their vaccine production facilities, and new entrants are emerging in the market. This expansion across key countries is expected to increase the demand for raw materials, including cultural media. Consequently, the global market for cell culture media is anticipated to experience significant growth during the forecast period driven by the rising vaccine production needs. For instance, in January 2024, AbbVie announced a USD 223 million investment to expand its biologics manufacturing capacity at its Singapore site. This expansion is expected to increase the site's biologics drug-substance capacity by 24,000 liters, enhancing AbbVie's ability to support existing products and upcoming immunology and oncology therapies in its pipeline.

Cell Culture Market Drivers

Expanding Use of Gene Therapies

Gene therapy is used to treat various acquired and inherited neurological disorders and is known for its potential to improve cellular dysfunction, offering a promising treatment option. Researchers worldwide are actively exploring new applications of gene therapy, which involves using viral vectors to introduce genetic material into target cells. Effective cell culture media, enriched with recombinant proteins, helps minimize the risk of contamination by viral RNA, DNA, and other harmful entities.

As a result, the growing demand for cell culture technologies, driven by advancements in gene therapies and the increasing prevalence of chronic diseases like cancer, is expected to significantly accelerate the expansion of the cell culture market. This trend is further supported by ongoing collaborations and innovations aimed at developing cutting-edge treatments, such as CAR-T and CAR-M therapies, which hold immense promise for revolutionizing cancer treatment and other therapeutic areas. Consequently, the cell culture market is poised for substantial growth as the biotechnology and pharmaceutical industries continue to push the boundaries of medical research and development.

Advancements in Cell Culture Techniques

The cell culture industry is witnessing ongoing advancements such as the use of nanofibers in cell culture media. These transparent fibers allow for live-cell imaging, real-time monitoring of cell movement, and replication of the three-dimensional topography found in living organisms. They can also be coated with extracellular matrix (ECM) proteins, which is particularly useful for cancer research. Companies such as Merck KGaA are offering nanofiber cell culture dishes with randomly oriented nanofibers, providing potential for the incorporation of epidermal and fibroblast growth factors. Additionally, new instruments designed to facilitate the analysis of drug products and cell culture media are accelerating the cell culture market expansion. For instance, in September 2023, Waters Corporation launched advanced walk-up solutions designed to enhance sample preparation and analysis efficiency. The solution streamlines the analysis of drug products and cell culture media, by integrating the BioAccord LC-MS system with the Andrew + robot. These advancements contribute to more efficient and effective research processes, driving the demand for innovative cell culture solutions.

Cell Culture Market Segment Analysis

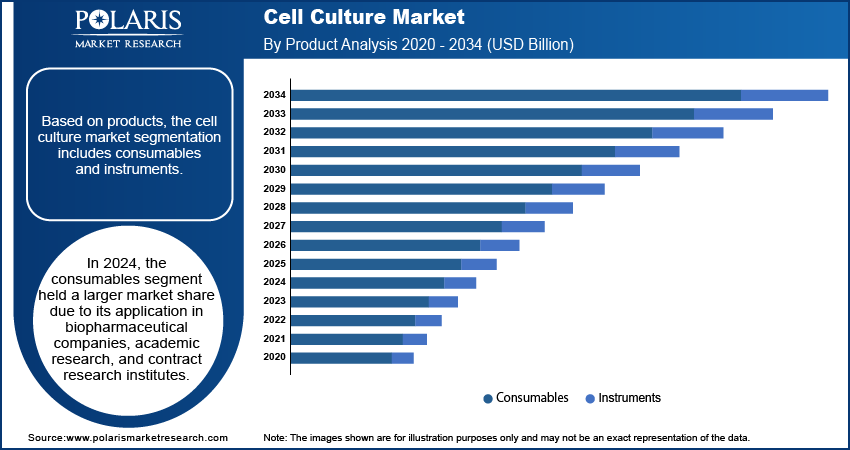

Cell Culture Market Assessment by Product Outlook

Based on products, the global cell culture market is segmented into consumables and instruments. In 2024, the consumables segment held a larger market share due to its rising application in biopharmaceutical companies, academic research, and contract research institutes. The increasing incidence of infectious diseases and chronic diseases such as tuberculosis (TB), malaria, HIV/aids, influenza (Flu), rabies, and cancer has driven the demand for personalized medicines, contributing to market growth. According to the World Health Organization (WHO) report published in June 2024, rabies is a deadly viral disease transmitted to humans through animal bites, primarily dogs, causing tens of thousands of deaths annually, with over 95% occurring in Asia and Africa.

In consumables, the media segment is expected to grow during the forecast period by eliminating contamination between samples and ensuring precise cell culture, meeting the high demand in life sciences, chemistry, and various end-use industries. The equipment segment is expected to experience rapid growth driven by increased R&D investments and the expanding life sciences industry, particularly in biopharmaceuticals. Additionally, the growth of the biotechnology sector, along with rising interest in stem cell research and its applications, contributes to the segment's growth. These advancements are driving demand for cell culture media in research and production processes.

Cell Culture Market Evaluation by Application Outlook

The global cell culture market, based on application, is segmented into biopharmaceutical production, diagnostics, drug discovery and development, tissue culture and regenerative medicine, cell and gene therapy, toxicity testing, and others. The biopharmaceutical production segment is expected to experience growth during the forecast period due to increased use in medical screening and compound synthesis. In June 2024, BD (Becton, Dickinson and Company) introduced the BD Rhapsody ATAC-Seq Assay, enhancing diagnostics, drug discovery, tissue culture, regenerative medicine, and cell and gene therapy by advancing precision medicine through improved disease mechanism understanding.

Government support to develop cell culture-based vaccines due to rising monoclonal disorders and their effectiveness in curing this illness is expected to accelerate the cell culture market development. The diagnostics segment is projected to register the highest CAGR, driven by the use of cell cultures in metabolomics to identify biomarkers for pathologically relevant conditions. Metabolites are vital in diagnosing cancer and monitoring its recurrence, thereby expanding the application scope of cell culture media products in disease diagnosis and enhancing market demand in this sector.

Cell Culture Market Regional Insights

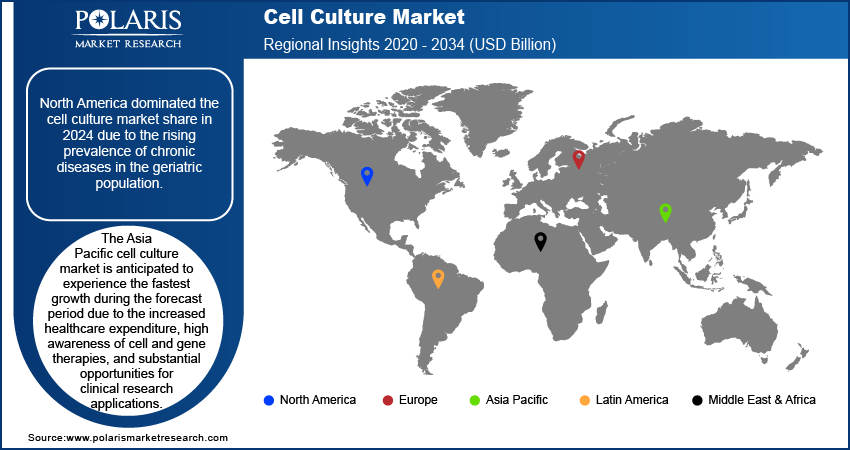

By region, the study provides the cell culture market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the market in 2024 due to the rising prevalence of chronic diseases in the geriatric population.

The US cell culture market is growing due to technological advancements and investments in biopharmaceutical centers and government initiatives and policies to develop medical research are contributing to the segment's growth. In November 2022, Fujifilm made a USD 188 million investment to build a new cell culture media manufacturing facility. This expansion aims to significantly increase the company's liquid cell culture media production capacity by three times. The move is designed to support the rising demand for biologics and enhance Fujifilm's ability to provide critical supplies to the biotechnology and pharmaceutical industries.

The Asia Pacific cell culture market is anticipated to experience the fastest growth during the forecast period due to the increased healthcare expenditure, high awareness of cell and gene therapies, and substantial opportunities for clinical research applications. Additionally, the region's rapid adoption of advanced scientific technologies and emerging therapeutics, such as regenerative medicines and cancer immunotherapies, is expected to boost market expansion in the future. Eminence Biotechnology's new GMP-certified facility in Suzhou, China, inaugurated in October 2023, produces substantial quantities of dry powder and liquid media annually, supporting the region's growth in regenerative medicines and cancer immunotherapies.

Cell Culture Market – Key Players and Competitive Analysis

The competitive landscape of the cell culture market features a mix of global leaders and regional players competing to capture market share through strategic alliances, technological advancements, and geographic expansion. Key players such as Thermo Fisher Scientific, Merck KGaA, Lonza, and GE Healthcare are utilizing their extensive research and development capabilities, along with robust distribution networks, to offer innovative cell culture media, reagents, and equipment. Cell culture market trends indicate rising demand for advanced cell culture solutions, driven by the increasing adoption of biopharmaceuticals, tissue engineering, and regenerative medicine.

Regional companies, particularly in emerging markets such as Asia Pacific, are addressing localized needs by providing cost-effective solutions, contributing to rapid market expansion. Competitive strategies such as mergers and acquisitions, partnerships with academic institutions, and the development of specialized products are becoming increasingly prevalent as cell culture technologies evolve. These factors highlight the role of innovation, regional investments, and market adaptability in propelling the cell culture market development. A few major players in the cell culture market are Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor, Inc.; BD; Eppendorf SE; Bio-Techne; and PromoCell GmbH.

Thermo Fisher Scientific Inc. focuses on improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, and increasing lab productivity. The company operates through its brands, which include Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD. Its team offers a mix of advanced technology, buying ease, and pharmaceutical services. In June 2024, Thermo Fisher Scientific unveiled the Stellar mass spectrometer and updated its Orbitrap Ascend Tribrid models at ASMS, enhancing capabilities for translational omics and specific applications in pharmaceutical and biopharma research.

Danaher Corporation is an American global conglomerate founded in 1984. Headquartered in Washington, D.C., the company specializes in designing, manufacturing, and marketing a diverse range of medical, industrial, and commercial products and services. The company operates through three main segments—Life Sciences, Diagnostics, and Environmental & Applied Solutions—leveraging the Danaher Business System (DBS) to drive operational efficiency and continuous improvement across its operations. Danaher Corporation, with a strategy focused on strategic acquisitions, has evolved from its initial industrial roots into a leading innovator in science and technology.

List of Key Companies in Cell Culture Market

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Corning Inc.

- Avantor, Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

Cell Culture Industry Developments

In July 2024, Avantor launched the J.T.Baker Cell Lysis Solution and J.T.Baker Endonuclease to expand its life sciences product range. These new products aim to enhance advanced research by providing improved tools for cell analysis and molecular applications.

In September 2023, Thermo Fisher Scientific launched the Gibco CTS Detachable Dynabeads, a groundbreaking platform with an innovative active-release mechanism designed for the clinical and commercial operation of cell therapy manufacturing.

In August 2023, Danaher acquired Abcam, a provider of validated antibodies, reagents, biomarkers, and assays essential for life sciences research, drug discovery, and diagnostics. Abcam will continue to operate independently within Danaher's Life Sciences segment, supporting its mission to improve disease understanding and accelerate drug development processes.

In September 2022, Adolf Kuhner launched a new orbitally shaken bioreactor SB10-X, which has a capacity of up to 3L. This vessel allows working with small units of 1.5–4.5L, which is used to perform cell culture.

Cell Culture Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Sera

- Fetal Bovine Serum

- Other

- Reagents

- Albumin

- Others

- Media

- Serum-Free Media

- CHO Media

- HEK 293 Media

- BHK Medium

- Vero Medium

- Other Serum-Free Media

- Serum-Free Media

- Classical Media

- Stem Cell Culture Media

- Chemically Defined Media

- Specialty Media

- Other Cell Culture Media

- Sera

- Instruments

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Drug Development

- Diagnostics

- Tissue Culture & Engineering

- Cell & Gene Therapy

- Toxicity Testing

- Other Applications

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Culture Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.38 billion |

|

Market Size Value in 2025 |

USD 22.61 billion |

|

Revenue Forecast by 2034 |

USD 58.98 billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cell culture market size was valued at USD 20.38 billion in 2024 and is projected to grow to USD 58.98 billion by 2034

The global market is projected to register a CAGR of 11.2% during the forecast period.

North America held the largest market share in 2024.

A few key players in the market are Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor, Inc.; BD; Eppendorf SE; Bio-Techne; and PromoCell GmbH.

The consumables segment held a larger share of the market in 2024.

The diagnostics segment is expected to register the highest CAGR during the forecast period in the market during the forecast period.