Cell & Gene Therapy Bioanalytical Testing Services Market Size, Share, Trends, Industry Analysis Report – By Test Type (Bioavailability & Bioequivalence Studies, Pharmacokinetics, Pharmacodynamics, and Others), By Product Type, By Stage of Development, By Indication, and By Region; Segment Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 114

- Format: PDF

- Report ID: PM5055

- Base Year: 2023

- Historical Data: 2019-2022

Cell & Gene Therapy Bioanalytical Testing Services Market Outlook

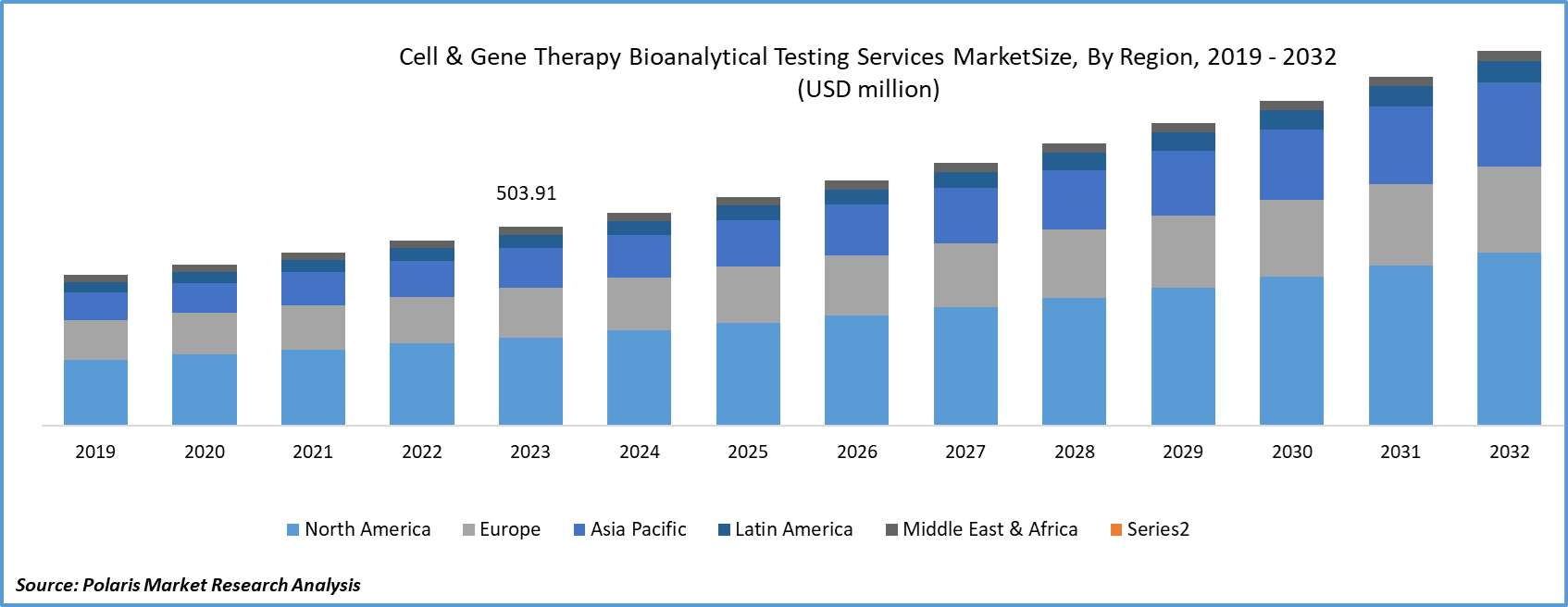

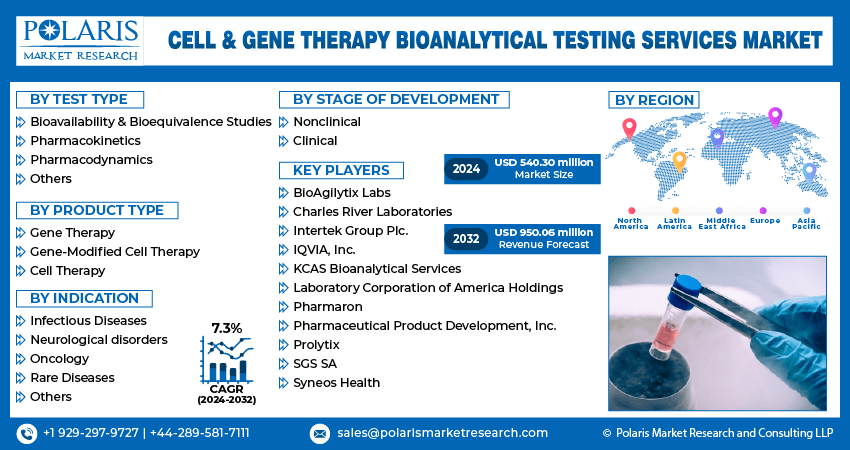

The cell & gene therapy bioanalytical testing services market size was valued at USD 503.91 million in 2023.The market is anticipated to grow from USD 540.30 million in 2024 to USD 950.06 million by 2032, exhibiting a CAGR of 7.3% during 2024–2032.

Market Overview

The rising prevalence of chronic diseases, such as cancer, which lack permanent cures, is significantly driving the demand for advanced cell and gene therapies, as well as intensifying research in this domain. Furthermore, the implementation of increasingly stringent government safety guidelines is compelling researchers to develop high-efficacy, safer cell and gene therapies. These dynamics are collectively contributing to the robust growth of the global cell and gene therapy bioanalytical testing services market.

For instance, in April 2024, the Biologics Evaluation and Research Center of the Food and Drug Administration launched two new guidance drafts for the safe testing of cell and gene therapy products. First draft includes products developed from human allogeneic cells, and the other contains cell and gene therapies produced by animal- and human-derived materials.

To Understand More About this Research:Request a Free Sample Report

Ongoing developments of new cell and gene therapies are creating favorable market conditions for bioanalytical testing services. For instance, as per the study published in Nature Biotechnology, the approvals of cell and gene therapies reached an all-time high in 2023. This includes five gene therapies, CRISPR-Cas9-edited therapies, and one disease modifying Alzheimer's drug. Thus the rising development in the new cell therapies is further driving the market growth over the forecast period.

Growth Drivers

Rising Investments in Cell and Gene Therapy Developments Drive the Market Growth

The rising global demand for cell and gene therapies is driving substantial investments in development activities, thereby increasing the need for bioanalytical testing solutions in this sector. For instance, the New York administration announced a USD 98 million investment in cell and gene therapy manufacturing to support the design and production of cancer treatments and other life-saving technologies. This trend is expected to significantly boost the demand for bioanalytical testing services during the forecast period. Furthermore, the growing demand for effective healthcare and specialty care is fueling innovation in cell and gene therapies, prompting market players to expand into bioanalytical testing services. For instance, in April 2024, Walgreens introduced Walgreens Specialty Pharmacy, a comprehensive service expanding care for patients with complex conditions while enhancing profitability through strategic partnerships. This investment is made to advance its specialty pharmacy offerings, including gene and cell therapy services. These developments are contributing to the growth of the cell and gene therapy bioanalytical testing services market.

Growing Development of Cell and Gene Therapies Drives Market Growth

The increasing awareness and benefits of cell and gene therapies and the limited side effects of these therapies are fostering healthcare research initiatives across the world. Ongoing research collaborations to enhance cell and gene therapy capabilities create demand for bioanalytical testing services. For instance, In April 2024, Xcell Biosciences entered a research collaboration with Labcorp to produce Xcellbio’s AVATAR incubator system for the R&D of cell therapy. In turn, LabCorp announced a rise in strategic investments in Xcellbio. The rising prevalence of deadly diseases is forcing researchers to conduct cell and gene research. In a 2024 study published in Cell Stem Cell, researchers discovered a new treatment method for polycystic kidney disease through gene editing technologies. Also, they developed a new drug, glycoside, to reduce or remove the effect of defective genes.

Restraining Factors

Stringent Regulations Hinders the Market Growth

The huge costs of designing and producing cell and gene therapies, the lower chance of attaining high-performing therapeutics, and growing government stringent regulations are negatively impacting the market. The limited availability of skilled professionals in the biopharmaceutical sector and the need for effective healthcare infrastructure also hinder the cell & gene therapy bioanalytical testing services market growth.

Cell & Gene Therapy Bioanalytical Testing Services Market Report Segmentation

The cell & gene therapy bioanalytical testing services market is segmented on the basis of test type, product type, stage of development, indication, and region.

|

By Test Type |

By Product Type |

By Stage of Development |

By Indication |

By Region |

|

|

|

|

|

By Test Type Analysis

Bioavailability & Bioequivalence Studies Segment to Witness Highest Growth Rate in Cell & Gene Therapy Bioanalytical Testing Services Market

The cell & gene therapy bioanalytical testing services market for the bioavailability and bioequivalence segment is expected to grow at the fastest pace owing to the rising drug development activities. Bioequivalence studies are used to monitor human body reactions and the functioning of the treatment. The rising stringent biopharmaceutical regulations are promoting the use of bioavailability and bioequivalence studies to evaluate the safety and efficiency of therapies for treating human diseases.

By Product Type Analysis

Cell Therapy Segment Accounted for Largest Share in Cell & Gene Therapy Bioanalytical Testing Services Market

The cell therapy segment accounted for the largest revenue share in 2023 and is likely to retain its market dominance during the forecast period. The rising development of cell therapies is positively impacting the demand for bioanalytical testing services. Moreover, the FDA has accelerated approvals for cell therapies, reflecting a rapidly evolving landscape driven by advancements in treating complex diseases. For instance, in March 2024, the US FDA announced the approval of Breyanzi, an initial cell therapy developed by the Breyanzi, for the treatment of small lymphocytic lymphoma in adults. This surge in approvals highlights the growing importance of cell therapy in modern healthcare, thereby contributing to the market growth.

Cell & Gene Therapy Bioanalytical Testing Services Market Regional Insights

Asia Pacific Held Largest Share of Global Cell & Gene Therapy Bioanalytical Testing Services Market in 2023

Asia Pacific accounted for the dominant share in the cell & gene therapy bioanalytical testing services market due to the rising prevalence of chronic health conditions, including cancer and neurological and genetic disorders, enabling companies to propel their gene and cell therapy research. Countries such as China, India, and Japan are recording a rise in number of cancer cases. For instance, according to the ICMR-NCRP, cancer cases are expected to reach 1.57 million by 2025 from 1.46 million in 2022. Thus, the rising number of cancer patients will further fuel research initiatives in cell and gene therapies, which in turn increase the demand for cell & gene therapy bioanalytical testing services in the Asia Pacific.

Europe is expected to register a significant CAGR in the cell & gene therapy bioanalytical testing services market during the forecast period. Government and nongovernment organizations are supporting advancements in cell and gene therapies by providing funds to companies engaged in R&D activities. For instance, in March 2023, the UK government announced the Life Sciences Innovative Manufacturing Fund (LSIMF) for biotech companies. Pharmaron and Touchlight received USD 190 million and USD 17.7 million, respectively, for cell and gene therapy development and production.

Key Market Players and Competitive Insights

Strategic Activities by Market Players to Drive Competition

The cell & gene therapy bioanalytical testing services market is fragmented and is anticipated to witness competition due to the presence of several players. The rising efforts taken by the key market players across the world in the form of investments, acquisitions, collaborations, and partnership activities are widening the expansion of global cell and gene therapy bioanalytical testing services.

Major Players Operating in Global Cell & Gene Therapy Bioanalytical Testing Services Market

- BioAgilytix Labs

- Charles River Laboratories

- Intertek Group Plc.

- IQVIA, Inc.

- KCAS Bioanalytical Services

- Laboratory Corporation of America Holdings

- Pharmaron

- Pharmaceutical Product Development, Inc.

- Prolytix

- SGS SA

- Syneos Health

Cell & Gene Therapy Bioanalytical Testing Services Recent Developments in Industry

- In April 2024, the National Institutes of Health (NIH) announced an investment of USD 6.2 million to the Washington University School of Medicine researchers to boost cell and gene research activities for HIV.

- In May 2024, Merck announced that it had completed the acquisition of the Mirus Bio for USD 600 million to boost its potential in producing cell and gene therapies.

Report Coverage

The cell & gene therapy bioanalytical testing services market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction across the world. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, test type, product type, stage of development, indication, and their futuristic growth opportunities.

Cell & Gene Therapy Bioanalytical Testing Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 540.30 million |

|

Revenue Forecast in 2032 |

USD 950.06 million |

|

CAGR |

7.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global cell & gene therapy bioanalytical testing services market size was valued at USD 503.9 million in 2023 and is projected to grow to USD 950.06 million by 2032.

The global market is projected to grow at a CAGR of 7.3% during the forecast period

Asia Pacific had the largest share in the global market due to the rising prevalence of chronic health conditions.

The key players in the market BioAgilytix Labs, Charles River Laboratories, Intertek Group, IQVIA, KCAS Bioanalytical Services, and Pharmaron.

The cell therapy category dominated the market in 2023 due to rising development of cell therapies is positively impacting the demand for bioanalytical testing services.

The bioavailability and bioequivalence category had the fastest share due to the rising drug development activities.