Catalyst Carrier Market Share, Size, Trends, Industry Analysis Report

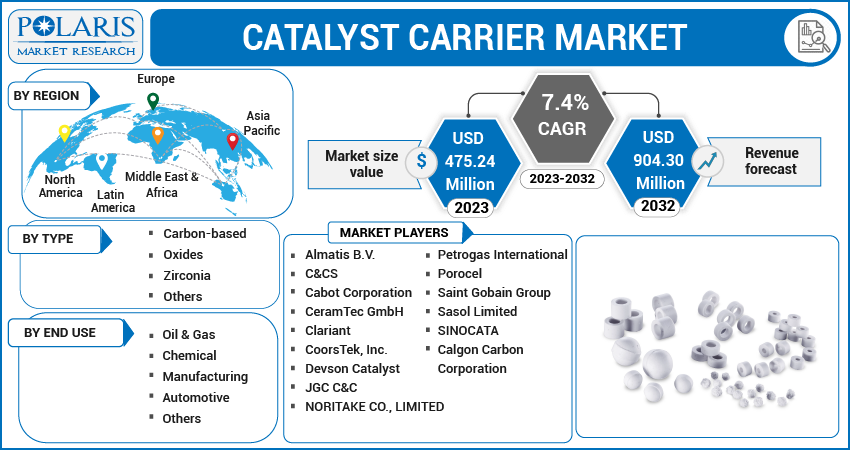

By Type (Carbon-based, Oxides, Zirconia, and Others); By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Mar-2023

- Pages: 118

- Format: PDF

- Report ID: PM3071

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

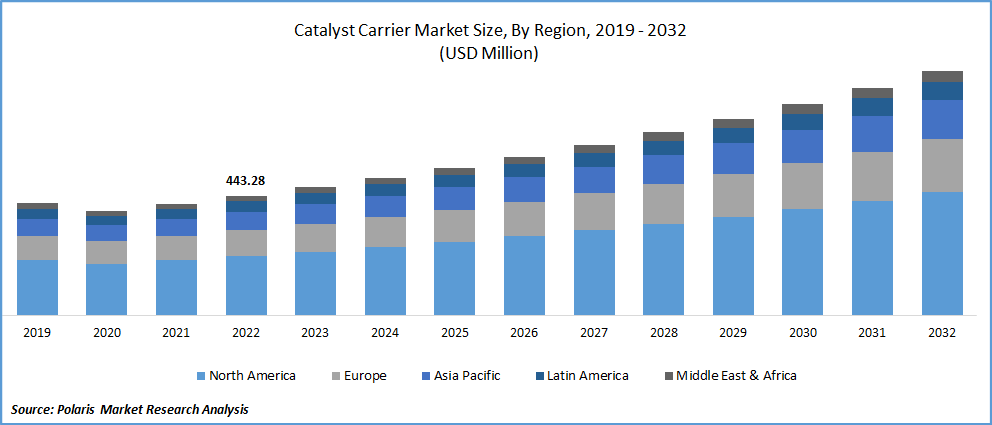

The global catalyst carrier market was valued at USD 443.28 million in 2022 and is expected to grow at a CAGR of 7.4% during the forecast period. The global market is growing at rapid pace, and several key manufacturers are actively engaged in expanding and integrating R&D activities; thereby there is an increase in the potential sales of catalyst carriers, thus driving the market growth. Furthermore, catalyst carriers are permeable materials extensively used in the petrochemical industries for refining gases and liquid substances during the intermediate process.

Know more about this report: Request for sample pages

Catalyst carrier is a solid material with a high surface area to which catalysts are reacted. Catalyst carrier is obtained from metal and non-metal oxides such as ceramic, alumina, copper, silica, zirconium, and among others. In addition, different types of a catalyst such as zirconium, oxides, carbon, and others are subjected to heat treatment under standard conditions. Furthermore, catalyst carriers possess various properties such as mechanical strength, chemical inertness, stability, and maintain homogeneity in the bulk material.

The outbreak of the COVID-19 pandemic had significantly impacted the growth of the market. The shutdown of various manufacturing units and the imposition of strict lockdown hampered the growth of the catalyst carrier market during 2020.

In addition, the decrease in the sales of the chemical manufacturing industry during the pandemic has disturbed market revenue. For instance, an article published by CEFIC the world's chemicals sales decreased by 4.3% from EUR 3,628 billion in 2019 to EUR 3,471 billion, in 2020. This situation has temporarily hampered the demand and supply chain of the market.

Furtherly, rising demand from automotive, oil & gas, and robust consumption of energy from various end-use industries is projected to get back the market on track post COVID-19.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Robust demand for energy in expanding economies and an increase in the consumption rate of petrochemical additives are projected to drive the market during the forecast period. This factor is likely to drive the market for catalyst carriers during the forecast period. In addition, the physical and mechanical benefits associated with catalyst carrier is expected to have a positive impact on catalyst carrier market growth. The petrochemical industry is one of the fastest-growing industries across Europe and substantially contributes to Europe’s economy.

For instance, data published by the Petrochemicals Europe petrochemical industry had contributed 25.4% of Europe’s chemical industry which generated EUR 565 sales, in 2018. This factor has positively impacted the market where it has been used in the petroleum refining of liquids and gases. This factor responsible for the growth of the market during the forecast period.

An increase in transportation and logistics activities has enhanced the demand for commercial vehicles where catalyst carriers are used for enhancing the efficiency of exhaust gas conversion. In addition, platinum and copper metal precious metal catalyst carries offers high durability, strength, and corrosion resistance properties owing to which it is most preferred in the automotive industry.

Furthermore, increase in the foreign direct investment (FDI) inflow in the automotive industry has increased. For instance, a report published by India Brand Equity Foundation, the automotive sector received an FDI inflow of around $30.51 billion from April 2000 to June 2021. Thus, the demand for catalyst carriers has increased in the automotive industry owing to such favorable key factors.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Carbon-based segment is accounted largest revenue share in 2022

In 2022, carbon-based carriers projected to garner largest revenue share over the study period. The chemical industry is growing at a rapid pace this is due to the rising demand for industrial chemicals and increase in the R&D investment has spurred the chemical industry. For instance, in an article published by Invest India in December 2023, the industrial production of chemicals and chemical products in FY 2021-22 is 120.7 and has grown by 4.1%. Activated carbon-based catalyst carriers possess high chemical inertness and maintain chemical stability. Thus, boost up the chemical reaction. This factor is projected to drive the market in the upcoming years. In addition, activated carbon-based catalyst carrier has additional beneficial properties comparatively to zirconium and alumina due to which it is best suited in the petrochemical and industrial chemical sectors. This may likely have a positive impact on the segment’s growth.

Oil & gas end use segment accounted for the largest market share in 2022

The growing demand for energy has spurred the crude oil drilling and inspection activities across the globe including countries like the U.S., Canada, Russia, Saudi Arabia, and others where catalyst carriers are widely used for enhancing product efficiency and mechanical resistance of oils. Moreover, increasing sales of automobiles have surged the need for refined fuel which in turn has led the global oil & gas refineries to surge their refining capacities where catalyst carriers are employed during the refining of liquid and gases during the intermediate and end-use products.

The demand in North America is expected to witness significant growth

North America is the dominant region in the market. This region is also anticipated to maintain its dominance throughout the forecast period. Moreover, the U.S., is a largest producer of oil and natural gases. According to an article published by U.S. Energy Information Administration, crude oil is extracted in around 32 U.S. states, & nearby coastal waters. In 2021, about 71 percent of the total production came from 5 states. This factor is creating high demand for catalyst carrier in the region.

Asia-Pacific and Europe shown considerable growth during the forecast period, due to the presence of oil reserves, giant automobile sectors, and chemical industry have enhanced the performance of overall industry. Furthermore, there are several manufacturing industries in Germany, UK, and other countries in Europe have increased their production capacities for the catalyst carrier-based products where it has been widely used in various end-use industry including automotive, industrial chemical, petrochemicals, oil & gas, and others.

Competitive Insight

Some of the major players operating in the global market include Almatis B.V., C&CS, Cabot Corporation, Calgon Carbon Corporation, CeramTec GmbH, Clariant, CoorsTek, Inc., Devson Catalyst, JGC C&C, NORITAKE CO., LIMITED, Petrogas International, Porocel, Saint Gobain Group, Sasol Limited, and SINOCATA.

Recent Developments

- In July 2023, BASF SE launched a new catalyst-based product named as PuriCycle. This new product comprises novel catalyst and adsorbent solutions. In addition, it also removes impurities from pyrolysis oil which is derived from plastic waste. This strategic product launch is projected to enhance the market growth.

- In April 2021, Unifrax introduced “Eco-lytic” catalyst carrier fitted into the vehicle to improve the emission reduction effect, reduce the consumption of precious metals and raw materials, and reduce the weight of the vehicle.

Catalyst Carrier Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 475.24 million |

|

Revenue forecast in 2032 |

USD 904.30 million |

|

CAGR |

7.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Almatis B.V., C&CS, Cabot Corporation, Calgon Carbon Corporation, CeramTec GmbH, Clariant, CoorsTek, Inc., Devson Catalyst, JGC C&C, NORITAKE CO., LIMITED, Petrogas International, Porocel, Saint Gobain Group, Sasol Limited, and SINOCATA. |

FAQ's

Key companies in catalyst carrier market are Almatis B.V., C&CS, Cabot Corporation, Calgon Carbon Corporation, CeramTec GmbH, Clariant, CoorsTek, Inc., Devson Catalyst, JGC C&C, NORITAKE CO., LIMITED

The global catalyst carrier market expected to grow at a CAGR of 7.4% during the forecast period.

The catalyst carrier market report covering key segments are type, end use, and region.

Key driving factor in catalyst carrier market are Increase in transportation and logistics activities.

The global catalyst carrier market size is expected to reach USD 904.30 million by 2032.