Castrate-Resistant Prostate Cancer Market Size, Share, Trends, Industry Analysis Report: By Therapy (Chemotherapy, Hormonal Therapy, Immunotherapy, and Radiotherapy) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5332

- Base Year: 2024

- Historical Data: 2020-2023

Castrate-Resistant Prostate Cancer Market Overview

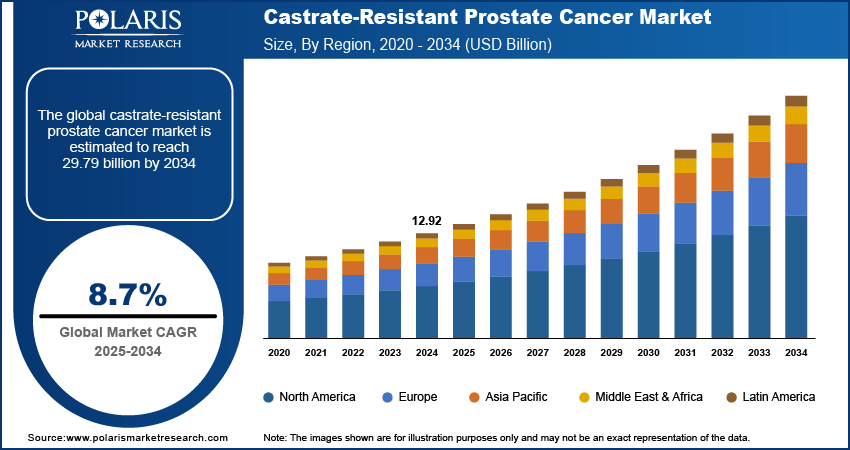

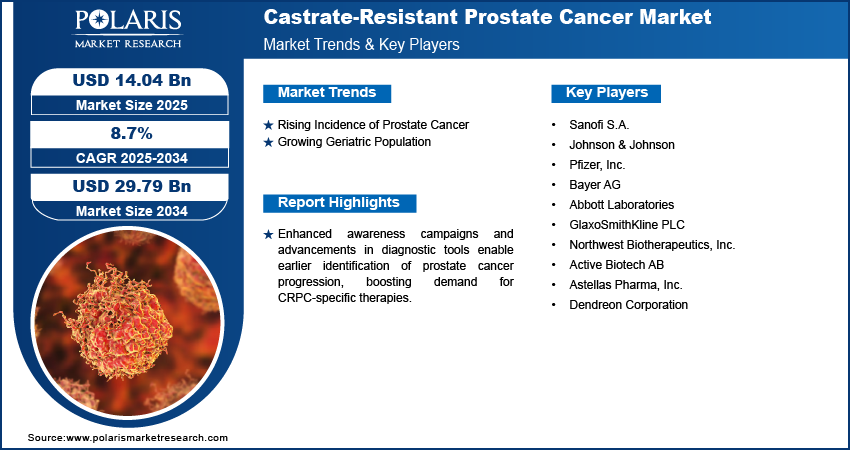

The castrate-resistant prostate cancer market size was valued at USD 12.92 billion in 2024. The market is projected to grow from USD 14.04 billion in 2025 to USD 29.79 billion by 2034, exhibiting a CAGR of 8.7% during 2025–2034.

Castrate-resistant prostate cancer (CRPC) is a type of prostate cancer that keeps growing despite treatments that lower testosterone, a hormone that fuels the cancer's growth. CRPC often spreads to other parts of the body, such as bones or lymph nodes, and is identified by rising PSA levels despite low testosterone. CRPC treatments include advanced hormone therapies, chemotherapy, immunotherapy, and bone-targeting agents to manage symptoms and improve survival. The growing focus on combination therapies such as pairing androgen receptor inhibitors with chemotherapy or immunotherapy has shown enhanced efficacy in treating CRPC, further driving the demand for treatment options. Furthermore, increased funding for oncology research and ongoing clinical trials boost innovation in castrate-resistant prostate cancer treatment, creating new CRPC market opportunities. Enhanced awareness campaigns and advancements in diagnostic tools enable earlier identification of prostate cancer progression, boosting demand for CRPC-specific therapies. Moreover, fast-track designations and regulatory approvals for novel drugs are accelerating their entry into the market, ensuring wider accessibility for patients.

To Understand More About this Research: Request a Free Sample Report

Castrate-Resistant Prostate Cancer Market Trend Analysis

Rising Incidence of Prostate Cancer

The rising number of prostate cancer cases worldwide is leading to more patients developing castrate-resistant prostate cancer (CRPC), a condition where the cancer continues to grow even after treatments that lower testosterone levels. This growing patient population requires more advanced treatments.

In the United States, the American Cancer Society predicts that about 299,010 new cases of prostate cancer will be diagnosed in 2024. Unfortunately, around 35,250 people are expected to die from the disease in the same year.

As more patients transition to CRPC, there is an increasing demand for effective treatments. This is driving growth in the CRPC treatment market, with the development of new therapies that aim to manage and treat the disease in its more advanced stages.

Growing Geriatric Population

The aging population across the world serves as a critical driver for the castrate-resistant prostate cancer market growth. The higher proportion of men entering the geriatric demographic correlates strongly with increased prostate cancer incidence and progression to castrate-resistant stages, intensifying demand for advanced CRPC treatment modalities. According to the World Health Organization, by 2030, 1 in 6 people globally will be aged 60 or above, increasing from 1 billion in 2020 to 1.4 billion. By 2050, this population will double to 2.1 billion. Additionally, the number of individuals aged 80 and above is projected to triple from 2020 to reach ∼426 million. This demographic shift emphasizes the need for targeted therapies and comprehensive management strategies to address the growing patient population.

Castrate-Resistant Prostate Cancer Market Segment Insights

Castrate-Resistant Prostate Cancer Market Assessment by Therapy Outlook

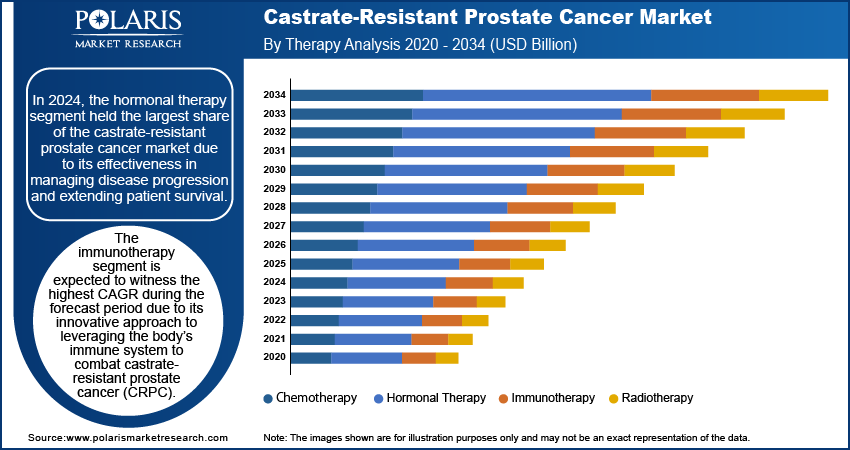

The global castrate-resistant prostate cancer (CRPC) market segmentation, based on therapy, includes chemotherapy, hormonal therapy, immunotherapy, and radiotherapy. In 2024, the hormonal therapy segment held the largest market share due to its effectiveness in managing disease progression and extending patient survival. Advanced hormonal therapies, such as androgen receptor inhibitors (e.g., enzalutamide) and androgen biosynthesis inhibitors (e.g., abiraterone acetate), have become standard treatments due to their ability to target cancer cells more precisely and delay progression. The widespread adoption of these therapies, supported by robust clinical evidence, regulatory approvals, and increasing patient access, contributed to their market leadership. Additionally, the preference for hormonal therapies over chemotherapy in early-stage CRPC solidified this segment's position as the largest contributor to the market.

The immunotherapy segment is expected to witness the highest CAGR during the forecast period due to its innovative approach to leveraging the body’s immune system to combat castrate-resistant prostate cancer. Immunotherapies, including cancer vaccines such as sipuleucel-T and immune checkpoint inhibitors, offer a promising alternative to traditional treatments by targeting cancer cells with high precision and reducing systemic side effects. Increasing investments in immunotherapy research, expanding clinical trials, and growing regulatory support for novel immune-based treatments are propelling advancements in this segment. The rising demand for personalized medicine and durable treatment responses is also boosting the adoption of immunotherapy, making it a key driver in the castrate-resistant prostate cancer market expansion.

Castrate-Resistant Prostate Cancer Market Regional Analysis

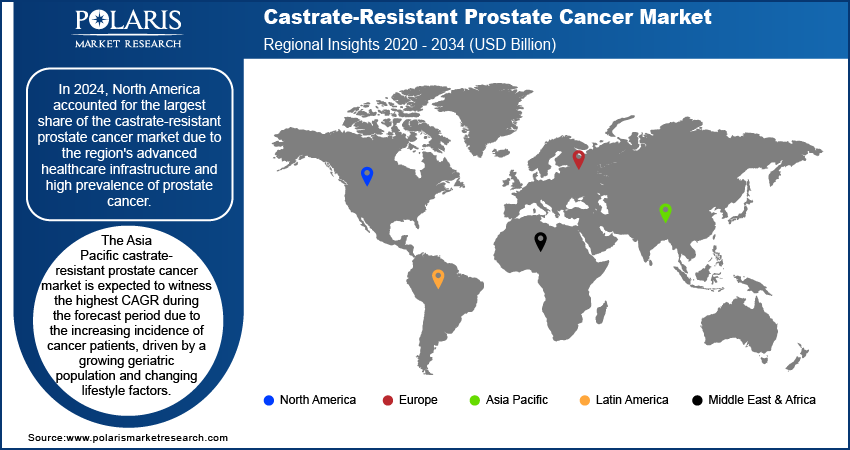

By region, the study provides castrate-resistant prostate cancer market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region's advanced healthcare infrastructure and high prevalence of prostate cancer. Mayo Clinic shows advanced healthcare infrastructure with its pioneering role in cancer detection. It was the first medical center to receive US Food and Drug Administration approval to prepare and administer the choline C-11 PET scan. This innovative imaging test enables the detection of prostate cancer recurrence at an earlier stage than traditional imaging methods, allowing for more targeted and timely interventions, thus improving patient outcomes in castrate-resistant prostate cancer management. According the National Cancer Institute, in 2021, around 3.4 million men in the US were diagnosed with prostate cancer. Additionally, favorable reimbursement policies, increased awareness of prostate cancer management, and early adoption of advanced treatment modalities boost the CRPC market dominance. High investments in research and development, coupled with strong regulatory support for novel therapies, reinforced North America's leadership in the CRPC market development.

The US accounted for the largest castrate-resistant prostate cancer market share due to the presence of leading pharmaceutical companies and ongoing innovations in drug development, which significantly contributed to the availability and adoption of advanced therapies, such as androgen receptor inhibitors and immunotherapies.

The Asia Pacific castrate-resistant prostate cancer market is expected to witness the highest CAGR during the forecast period due to the increasing incidence of cancer patients, driven by a growing geriatric population and changing lifestyle factors. According to the World Cancer Research Fund, in Asia, countries such as China, Japan, and India are reporting increasing prostate cancer cases, driving the castrate-resistant prostate cancer (CRPC) market expansion. In 2022, China reported 134,156 new cases, Japan had 104,318, and India recorded 37,948 cases. These growing numbers, coupled with rising awareness and healthcare access, are fueling demand for advanced CRPC treatments in the region.

The Japan castrate-resistant prostate cancer market is expected to witness significant growth during the forecast period due rapidly aging population, with prostate cancer incidence increasing among older men, leading to higher demand for advanced CRPC treatments. Additionally, Japan's well-developed healthcare infrastructure supports the adoption of innovative therapies, such as androgen receptor inhibitors and immunotherapies, which are becoming increasingly accessible to patients.

Castrate-Resistant Prostate Cancer Market – Key Players and Competitive Analysis

The competitive landscape of the castrate-resistant prostate cancer market is characterized by the presence of several key players, including pharmaceutical companies, biotech firms, and emerging players focused on innovative therapies. Major pharmaceutical companies, such as Johnson & Johnson, Astellas Pharma, Bayer, and Pfizer, dominate the market with their leading CRPC treatments, including Zytiga (abiraterone acetate), Xtandi (enzalutamide), and Janssen's Erleada. Major companies have strong market positions due to their established brands, significant research and development (R&D) investments, and extensive clinical trial portfolios. Additionally, the market is witnessing the entry of biotechnology firms focusing on immunotherapy, targeted therapies, and novel androgen receptor antagonists. Companies such as Bristol-Myers Squibb, Astellas, and Merck & Co. are developing next-generation therapies and expanding their pipelines for CRPC treatment. Moreover, increasing partnerships, collaborations, and acquisitions are shaping the competitive landscape as companies aim to enhance their therapeutic offerings and expand market reach. The growing focus on personalized medicine, precision oncology, and immunotherapy is expected to intensify competition, with companies aiming to introduce more effective treatments with fewer side effects. A few key major players are Sanofi S.A.; Johnson and Johnson; Pfizer, Inc.; Bayer AG; Abbott Laboratories; GlaxoSmithKline PLC; Northwest Biotherapeutics, Inc.; Active Biotech AB; Astellas Pharma, Inc; and Dendreon Corporation.

AstraZeneca is a biopharmaceutical company known for discovering, developing, manufacturing, and commercializing prescription medicines. Their broad portfolio of marketed products addresses various medical needs across cardiovascular, renal, metabolic, and oncology fields. In June 2024, AstraZeneca completed the acquisition of Fusion Pharmaceuticals Inc., a clinical-stage biopharmaceutical firm focused on next-generation radioconjugates (RCs). This acquisition supports AstraZeneca’s goal of shifting from traditional cancer therapies such as chemotherapy and radiotherapy to more targeted treatment approaches, ultimately enhancing patient outcomes.

Sanofi is a healthcare company that researches, develops, manufactures, and markets therapeutic solutions worldwide. Sanofi operates through three segments: pharmaceuticals, vaccines, and consumer healthcare. In the pharmaceuticals segment, Sanofi provides specialty care treatments for various conditions such as dupixent, rare diseases, oncology, neurology and immunology, rare blood disorders, and medicines for diabetes and cardiovascular diseases. The consumer healthcare segment provides over-the-counter products for cough, cold, flu, allergies, pain, and various wellness needs. Sanofi's Jevtana (cabazitaxel) has emerged as a significant advancement in the therapeutic landscape for prostate cancer management, demonstrating breakthrough efficacy in clinical applications.

List of Key Companies in Castrate-Resistant Prostate Cancer Market

- Sanofi S.A.

- Johnson & Johnson

- Pfizer, Inc.

- Bayer AG

- Abbott Laboratories

- GlaxoSmithKline PLC

- Northwest Biotherapeutics, Inc.

- Active Biotech AB

- Astellas Pharma, Inc.

- Dendreon Corporation

Castrate-Resistant Prostate Cancer Market Developments

In August 2023, Johnson & Johnsons announced that the US FDA had approved its AKEEGA (Abiraterone Acetate and Niraparib), the first dual-action tablet for treating BRCA-positive metastatic castration-resistant prostate cancer (mCRPC). This innovative formulation combines a PARP inhibitor with an androgen receptor inhibitor to target genetic vulnerabilities and inhibit androgen signaling, enhancing treatment efficacy in this specific patient group.

In May 2023, Novartis agreed to acquire Mariana Oncology, a preclinical biotech firm in Watertown, Massachusetts, focused on novel radioligand therapies (RLTs) for cancers with high unmet needs. This acquisition enhances Novartis's RLT pipeline and boosts its research and clinical supply capabilities, aligning with its strategic oncology priorities.

Castrate-Resistant Prostate Cancer Market Segmentation

By Therapy Outlook (Revenue, USD Billion; 2020–2034)

- Chemotherapy

- Hormonal Therapy

- Immunotherapy

- Radiotherapy

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Castrate-Resistant Prostate Cancer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.92 billion |

|

Market Size Value in 2025 |

USD 14.04 billion |

|

Revenue Forecast by 2034 |

USD 29.79 billion |

|

CAGR |

8.7% from 2025 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.92 billion in 2024 and is projected to grow to USD 29.79 billion by 2034.

The global market is projected to register a CAGR of 8.7% during the forecast period.

In 2024, North America dominated the market due to the region's advanced healthcare infrastructure and high prevalence of prostate cancer.

A few key players in the market are Laboratory Corporation of America Holding; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Genome Medical, Inc.; Coriell Life Sciences; Thermo Fisher Scientific Inc.; NeoGenomics Laboratories; FOUNDATION MEDICINE, INC.; Illumina, Inc.; and Guardant Health.

In 2024, the hormonal therapy segment held the largest share of the castrate-resistant prostate cancer market revenue due to its effectiveness in managing disease progression and extending patient survival.

The immunotherapy segment is expected to witness the highest CAGR during the forecast period due to its innovative approach to leveraging the body’s immune system to combat castrate-resistant prostate cancer (CRPC).