Castor Oil Derivatives Market Size, Share, Trends, Industry Analysis Report: By Product, Application (Lubricants, Surface Coatings, Biodiesel, Cosmetics and Pharmaceuticals, Plastics and Resins, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025– 2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3175

- Base Year: 2024

- Historical Data: 2020-2023

Castor Oil Derivatives Market Overview

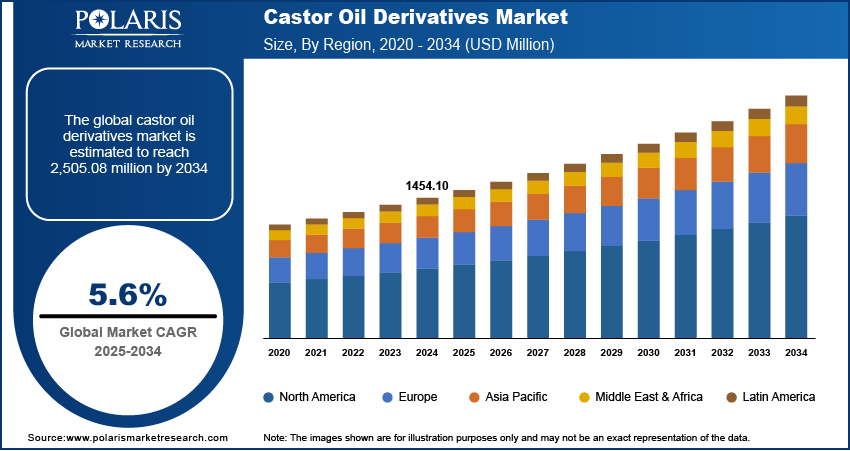

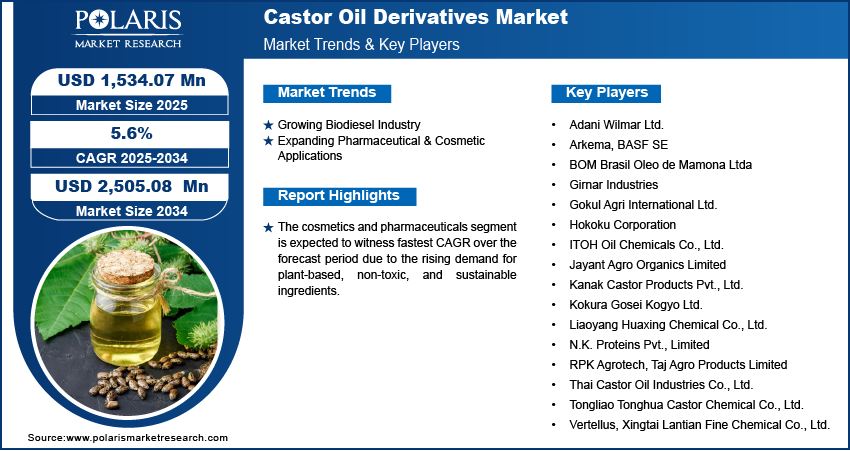

The global castor oil derivatives market size was valued at USD 1,454.10 million in 2024. The market is expected to grow from USD 1,534.07 million in 2025 to USD 2,505.08 million by 2034, exhibiting a CAGR of 5.6% from 2025 to 2034.

The castor oil derivatives market focuses on products derived from castor oil, including sebacic acid, ricinoleic acid, hydrogenated castor oil, and others. These derivatives are widely used in industries such as pharmaceuticals, cosmetics, lubricants, plastics, and biodiesel due to their bio-based, sustainable, and versatile chemical properties.

The castor oil derivatives market is experiencing significant growth, driven by the increasing demand for eco-friendly products and rising usage in industrial applications. As industries shift toward sustainable and renewable resources, castor oil derivatives have emerged as a crucial raw material in cosmetics, pharmaceuticals, and lubricants, contributing to market expansion.

To Understand More About this Research: Request a Free Sample Report

The widespread applications of castor oil derivatives in lubricants, plastics, paints, and coatings are fueling the castor oil derivatives market demand, as manufacturers seek bio-based alternatives to conventional petrochemicals. Furthermore, regulatory frameworks supporting the adoption of bio-based chemicals and stringent policies aimed at reducing reliance on petroleum-derived products are shaping the castor oil derivatives market development.

Castor Oil Derivatives Market Dynamics

Growing Biodiesel Industry

The rising emphasis on renewable energy sources and stringent regulations on carbon emissions are significantly impacting the castor oil derivatives market dynamics, particularly in the biodiesel sector. Castor oil-based biodiesel, known for its high viscosity, excellent lubricity, and low freezing point, is gaining traction as an alternative to petroleum-based fuels. The increasing focus on reducing greenhouse gas emissions and achieving energy security is driving market demand for biofuels, particularly in regions enforcing renewable energy mandates and carbon reduction targets. Additionally, government incentives and policies supporting biofuel blending programs are contributing to market growth. For instance, in June 2023, the US Department of Agriculture announced an investment of up to USD 500 million from the Inflation Reduction Act to increase domestic biofuel availability and expand cleaner fueling options for consumers. The versatility of castor oil in biodiesel production also provides a strategic castor oil derivatives market opportunity, as advancements in bio-refining technologies are enhancing its efficiency and scalability.

Expanding Pharmaceutical & Cosmetic Applications

Castor oil derivatives, such as ricinoleic acid, hydrogenated castor oil, and ethoxylated castor oil, are extensively utilized in skincare, hair care, and drug formulations due to their moisturizing, anti-inflammatory, and antimicrobial properties. The growing consumer preference for plant-derived, non-toxic, and sustainable cosmetic formulations is driving market demand, particularly in emollients, surfactants, and active pharmaceutical ingredients (APIs). Furthermore, the pharmaceutical industry is increasingly leveraging castor oil derivatives for drug delivery systems, excipients, and laxatives. For instance, in October 2023, Clariant launched three new VitiPure excipients to enhance API formulations and administration routes. VitiPure CO 35 Superior is a non-ionic emulsifier and solubilizer for human and veterinary applications, produced by ethoxylating castor oil. Thus, the rising demand for bio-based ingredients in pharmaceutical and cosmetic applications is driving the castor oil derivates market revenue.

Castor Oil Derivatives Market Segment Insights

Castor Oil Derivatives Market Assessment by Product Outlook

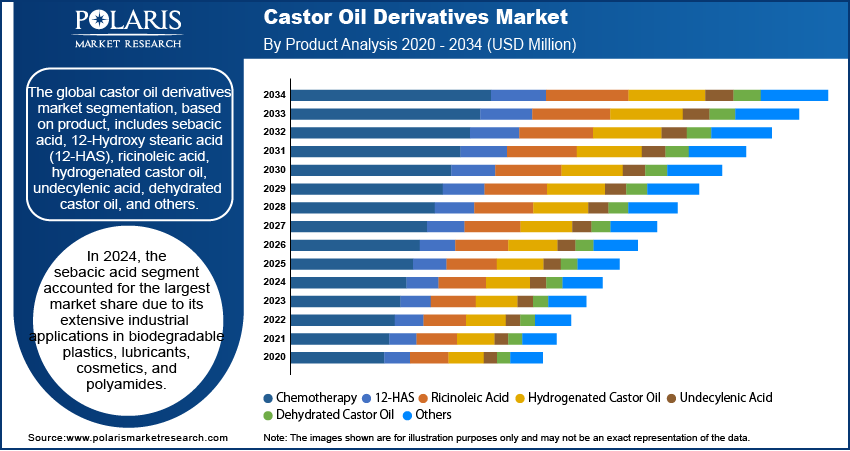

The global castor oil derivatives market segmentation, based on product, includes sebacic acid, 12-Hydroxy stearic acid (12-HAS), ricinoleic acid, hydrogenated castor oil, undecylenic acid, and dehydrated castor oil. In 2024, the sebacic acid segment accounted for the largest market share due to its extensive industrial applications in biodegradable plastics, lubricants, cosmetics, and polyamides. The rising demand for eco-friendly and high-performance polymers has significantly contributed to sebacic acid's dominance in the market. Additionally, the increasing use of sebacic acid in automotive, aerospace, and textile coatings propels segmental growth. The segment’s expansion is also driven by growing regulatory support for bio-based materials, aligning with sustainability goals and reducing dependence on petroleum-based chemicals.

Castor Oil Derivatives Market Evaluation by Application Outlook

The global castor oil derivatives market segmentation, based on application, includes lubricants, surface coatings, biodiesel, cosmetics and pharmaceuticals, plastics and resins, and others. The cosmetics and pharmaceuticals segment is expected to witness the highest CAGR during the forecast period due to the rising demand for plant-based, non-toxic, and sustainable ingredients. Castor oil derivatives, particularly ricinoleic acid and hydrogenated castor oil, play a crucial role in skincare, hair care, and medicinal formulations, owing to their moisturizing, anti-inflammatory, and antimicrobial properties. The shift toward clean-label, organic, and cruelty-free beauty products is further driving the demand for castor oil derivatives in the cosmetics sector. Additionally, the pharmaceutical industry’s growing reliance on castor oil-based excipients and drug delivery systems is anticipated to fuel the segment’s growth.

Castor Oil Derivatives Market Regional Analysis

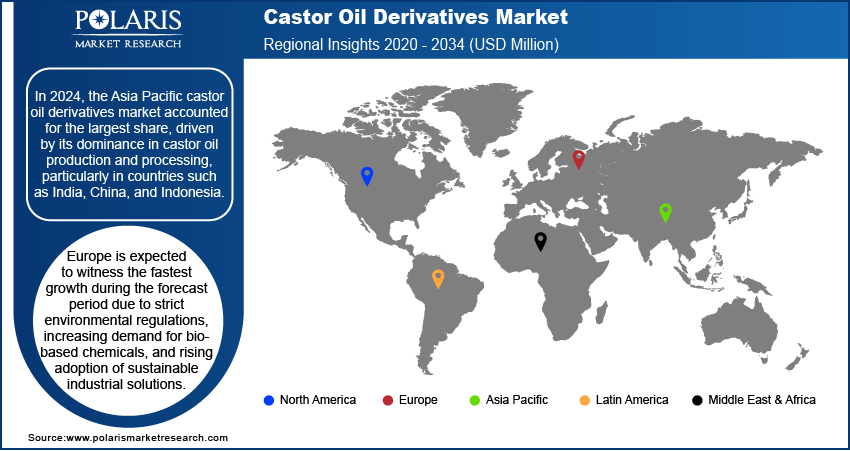

By region, the study provides the castor oil derivatives market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share due to the region’s dominance in castor oil production and processing, particularly in India, China, and Indonesia. India, the world's largest producer of castor seeds, plays a crucial role in market expansion, supplying a significant portion of global demand. For instance, the Agro-Economic Research Division reported that India accounts for 85.02% of global castor seed production. The presence of well-established manufacturing facilities, cost-effective labor, and abundant raw material availability has further strengthened the region’s leadership in the market. Additionally, the increasing demand for castor oil derivatives across industries such as pharmaceuticals, cosmetics, lubricants, and biodiesel is fueling market growth. Government initiatives supporting bio-based and sustainable chemicals, coupled with rising investments in biodegradable polymers and specialty chemicals, present lucrative castor oil derivatives market opportunities.

The Europe castor oil derivatives market is expected to witness the fastest growth during the forecast period due to strict environmental regulations, increasing demand for bio-based chemicals, and rising adoption of sustainable industrial solutions. The region's stringent policies aimed at reducing carbon footprints and promoting circular economies are driving castor oil derivatives market demand, particularly in the biodegradable plastics, lubricants, and pharmaceutical sectors. For instance, the European Union aims for climate neutrality by 2050, with a temporary target of a 55% reduction in CO2 emissions by 2030. European industries are rapidly shifting toward plant-based and renewable alternatives to meet sustainability targets, fostering castor oil derivatives market expansion. Additionally, the region’s robust cosmetics and personal care industry, driven by consumer preference for organic and cruelty-free products, is significantly contributing to market growth.

Castor Oil Derivatives Market – Key Players and Competitive Insights

The castor oil derivatives market is highly competitive, with key players focusing on strategic expansions, product innovations, and sustainability initiatives to strengthen their market presence. The market is characterized by the presence of leading manufacturers, raw material suppliers, and regional producers catering to the rising global demand for bio-based chemicals and sustainable industrial solutions. Companies are investing heavily in research and development (R&D) to enhance product performance, expand application areas, and develop cost-effective production techniques. Major market players such as Arkema, BASF SE, Gokul Agro Resources, Jayant Agro-Organics, and Adani Wilmar dominate the landscape, leveraging their extensive supply chain networks and strong distribution channels. India remains a key production hub, with companies focusing on export-oriented growth strategies to serve international markets. Additionally, strategic partnerships, mergers, and acquisitions are playing a pivotal role in castor oil derivatives market expansion, allowing companies to diversify their product portfolios and tap into emerging opportunities.

Adani Wilmar Ltd. is engaged in the production and distribution of edible oils and food products, specializing in a diverse range of kitchen commodities. The company was founded in 1999. It is a joint venture between the Adani Group and Wilmar International Limited, with its headquarters located in Mumbai, India. Adani Wilmar's product portfolio includes various edible oils, packaged foods, and industrial essentials such as oleochemicals and castor oil derivatives. The company has established itself as a significant player in the castor oil market, with a processing capacity of 1,200 MT of castor seeds per day and advanced manufacturing facilities that produce different grades of castor oil, catering to both domestic and international markets.

BOM Brasil Oleo de Mamona Ltda is engaged in the production of castor oil and its derivatives, focusing on sustainable practices within the agricultural sector. The company was founded in 2009 and operates primarily in the state of Bahia, Brazil. It specializes in the extraction and refinement of castor oil for various applications, including cosmetics, pharmaceuticals, and biodiesel production. BOM Brasil is an active player in the global castor derivatives market, making significant contributions to Brazil's position as a leading producer of castor oil worldwide.

List of Key Companies in Castor Oil Derivatives Market

- Adani Wilmar Ltd.

- Arkema

- BASF SE

- BOM Brasil Oleo de Mamona Ltda

- Girnar Industries

- Gokul Agri International Ltd.

- Hokoku Corporation

- ITOH Oil Chemicals Co., Ltd.

- Jayant Agro Organics Limited

- Kanak Castor Products Pvt., Ltd.

- Kokura Gosei Kogyo Ltd.

- Liaoyang Huaxing Chemical Co., Ltd.

- N.K. Proteins Pvt., Limited

- RPK Agrotech

- Taj Agro Products Limited

- Thai Castor Oil Industries Co., Ltd.

- Tongliao Tonghua Castor Chemical Co., Ltd.

- Vertellus

- Xingtai Lantian Fine Chemical Co., Ltd.

Castor Oil Derivatives Industry Developments

In January 2022, Biosynthetic Technologies, LLC acquired Innoleo LLC, a distributor of high-quality castor derivatives for greases, lubricants, metal-working fluids, coatings, and personal care products.

Castor Oil Derivatives Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Sebacic Acid

- 12-Hydroxy stearic acid (12-HAS)

- Ricinoleic Acid

- Hydrogenated Castor Oil

- Undecylenic Acid

- Dehydrated Castor Oil

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Lubricants

- Surface Coatings

- Biodiesel

- Cosmetics and Pharmaceuticals

- Plastics and Resins

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Castor Oil Derivatives Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,454.10 million |

|

Market Size Value in 2025 |

USD 1,534.07 million |

|

Revenue Forecast by 2034 |

USD 2,505.08 million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global castor oil derivatives market size was valued at USD 1,454.10 million in 2024 and is projected to grow to USD 2,505.08 million by 2034.

• The global market is projected to register a CAGR of 5.6% during the forecast period.

• In 2024, Asia Pacific accounted for the largest market share due to the region’s dominance in castor oil production and processing, particularly in India, China, and Indonesia.

• Some of the key players in the market are Adani Wilmar Ltd.; Arkema, BASF SE, BOM Brasil Oleo de Mamona Ltda; Girnar Industries; Gokul Agri International Ltd.; Hokoku Corporation; ITOH Oil Chemicals Co., Ltd.; Jayant Agro Organics Limited; Kanak Castor Products Pvt., Ltd.; Kokura Gosei Kogyo Ltd.; Liaoyang Huaxing Chemical Co., Ltd.; N.K. Proteins Pvt., Limited; RPK Agrotech; Taj Agro Products Limited; Thai Castor Oil Industries Co., Ltd.; Tongliao Tonghua Castor Chemical Co., Ltd.; Vertellus; and Xingtai Lantian Fine Chemical Co., Ltd.

• In 2024, the sebacic acid segment accounted for the largest market share due to its extensive industrial applications in biodegradable plastics, lubricants, cosmetics, and polyamides.

• The cosmetics and pharmaceuticals segment is expected to witness the highest CAGR during the forecast period due to the rising demand for plant-based, non-toxic, and sustainable ingredients.