Cash Management System Market Share, Size, Trends, Industry Analysis Report

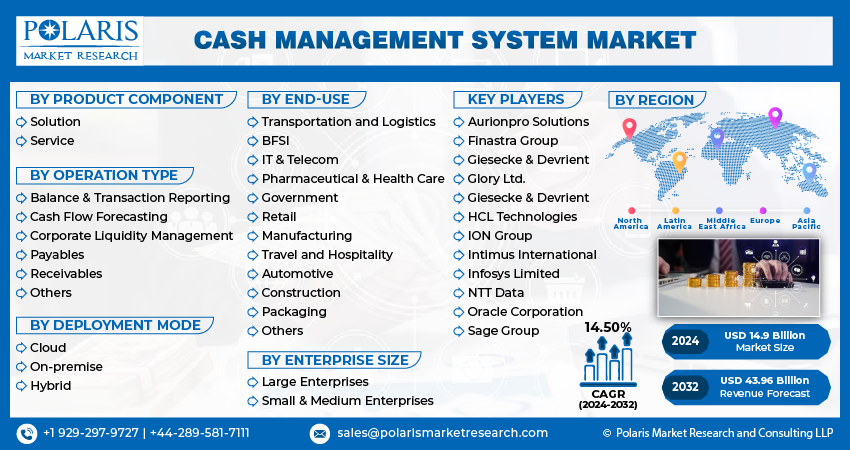

By Component (Solution, and Services); By Operation Type; By Deployment Mode; By Enterprise size; By End-Use; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3330

- Base Year: 2023

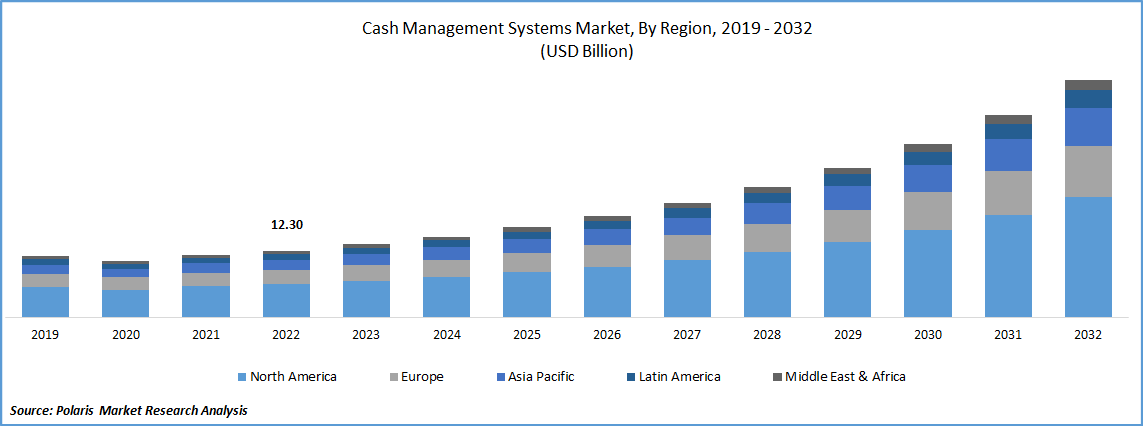

- Historical Data: 2019-2022

Report Outlook

The global cash management system market was valued at USD 13.48 billion in 2023 and is expected to grow at a CAGR of 14.50% during the forecast period. Cash management systems are so important to financial stability because businesses are paying more attention to them. Due to the significant advancements achieved in digital transformation, there have been changes in how banks interact with businesses and how they handle cash. As the emphasis on profits and other business assets has increased, a system that can provide them with more strategic and consultative methods to enhance their cash management has become necessary. Technology has so begun to take off in the market. The use of digital cash management systems helps organizations see their financial status. Business transactions are related owing to the modern monetary system. The cash system streamlines and automates an organization's financial operations while enabling real-time process expansion and integration.

To Understand More About this Research: Request a Free Sample Report

The market is expected to increase as smart secure cash management solutions are increasingly used across a range of end applications. Issues with handling and storing cash are addressed by firms using smart safe solutions. These highly developed safes provide organizations with the ability to keep an eye on cash at each stage of the money-handling procedure. These safes offer a constant, unobstructed view into the money movement.

cash management system market expansion is predicted to be fueled by the growing need for centralized cash management solutions in banking transaction processes. In July 2021, Based on Infosys Finacle technology, Santander UK unveiled a new cash management platform as support of its continuing digital transformation. Using Santander Global Connect, the bank's corporate and business clients may assist their objectives for global expansion. A centralized multi-bank information portal will be made available, providing a consolidated picture of cash holdings, account and payment reporting, and transparency of foreign currency at the country level. These technologies enable companies to examine data on money and financial activities. Driving financial efficiency and controlling transaction risk are two areas on which many companies are concentrating. Businesses are consequently frequently using a centralized cash management system.

However, for suppliers offering cash management solutions, the software compatibility issue throughout growth has created a significant disadvantage. This is attributed to the interoperability issues the systems encounter when businesses cooperate or are bought by another firm. Also, establishing a cash management system needs a particular infrastructure that can work with new services and applications. Additionally, integrating new technology into an existing firm requires a significant initial expenditure. These elements appear to work together to limit market expansion.

The COVID-19 epidemic has generated deep and quick devastation to enterprises globally. Falls in demand, supply, and productivity are affecting liquidity regardless of size, industry, or region, and many businesses are concerned about being able to cover their expenses. Because of the rapid changes in the environment, firms must be adaptable. Numerous businesses have already proven their creativity and quick thinking throughout this crisis. Working with businesses in times of stress and uncertainty, enterprises understand that cash flow management should be at the center of resilience planning, even though different nations are using various strategies to combat the epidemic.

Industry Dynamics

Growth Drivers

Market is anticipated to see expansion due to the integration of machine learning (ML) and artificial intelligence (AI) methods in the financial sector. Businesses are using AI and ML systems to help them provide the most precise money flow estimates. For instance, in September 2022, The treasury management software company Kyriba, a fintech company, introduced Cash Management AI, an AI-based application. The new technology makes better projections of cash availability using past data, enabling increased speed, dependability, and control. Dashboards allow users to examine data and include features like configurable filters and movable prediction periods. While deciding on their ideal trust level, they can make forecast adjustments in real-time while taking into consideration the unique company plan.

Further, due to its smooth integration with accounting, enterprise resource planning (ERP), and bank management systems, AI and ML-integrated solutions are frequently used by businesses. For accurate and thorough money flow estimates, ML and AI algorithms process information comprising vendor bills, customer invoices, and inflows/outflows from bank statements. For instance, in January 2022, the introduction of CashPro Forecasting was announced by Bank of America. It is a tool that makes better predictions about future cash situations across customer accounts at Bank of America and other financial firms using artificial intelligence (AI) and machine learning (ML) technologies. So, in recent years, the market has increased as a result of such innovation and progress in the cash management solution.

Report Segmentation

The market is primarily segmented based on component, operation type, deployment mode, end-use, enterprise size, and region.

|

By Product Component |

By Operation Type |

By Deployment Mode |

By End-Use |

By Enterprise Size |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The cash flow forecasting segment is expected to witness the fastest growth during projected timeframe

Over the projected period, the cash flow forecasting category is expected to increase at the highest rate. Corporations and banks frequently utilize money flow forecasting tools to determine their future cash requirements. Organizations are being pushed to provide more value to their customers by a variety of circumstances, including an intensely competitive market and an uncertain economy. The desire for an accurate assessment of money demand is rising quickly, which is anticipated to drive segment expansion throughout the projected period.

Further, due to the rising use of the balance and transactions associated with the overall by corporate treasurers to precisely track all receivables and payables in real-time, this section of the market dominated the market. Over the projection period, the industry is also expected to rise as a result of a growing demand for insight into money transfer activities across various accounts, currencies, and locations. Additionally, these modules give firms the ability to keep control over cash flow and liquidity.

The solution segment industry accounted for the largest market in 2022

The solution segment dominates the cash management system market. Due to the growing need for automating cash transfer operations and optimizing money management procedures, the solutions segment is anticipated to dominate the market throughout the projected period. Businesses may streamline complicated money transfer procedures and lessen manual labor with the help of cash management systems. In November 2022, The latest edition of SmartStream's TLM Cash and Liquidity Management system, v 3.1, has just been released. With the ability to design dashboards and supplement data without the need for technical support, TLM Cash and Liquidity Management users now have unmatched control. This method reduces the total cost of ownership by saving not only time but also the labor involved in creating dashboards and training. Providing adjustable automation algorithms that may be tailored to the demands of the business is a major emphasis for many providers.

Cloud segment industry accounted for the largest market share in 2022

Over the next years, the segment for cloud deployment is predicted to increase at the fastest rate. With this deployment approach, businesses that use cloud services do not need to upgrade those services regularly. In addition, this deployment makes it possible to manage, watch over, and control big, complicated systems. Over the course of the projected period, it is expected that the on-premise deployment segment would maintain its leadership. In contrast to cloud deployment, this kind of deployment gives organizations ownership of their data and control over it. Additionally, the process of on-premise implementation allows for extended service and product customization while providing flexible infrastructure.

The demand in Europe is expected to witness significant growth during forecast period

The expansion can be due to the existence of well-known market participants. The European Union is stepping up its efforts to promote projects related to cutting-edge technology like blockchain. The rising adoption of these systems from the various verticals in the regions is boosting growth. Due to the rising implementation of money management systems to shorten transaction times and support banks' high net profits, the bank is anticipated to dominate the market over the projection period.

Further, these solutions also assist banks in enhancing the technical competence of their staff. These systems provide a range of services, such as sophisticated online services, account reconciliation services, and balance reporting services. To improve their cash flow, many commercial enterprises are widely implementing money management technologies. These tools give companies access to a variety of online reporting, payable, and receivable options to suit their needs. Additionally, these solutions provide straightforward access to e-Statements, balances, and transactional data via a single dashboard.

Over the forecast period, Asia Pacific is expected to become the region with the quickest growth. The increase is predicted to be fueled by several factors, including the rising demand for enterprise-level connectivity and liquidity management. Also, to achieve considerable returns on investment, both major and small and medium-sized businesses in the region are implementing customized money management systems.

Competitive Insight

Some of the major players operating in the global market include Aurionpro Solutions, Finastra Group, Giesecke & Devrient, Glory Ltd., Giesecke & Devrient, HCL Technologies, ION Group, Intimus International, Infosys Limited, NTT Data, Oracle Corporation, and Sage Group.

Recent Developments

- In May 2022, Murex has upgraded its cooperation with Aurionpro as "Business Partners," according to Aurionpro Market Systems, a subsidiary of Aurionpro. In a short period, a significant milestone has been reached. As a result of this change, Aurionpro will now be listed on the Murex website's Partnership category and link to Murex Partners' website, where it will collaborate with Murex on projects in additional geographies.

Cash Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.9 billion |

|

Revenue forecast in 2032 |

USD 43.96 billion |

|

CAGR |

14.50% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019- 2022 |

|

Forecast period |

2024- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Operation Type, Deployment Mode, By End-Use, By Enterprise Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aurionpro Solutions Limited, Finastra Group Holdings Limited, Giesecke & Devrient GmbH, Glory Ltd., Giesecke & Devrient GmbH, HCL Technologies Ltd., ION Group, Intimus International Group, Infosys Limited, NTT Data Corporation, Oracle Corporation, and The Sage Group PLC |

FAQ's

The cash management system market report covering key segments are product component, operation type, deployment mode, end-use, enterprise size, and region.

Cash Management System Market Size Worth $43.96 Billion By 2032.

The global cash management system market expected to grow at a CAGR of 14.03% during the forecast period.

Europe is leading the global market.

key driving factors in cash management system market are growing demand for automation and optimization of working capital.