Cargo Drones Market Size, Share, Trends, Industry Analysis Report

: By Industry (Retail, Healthcare, Agriculture, Defense, and Maritime), Range, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 117

- Format: PDF

- Report ID: PM3255

- Base Year: 2024

- Historical Data: 2020-2023

Cargo Drones Market Overview

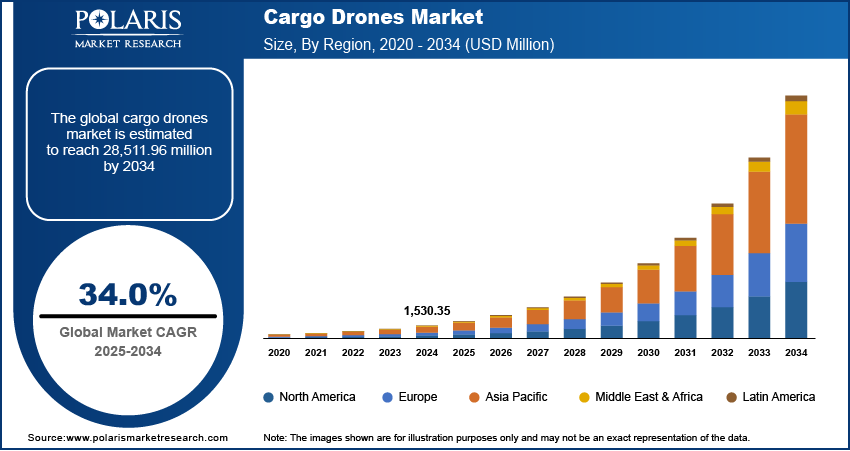

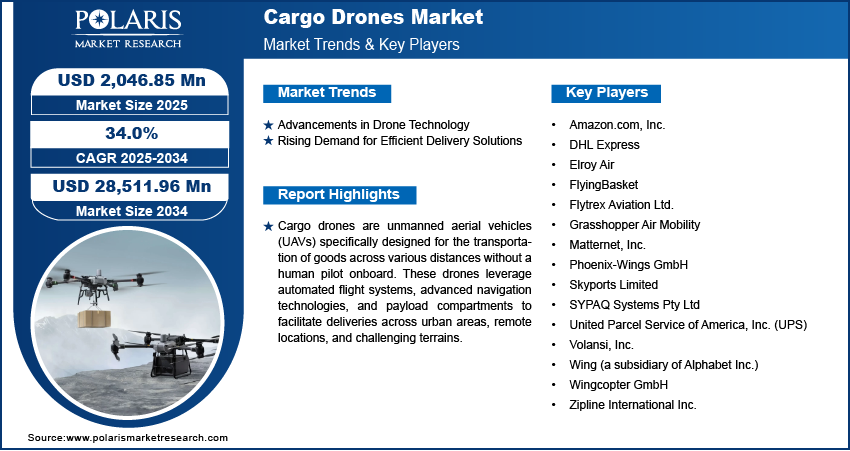

The cargo drones market size was valued at USD 1,530.35 million in 2024. The market is projected to grow from USD 2,046.85 million in 2025 to USD 28,511.96 million by 2034, exhibiting a CAGR of 34.0% during 2025–2034.

The cargo drones market is experiencing significant growth due to advancements in autonomous aerial vehicle technology, increasing demand for faster and cost-effective logistics solutions, and the expansion of e-commerce. These unmanned aerial vehicles (UAVs) are designed to transport goods efficiently, reducing delivery times and operational costs compared to traditional logistics methods. Key applications include last-mile delivery, medical supply transportation, and heavy-lift logistics for industrial sectors. Governments and regulatory bodies are also supporting the adoption of cargo drones through favorable policies and airspace management frameworks, further accelerating market expansion.

Key drivers of the cargo drones market include the rising demand for efficient and contactless delivery solutions, particularly in remote and inaccessible areas. Additionally, the rapid growth of e-commerce and same-day delivery services is increasing the need for autonomous delivery systems. Technological advancements in battery efficiency, AI-driven navigation, and payload capacity are further enhancing the capabilities of cargo drones.

To Understand More About this Research: Request a Free Sample Report

Cargo Drones Market Dynamics

Advancements in Drone Technology

The cargo drones market has experienced significant growth due to continuous advancements in drone technology. Innovations in propulsion systems, such as the development of hybrid-powered drones, have enabled longer flight times and increased payload capacities. For instance, in April 2022, Aergility, a US-based aerospace startup, introduced the Atlis Gen 3, an electric vertical takeoff and landing (eVTOL) cargo drone designed to carry payloads of up to 300 pounds and travel at speeds of up to 100 miles per hour for distances up to 300 miles. These technological advancements have enhanced the efficiency and versatility of cargo drones, making them more attractive for various industries, including logistics and transportation.

Rising Demand for Efficient Delivery Solutions

The increasing demand for efficient and rapid delivery solutions has significantly contributed to the cargo drones market expansion. The surge in e-commerce has heightened the need for faster delivery and improved efficiency in freight transportation. Cargo drones offer a viable solution to meet these demands by providing timely and reliable delivery services, especially in remote or hard-to-reach areas. Their ability to reduce delivery times and operational costs compared to traditional logistics methods has made them an essential component in modern supply chain management.

Cargo Drones Market Segment Insights

Cargo Drones Market Assessment by Industry

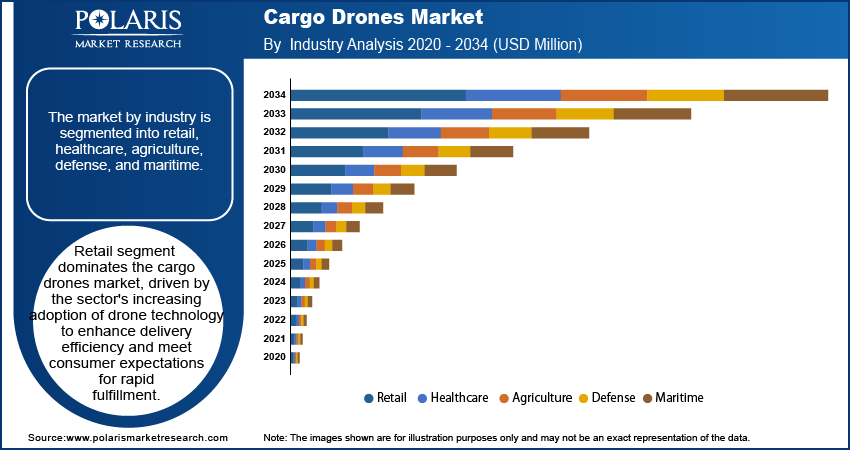

The cargo drones market segmentation, based on industry, includes retail, healthcare, agriculture, defense, and maritime. The retail segment dominates the market, driven by the sector's increasing adoption of drone technology to enhance delivery efficiency and meet consumer expectations for rapid fulfillment. The rise of e-commerce has intensified the demand for swift and reliable delivery solutions, prompting retailers to integrate drones into their logistics operations. This integration not only accelerates delivery times but also optimizes supply chain processes, allowing retailers to reach customers in both urban and remote areas more effectively. The ability of drones to bypass traditional transportation challenges, such as traffic congestion, further solidifies their role in modern retail logistics.

Cargo Drones Market Evaluation by Range

The cargo drones market is segmented by range into close–range, short-range, mid–range, and long–range. Mid-range segment holds the largest cargo drones market share, designed for distances between 150 to 650 kilometers. Their capacity to facilitate city-to-city transportation makes them invaluable for regional logistics, enabling efficient movement of goods across urban centers. Technological advancements, such as the development of lift + cruise configurations and vectored propulsion systems, have enhanced the operational range and efficiency of these drones, thereby driving the segmental growth in the market.

Cargo Drones Market Regional Insights

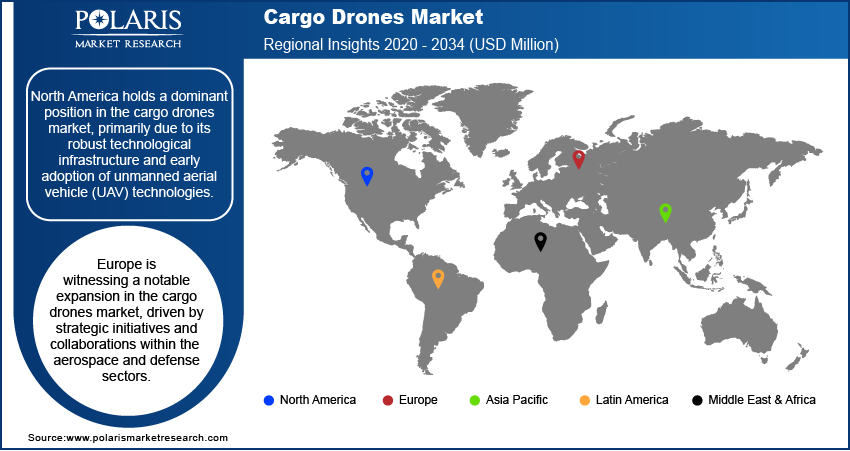

By region, the study provides cargo drones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds a dominant position in the market, primarily due to its robust technological infrastructure and early adoption of unmanned aerial vehicle (UAV) technologies. The region's leadership is bolstered by the presence of major drone manufacturers and a strong culture of innovation, particularly in the US. Supportive regulatory frameworks have facilitated extensive testing and deployment of cargo drones across various industries, including logistics and healthcare. For instance, companies such as Wing, owned by Google's parent company Alphabet, have been conducting deliveries in trial areas for over four years, delivering items such as fresh food and pharmaceuticals. This environment has enabled North America to maintain its leadership in the market, driven by technological advancements and a proactive regulatory approach.

Europe is witnessing a notable expansion in the cargo drones market, driven by strategic initiatives and collaborations within the aerospace and defense sectors. For instance, Embraer, a Brazilian aerospace company, is considering establishing a final assembly line for its KC-390 military cargo aircraft in Poland. This move aims to capitalize on strong sales momentum in Europe and underscores Poland's strategic importance in aerospace manufacturing. Such developments highlight Europe's commitment to integrating advanced cargo drone technologies to enhance logistical capabilities.

Cargo Drones Market – Key Players and Competitive Insights

The cargo drones market is highly competitive, driven by rapid technological advancements and increasing demand for cost-effective, autonomous logistics solutions. Companies compete on factors such as payload capacity, range, endurance, and regulatory compliance. Innovations in battery efficiency, AI-powered navigation, and hybrid propulsion systems are key differentiators. Startups focus on lightweight, long-range models, while established firms leverage scale and integration with existing supply chains. Regulatory barriers and airspace management challenges create opportunities for firms with strong compliance capabilities. Partnerships with logistics providers, defense sectors, and e-commerce firms enhance market penetration. The competitive landscape is further shaped by regional policies, with companies adapting to different regulatory frameworks. Cost, reliability, and operational scalability remain crucial in defining market leadership.

Notable key players include Amazon.com, Inc.; Alphabet Inc.'s Wing; Zipline International Inc.; DJI Innovations; Matternet Inc.; Flytrex Aviation Ltd.; Volansi, Inc.; Elroy Air; FlyingBasket; Phoenix-Wings GmbH; Skyports Ltd.; Drone Delivery Canada Corp.; Aerialtronics DV B.V.; Pipistrel d.o.o. These companies are actively developing and deploying cargo drone solutions across various industries.

In the competitive landscape, Amazon.com, Inc. has been advancing its Prime Air drone delivery service, aiming to deliver packages up to 2.3 kilograms within 30 minutes. Alphabet Inc.'s Wing has conducted extensive trials in the United States and Australia, focusing on efficient last-mile delivery. Zipline International Inc. specializes in medical supply deliveries, particularly in remote regions, showcasing the humanitarian potential of cargo drones. DJI Innovations continues to lead in drone manufacturing, offering versatile platforms adaptable for cargo applications. Matternet Inc. has established partnerships with logistics companies to integrate drone delivery into existing networks.

Amazon.com, Inc. has been actively developing its Prime Air drone delivery service, aiming to enhance delivery efficiency by integrating drones into its logistics network. The company has been conducting trials and seeking regulatory approvals to expand these services.

DHL Express has integrated cargo drones into its operations, primarily in collaboration with EHang in China. The drones, such as EHang's Falcon model, are designed for urban logistics, capable of carrying up to 5 kg per flight. They feature vertical take-off and landing capabilities, GPS navigation, and real-time connectivity. The system includes intelligent cabinets for automated loading and unloading, using facial recognition and ID scanning. The drones operate on a customized route in the Greater Bay Area, specifically between a customer site and a DHL service center in Liaobu, Dongguan. This setup reduces delivery times significantly, from 40 minutes to 8 minutes, and offers potential environmental benefits by lowering energy consumption and carbon emissions compared to traditional road transport. Currently, the service is focused on South China, with ongoing development to expand its reach and efficiency.

List of Key Companies in Cargo Drones Market

- Amazon.com, Inc.

- DHL Express

- Elroy Air

- FlyingBasket

- Flytrex Aviation Ltd.

- Grasshopper Air Mobility

- Matternet, Inc.

- Phoenix-Wings GmbH

- Skyports Limited

- SYPAQ Systems Pty Ltd

- United Parcel Service of America, Inc. (UPS)

- Volansi, Inc.

- Wing (a subsidiary of Alphabet Inc.)

- Wingcopter GmbH

- Zipline International Inc.

Cargo Drones Market Developments

- January 2023: Natilus announced a purchase agreement with Ameriflight for 20 autonomous feeder cargo aircraft, valued at USD 134 million. This strategic move positions Ameriflight as the first regional U.S. carrier to develop a new roadmap for the future of air freight operations.

- February 2025: Canadian charter airline Nolinor Aviation agreed to acquire multiple Natilus Kona feeder cargo aircraft. The Kona's design, capable of operating on unpaved runways as short as 800 meters, aligns with Nolinor's operations in remote and rugged areas

Cargo Drones Market Segmentation

By Industry Outlook (Revenue-USD Million, 2020–2034)

- Retail

- Healthcare

- Agriculture

- Defense

- Maritime

By Range Outlook (Revenue-USD Million, 2020–2034)

- Close – Range

- Short- Range

- Mid – Range

- Long – Range

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Cargo Drones Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,530.35 Million |

|

Market Size Value in 2025 |

USD 2,046.85 Million |

|

Revenue Forecast by 2034 |

USD 28,511.96 Million |

|

CAGR |

34.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The cargo drones market has been segmented into detailed segments of industry and range. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the cargo drones market are focusing on expanding their operations through strategic partnerships, regulatory approvals, and technological advancements. Investments in autonomous flight systems, extended battery life, and payload capacity are key areas of development to enhance efficiency and reliability. Market players are also strengthening collaborations with logistics providers, healthcare organizations, and government agencies to integrate drones into supply chain networks. Expanding geographic presence, particularly in regions with supportive drone regulations, is another major strategy. Additionally, firms are engaging in pilot programs and demonstrations to gain consumer trust and regulatory acceptance, accelerating the commercialization of cargo drone solutions.

FAQ's

The cargo drones market size was valued at USD 1,530.35 million in 2024 and is projected to grow to USD 28,511.96 million by 2034.

The market is projected to register a CAGR of 34.0% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the cargo drones market include Amazon.com, Inc., Alphabet Inc.'s Wing, Zipline International Inc., DJI Innovations, and Matternet Inc. Other significant contributors are Flytrex Aviation Ltd., Volansi, Inc., and Elroy Air. European entities such as FlyingBasket and Phoenix-Wings GmbH are also prominent in this sector. Additional companies include Skyports Ltd., Drone Delivery Canada Corp., Aerialtronics DV B.V., and Pipistrel d.o.o.

The retail segment accounted for the larger share of the market in 2024.

Cargo drones are unmanned aerial vehicles (UAVs) designed for transporting goods, packages, or medical supplies over short to long distances without requiring a human pilot onboard.