Cardiac Marker Testing Market Size, Share, Trends, Industry Analysis Report

: By Product (Reagents & Kits and Instruments), Biomarker Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 116

- Format: PDF

- Report ID: PM3322

- Base Year: 2024

- Historical Data: 2020-2023

Cardiac Marker Testing Market Overview

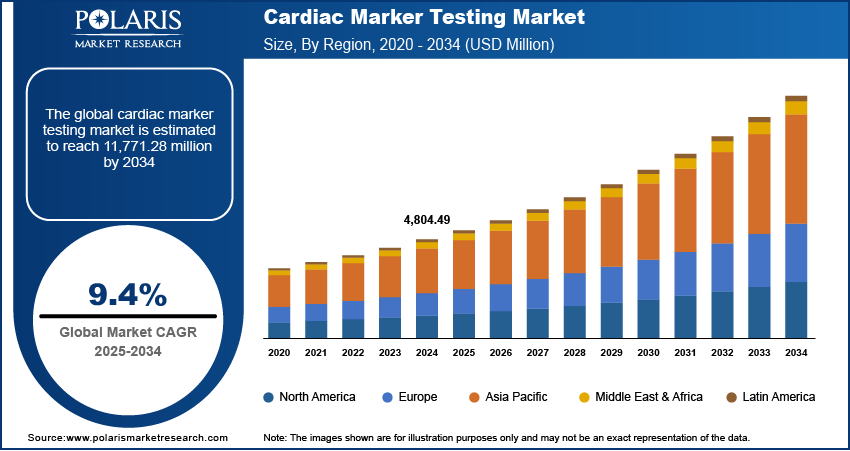

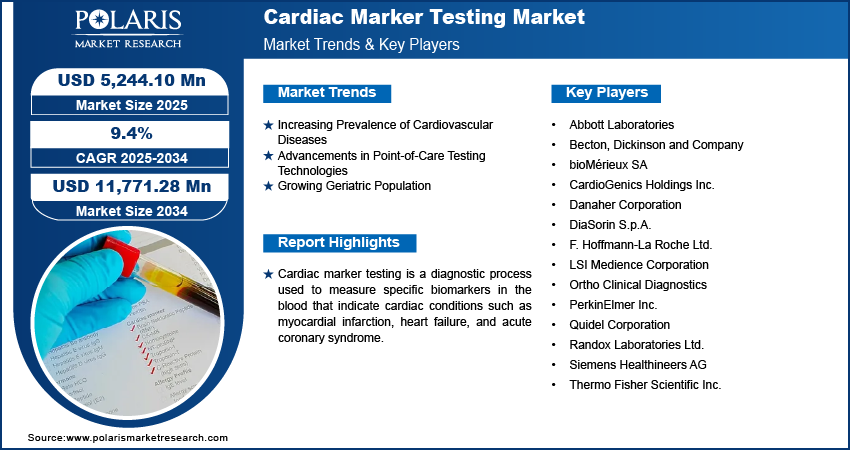

The cardiac marker testing market size was valued at USD 4,804.49 million in 2024. The market is projected to grow from USD 5,244.10 million in 2025 to USD 11,771.28 million by 2034, exhibiting a CAGR of 9.4% during 2025–2034.

The cardiac marker testing market involves diagnostic tests used to measure biomarkers associated with cardiovascular diseases, including troponins, creatine kinase-MB, and B-type natriuretic peptides. These tests are essential for early diagnosis, risk assessment, and management of conditions such as myocardial infarction and heart failure.

Key drivers of the cardiac marker testing market demand include the increasing prevalence of cardiovascular diseases, the growing geriatric population, and advancements in point-of-care testing technologies. Additionally, rising awareness regarding early disease detection and the demand for rapid and accurate diagnostic solutions contribute to market growth.

To Understand More About this Research: Request a Free Sample Report

Cardiac Marker Testing Market Dynamics

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases (CVDs) is propelling the cardiac marker testing market growth, as it significantly increases the demand for early and accurate diagnosis. Cardiovascular diseases, including heart attacks, strokes, and heart failure, are among the leading causes of mortality worldwide, necessitating the use of cardiac biomarkers for timely detection and management. Factors such as aging populations, sedentary lifestyles, unhealthy dietary habits, and increasing stress levels contribute to the growing prevalence of CVDs, further driving market expansion.

Advancements in Point-of-Care Testing Technologies

Technological innovations have led to the development of advanced point-of-care testing (POCT) devices, enhancing the accessibility and efficiency of cardiac marker testing. Modern POCT devices offer rapid and accurate results, facilitating immediate clinical decisions. The integration of microfluidics and biosensors has enabled the miniaturization of devices, making them portable and user-friendly. These advancements are particularly beneficial in emergency settings and remote areas, where timely diagnosis is critical. Thus, rising advancements in point-of-care testing technologies are expected to influence cardiac marker testing market trends.

Growing Geriatric Population

The expanding elderly population contributes to the increased demand for cardiac marker testing. Older individuals are more susceptible to CVDs, necessitating regular monitoring and diagnostic assessments. As the global population aged 65 and above continues to rise, the healthcare system faces a higher prevalence of age-related cardiac conditions. This demographic shift underscores the need for efficient diagnostic solutions, thereby driving the cardiac marker testing market development.

Cardiac Marker Testing Market Segment Insights

Cardiac Marker Testing Market Assessment by Product

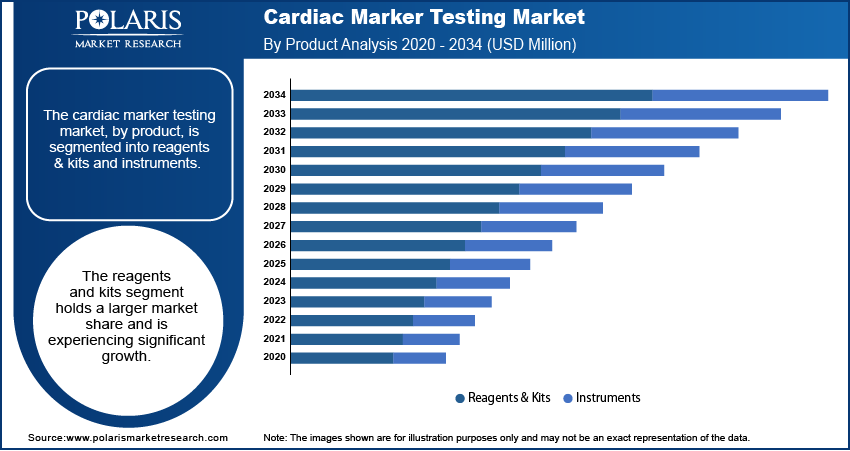

The cardiac marker testing market, by product, is segmented into reagents & kits and instruments. The reagents & kits segment dominated the cardiac marker testing market share in 2024. This dominance is attributed to their widespread use in laboratory settings, offering high sensitivity and specificity in detecting cardiac biomarkers, which ensures accurate diagnosis of cardiovascular conditions. The availability of a diverse range of reagents and kits catering to various testing needs further solidifies their position as the preferred choice among healthcare providers. Additionally, the recurring need for these consumables in diagnostic procedures contributes to their substantial market share.

The instruments segment, encompassing devices such as chemiluminescence analyzers, immunofluorescence systems, ELISA readers, and immunochromatography equipment, is witnessing growth due to technological advancements. These instruments enhance the efficiency and accuracy of cardiac marker testing, facilitating rapid and reliable results. The integration of advanced technologies in these instruments supports their adoption in various healthcare settings, including hospitals and diagnostic laboratories.

Cardiac Marker Testing Market Evaluation by Biomarker Type

The cardiac marker testing market, by biomarker type, is segmented into troponin I & T, creatine kinase-MB (CK-MB), natriuretic peptide, myoglobin, high sensitivity c-reactive protein, and other cardiac biomarkers. The troponin I & T segment dominated the major market share in 2024. Troponins are highly specific and sensitive biomarkers for myocardial injury, making them the preferred choice for diagnosing acute coronary syndromes. Their elevated levels in the blood indicate cardiac muscle damage, facilitating early and accurate detection of myocardial infarction. The adoption of high-sensitivity troponin assays has further enhanced their clinical utility, allowing for the detection of even minor cardiac injuries and improving patient outcomes. This widespread clinical reliance on troponin testing underscores its dominant position in the market.

The natriuretic peptide segment is witnessing notable growth, primarily due to its role in diagnosing and managing heart failure. B-type natriuretic peptide (BNP) and its N-terminal fragment (NT-proBNP) are released in response to ventricular volume expansion and pressure overload, serving as critical indicators of cardiac function. Elevated levels of these peptides correlate with the severity of heart failure, aiding clinicians in assessing prognosis and tailoring treatment strategies. The increasing prevalence of heart failure globally has amplified the demand for natriuretic peptide testing, contributing to the expansion of the market segment.

Cardiac Marker Testing Market Outlook by End User

The cardiac marker testing market, by end user, is segmented into laboratory testing facilities, point-of-care testing facilities, and academic institutions. The laboratory testing facilities segment represented the largest market share in 2024. These facilities, encompassing hospital labs, reference labs, and contract testing labs, are equipped with advanced instrumentation and staffed by skilled professionals, enabling them to handle a substantial volume of tests with precision. The preference for laboratory-based testing is driven by the need for comprehensive analysis and the ability to conduct a wide array of assays, which is essential for accurate diagnosis and effective patient management. Additionally, laboratory settings offer controlled environments that minimize variability, ensuring consistent and reliable results. The integration of new immunoassay technologies further enhances the capabilities of these facilities, contributing to their dominant position in the market.

The point-of-care testing (POCT) facilities segment is experiencing significant growth. The increasing demand for rapid diagnostic solutions in emergency and critical care settings has propelled the adoption of POCT. These facilities offer the advantage of immediate results, facilitating prompt clinical decision-making and timely intervention. Technological advancements have led to the development of portable and user-friendly POCT devices, enabling their deployment in diverse healthcare environments, including remote and resource-limited areas. The shift toward decentralized healthcare and the emphasis on patient-centered care models further contribute to the expansion of POCT facilities in the cardiac marker testing landscape.

Cardiac Marker Testing Market Regional Outlook

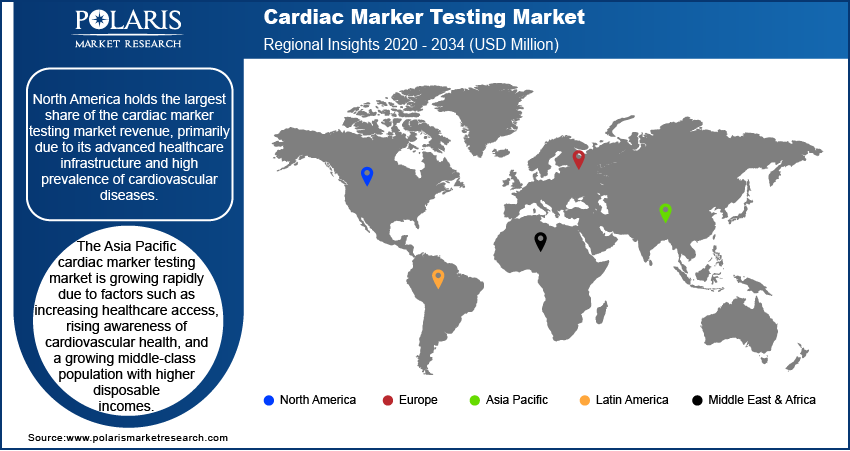

By region, the report provides cardiac marker testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global cardiac marker testing market revenue share in 2024 due to its advanced healthcare infrastructure and high prevalence of cardiovascular diseases. The region's well-established medical facilities and significant investments in research and development have facilitated the adoption of advanced diagnostic technologies, including high-sensitivity cardiac marker assays. Additionally, the presence of major market players and favorable reimbursement policies further bolster the market's growth in the region. The increasing geriatric population, which is more susceptible to heart conditions, also contributes to the heightened demand for cardiac marker testing in North America.

In Europe, the cardiac marker testing market is experiencing growth due to several key factors. The region's advanced healthcare infrastructure and significant investments in research and development have facilitated the adoption of innovative diagnostic technologies. Additionally, the increasing prevalence of cardiovascular diseases, particularly among the aging population, has heightened the demand for early and accurate diagnostic solutions. Countries such as Germany, the UK, and France are leading contributors to the Europe cardiac marker testing market expansion, driven by rising healthcare expenditures and a focus on improving patient outcomes.

Asia Pacific is emerging as a rapidly growing market for cardiac marker testing. This growth is propelled by factors such as increasing healthcare access, rising awareness of cardiovascular health, and a growing middle-class population with higher disposable incomes. Countries such as China, Japan, and India are at the forefront of this expansion, with China and India witnessing a surge in cardiovascular cases due to lifestyle changes and urbanization. Government investments in healthcare infrastructure and the establishment of independent clinical laboratories further support the adoption of advanced diagnostic solutions in the region.

Cardiac Marker Testing Market – Key Players and Competitive Analysis Report

In the cardiac marker testing market, several key players are actively contributing to advancements in diagnostic solutions. These include Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Danaher Corporation; bioMérieux SA; Ortho Clinical Diagnostics; Randox Laboratories Ltd.; Beckman Coulter, Inc. (a subsidiary of Danaher Corporation); DiaSorin S.p.A.; Thermo Fisher Scientific Inc.; Becton, Dickinson and Company; PerkinElmer Inc.; Quidel Corporation; CardioGenics Holdings Inc.; and LSI Medience Corporation.

Companies operating in the cardiac marker testing market ecosystem are engaged in the development and distribution of innovative cardiac marker testing solutions, focusing on enhancing diagnostic accuracy and efficiency. Their product portfolios often include a range of assays and instruments designed for the detection of cardiac biomarkers, aiding in the early diagnosis and management of cardiovascular diseases. Collaborations, research and development investments, and strategic partnerships are common approaches among these organizations to maintain a competitive edge in the market.

The competitive landscape is characterized by continuous technological advancements and a commitment to addressing the growing global burden of cardiovascular diseases. Companies are striving to expand their market presence through geographic expansion, product innovation, and by meeting regulatory standards to ensure the delivery of reliable and efficient diagnostic tools to healthcare providers worldwide.

Abbott Laboratories is a prominent healthcare company specializing in medical devices, diagnostics, branded generic medicines, and nutritional products. In the cardiac marker testing market, Abbott offers a comprehensive range of diagnostic solutions designed to deliver accurate and rapid results, aiding in the early detection and management of cardiovascular diseases. Their portfolio includes assays and analyzers that measure critical cardiac biomarkers, such as troponin, which are essential for diagnosing heart attacks and other cardiac conditions. Abbott's commitment to innovation is evident in their continuous development of high-sensitivity assays and point-of-care testing devices, enhancing the efficiency of cardiac care.

F. Hoffmann-La Roche Ltd., commonly known as Roche, is a global leader in pharmaceuticals and diagnostics. Within the cardiac marker testing domain, Roche provides a diverse array of diagnostic tools and assays that facilitate the precise assessment of cardiac health. Their offerings include tests for biomarkers like NT-proBNP, which are instrumental in diagnosing and managing heart failure. Roche's focus on research and development has led to the creation of advanced diagnostic platforms that integrate seamlessly into clinical workflows, thereby improving patient outcomes through timely and accurate cardiac diagnostics.

List of Key Companies in Cardiac Marker Testing Market

- Abbott Laboratories

- Becton, Dickinson and Company

- bioMérieux SA

- CardioGenics Holdings Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- LSI Medience Corporation

- Ortho Clinical Diagnostics

- PerkinElmer Inc.

- Quidel Corporation

- Randox Laboratories Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Cardiac Marker Testing Industry Developments

- January 2025: Roche announced that its whole slide imaging system, Roche Digital Pathology Dx, received approval from the U.S. Food and Drug Administration (FDA) for the VENTANA DP 600 slide scanner.

- October 2023: Mindray, a global medical devices and solutions provider, announced the introduction and global launch of two new high-sensitivity troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers.

Cardiac Marker Testing Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Reagents & Kits

- Instruments

By Biomarker Type Outlook (Revenue – USD Million, 2020–2034)

- Troponin I & T

- Creatine Kinase-MB (CK-MB)

- Natriuretic Peptide

- Myoglobin

- High Sensitivity C-Reactive Protein

- Other Cardiac Biomarkers

By End User Outlook (Revenue – USD Million, 2020–2034)

- Laboratory Testing Facilities

- Point-Of-Care Testing Facilities

- Academic Institutions

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cardiac Marker Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,804.49 million |

|

Market Size Value in 2025 |

USD 5,244.10 million |

|

Revenue Forecast by 2034 |

USD 11,771.28 million |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The cardiac marker testing market has been segmented into detailed segments of product, biomarker type, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the cardiac marker testing market focus on growth and marketing strategies that emphasize product innovation, strategic partnerships, and geographic expansion. Investments in research and development enable the introduction of high-sensitivity assays and point-of-care testing solutions, improving diagnostic accuracy and accessibility. Collaborations with healthcare institutions and laboratories help expand market reach, while regulatory approvals support product adoption in new regions. Digital marketing, participation in medical conferences, and educational initiatives enhance awareness among healthcare professionals. Additionally, mergers and acquisitions are pursued to strengthen portfolios and gain competitive advantages in emerging markets.

FAQ's

The cardiac marker testing market size was valued at USD 4,804.49 million in 2024 and is projected to grow to USD 11,771.28 million by 2034.

The market is projected to register a CAGR of 9.4% during the forecast period.

North America had the largest share of the market in 2024.

In the cardiac marker testing market, several key players are actively contributing to advancements in diagnostic solutions. These include Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Danaher Corporation; bioMérieux SA; Ortho Clinical Diagnostics; Randox Laboratories Ltd.; DiaSorin S.p.A.; Thermo Fisher Scientific Inc.; Becton, Dickinson and Company; PerkinElmer Inc.; Quidel Corporation; CardioGenics Holdings Inc.; and LSI Medience Corporation.

The reagents & kits segment accounted for the largest share of the market in 2024.

The Troponin I & T segment accounted for the largest share of the market in 2024.

Cardiac marker testing is a diagnostic process used to measure specific biomarkers in the blood that indicate heart-related conditions, such as myocardial infarction (heart attack), heart failure, and acute coronary syndrome. These biomarkers, including troponin, creatine kinase-MB (CK-MB), myoglobin, and natriuretic peptides, help healthcare professionals assess cardiac function, detect damage to heart muscle, and guide treatment decisions. The testing is performed in laboratory and point-of-care settings using immunoassays and other diagnostic techniques to provide rapid and accurate results for timely medical intervention.

A few key trends in the market are described below: Growing Adoption of High-Sensitivity Troponin Assays – High-sensitivity troponin tests are increasingly used for early and accurate detection of myocardial infarction, improving patient outcomes. Expansion of Point-of-Care Testing (POCT) – The demand for rapid and portable cardiac marker testing devices is rising, particularly in emergency settings and remote healthcare facilities. Integration of Artificial Intelligence (AI) and Automation – AI-powered diagnostic solutions and automated analyzers are enhancing test accuracy, reducing turnaround time, and improving workflow efficiency. Rising Incidence of Cardiovascular Diseases (CVDs) – The increasing prevalence of heart diseases, driven by aging populations and lifestyle factors, is fueling the demand for cardiac biomarker tests.

A new company entering the cardiac marker testing market must focus on developing high-sensitivity and multiplex assays to improve diagnostic accuracy and efficiency. Investing in point-of-care testing (POCT) solutions can offer rapid results, catering to emergency and remote healthcare settings. Integrating artificial intelligence (AI) and automation into diagnostic platforms can enhance data analysis and workflow efficiency. Collaborating with healthcare institutions and research organizations can help in product validation and market penetration. Additionally, targeting emerging markets with affordable and scalable testing solutions can provide a competitive edge in regions with rising healthcare investments.

Companies manufacturing, distributing, or purchasing cardiac marker testing-related products, and other consulting firms must buy the report.