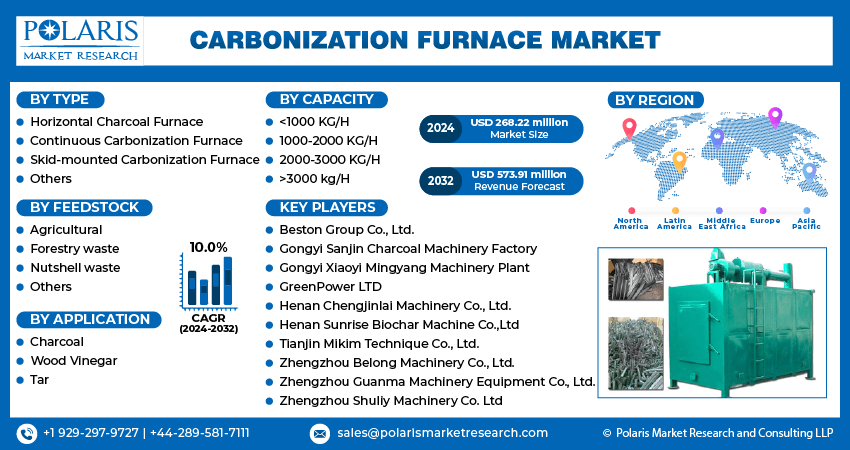

Carbonization Furnace Market Size, Share, Trends, Industry Analysis Report: By Type (Horizontal Charcoal Furnace, Continuous Carbonization Furnace, Skid-mounted Carbonization Furnace, and Others), By Feedstock, By Application, By Capacity, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 – 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM5021

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

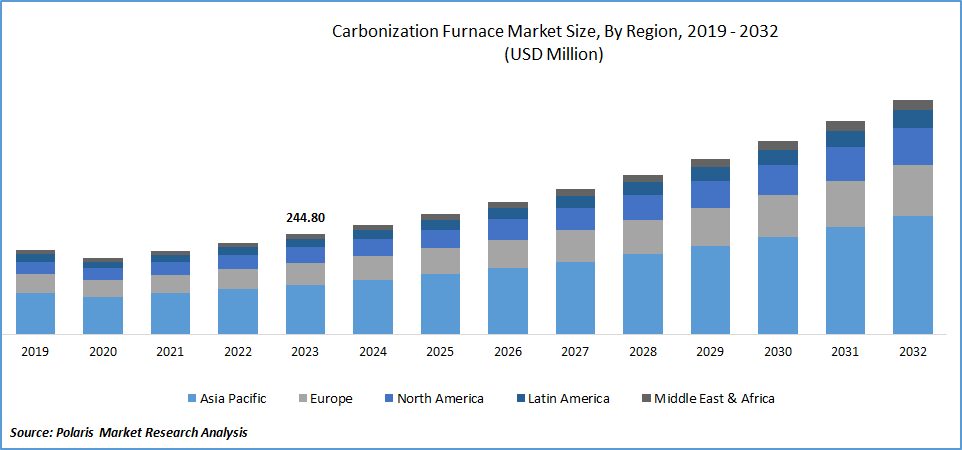

Global carbonization furnace market size was valued at USD 244.80 million in 2023. The industry is projected to grow from USD 268.22 million in 2024 to USD 573.91 million by 2032, exhibiting a compound annual growth rate (CAGR) of 10.0% during the forecast period.

The carbonization furnace refers to the production, sale, and use of furnaces designed for carbonization processes. It is a thermal decomposition process where organic materials, such as biomass, coal, or other carbon-rich substances, are heated in an oxygen-limited environment. This process converts the materials into carbon-rich products like charcoal, carbon black, or activated carbon, while releasing volatile substances.

The increasing emphasis on sustainability and the principles of a circular economy are major factors propelling the growth of the carbonization furnace market. Agricultural waste, such as crop residues, animal manure, and biomass, is abundant, cost-effective, and renewable, making it an ideal feedstock for these furnaces. These materials, with their high carbon content, can undergo carbonization processes to produce valuable outputs like biochar, bio-oil, and syngas.

To Understand More About this Research:Request a Free Sample Report

The adoption of agricultural feedstock in carbonization furnaces is driven by its potential to mitigate environmental impact. By diverting waste from landfills and reducing greenhouse gas emissions, these technologies contribute significantly to sustainable practices. Moreover, biochar derived from agricultural waste not only enhances soil health and carbon sequestration but also boosts crop yields, creating additional incentives for its application.

Technological advancements have further enhanced the efficiency and versatility of carbonization furnaces, expanding their economic viability across various industries. These developments facilitate the processing of diverse agricultural waste streams, thereby fostering broader adoption and utilization of carbonization technologies.

Carbonization Furnace Market Trends:

Increasing Demand for Charcoal for Various Applications

The rising demand for charcoal is driving market CAGR for carbonization furnaces stems for versatile applications across households, restaurants, and various industries worldwide. In many regions, especially in developing countries, charcoal remains a vital source of energy for cooking and heating due to its affordability and accessibility compared to other fuels like electricity or natural gas. In urban areas, charcoal is often preferred for its intense heat and unique flavor when used in grilling and barbecuing, making it a popular choice among both consumers and businesses. This steady demand creates a continuous need for efficient carbonization furnaces capable of producing high-quality charcoal in large quantities.

Industries such as metallurgy and chemicals rely on charcoal as a crucial raw material for processes like metal melting and chemical reduction. The stable and predictable combustion properties of charcoal make it indispensable in these applications, further driving the growth of the carbonization furnace market.

Rising Technological Advancements in Carbonization Furnace

Technological advancements in carbonization furnace design and manufacturing have been a key driver of market growth. Continuous improvements to the equipment have enhanced its efficiency and capabilities, making carbonization furnaces more cost-effective and attractive to a wider range of industries. For instance, in July 2021, the continuous carbonization furnace BIO-KILN-1 was shipped to Georgia for installation and utilized hazelnut shells as raw materials for carbonization.

For example, the development of continuous carbonization furnaces has been a major innovation in the field. These furnaces feature a unique design that allows for a continuous, automated carbonization process, improving production efficiency and reducing labor costs. Additionally, advancements in materials and control systems have enabled carbonization furnaces to process a more diverse range of biomass feedstocks, expanding their applications across various sectors and driving the carbonization furnace market revenue.

Carbonization Furnace Market Segment Insights:

Carbonization Furnace Type Insights:

The global carbonization furnace market segmentation, based on type, includes horizontal charcoal furnaces, continuous carbonization furnaces, skid-mounted carbonization furnaces, and others. The horizontal charcoal furnace held a significant revenue share in the carbonization furnace market due to its efficiency and versatility. These furnaces differ from traditional vertical models by offering continuous feeding and discharge capabilities designed to convert a wide range of biomass materials into charcoal by heating them to specific temperatures. This feature enhances production efficiency and minimizes downtime driving the segment growth in the carbonization furnace market outlook.

Horizontal charcoal furnaces provide superior heat distribution, ensuring consistent and high-quality charcoal output. Also, its design facilitates automation and seamless integration into large-scale industrial operations, making it particularly attractive to commercial producers. Further, horizontal charcoal furnaces have solidified their significant market presence due to their increased adaptability, productivity, and suitability for production.

Carbonization Furnace Application Insights:

The global carbonization furnace market segmentation, based on application, includes charcoal, wood vinegar, and tar. The tar segment held a significant market share due to its wide-ranging applications across various sectors. It is a versatile byproduct of the carbonization process utilized extensively in construction, particularly for its adhesive and waterproofing properties in road paving and roofing.

Tar is essential in the production of compounds like creosote, used for wood preservation and carbon black, a key component in rubber manufacturing and other industrial processes. The demand stemming from these diverse applications ensures a stable market for tar, boosting its economic value and making its extraction and utilization economically viable. This versatility and critical role in multiple industries underscore tar's significant presence in the carbonization furnace market.

Global Carbonization Furnace Market, Segmental Coverage 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Carbonization Furnace Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific region dominated the carbonization furnace market driven by rising demand for charcoal and activated carbon, fueled by industrialization and sustainable waste management practices. Key countries such as China, India, and Indonesia are leading the market due to their substantial agricultural sectors and focus on biomass utilization. In the Asia Pacific region, China is dominant due to its vast population and its tradition of using charcoal extensively in industries ranging from steel production to household cooking. The country's industrial sector, which includes iron and steel manufacturing, relies heavily on charcoal as a source of fuel and reducing agent. Moreover, China's focus on environmental sustainability has spurred investments in technologies like carbonization furnaces aimed at producing charcoal and biochar from agricultural residues and forestry waste.

Moreover, India is experiencing a surge in demand for carbonization furnaces driven by rapid industrialization and an increasing focus on agricultural waste management. The country's expanding industrial sector, coupled with initiatives promoting cleaner energy sources and waste-to-energy solutions, has led to heightened interest in carbonization technologies. This is particularly evident in sectors such as biomass power generation and biofuel production, where carbonization furnaces are crucial in converting agricultural residues like rice husk and coconut shells into valuable products such as biochar. which can be used for soil enhancement, carbon sequestration, and renewable energy generation.

Global Carbonization Furnace Market, Regional Coverage 2019-2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Europe held the second-largest market share in the carbonization furnace market in 2023, driven by environmental sustainability, advanced technological capabilities, and supportive regulatory frameworks. The stringent carbon emissions regulations and renewable energy targets set by the European Union promote the adoption of carbonization technology for producing biochar and charcoal, which is crucial for carbon sequestration and effective waste management. For instance, the European Union's Emissions Trading System (ETS) regulates around 10,000 power stations and manufacturing plants by requiring companies to purchase permits for each tonne of CO2 they emit, thus incentivizing reductions in greenhouse gas emissions.

Significant investments in research and development continuously enhance the design and efficiency of carbonization furnaces across the region. Additionally, Europe's robust industrial base and adherence to circular economy principles facilitate the integration of carbonization processes into diverse sectors such as agriculture, waste management, and energy production. Government incentives, subsidies, and funding initiatives further accelerate the deployment of carbonization technologies, solidifying Europe's prominent role in the global market.

Carbonization Furnace Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the carbonization furnace market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, carbonization furnace industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global carbonization furnace industry to benefit clients and increase the market sector. In recent years, the carbonization furnace industry has offered some technological advancements. Major players in the carbonization furnace market, including Beston Group Co., Ltd., Gongyi Sanjin Charcoal Machinery Factory, Gongyi Xiaoyi Mingyang Machinery Plant, GreenPower LTD, Henan Chengjinlai Machinery Co., Ltd., Henan Sunrise Biochar Machine Co.,Ltd, Tianjin Mikim Technique Co., Ltd., Zhengzhou Belong Machinery Co., Ltd., Zhengzhou Jiutian Machinery Equipment Co., Ltd., Zhengzhou Shuliy Machinery Co. Ltd.

Beston Group Co., Ltd. specializes in environmental protection and resource regeneration solutions, focusing on waste recycling technologies such as pyrolysis and biomass carbonization. Beston is offering comprehensive services, including project planning, installation, and after-sales support with a global presence in over 100 countries. In June 2024, Beston Group achieved a 120-hour continuous operation milestone with their carbonization machine using various biomass materials and fuel sources in China.

GreenPower is a bio-energy company specializing in the development and production of equipment for pyrolysis, gasification, and charcoal activation processes. The company focuses on manufacturing carbonization furnaces, including its models EKKO and BIO-KILN, designed for processing wood and agricultural waste. The company operates its manufacturing facilities in Ukraine, Indonesia, and South Korea. For instance, GreenPower launched an EKKO-2 charcoal furnace in Pucallpa, Peru, emphasizing sustainable wood sawdust charcoal production and community impact.

Key Companies in the Carbonization Furnace market include:

- Beston Group Co., Ltd.

- Gongyi Sanjin Charcoal Machinery Factory

- Gongyi Xiaoyi Mingyang Machinery Plant

- GreenPower LTD

- Henan Chengjinlai Machinery Co., Ltd.

- Henan Sunrise Biochar Machine Co.,Ltd

- Tianjin Mikim Technique Co., Ltd.

- Zhengzhou Belong Machinery Co., Ltd.

- Zhengzhou Guanma Machinery Equipment Co., Ltd.

- Zhengzhou Shuliy Machinery Co. Ltd

Carbonization Furnace Industry Developments

- March 2023: JSW Steel plans to launch a new blast furnace at its Dolvi plant in Maharashtra by 2026, increasing its annual production capacity by 4.5 million tons to meet growing demand in India and enhance environmental sustainability.

Carbonization Furnace Market Segmentation:

Carbonization Furnace Type Outlook

- Horizontal Charcoal Furnace

- Continuous Carbonization Furnace

- Skid-mounted Carbonization Furnace

- Others

Carbonization Furnace Feedstock Outlook

- Agricultural

- Corn stalks

- Wheat straw

- Rice husks

- Bagasse sugarcane

- Forestry waste

- Sawdust and wood chips

- Bamboo

- Trunks & Branches

- Nutshell waste

- Coconut shell

- Palm shell

- Olive shell

- Hazelnut shells

- Others

Carbonization Furnace, Application Outlook

- Charcoal

- Smelting

- Fuel

- Purifier

- Fertilizer

- Insulation

- Wood Vinegar

- Soil improvement

- Deodorize

- Fertilizer

- Additive

- Food preservation

- Tar

- Fuel

- Waterproof feedstock

- Carbon black

Carbonization Furnace Capacity Outlook

- <1000 KG/H

- 1000-2000 KG/H

- 2000-3000 KG/H

- >3000 kg/H

Carbonization Furnace Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbonization Furnace Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 244.80 million |

|

Market size value in 2024 |

USD 268.22 million |

|

Revenue Forecast in 2032 |

USD 573.91 million |

|

CAGR |

10.0% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global carbonization furnace market size was valued at USD 244.80 million in 2023 and is anticipated to reach USD 573.91 million in 2032

The global market is projected to grow at a CAGR of 10.0% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market.

The key players in the market are Beston Group Co., Ltd., Gongyi Sanjin Charcoal Machinery Factory, Gongyi Xiaoyi Mingyang Machinery Plant, GreenPower LTD, Henan Chengjinlai Machinery Co., Ltd., Henan Sunrise Biochar Machine Co.,Ltd, Tianjin Mikim Technique Co., Ltd., Zhengzhou Belong Machinery Co., Ltd., Zhengzhou Jiutian Machinery Equipment Co., Ltd., and Zhengzhou Shuliy Machinery Co. Ltd.

The horizontal charcoal furnace category dominated the market in 2023.

The tar had the largest share in the global market.