Carbon Prepreg Market Size, Share, Trends, Industry Analysis Report: By Resin Type, Manufacturing Process (Hot Melt Process and Solvent Dip Process), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM3430

- Base Year: 2024

- Historical Data: 2020-2025

Carbon Prepreg Market Overview

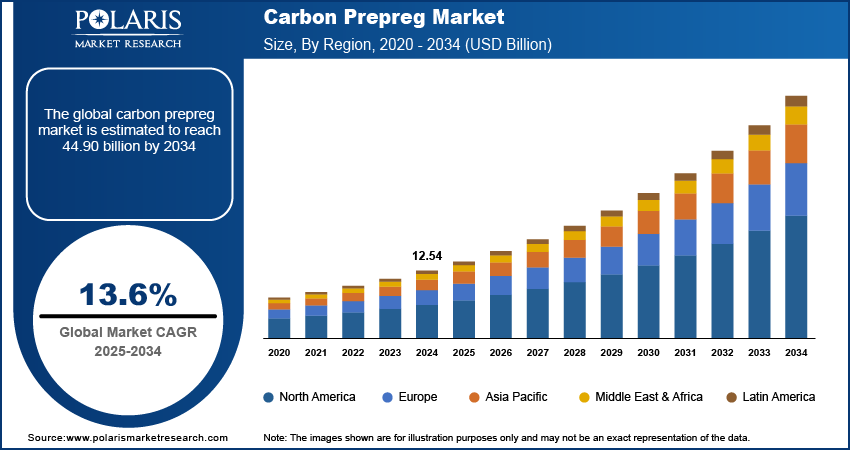

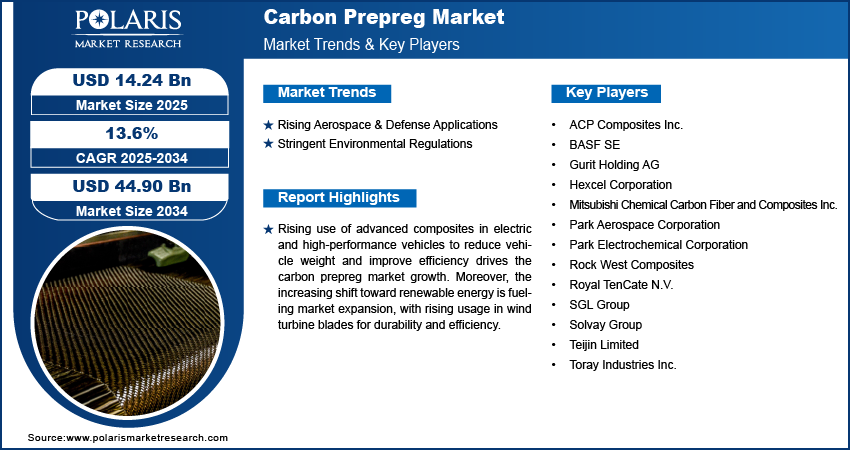

The global carbon prepreg market size was valued at USD 12.54 billion in 2024 and is expected to reach USD 14.24 billion by 2025 and USD 44.90 billion by 2034, exhibiting a CAGR of 13.6% during 2025–2034.

The carbon prepreg market includes pre-impregnated carbon fiber materials with resins, offering high strength and lightweight properties. It is widely used in aerospace, automotive, sports, and industrial applications for advanced manufacturing.

Expanding use of advanced composites in electric and high-performance vehicles is contributing to carbon prepreg market growth, reducing vehicle weight and improving efficiency. Moreover, the shift toward renewable energy is fueling carbon prepreg market expansion, with rising usage in wind turbine blades for durability and efficiency.

High-performance sports equipment and protective gear are creating new carbon prepreg market opportunities, leveraging superior strength-to-weight benefits. Furthermore, innovations in automated fiber placement and resin infusion techniques are increasing demand for carbon prepreg, enhancing production efficiency and scalability.

To Understand More About this Research: Request a Free Sample Report

Carbon Prepreg Market Dynamics

Rising Aerospace & Defense Applications

Increasing reliance on lightweight, high-strength materials in the aerospace & defense sector has significantly driven carbon prepreg market demand. Aircraft manufacturers are incorporating advanced composite materials to enhance fuel efficiency, improve aerodynamics, and reduce overall structural weight. The increasing production of commercial aircraft, coupled with rising investments in military aviation and space exploration, has contributed to the demand for lightweight materials. Toray Composite Materials America, Inc. presents the rising aerospace and defense applications through its production of high-quality aerospace composite prepreg materials. These advanced materials are crucial for various aerospace, including commercial jets, military aircraft, and space exploration vehicles, where they provide significant weight savings and enhanced performance. For instance, Toray's materials are used in primary and secondary aircraft structures, contributing to the industry's shift toward lighter, more efficient, and sustainable technologies. The superior strength-to-weight ratio and fatigue resistance of carbon prepregs have positioned them as essential materials in next-generation aircraft, boosting carbon prepreg market growth.

Stringent Environmental Regulations

Stringent environmental policies and sustainability goals have accelerated the shift toward eco-friendly composite materials, positively influencing carbon prepreg market development. Industries are increasingly adopting low-emission and recyclable prepreg solutions to comply with stringent carbon reduction mandates. Regulatory bodies across aviation, automotive, and energy sectors have mandated the use of lightweight, fuel-efficient materials. For instance, in October 2024, the Biden-Harris Administration finalized the most stringent pollution standards for automobiles, strengthening the US in clean vehicle innovation, advancing climate crisis mitigation, enhancing public health protections, and reducing consumer fuel costs. Companies investing in bio-based epoxy resins and advanced recycling technologies are shaping the industry's sustainability landscape. The ongoing push for greener manufacturing processes is expected to provide lucrative market growth opportunities during the forecast period.

Carbon Prepreg Market Segment Insights

Carbon Prepreg Market Assessment by Manufacturing Process Outlook

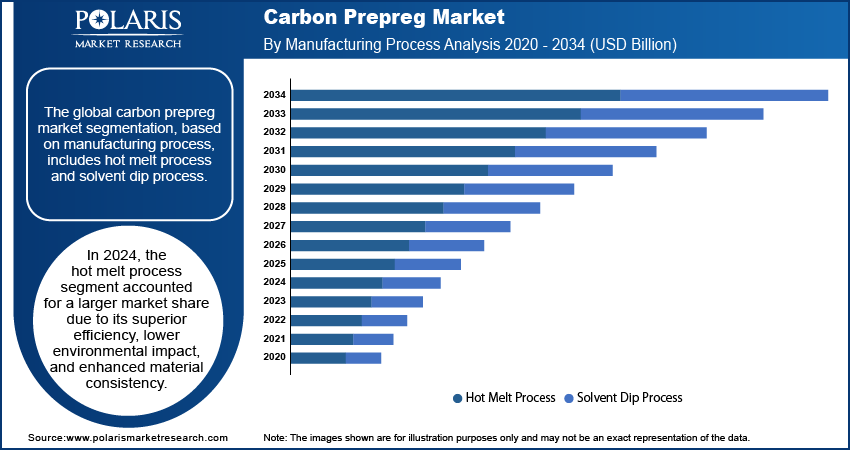

The global carbon prepreg market segmentation, based on manufacturing process, includes hot melt process and solvent dip process. In 2024, the hot melt process segment accounted for a larger market share due to its superior efficiency, lower environmental impact, and enhanced material consistency. This process eliminates the need for solvents, reducing volatile organic compound (VOC) emissions and aligning with stringent environmental regulations. High adoption across aerospace, automotive, and wind energy sectors further propelled the market demand, as manufacturers prioritized high-performance composites with extended shelf life and better process ability. The increasing need for lightweight, high-strength materials in advanced engineering applications strengthened market growth, reinforcing its dominance in industrial-scale production.

The solvent dip process segment is expected to witness a higher CARG over the forecast period due to its ability to achieve superior fiber wetting and resin impregnation. This technique is particularly preferred for applications requiring high-quality surface finish and exceptional mechanical properties, such as in high-performance sporting goods and specialized aerospace components. The growing focus on customized prepreg solutions and advancements in resin chemistry have further fueled market expansion. Despite regulatory concerns over solvent emissions, continuous innovation in low-VOC resin formulations has propelled the carbon prepreg market growth for the solvent dip process segment.

Carbon Prepreg Market Evaluation by Application Outlook

The global carbon prepreg market segmentation, based on application, includes aerospace & defense, automotive, sports and leisure, wind energy, and others. In 2024, the automotive segment accounted for the largest market share due to the rising adoption of lightweight composites for electric and high-performance vehicles. Automakers are increasingly integrating carbon prepregs into structural and aesthetic components to enhance fuel efficiency, crash resistance, and overall vehicle performance. Stringent emission standards and the push toward sustainable mobility have strengthened market demand in this sector. The expansion of advanced manufacturing techniques, including automated layup processes, has further contributed to market revenue.

The aerospace & defense segment is expected to register the highest CAGR over the forecast period due to the increasing production of commercial aircraft, military jets, and space exploration vehicles. Rising investments in next-generation aircraft that prioritize fuel efficiency and structural integrity have accelerated market growth in this segment. The superior mechanical properties of carbon prepregs, including high stiffness, fatigue resistance, and corrosion resistance, have positioned them as essential materials for modern aerospace applications. Ongoing innovations in out-of-autoclave processing and hybrid composite structures are further shaping the carbon prepreg market trends, ensuring sustained momentum in aerospace and defense applications.

Carbon Prepreg Market Regional Analysis

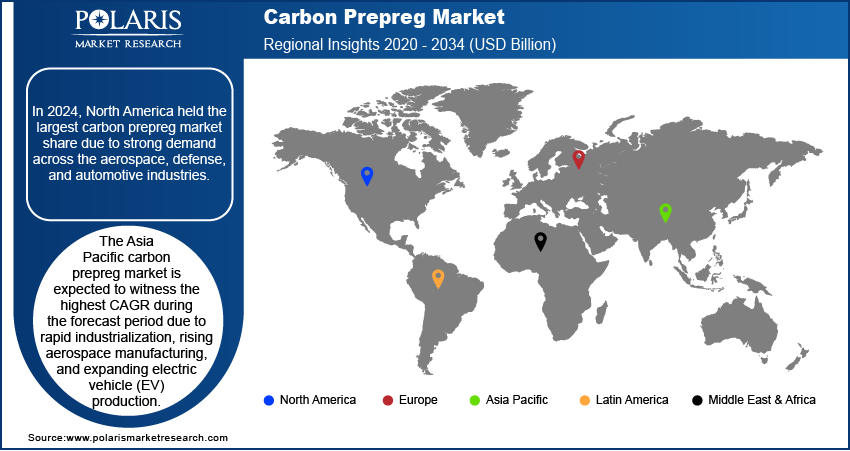

By region, the study provides carbon prepreg market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest carbon prepreg market share due to strong demand across aerospace, defense, and automotive industries. Major aircraft manufacturers and defense contractors in the region have significantly increased their adoption of carbon prepregs to enhance fuel efficiency, structural performance, and durability. Stringent environmental regulations promoting lightweight materials and fuel-efficient technologies have further strengthened market demand. Additionally, the presence of key industry players, advanced R&D capabilities, and substantial investments in next-generation composite manufacturing are supporting North America's leadership in the industry. As of 2023, foreign direct investment (FDI) in the US aerospace industry exceeded USD 20 billion.

The Asia Pacific carbon prepreg market is expected to witness the highest CAGR during the forecast period due to rapid industrialization, rising aerospace manufacturing, and expanding electric vehicle (EV) production. In April 2024, India produced about 2.36 million units of passenger vehicles, three-wheelers, two-wheelers, and quadricycles. In FY23, India exported around 4.76 million vehicles. Increasing government investments in sustainable infrastructure, coupled with the growing adoption of lightweight composites in the automotive and wind energy sectors, have propelled market growth in the region. The presence of cost-effective manufacturing hubs and advancements in composite processing technologies have further boosted market opportunity. Rising defense expenditures and a growing commercial aviation sector are expected to sustain market expansion.

Carbon Prepreg Key Market Players & Competitive Analysis Report

The carbon prepreg market is highly competitive, with key players focusing on mergers and acquisitions, joint ventures, and strategic partnerships to strengthen their market position and expand their product portfolios. Leading companies are heavily investing in technology advancements to enhance manufacturing processes, improve material performance, and develop next-generation lightweight composites. Collaboration between aerospace and automotive manufacturers with carbon prepreg suppliers is driving innovation, ensuring superior product integration. Additionally, competition strategy revolves around expanding production capacities, securing long-term supply agreements, and meeting stringent industry regulations. Companies are also leveraging sustainability initiatives to gain a competitive edge in the evolving market dynamics.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals.

Solvay SA (Solvay) is a chemical manufacturing company. The company is engaged in manufacturing and distributing specialty polymers, essential chemicals, chemical materials, and others. The company has research & innovation centers and industrial sites in Europe, North America, Latin America, and Asia. Solvay is headquartered in Brussels, Belgium. The company serves customers operating in aeronautics & automotive, natural resources & environment, electrical & electronics, agrochemical, food, consumer goods, building & construction, healthcare, industrial applications, and other sectors. It uses special chemicals made with eco-friendly materials to enhance product quality and performance. Solvay SA, a key player in the carbon prepreg market, specializes in advanced composite materials, catering to aerospace, automotive, and industrial applications. The company focuses on technology advancements and sustainability initiatives, enhancing the performance and efficiency of carbon prepreg solutions while expanding its global footprint through strategic partnerships and acquisitions.

List of Key Companies in Carbon Prepreg Market

- ACP Composites Inc.

- BASF SE

- Gurit Holding AG

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Park Aerospace Corporation

- Park Electrochemical Corporation

- Rock West Composites

- Royal TenCate N.V.

- SGL Group

- Solvay Group

- Teijin Limited

- Toray Industries Inc.

Carbon Prepreg Industry Developments

In July 2024, Toray partnered with Elevated Materials to repurpose carbon fiber prepreg waste, advancing sustainability efforts. Under a three-year agreement, Elevated Materials transformed Toray's scrap prepreg materials into press-cured carbon fiber sheets, plates, and blocks, which are used in various industries such as sports equipment and drones.

In March 2024, Mitsubishi Chemical Group developed the BiOpreg 400 Series, a carbon fiber prepreg material using plant-derived resin. This innovation featured up to 25% biomass content, offering a sustainable alternative for applications in sports, mobility, and industrial sectors.

In July 2022, Hexcel signed a long-term agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program. This marked the first Dassault business jet program to use high-performance advanced carbon fiber composites in manufacturing aircraft wings.

Carbon Prepreg Market Segmentation

By Resin Type Outlook (Revenue – USD Billion, 2020–2034)

- Epoxy Resin

- Phenolic Resin

- BMI Resin

- Cyanate Ester Resin

- Thermoplastic Resin

- Others

By Manufacturing Process Outlook (Revenue – USD Billion, 2020–2034)

- Hot Melt Process

- Solvent Dip Process

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace & Defense

- Automotive

- Sports and Leisure

- Wind Energy

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Prepreg Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.54 Billion |

|

Market Size Value in 2025 |

USD 14.24 Billion |

|

Revenue Forecast in 2034 |

USD 44.90 Billion |

|

CAGR |

13.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025– 034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global carbon prepreg market size was valued at USD 12.54 billion in 2024 and is projected to grow to USD 44.90 billion by 2034.

The global market is projected to register a CAGR of 13.6% during the forecast period.

In 2024, North America accounted for the largest market share due to strong demand across aerospace, defense, and automotive industries.

A few of the key players in the market are ACP Composites Inc., BASF SE, Gurit Holding AG, Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites Inc., Park Aerospace Corporation, Park Electrochemical Corporation, Rock West Composites, Royal TenCate N.V., SGL Group, Solvay Group, Teijin Limited, and Toray Industries Inc.

In 2024, the hot melt process segment accounted for a larger market share due to its superior efficiency, lower environmental impact, and enhanced material consistency.

In 2024, the automotive segment accounted for the largest market share due to the rising adoption of lightweight composites for electric and high-performance vehicles.