Carbon Nanotubes (CNT) Market Size, Share, Trends, Industry Analysis Report: By Type [Single-Walled CNT (SWCNT) and Multi-Walled CNT (MWCNT)], Application, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM1925

- Base Year: 2024

- Historical Data: 2020-2023

Carbon Nanotubes (CNT) Market Overview

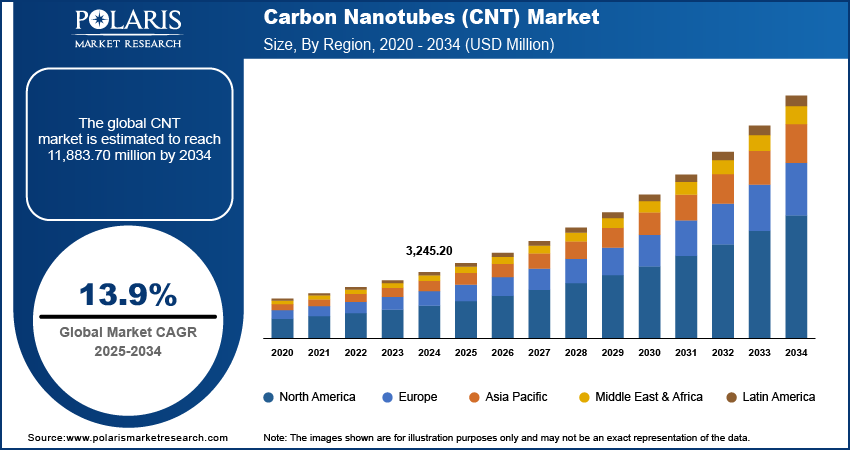

The global carbon nanotubes (CNT) market size was valued at USD 3,245.20 million in 2024. The market is projected to grow from USD 3,689.15 million in 2025 to USD 11,883.70 million by 2034, exhibiting a CAGR of 13.9% from 2025 to 2034.

Carbon nanotubes (CNT), composed of carbon atoms arranged in cylindrical nanostructures, offer exceptional mechanical strength, electrical conductivity, and thermal stability. These properties make them crucial in industries such as electronics, aerospace, automotive, energy, and healthcare.

To Understand More About this Research:Request a Free Sample Report

The increasing focus on renewable energy systems and the growing adoption of electric vehicles (EVs) propels the carbon nanotube market growth. For instance, according to data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. CNTs are integrated into EVs to enhance battery performance by improving the electrical conductivity of the electrodes. The carbon nanotubes market expansion is further fueled by increasing investments in research and development, rising applications in emerging industries such as 5G communication and nanomedicine, and the growing adoption of sustainable materials.

Carbon Nanotubes (CNT) Market Dynamics

Growing Adoption of Flexible Displays and Wearable Devices

Touchscreens and display makers incorporate CNTs into conductive films and electrodes for flexible displays, as these materials offer superior performance compared to traditional rigid materials such as indium tin oxide. The growing adoption of smartwatches and fitness trackers drives CNT demand, as manufacturers need these materials to create durable, flexible components that withstand repeated bending and stretching. CNTs also enable the development of stretchable sensors and circuits essential for advanced wearable technologies. Thus, the growing adoption of flexible displays and wearable devices is fueling the carbon nanotubes (CNT) market development.

Technological Advancements in Cost-Effective Production Methods

Chemical vapor deposition (CVD) has emerged as a preferred method for producing high-quality CNTs due to its scalability, cost efficiency, and ability to produce nanotubes with controlled dimensions and properties. This technique allows for the large-scale synthesis of single-walled and multi-walled CNTs at reduced costs, making them more accessible for various industrial applications. Ongoing innovations in CVD processes, such as the use of sustainable precursors and optimized reaction conditions, are improving production efficiency while reducing environmental impact. These advancements are not only lowering barriers to entry for manufacturers but also enabling the development of new CNT-based products. As a result, technological advancements in cost-effective production methods, such as CVD, are driving the carbon nanotubes (CNT) market revenue.

Market1.png)

Carbon Nanotubes (CNT) Market Segment Insights

Carbon Nanotubes (CNT) Market Evaluation by Type Insights

Based on type, the carbon nanotubes (CNT) market is categorized into single-walled CNT (SWCNT) and multi-walled CNT (MWCNT). The multi-walled CNT (MWCNT) segment dominated the market in 2024 due to their cost-effectiveness and broader usage compared to single-walled CNTs. MWCNTs are widely used in structural reinforcement and energy storage applications, where their mechanical strength and electrical properties are critical. Advancements in MWCNT manufacturing processes, which have reduced production costs and improved scalability, further dive into the adoption of multi-walled CNTs.

Carbon Nanotubes (CNT) Market Evaluation by Industry Vertical Insights

In terms of industry vertical, the carbon nanotubes (CNT) market is divided into automotive & aerospace, energy & power, and healthcare & biotechnology. The automotive & aerospace segment accounted for a major market share in 2024 due to the growing need for lightweight, high-performance materials. CNTs offer exceptional strength-to-weight ratios, making them ideal for supporting composite materials used in vehicles and aircraft.

Market Seg.png)

Carbon Nanotubes (CNT) Market Regional Analysis

By region, the report provides the carbon nanotubes (CNT) market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest CNT market share in 2024, with countries such as China and Japan dominating due to their advanced manufacturing infrastructure, extensive R&D investments, and strong presence in the automotive and energy industries. As a global manufacturing hub for electronics and EVs, China plays a key role in boosting CNT adoption, further contributing to regional dominance.

The North America carbon nanotubes (CNT) market is expected to grow at a rapid pace during the forecast period due to advancements in nanotechnology and the increasing use of CNTs in aerospace and defense industries. The US, in particular, plays a key role in funding R&D and commercializing CNT-based technologies. Strategic collaborations between academic institutes and key companies, coupled with government policies promoting nanotechnology innovations, are driving the market growth in the region.

Market Reg.png)

Carbon Nanotubes (CNT) Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the carbon nanotubes (CNT) market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

CHASM is a pioneering company specializing in the development and manufacturing of advanced materials, particularly focusing on carbon nanotubes (CNTs). Established in 2005, CHASM initially operated as a consultancy before evolving into a manufacturer after acquiring the assets of Southwest NanoTechnologies in 2015. The company has since made significant strides in the field of nanotechnology, particularly through its proprietary nanotube-enhanced carbon (NTeC) technology.

Cabot Corporation, founded in 1882, is a global specialty chemicals and performance materials company headquartered in Boston, Massachusetts. With operations spanning over 20 countries and 36 manufacturing plants, Cabot has established itself as a key player in the production of reinforcing carbons, specialty compounds, and advanced materials. The company operates through two primary segments: Reinforcement Materials and Performance Chemicals. The Reinforcement Materials segment focuses on products that enhance the performance of tires and industrial applications, while the Performance Chemicals segment delivers materials used in various sectors, including automotive, construction, and electronics.

List of Key Companies in Carbon Nanotubes (CNT) Market

- Arkema

- Arry International Group Limited

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Continental Carbon Nanotechnologies, Inc.

- Hanwha Solutions Chemical Division Corporation

- Jiangsu Cnano Technology Co., Ltd

- LG Chem

- Nanocyl SA

- OCSiAl

- Resonac Holdings Corporation

Carbon Nanotubes (CNT) Industry Developments

March 2024: CHASM Advanced Materials, Inc. announced a partnership with Ingevity Corporation to expand carbon nanotube (CNT) supply for gigafactories in North America and Europe.

May 2023: LG Chem announced that it started the construction of its fourth carbon nanotube (CNT) plant at its Daesan Complex, 80 kilometers southwest of Seoul. LG Chem’s CNT 4 Plant is slated for operation in 2025 and will contribute to doubling LG Chem’s annual CNT production capability to 6,100 tons.

March 2021: Cabot Corporation, a global company that provides specialty chemicals and performance materials, announced the launch of the ENERMAX 6 carbon nanotube (CNT) series. ENERMAX 6 carbon nanotube products are the company’s latest development in high-performance CNTs.

Carbon Nanotubes (CNT) Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Single-Walled CNT (SWCNT)

- Multi-Walled CNT (MWCNT)

By Application Outlook (Revenue, USD Million, 2020–2034)

- Electronics & Semiconductors

- Energy Storage

- Structural Materials

- Medical & Pharmaceuticals

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- Automotive & Aerospace

- Energy & Power

- Healthcare & Biotechnology

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Nanotubes (CNT) Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,245.20 million |

|

Market Forecast Value in 2025 |

USD 3,689.15 million |

|

Revenue Forecast by 2034 |

USD 11,883.70 million |

|

CAGR |

13.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 3,245.20 million in 2024 and is projected to grow to USD 11,883.70 million by 2034.

• The global market is projected to register a CAGR of 13.9% from 2025 to 2034.

• Asia Pacific had the largest share of the global market in 2024.

• Some of the key players in the market are Jiangsu Cnano Technology Co., Ltd; Arkema; CHASM; Cabot Corporation; Nanocyl SA; Continental Carbon Nanotechnologies, Inc.; Resonac Holdings Corporation; Hanwha Solutions Chemical Division Corporation; Arry International Group Limited; Carbon Solutions, Inc.; OCSiAl; and LG Chem.

• The multi-walled CNT (MWCNT) segment dominated the market in 2024.