Carbon Fiber Market Size, Share, Trends & Industry Analysis Report

By Fiber (Virgin and Recycled), By Raw Material, By Modulus, By Product, By Application, By End Use, and By Region – Segment Forecasts, 2025–2034

- Published Date:Aug-2025

- Pages: 132

- Format: PDF

- Report ID: PM3100

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

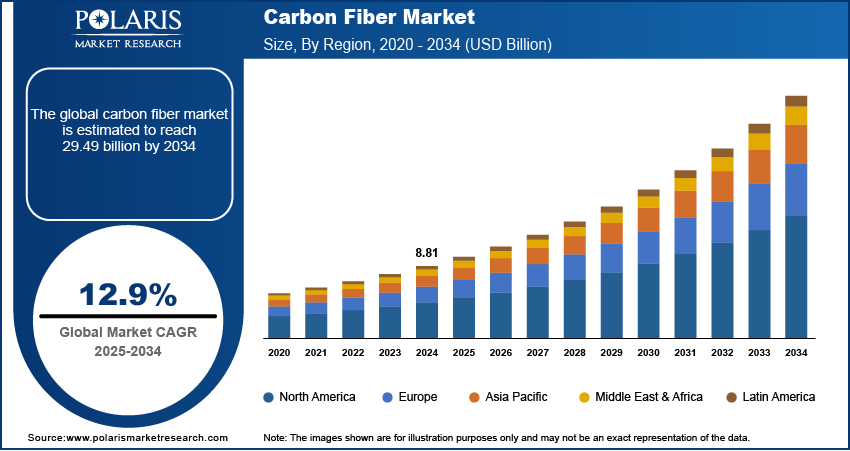

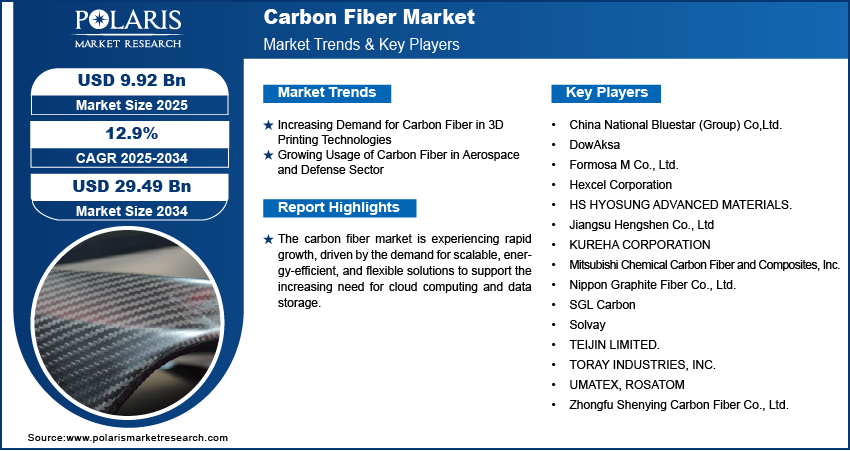

The global carbon fiber market was valued at USD 8.81 billion in 2024 and is expected to grow at a CAGR of 12.9% from 2025 to 2034. The market is driven by rising demand in aerospace, automotive, and 3D printing sectors for lightweight, durable, and high-performance materials that enhance fuel efficiency, structural strength, and manufacturing precision.

Key Insights

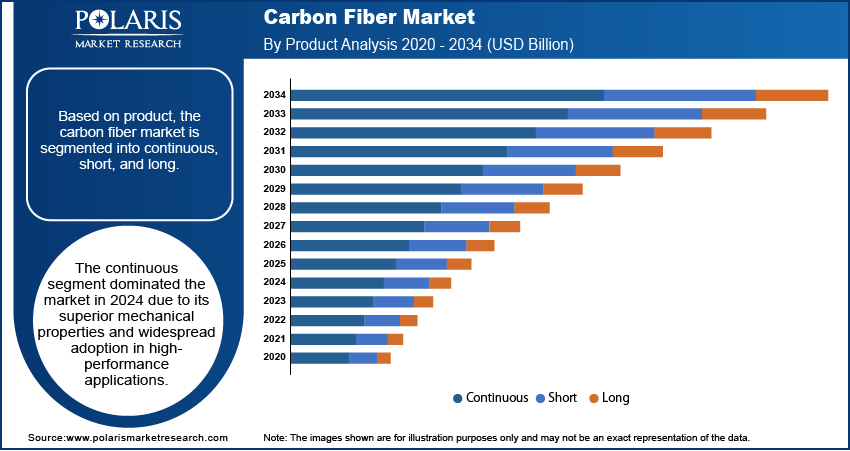

- The continuous carbon fiber segment led the market in 2024 due to its high strength, stiffness, and reliability in structural applications.

- The composite segment is expected to grow fastest, driven by its superior strength-to-weight ratio and corrosion resistance.

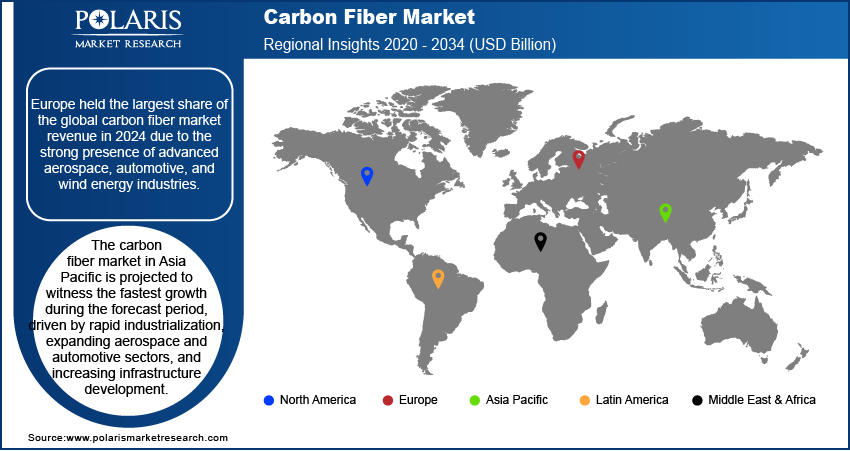

- Europe held the largest carbon fiber market share in 2024 due to its advanced aerospace and automotive manufacturing capabilities.

- The Asia Pacific region is projected to witness the highest growth due to rising investments in the manufacturing, energy, and transportation sectors.

Industry Dynamics

- Rising demand for lightweight, high-strength materials in aerospace, automotive, and 3D printing drives growth in the carbon fiber market across industries.

- Expanding satellite deployments for defense and communication drive the adoption of carbon fiber composites for improved durability and thermal resistance.

- Electric vehicle manufacturers increasingly use carbon fiber to enhance energy efficiency, crash safety, and meet emission regulations.

- Additive manufacturing enables cost-effective, complex carbon fiber components, supporting innovation in aerospace, automotive, and electronics sectors.

- High production costs, limited recyclability, and strict regulatory standards restrain broader adoption in cost-sensitive or highly regulated markets.

Market Statistics

2024 Market Size: USD 8.81 billion

2034 Projected Market Size: USD 29.49 billion

CAGR (2025–2034): 12.9%

Europe: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The increasing demand for carbon fiber in satellite manufacturing is driving the overall market development. The aerospace sector prioritizes advanced materials such as GRX-810 to improve thermal stability, durability, and structural strength while minimizing weight. Satellites require materials with high tensile strength and resistance to extreme conditions, making carbon fiber an ideal choice. Carbon fiber is a high-strength, lightweight material composed of thin, crystalline carbon filaments, widely used across aerospace, automotive, and industrial applications. Additionally, manufacturers are increasingly integrating carbon fiber composites to improve payload efficiency and operational longevity with the rise in satellite launches for communication, defense, and space launch services. In November 2024, Bristol Composites Institute launched a new generation of space materials to build future space bases, spacecraft for interplanetary travel, or a new International Space Station. This trend is expected to continue during the forecast period as governments and private players expand their satellite deployment initiatives.

Automakers are shifting toward lightweight materials to reduce vehicle weight and improve energy efficiency as governments push for lower emissions and enhanced fuel efficiency. In January 2022, Mercedes-Benz launched the VISION EQXX, an electric vehicle with lightweight doors made from carbon- and glass-fiber reinforced plastics. This design improves crash safety and energy absorption. Additionally, carbon fiber and its composites offer considerable advantages over conventional materials, enabling manufacturers to meet regulatory standards without compromising performance. The push for EVs further amplifies this demand, as weight reduction directly influences battery efficiency and driving range. The integration of carbon fiber in automotive applications is expected to accelerate, reinforcing its role in next-generation vehicle design with sustainability becoming a priority.

Market Dynamics

Increasing Demand for Carbon Fiber in 3D Printing Technologies

Carbon fiber-reinforced filaments offer superior strength-to-weight ratios, high stiffness, and thermal resistance, making them ideal for producing lightweight, durable components. The increasing demand for carbon fiber in 3D printing technologies is driving the carbon fiber market growth as industries seek advanced materials that enhance manufacturing efficiency and product performance. In June 2024, Farsoon Technologies launched a high-performance carbon-fiber reinforced PA6 material, FS6130CF-F, tailored for demanding industries such as automotive, aerospace, electronics, and electrical devices. This material offers exceptional heat resistance, strength, rigidity, modulus, and impact performance. Moreover, additive manufacturing enables complex geometries and rapid prototyping, allowing industries such as aerospace, automotive, and healthcare to benefit from cost-effective, high-performance solutions. Thus, the integration of carbon fiber materials is expected to rise as 3D printing adoption expands, driving innovation in precision manufacturing while reducing material waste and production costs.

Growing Usage of Carbon Fiber in Aerospace & Defense Sector

The aerospace & defense industry demands materials that offer exceptional strength, reduced weight, and resistance to extreme environmental conditions, making carbon fiber an essential choice for aircraft structures, military equipment, and unmanned aerial vehicles (UAVs). The shift toward fuel-efficient aircraft and enhanced defense capabilities further accelerated the need for lightweight, high-performance materials, such as carbon fiber. Furthermore, carbon fiber composites contribute to improved fuel efficiency, operational durability, and structural integrity, aligning with the aerospace sector’s goals of optimizing performance while meeting stringent safety and regulatory standards. In November 2021, Akasa Air ordered 72 fuel-efficient airplanes from Boeing to launch service in the Indian market. The new Indian carrier's order, valued at nearly USD 9 billion, includes the 737-8 and the high-capacity 737-8-200. Hence, the rising usage of carbon fiber in the aerospace & defense sector propels the carbon fiber market demand.

Segmental Insights

Market Assessment by Product Outlook

The global carbon fiber market segmentation, based on product, includes continuous, short, and long. The continuous segment dominated the market share in 2024 due to its superior mechanical properties and widespread adoption in high-performance applications. Continuous carbon fiber offers exceptional strength, stiffness, and durability, making it the preferred choice in the aerospace, automotive, and wind energy industries. Its ability to be incorporated into complex structures while maintaining structural integrity improves its applicability in advanced composite manufacturing. Additionally, industries focused on lightweight solutions for improved fuel efficiency and sustainability have increasingly integrated continuous carbon fiber into critical components. This growing demand across key sectors has reinforced the market development for the continuous segment.

Application Outlook

The global carbon fiber market evaluation, based on application, includes composite and non-composite. The composite segment is expected to witness a higher growth rate during the forecast period, driven by the rising demand for lightweight, high-strength materials in various industries. Carbon fiber-reinforced composites provide considerable advantages over traditional materials, such as superior strength-to-weight ratio, corrosion resistance, and design flexibility. These properties make composites essential in aerospace, automotive, wind energy, and sports equipment manufacturing. The shift toward fuel-efficient transportation and sustainability initiatives further accelerates composite adoption as industries seek innovative solutions to enhance performance while meeting regulatory requirements. The composite segment is poised for notable expansion with continuous advancements in composite processing technologies.

Regional Analysis

By region, the report provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the carbon fiber market revenue share in 2024 due to the strong presence of advanced aerospace, automotive, and wind energy industries. The region's stringent environmental regulations and sustainability initiatives have driven the demand for lightweight, high-performance materials to enhance fuel efficiency and reduce carbon emissions. The August 2024 European Environment Agency report emphasizes that the European Green Deal aims for net-zero emissions by 2050, sustainable economic growth, a toxin-free environment, and inclusivity. Leading aerospace manufacturers and luxury automobile producers in Europe have increasingly integrated carbon fiber composites into structural components, reinforcing their market leadership. In March 2024, Toray Carbon Fibers Europe S.A. announced the development of prototype tennis racquets and pickle ball paddles made with Toray’s bio-circular carbon fiber, using the mass balance approach, as certified by the ISCC PLUS standard. Additionally, continuous investments in research and development, coupled with technological advancements in composite manufacturing, have solidified Europe's position as a key hub for carbon fiber adoption and innovation.

The Asia Pacific market is expected to grow rapidly in the coming years due to industrial expansion, a booming aerospace and automotive sector, and increasing infrastructure projects. Countries like China, Japan, and South Korea are using more carbon fiber composites to make fuel-efficient vehicles and lightweight materials. Investments in wind energy projects and advanced manufacturing are also driving market growth. A June 2024 IEEFA report stated that more than USD 1.1 trillion will be invested in solar and offshore wind power supply chains by 2050, generating 873 GW of clean energy across seven Asian markets. With strong government support for sustainable materials and the presence of major industry players, Asia Pacific is set to lead the global market.

Key Players & Competitive Analysis Report

The competitive landscape of the carbon fiber market comprises global leaders and regional players aiming to capture market share through technological innovation, strategic collaborations, and geographic expansion. Industry leaders such as Toray Industries, SGL Carbon, Mitsubishi Chemical Group, and Hexcel Corporation leverage strong R&D capabilities and extensive supply chains to deliver high-performance carbon fiber solutions across aerospace, automotive, wind energy, and industrial applications. Carbon fiber market trends indicate a growing demand for advanced carbon fiber composites, including recycled carbon fiber and high-temperature-resistant variants, reflecting ongoing advancements in material science and sustainable manufacturing. The market is poised for substantial growth, driven by increasing applications in lightweight structures, electric vehicles, and next-generation aircraft. Regional players focus on localized production and cost-effective solutions, particularly in high-growth markets such as Asia Pacific, which is projected to expand at the fastest rate. Competitive strategies include mergers and acquisitions, joint ventures with end-use industries, and investments in automation to enhance production efficiency. Additionally, the push for sustainability and regulatory compliance accelerates the adoption of bio-based and recycled carbon fiber products, reinforcing the role of technological advancements, market adaptability, and regional investments in shaping the future of the carbon fiber industry.

DowAksa, established in 2012, is Turkey's carbon fiber manufacturer and a player in the global market. This joint venture between The Dow Chemical Company and Aksa Akrilik Kimya Sanayii A.Ş. leverages the expertise of both partners to produce advanced carbon fiber solutions tailored for various applications, particularly in energy, transportation, defense, and infrastructure sectors. The company operates a state-of-the-art manufacturing facility located in Yalova, Turkey, which is strategically positioned within a four-hour flight radius of key markets in Europe, MENA, and Central Asia. DowAksa's product offerings include a comprehensive range of carbon fiber composites, from prototypes to finished products, enabling innovations that enhance performance through weight reduction and improved energy efficiency. DowAksa is committed to meeting the evolving demands of the carbon fiber industry with a focus on sustainability and technological advancement.

Toray Industries, Inc. is a multinational corporation based in Japan, specializing in advanced materials and technologies. Founded in 1926 as Toyo Rayon, the company has evolved significantly, now focusing on a diverse range of sectors such as textiles, chemicals, pharmaceuticals, and, notably, carbon fiber production. Toray is recognized as the world's largest producer of carbon fiber, which is extensively utilized in various industries such as aerospace, automotive, and sporting goods. Its carbon fiber products are integral to the construction of modern aircraft such as the Boeing 787. The company emphasizes innovation and sustainability, aiming to address global challenges through its advanced material solutions. Toray continues to expand its footprint in advanced composite materials and other high-performance applications with operations spanning 20 countries.

Key Companies

- China National Bluestar (Group) Co, Ltd.

- DowAksa

- Formosa M Co., Ltd.

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS.

- Jiangsu Hengshen Co., Ltd

- KUREHA CORPORATION

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Nippon Graphite Fiber Co., Ltd.

- SGL Carbon

- Solvay

- TEIJIN LIMITED.

- TORAY INDUSTRIES, INC.

- UMATEX, ROSATOM

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Carbon Fiber Industry Development

March 2025: Mercedes-AMG Petronas F1 Team will use sustainable carbon fiber composites for the first time in F1 on their 2025 W16 car, qualifying and applying eco-friendly materials without sacrificing on-track performance as part of their net-zero carbon footprint goals.

November 2024: 4M Carbon Fiber launched a 50-ton plasma oxidation qualification line to accelerate revolutionary carbon fiber technology, significantly improving efficiency, reducing costs, and enhancing material properties.

March 2024: Hexcel launched the new HexTow IM9 24K carbon fiber, which offers enhanced value for the world’s most advanced aerospace composite applications.

Market Segmentation

By Raw Material Outlook (Revenue, USD Billion, 2020–2034)

- Pan-Based Carbon Fiber

- Pitch-Based Carbon Fiber

By Fiber Outlook (Revenue, USD Billion, 2020–2034)

- Virgin

- Recycled

By Modulus Outlook (Revenue, USD Billion, 2020–2034)

- Standard Modulus

- Intermediate Modulus

- High Modulus

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Continuous

- Short

- Long

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Composite

- Non-Composite

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Aerospace and Defense

- Automotive

- Wind Energy

- Pipes and Tanks

- Sporting Goods

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.81 billion |

|

Market Size Value in 2025 |

USD 9.92 billion |

|

Revenue Forecast by 2034 |

USD 29.49 billion |

|

CAGR |

12.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global carbon fiber market size was valued at USD 8.81 billion in 2024 and is projected to grow to USD 29.49 billion by 2034.

The global market is projected to register a CAGR of 12.9% during the forecast period.

Europe dominated the market share in 2024.

A few of the key players in the market are China National Bluestar (Group) Co., Ltd.; DowAksa; Formosa M Co., Ltd.; Hexcel Corporation; HS Hyosung Advanced Materials; Jiangsu Hengshen Co., Ltd.; Kureha Corporation; Mitsubishi Chemical Carbon Fiber and Composites, Inc.; Nippon Graphite Fiber Co., Ltd.; SGL Carbon; Solvay; Teijin Limited; Toray Industries, Inc.; Umatex, Rosatom; and Zhongfu Shenying Carbon Fiber Co., Ltd.

The continuous segment dominated the market in 2024.