Carbon Dioxide Market Size, Share, Trends, Industry Analysis Report: By Source, Application, End User (Ethanol Production, Natural Gas Processing, Industrial Processes, and Fermentation), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1557

- Base Year: 2024

- Historical Data: 2020-2023

Carbon Dioxide Market Overview

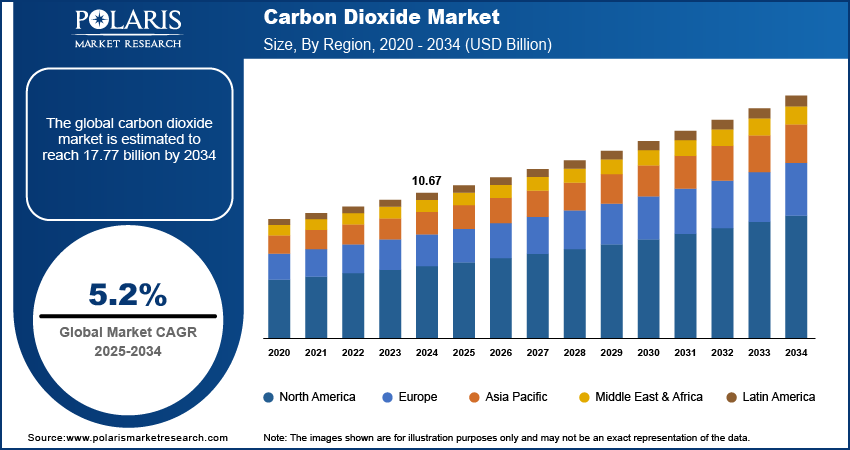

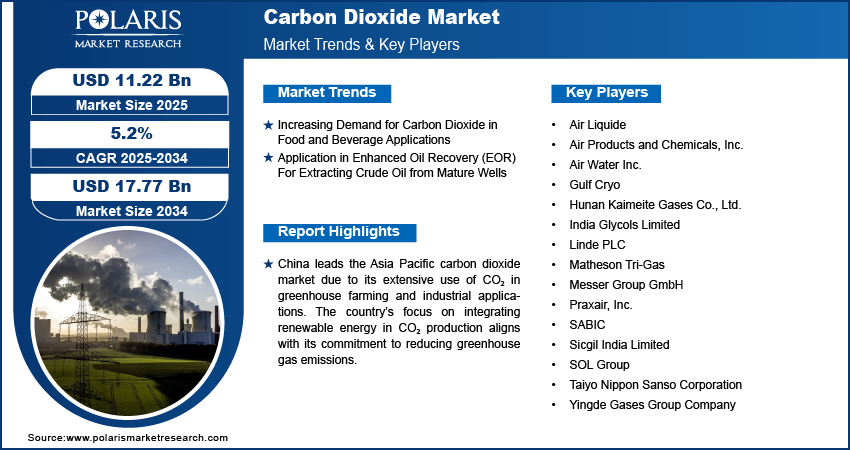

The carbon dioxide market size was valued at USD 10.67 billion in 2024. The market is projected to grow from USD 11.22 billion in 2025 to USD 17.77 billion by 2034, exhibiting a CAGR of 5.2% during 2025–2034.

The global carbon dioxide (CO₂) market involves the production, storage, distribution, and utilization of carbon dioxide across various industries. CO₂ is widely used in various applications ranging from food and beverages medical applications, and enhanced oil recovery (EOR) to industrial processes such as welding and cooling. The primary use of medical CO2 is to expand and stabilize body cavities during surgeries such as endoscopy, laparoscopy, and arthroscopy. This procedure enhances visibility in the surgical area. The CO₂ market growth is attributed to rising industrialization, advancements in manufacturing technologies, and increasing demand for carbon dioxide in sustainable and environmentally friendly applications. The use of CO2 in greenhouse farming and carbon capture, utilization, and storage (CCUS) technologies is gaining traction globally. Furthermore, owing to the growing shifts toward decarbonization and a circular economy across the world, the development of CO₂-derived chemicals and fuels is expected to emerge as a prominent carbon dioxide market trend during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Carbon Dioxide Market Dynamics

Increasing Demand for Carbon Dioxide in Food and Beverage Applications

In the food & beverages industry, CO₂ is widely used for carbonating beverages such as soft drinks, sparkling water, and beer, with rising consumer demand for these products. In May 2023, Asahi Group Holdings announced that its beverage division was set to initiate a pilot program in Japan featuring innovative vending machines designed to capture atmospheric CO2. These machines represent a significant advancement in sustainable technology, integrating carbon capture mechanisms to mitigate environmental impact while delivering beverage products. Additionally, CO₂ is integral to preserving perishable goods through freezing and chilling. Also, it plays a key role in modified atmosphere packaging (MAP), which extends the shelf life of fresh meat, fruits, and vegetables. The growing popularity of ready-to-eat meals and packaged food, especially in emerging markets, further amplifies the demand for CO₂ in this sector. Thus, the expanding use of CO2 in food and beverage applications drives the carbon dioxide (CO₂) market demand.

Application in Enhanced Oil Recovery (EOR) for Extracting Crude Oil from Mature Wells

Enhanced oil recovery (EOR) technology involves injecting CO₂ into depleted or mature oil wells to enhance crude oil recovery, enabling energy producers to extract additional resources from existing reserves. This method boosts efficiency and aligns with global sustainability efforts through CCUS initiatives. Governments and energy companies are prioritizing investments in EOR projects to maximize resource utilization while mitigating greenhouse gas emissions with increasing energy demands and the depletion of easily accessible oil reserves. These dual applications of CO₂ underscore its importance across the oil & gas industry. Therefore, the rising application of CO2 in enhanced oil recovery (EOR) in the energy sector propels the carbon dioxide (CO₂) market development.

Carbon Dioxide Market Segment Insights

Carbon Dioxide Market Evaluation by Source Outlook

The global carbon dioxide market evaluation, based on source, includes ethanol production, natural gas processing, industrial processes, and fermentation. In 2024, the natural gas processing segment accounted for the largest market share due to its high yield and efficiency in producing commercial-grade CO₂. The abundance of natural gas reserves and its cost-effective extraction methods make it the most widely adopted source of carbon dioxide. Moreover, industries are increasingly leveraging natural gas processing to meet the growing carbon dioxide (CO₂) market demand for in conventional and emerging applications, including CCUS technologies.

Carbon Dioxide Market Assessment by Application Outlook

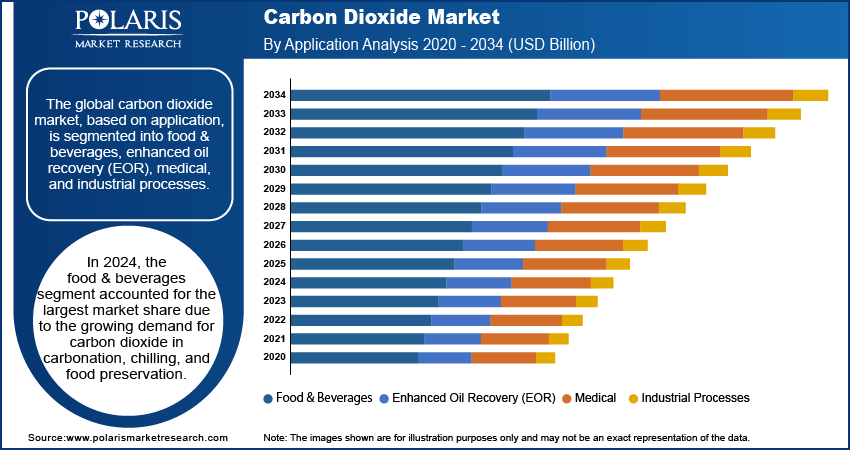

Based on application, the global carbon dioxide market assessment includes food & beverages, enhanced oil recovery (EOR), medical, and industrial processes. In 2024, the food & beverages segment held the largest market share due to the growing demand for carbon dioxide in carbonation, chilling, and food preservation. The food & beverage industry's robust growth, fueled by rising consumer demand for carbonated drinks and packaged food, has made this application a dominant area in the market. Additionally, the use of CO₂ for modified atmosphere packaging (MAP) helps extend the shelf life of perishable goods, further fueling the carbon dioxide CO2 market growth.

Carbon Dioxide Market Regional Insights

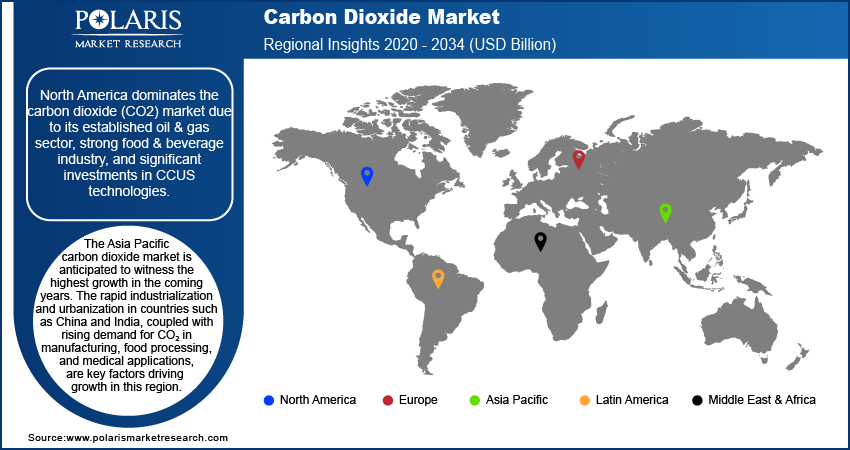

By region, the report provides the carbon dioxide market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the carbon dioxide (CO2) market share in 2024 due to its established oil & gas sector, strong food & beverage industry, and significant investments in CCUS technologies. According to the US Energy Information Administration, in December 2022, oil production in the US averaged 12.2 million barrels per day (b/d), while natural gas gross withdrawals averaged 121.1 billion cubic feet per day (Bcf/d). In December 2023, oil production increased to 13.3 million b/d, and natural gas withdrawals rose to 128.8 Bcf/d. The US is the leading country in this region, driven by its large-scale adoption of CO₂ for enhanced oil recovery (EOR) and carbon capture initiatives. The US government’s support for decarbonization and its strong infrastructure for CO₂ storage and transportation have also propelled the carbon dioxide market expansion. The Asia Pacific carbon dioxide market expansion is anticipated to witness the fastest growth in the coming years. The rapid industrialization and urbanization in countries such as China and India, coupled with rising demand for CO₂ in manufacturing, food processing, and medical applications, are key factors driving growth in this region. China, in particular, leads the Asia Pacific market due to its extensive use of CO₂ in greenhouse farming and industrial applications. The country’s focus on integrating renewable energy in CO₂ production aligns with its commitment to reducing greenhouse gas emissions.

Carbon Dioxide Market – Key Players and Competitive Analysis Report

The carbon dioxide (CO2) market value is dominated by leading companies such as Air Liquide, Linde PLC, and Air Products and Chemicals, Inc., which collectively hold a significant share due to their advanced technologies and extensive global networks. These companies focus on innovation, strategic acquisitions, and collaborations to maintain their competitive edge. For example, Linde has been at the forefront of developing CCUS solutions, while Air Liquide emphasizes sustainable CO₂ production through renewable energy integration. Emerging players are targeting niche markets such as synthetic fuels and specialized medical applications to hold a significant share of the competitive landscape. Additionally, regional players such as Gulf Cryo and Yingde Gases leverage localized production and distribution networks to serve cost-sensitive markets effectively. The competitive environment is further intensified by technological advancements and the growing focus on sustainability, pushing companies to innovate and expand their portfolios. A few key major players in the CO2 market are Air Liquide; Linde PLC; Air Products and Chemicals, Inc.; Praxair, Inc.; Taiyo Nippon Sanso Corporation; Messer Group GmbH; Gulf Cryo; SOL Group; Hunan Kaimeite Gases Co., Ltd.; Yingde Gases Group Company; Air Water Inc.; Matheson Tri-Gas; India Glycols Limited; SABIC; and Sicgil India Limited.

Air Products and Chemicals, Inc. offers industrial gases. The Company offers industrial gases, correlated equipment and applications to customers in various domains such as refining, metals, electronics, manufacturing, chemical and food and beverage. The Company’s serves to the region such as Americas, Asia, Europe, and Middle East and India. Additionally, the Company also delivers liquefied natural gas process technology and its equipment. The Company is operating in industrial gas projects, including carbon capture projects, gasification projects, and carbon-free hydrogen projects supporting global transportation and energy transition.

Air Water Inc. offers various chemicals and chemical-based products. The company offers its products into five primary segments on the basis of product type. The industrial gas segment offers oxygen gases utilized in blast furnaces for the production of steel. The chemical business segment offers coal and fine chemicals & serves to the agricultural and pharmaceutical industries. While, the medical business segment offers sterilization equipment & medical gases and to home-care facilities & hospitals. Besides this, the agricultural and food products segment offers fruit and vegetable juices, frozen foods, & delicatessen meat. The energy segment delivers natural gas. Additionally, Air Products and Chemicals, Inc. provides industrial gases. The Company offers essential industrial gases, related equipment and applications to customers in multiple sectors such as metals, refining, electronics, chemical, manufacturing, and food and beverage. The Company’s serves to the region such as Asia, Americas, Europe, and Middle East and India. Additionally, the Company is also delivering liquefied natural gas process technology and equipment. The applications involve cooling, aeration, cryogenic filling, freezing, fire suppression, hydrogen fueling, heat treating, hydro processing, inserting/blanketing, oxygen enrichment, melting, and welding.

List of Key Companies in Carbon Dioxide Market Outlook

- Air Liquide

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Gulf Cryo

- Hunan Kaimeite Gases Co., Ltd.

- India Glycols Limited

- Linde PLC

- Matheson Tri-Gas

- Messer Group GmbH

- Praxair, Inc.

- SABIC

- Sicgil India Limited

- SOL Group

- Taiyo Nippon Sanso Corporation

- Yingde Gases Group Company

Carbon Dioxide Market Development

In October 2022, ArcelorMittal and partners announced the launch of pilot carbon capture unit at ArcelorMittal’s steel plant in Ghent, Belgium. ArcelorMittal and Mitsubishi Heavy Industries, Ltd. (MHI) have been working on the project since 2022, with partners BHP and Mitsubishi Development.

In April 2023, Linde announced that it had signed a long-term agreement with ExxonMobil for the off-take of carbon dioxide associated with Linde’s new clean hydrogen production in Beaumont, Texas. Under the terms of the agreement, ExxonMobil will transport and permanently store up to 2.2 million metric tons of carbon dioxide each year from Linde’s hydrogen production facility.

In December 2023, Air Liquide announced that it would build, own, and operate a world-scale carbon capture unit in the industrial basin of Rotterdam, the Netherlands, leveraging its proprietary Cryocap technology. The new unit will be installed at the Group’s hydrogen production plant located in the port of Rotterdam and will be connected to Porthos, one of Europe’s largest carbon capture and storage infrastructure.

Carbon Dioxide Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Ethanol Production

- Natural Gas Processing

- Industrial Processes

- Fermentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverages

- Enhanced Oil Recovery (EOR)

- Medical

- Industrial Processes

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Food & Beverage Industry

- Healthcare

- Chemicals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Dioxide Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.67 Billion |

|

Market Size Value in 2025 |

USD 11.22 Billion |

|

Revenue Forecast by 2034 |

USD 17.77 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global carbon dioxide market size was valued at USD 10.67 billion in 2024 and is projected to grow to USD 17.77 billion by 2034

The global market is projected to register a CAGR of 5.2% during the forecast period.

In 2024, North America dominated the market due to its established oil & gas sector, strong food & beverage industry, and significant investments in CCUS technologies.

A few key players in the market are Air Liquide; Linde PLC; Air Products and Chemicals, Inc.; Praxair, Inc.; Taiyo Nippon Sanso Corporation; Messer Group GmbH; Gulf Cryo; SOL Group; Hunan Kaimeite Gases Co., Ltd.; Yingde Gases Group Company; Air Water Inc.; Matheson Tri-Gas; India Glycols Limited; SABIC; and Sicgil India Limited.

In 2024, the food & beverages segment accounted for the largest market share, driven by the growing demand for carbon dioxide in carbonation, chilling, and food preservation.

In 2024, the natural gas processing segment held the dominant market share owing to its high yield and efficiency in producing commercial-grade CO?.